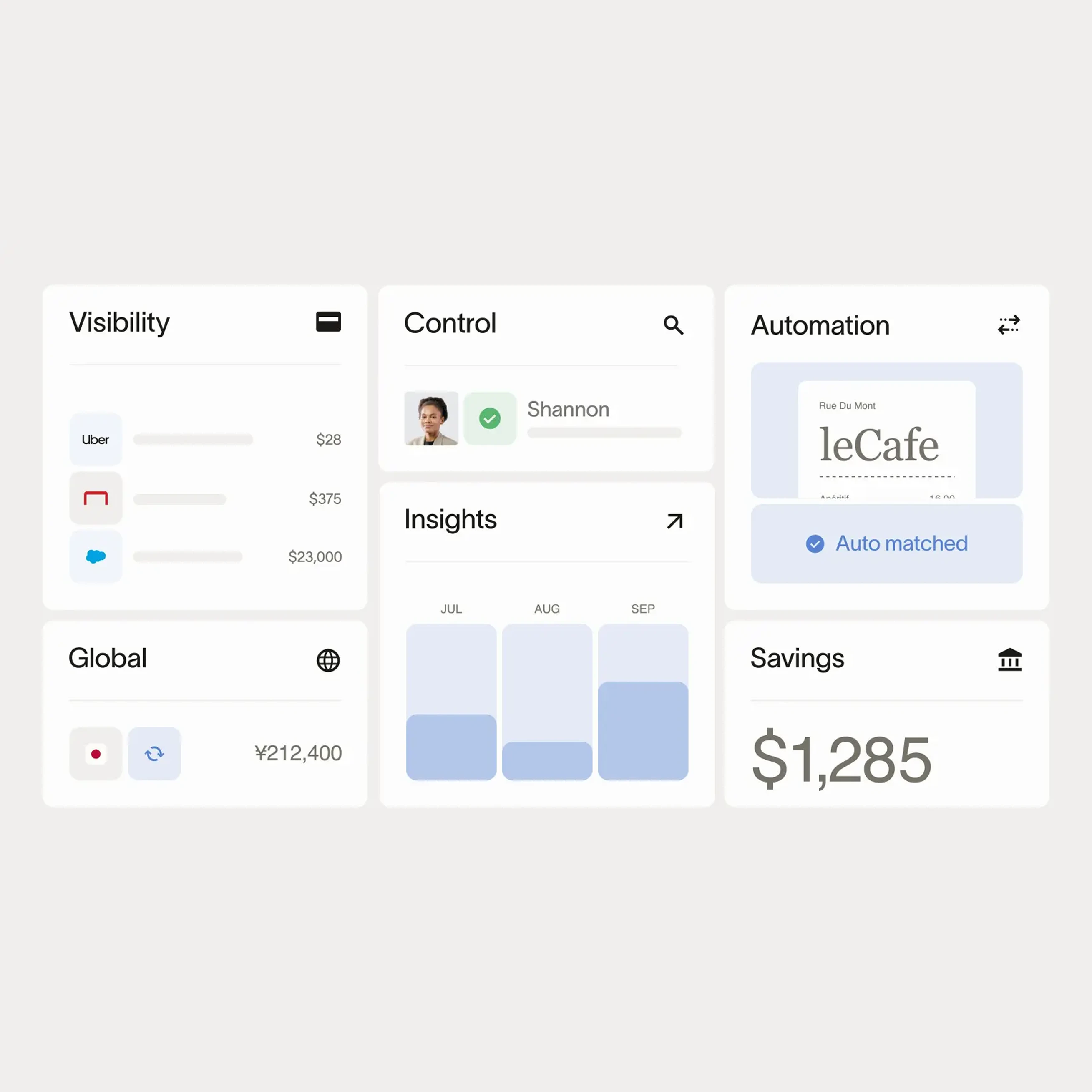

Start earning on customer spend

Ramp handles PCI, fraud controls, spend limits, and reconciliation—so your team can support payments without breaking a sweat.

5 stars on G2

check_circle

Earn on interchange

check_circle

No capital requirements

check_circle

Global acceptance

Earn margin from every payout

Ramp lets you earn interchange on vendor payments without needing to build your own payment stack.

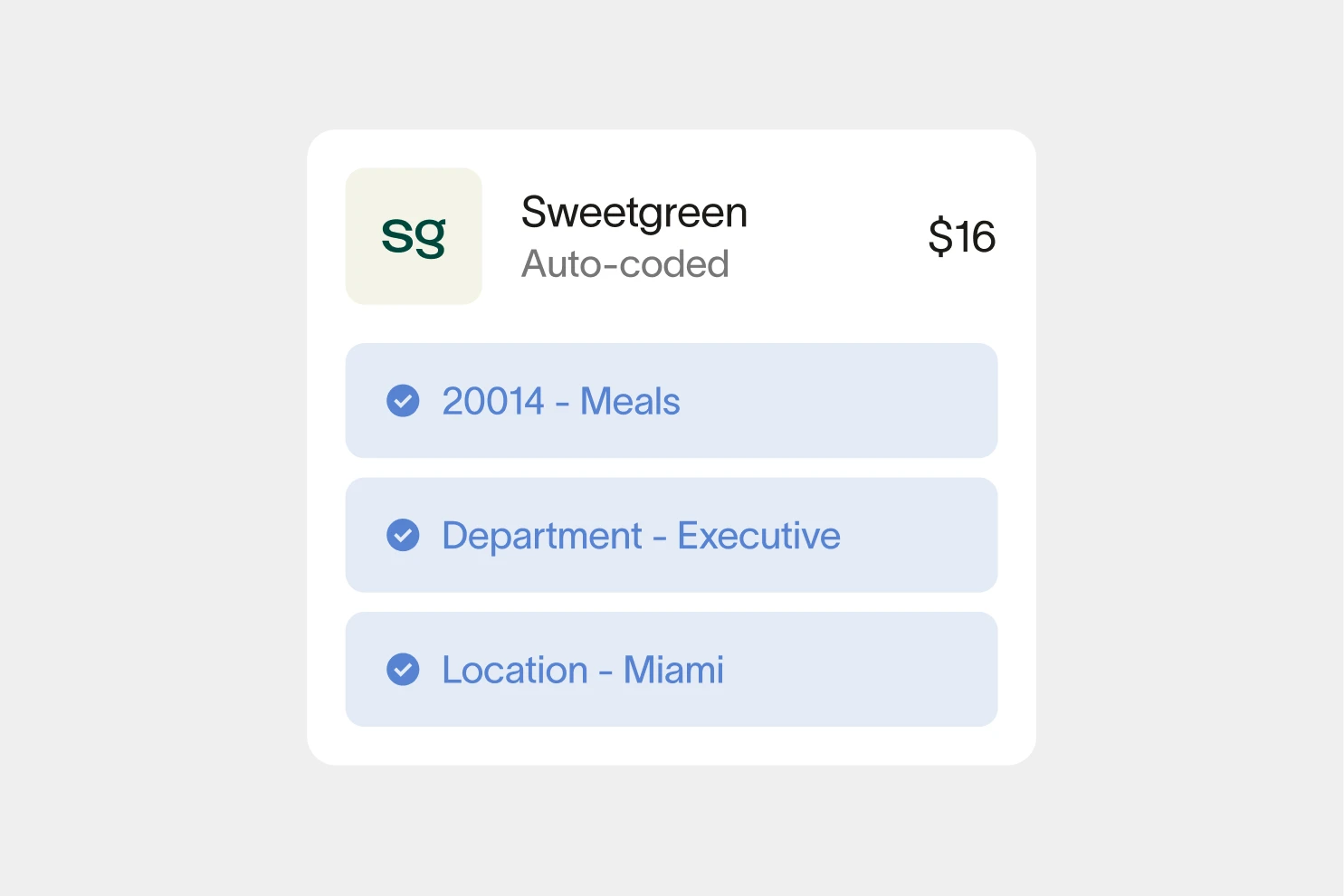

From card to close, fully automated

A single API to automatically generate cards, deliver payment details to vendors and reconcile transactions.

Deliver payments instantly

Eliminate payout delays—vendors receive cards immediately and can use them with no delay.

Launch in 24 hours

PCI compliance, fraud, merchant controls, and the card network—all fully managed by Ramp.

FAQs

A single-use virtual card is a unique payment method generated for a specific transaction or use case. It can be configured with expiration dates, merchant restrictions, and spending caps—ideal for precise, auditable payments tied to a single vendor, booking, or invoice.

Ramp's single-use virtual cards are ideal for:

- Travel aggregators

- B2B marketplaces

- Field service platforms

If your platform facilitates payments between buyers and suppliers—or needs to control spend per transaction—this solution is for you.

Yes. You can:

- Restrict cards to specific merchant categories (e.g., airlines, hotels)

- Lock cards to specific vendors

- Set spending limits and expiration dates to prevent misuse

Ramp uses a unique Card ID to Transaction mapping so every card is directly linked to the payment, booking, or vendor it represents.

- Simplifies refund workflows

- Supports reconciliation even after a card is locked or expired

- Enables webhook notifications for charges, refunds, and declines

Yes. Refunds can still be processed on locked or expired cards, which ensures clean reconciliation without any manual intervention.

A traditional credit card will let you carry a balance month over month and will charge you interest. Ramp cards are a charge card, which means you can’t carry a balance and you don’t have to pay any interest or fees. Ramp cards also come with advanced expense management software and time-saving features that are unavailable on traditional credit cards.

Platforms earn interchange revenue on every transaction processed through Ramp’s virtual cards—without needing to build a full payments stack.