6 benefits of business credit cards to boost your bottom line

straight to your inbox

Business credit cards can serve as a critical lifeline to your small businesses when it’s starting out, giving it access to spending power it wouldn’t otherwise have. If you’re considering signing up for a card (or multiple cards) to cover your company’s business expenses, you may be swimming in a sea of advertised benefits like waived annual fees, welcome bonuses, and membership rewards.

In this article, we’ll cut through the noise and explain which business credit card benefits offer the greatest potential impact on your business. Some of the main benefits to consider are:

- Cashback

- Partner rewards

- Customized card controls

- Unlimited cards

- No personal guarantees on business credit

- Integrated spend management software

Read on as we take a deep dive into each of these business credit card benefits so you can make an informed decision. First, though, a brief explanation of what business credit cards are and how they’re distinct from personal credit cards.

What is a business credit card?

A business credit card is specifically designed for use by businesses rather than for personal expenses. These cards are used to manage company-related purchases, operational expenses, and travel expenses.

Business credit cards offer distinct advantages and features compared to personal credit cards, catering specifically to business needs. This includes higher credit limits, access to rewards programs, and business expense management tools.

While you may be required to use your social security number the first time you sign up for a business credit card, it will report credit activity into commercial credit bureaus rather than consumer ones. That means you’ll be building your business credit score as opposed to your personal credit score. The exception to this is a negative payment history (i.e. late payments and delinquencies)—in this case, your personal credit score may very well be negatively impacted. For more on this, check out our guide on how business credit scores affect your personal credit score.

1. Cashback

One particularly helpful benefit of certain business credit cards is cashback. With this benefit, a percentage of what you spend is refunded to your account, which you can cash out or use as a statement credit.

You should look for cashback rewards versus a points rewards program, because of the consistent value over time. While a points rewards card can be tempting because of the aspirational value (i.e., business travel rewards, such as upgraded hotel stays and airfare), cashback provides real monetary value that won’t change on the whim of a rewards points program. A $100 cash value today will still be $100 cash value tomorrow.

Before choosing your cashback card, read its terms carefully to gauge how they may change over time. Look for business credit cards with transparent cashback rewards on every purchase with no annual caps or category spending limits for eligible purchases to get the most value. Some cards may advertise an impressive 5% cashback, but that also comes with an annual cap each calendar year and only applies to specific categories during certain quarters—so earning cashback is a constantly moving target. You don't want your cashback benefits to be limited to only purchases made at gas stations or airport lounges.

2. Partner rewards

Partner rewards are vendor discounts in the form of credits, percentages off, or exclusive access to services. They’re distinct from points rewards, as they are not accrued by card spend, but are perks you receive when you open an account.

Partner rewards can save your company thousands of dollars on everyday business-related expenses, like software subscriptions, office supplies, and cleaning services. To get the most immediate bottom-line value from this business credit card benefit, look for partner rewards that offer discounts on services you already use. For example, if you’re already using Amazon Web Services(AWS), then find a card that gives you AWS credits or discounts that can help you reduce AWS costs.

3. Customized card controls

The key to protecting your budget is to set clear guardrails for employee spending. Customized card controls are a powerful way to automatically enforce your expense policy. These controls allow you to limit who spends, how much they spend, and where they spend.

When evaluating card controls, find solutions that answer the 5 W’s (who, what, when, where, why). Your card controls should be able to dictate precisely:

- Who is approved to use the card

- What they are allowed to purchase

- When they are allowed to make purchases (down to the day and hour)

- Where they are allowed to make purchases

- Why the money is spent in the first place by directly tying it to expense categories

These controls will help you gain real visibility into your business spending and manage it effectively.

4. Unlimited cards

Many credit card issuers will limit how many employee cards can be issued, which can create problems as a company scales.

Say you’re only allowed ten cards, but you have 25 employees who need one. People will likely need to share these cards, which can create spend visibility issues. You might not know who made a purchase, and you won’t be able to set personalized controls on the card. What’s more, employees may have to resort to using their personal cards for business purchases. With unlimited cards—particularly unlimited virtual cards—these issues are no longer a concern.

Make sure to look for cards with personalized pre-approval controls, so you don't have to worry about risk exposure from the number of cards issued. You may also want to consider offering virtual cards as an alternative to physical cards, which can help reduce the number of cardholders. With a virtual card option, you can easily pre-approve an expense for employees who typically only have one-off purchases and don't require a physical card. After the expense request is approved, the credit card software will send them a one-time-use virtual card for the transaction.

5. No personal guarantees on business credit

Some credit card issuers will require small business owners to personally guarantee their business's debt in the underwriting process of acquiring a business credit card for their new business. However, if a founder or business owner signs an agreement where these terms apply, their personal assets are at risk of being taken.

To satisfy the business's debts in the event of a default, the lender can take anything from liquid assets and real estate to personal vehicles if the debt cannot be recouped from business assets. The lender can even hold a business owner personally liable for any legal fees incurred for pursuing debt repayment.

It may be tempting to do whatever it takes to get business cash flow in the early days of establishing your business, but making yourself personally liable for your small business credit card is a significant risk you should avoid. Look for credit card companies that consider the overall health of your company as their guarantee of creditworthiness rather than your personal assets. Be sure to check the fine print of the agreement before signing anything.

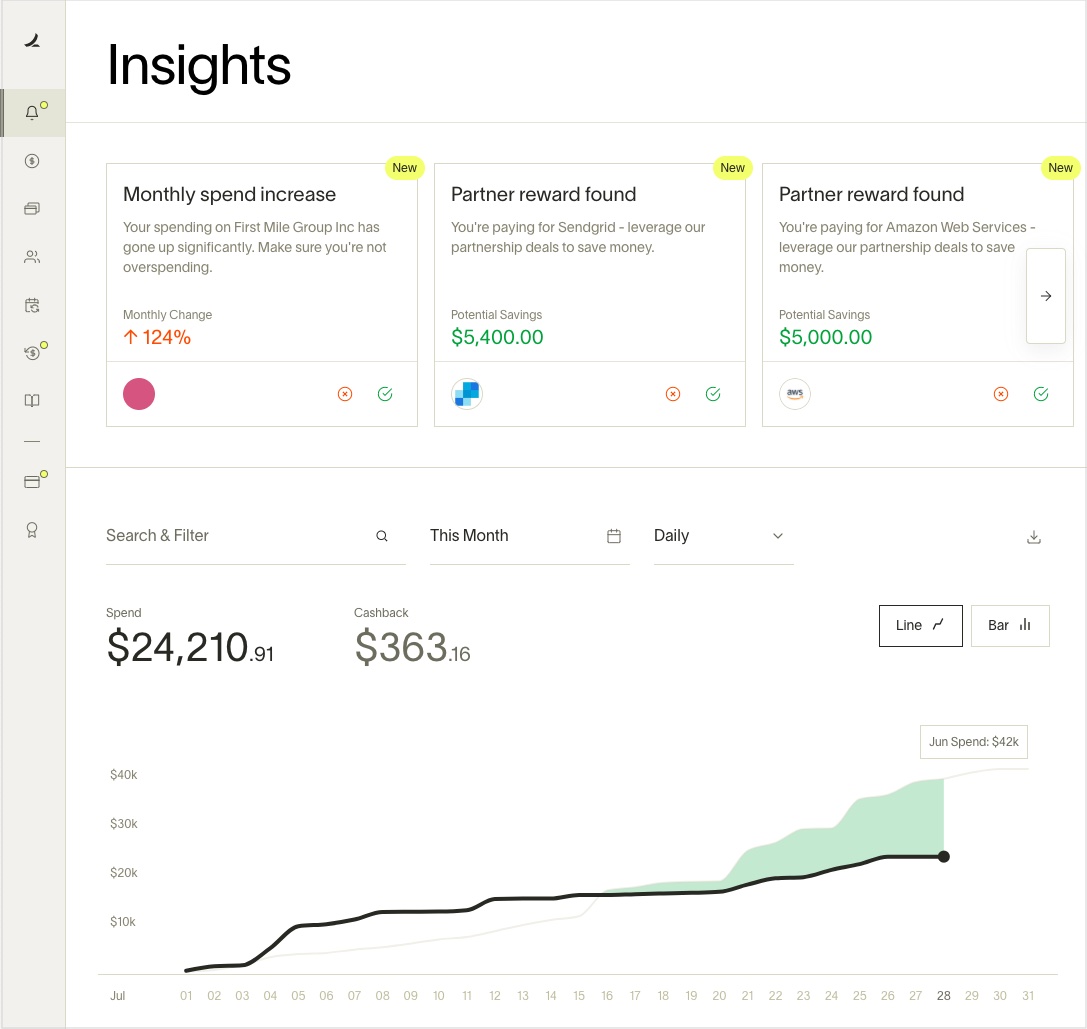

6. Integrated spend management software

The best corporate card should help you save money, not spend it. The easiest way to do this is with a spend management platform that will give you complete spend visibility and control. Unfortunately, not all corporate cards offer spend management software or at the same level as others. Look for integrated spend management software that will:

- Automate digital receipt collection so you'll never lose documentation

- Automate expense policy enforcement

- Provide real-time expense management

- Highlight savings opportunities through AI insights

- Integrate with bill pay and accounting software to centralize spend management and simplify accounting for cashback rewards

Build your company’s future with the right corporate card

Taking the time to secure the right corporate card for your organization is anything but time wasted. A card with strong benefits will help you bolster your company’s financial security and embrace opportunities for growth.

Ramp’s corporate charge card offers crucial benefits to small businesses, which include:

- Unlimited card issuance

- The backing of a comprehensive expense management platform

- Spending limits

- Travel perks

- Integration with popular accounting software

- An easy way to build your business credit history and score

With Ramp’s card and spend management software in hand, you can start to implement expense policies that pre-approve spend requests and block out-of-policy charges before they take place.

.webp)

.webp)

.png)