Do business credit cards affect your personal credit score?

- Understanding how business credit cards can affect your personal credit score

- Understanding business credit vs. personal credit

- Which business credit cards report to personal credit bureaus?

- Whose credit do business credit cards affect?

- Build business credit with Ramp without affecting your personal credit score

A business credit card can affect your personal credit score, but it depends on the type of card, how the provider reports your card activity to credit bureaus, and how you use the card.

Understanding how business credit cards can affect your personal credit score

If you apply for a business credit card, your personal credit score will likely take a temporary hit due to a hard inquiry from the credit card issuer. However, the impact is usually minor and brief.

This is because business credit card issuers usually rely on your personal credit for approval, in addition to a personal guarantee that holds you to paying off any debts on the card if your business fails.

After the initial hard credit inquiry, card issuers may report both positive and negative card activity to credit bureaus, such as Equifax or Experian. On-time payments can improve your score, and late payments may reduce the credit score.

Likewise, any other business debts that are attached to your SSN will affect your personal credit score. So, be careful before attaching a personal guarantee to any business loan.

Getting a business credit card using your EIN number helps build your business credit. A good business credit score can lead to more favorable loan terms and repayment options.

Understanding business credit vs. personal credit

Your business credit score is linked to your Employer Identification Number (EIN), which is your business’s tax ID number. You can apply for an EIN number online after you’ve registered your business with the state. Your business credit score is used to apply for credit accounts, like small business loans and lines of credit. You can check your business credit score with the major commercial credit bureaus: Dun & Bradstreet, Equifax, and Experian.

Your personal credit score, often called a FICO score, is tied to your Social Security Number (SSN). This score reflects your personal financial history, including credit card usage, loan repayment, and other financial activities tied to your personal identity. Personal credit scores play a significant role when you’re seeking personal loans, mortgages, or other forms of personal financing.

If you don’t have a good business credit score—which is difficult for newly established businesses—your personal credit score will likely be used to access business financing as well. You can check your personal credit score with the major consumer credit bureaus: Equifax, TransUnion, and Experian.

Personal vs. Business Credit Bureaus

The key difference between personal and business credit bureaus is that business credit reports are used to assess the financial health and creditworthiness of businesses, while personal credit reports are used to evaluate individuals' credit behavior and ability to repay personal debts.

Which business credit cards report to personal credit bureaus?

Business credit card activity usually isn’t reported to the personal credit bureaus, but there are some exceptions.

Certain business credit cards, like the Capital One Venture X Business and Capital One Spark Cash Plus, will report late payments and serious delinquencies to the consumer credit bureaus, negatively impacting your personal credit score.

If you have a business credit card from American Express or U.S. Bank, late payments will also show up on your personal credit report.

Issuer | Reports to consumer credit bureaus | Reports to commercial credit bureaus |

|---|---|---|

American Express | Yes, but only negative payment history | Yes |

Bank of America | No | Yes |

Capital One | Yes, the Capital One Spark Cash Plus and Venture X business credit cards report delinquencies | Yes |

Chase | Yes, but only if the account is seriously delinquent | Yes |

Citi | No | Yes |

U.S. Bank | Yes, but only if the account is seriously delinquent | Yes |

Wells Fargo | No | Yes |

Can you build personal and business credit at the same time?

Personal credit cards don't build business credit, and vice versa, so you cannot build personal and business credit at the same time. Use separate credit cards for business and personal expenses and limit your business credit card use to business expenses.

Discover Ramp's corporate card for modern finance

Whose credit do business credit cards affect?

When business credit card activity is reported to the consumer credit bureaus, it typically only affects the primary cardholder—that is, the business owner who opened the card and personally guaranteed any credit card debt. Sometimes, a business owner may add an authorized user to their business credit card. In that case, the authorized user’s credit report could also be affected.

Let’s get into what it means to be a primary cardholder or an authorized user on a business credit card:

Primary cardholders

Whoever applies for and is approved for a small business credit card is considered the primary account holder. Usually, this is the owner of the company, not an employee.

When you open the card as the primary account holder, the tax identification number you provide will determine whether the card reflects on your personal or business credit score. If you open the card with your SSN, it’ll be linked to your personal credit score. Opening the card with your business’s EIN will keep your business credit score separate.

If you open a card with your SSN, you’ll probably also have to provide a personal guarantee of repayment so that lenders know you’ll personally repay any debts if your business account defaults on its payments.

Authorized users

An authorized user is someone who has been added to a credit card account by the primary cardholder—usually, this is an employee. This allows the employee to make purchases on the card as if it’s their own.

As an authorized user, your credit score will reflect how both you and the primary cardholder use the card. If the account holder makes timely payments, then it’ll help build your credit score. If the account holder fails to make payments, however, your credit score will take a hit.

If a card can be used by more than one person, the business needs a system that identifies who used the card and who must approve the purchase.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Does a corporate credit card affect your credit score?

Generally, with corporate credit cards, your personal credit score won't be affected. This is because most corporate cards are opened using your business’s EIN number, not your personal SSN. Business owners and employees both shouldn’t see any changes to their personal credit scores when a corporate card is used.

As a business owner, corporate cards differ from traditional business credit cards in how they affect your business credit report. This is because:

- Corporate cards don't factor in credit utilization ratios. That means you don’t have to worry about how much of your available credit you’ve used out of your credit limit, like you would with a traditional credit card.

- Corporate cards typically require full monthly balance payments, often automatically drawing from your business bank account. This eliminates the possibility of late payments and credit card debt being reported to the credit bureaus.

The only case in which a corporate card would affect an employee’s personal score is if the business made a billing mistake and added it in their name. If you see that a corporate charge card appears in a personal credit check, take steps to speak with the person in your company issuing the cards to remove your name.

How does an LLC affect a credit report?

If your LLC has debts taken out in the company’s name, only the LLC’s business credit report will be impacted by whether you repay your debts on time. An LLC loan will only impact your personal credit if you cosign or guarantee it. If you don't do so, your personal credit report will remain unaffected.

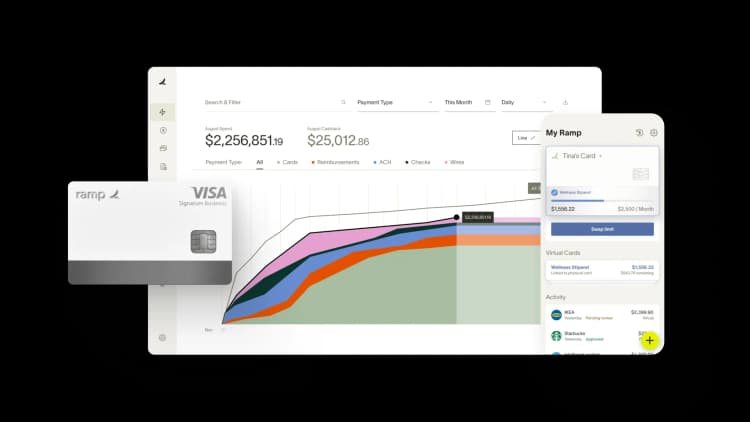

Build business credit with Ramp without affecting your personal credit score

With a corporate card from Ramp, your credit score won’t be impacted when you apply, because we don’t need to perform either a soft or hard inquiry. All you need to qualify is an EIN number attached to your registered business, as well as at least $25,000 in any U.S. business bank account linked to your application.

Unlike a traditional business credit card, Ramp requires full monthly balance payments—avoiding worries about on-time payments and any negative impact on your credit score. But like other business cards, Ramp reports to the business credit bureaus, allowing you to build business credit.

What’s more, with Ramp’s advanced spend controls, you can automate many of the factors that might negatively affect both your personal and business credit score. Use Ramp to enact spending limits, automate expense reports, and get a clear picture of your company’s cash flow.

Don't miss these

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark

“I was shocked at how easy it was to set up Ramp and get our end users to adopt it. Our prior procurement platform took six months to implement, and it was a lot of labor. Ramp was so easy it was almost scary.”

Michael Natsch

Procurement Manager, AIRCO