Business loan underwriting process: Overview and tips

- What is business loan underwriting?

- Key factors lenders consider for business loan approval

- Documents required for business loan underwriting

- 12 steps in the business loan underwriting process

- Different underwriting standards by loan type

- Types of business loan underwriting methods

- How to improve your chances of approval

- Common reasons for loan denial and how to address them

- How Ramp streamlines your financial data for stronger loan applications

- Commerce sales-based underwriting: An alternative to traditional business loans

Underwriting determines whether your business qualifies for financing. It’s the process lenders use to assess risk before approving a loan or line of credit. While most people associate underwriting with insurance, it’s just as critical for business owners seeking funding.

Underwriters evaluate each application in detail, especially for business lines of credit, Small Business Administration (SBA) loans, and unsecured financing. Understanding how the business loan underwriting process works can help you prepare stronger applications and improve your approval odds.

What is business loan underwriting?

Business loan underwriting is the process lenders use to assess credit risk and evaluate loan applications. It helps determine whether your business is financially stable enough to borrow and repay funds.

Before full underwriting begins, lenders may offer prequalification or preapproval based on limited financial data. These early steps give you a sense of potential eligibility, but final underwriting is where a lender verifies income, credit, and financial documents before approving the loan.

The term “underwriting” comes from the early practice of signing one’s name under the amount of risk taken for a fee. Today, underwriters perform the same function: assessing risk and deciding whether your business qualifies for financing. Even with unsecured loans, the lender assumes some risk of default, so underwriting ensures the decision is sound.

Key factors lenders consider for business loan approval

When you apply for a business loan, underwriters evaluate several key factors to assess your eligibility and determine the level of risk.

Creditworthiness

Your personal and business credit scores play a big role in the underwriting process. Lenders review your credit history, including payment patterns, outstanding debts, credit utilization, and any negative marks. A strong credit profile shows you’re responsible with debt and likely to repay what you borrow.

Financial health

Underwriters closely examine your business’s financial statements, including profit and loss statements, balance sheets, and cash flow reports. These documents help them assess whether your business generates consistent revenue and manages expenses effectively.

They also review ratios such as your debt-to-income (DTI) ratio and the loan-to-value (LTV) ratio for secured loans. A lower DTI or LTV signals lower risk and can improve your chances of approval. Underwriters may also calculate your debt service coverage ratio (DSCR), your business’s net operating income divided by total debt service. A DSCR of 1.25 or higher generally indicates your business earns enough to comfortably cover its loan payments.

Business plan and purpose

Lenders want to see a clear plan for how you’ll use the loan. A detailed explanation builds confidence, whether it’s for expanding operations, purchasing inventory, or launching a new product. A business plan should also show you’ve thought through your financial strategy and understand your market.

Capital investment

Lenders also evaluate how much capital you’ve personally invested. A sizable down payment or personal investment signals confidence and reduces lender risk. For many SBA loans, a 10%–20% equity contribution is typical.

Collateral and guarantees

Some business loans don’t require collateral, but many do. If you can’t repay the loan, lenders want something they can claim as a backup, such as equipment or property. Even if no collateral is required, you might still need to personally guarantee the loan. These requirements help reduce the lender’s risk and can boost your chances of approval.

Industry and market risk

Lenders look at how stable your industry is and whether your business has room to grow. If you’re in a high-risk field, such as a new tech startup or a seasonal business, you may face more scrutiny during underwriting. But if your business has steady income or valuable assets, it’s usually easier for lenders to evaluate and approve.

Documents required for business loan underwriting

Before approving a business loan, underwriters review several key documents to verify your company’s financial stability and legitimacy.

Financial statements

Underwriters typically request balance sheets, income statements, and cash flow statements covering the past two years. These documents show your revenue trends, expenses, and liquidity, helping lenders understand your business’s overall financial health.

Tax returns

You’ll usually need to provide at least two years of both personal and business tax returns. These help underwriters verify income accuracy, confirm profitability, and ensure consistency across your financial records.

Bank statements

Lenders generally ask for three to six months of recent bank statements. These records help them assess cash flow consistency, deposit history, and how well you manage operational expenses.

Business documentation

Be ready to share proof of registration, such as business licenses, articles of incorporation, and ownership agreements. Some industries may also require additional permits or certifications depending on regulatory requirements.

12 steps in the business loan underwriting process

The business loan underwriting process starts with an application, but several key steps come first. Understanding how each one works helps you prepare stronger documentation and improve your approval odds.

- Create or update your business plan: A current business plan shows lenders you’ve planned for growth and understand your cash flow. Even established companies should refresh theirs before applying.

- Prepare financial statements for your business: Keep your statements current and accurate—profit and loss, balance sheet, and cash flow reports. These give underwriters a clear picture of your business’s assets, liabilities, and accounts receivable.

- Obtain a Certificate of Good Standing: Lenders often require a certificate of good standing as part of the underwriting process to verify the business is legally compliant and authorized to operate. This document confirms your business is registered with the state, has filed all required reports, and is current on taxes and fees. Having this certificate ready can help speed up the approval process and demonstrate your business's legitimacy to lenders.

- Establish a detailed plan for the funds: Be specific about how you’ll use the money. A clear plan builds lender confidence and speeds up approval.

- Submit your application: Review every field for accuracy before submitting. Even small errors can delay processing or lower your approval odds.

- Loan officer screens your application: The loan officer reviews it for completeness and eligibility. If it meets basic standards, it moves to underwriting.

- Loan officer sends your application to the underwriter: Once cleared, your file goes to underwriting for deeper analysis. Larger loans often take longer to review.

- Underwriter double-checks your application: The underwriter verifies your data and supporting documents. This ensures the file is accurate before formal analysis.

- Underwriter reviews creditworthiness: They take a close look at your personal and business credit. This helps determine your overall risk profile.

- Underwriter appraises your business: Beyond credit, they assess your company’s financial strength and cash flow. This helps determine whether you can manage additional debt.

- Underwriter assigns a risk level: Based on financials and credit, they assign a risk rating. This guides the terms and amount the lender can offer.

- Lender approves or denies the loan: The lender makes the final decision using the underwriter’s report. If denied, you can reapply after improving your financial position.

Different underwriting standards by loan type

Underwriting requirements vary by loan type. Some lenders focus on documentation and credit history, while others rely on real-time data to make faster decisions.

- Traditional bank loans: These have the strictest standards and longest timelines. Banks require extensive documentation, strong credit scores, and proven revenue history, but they typically offer the lowest rates and best terms for qualified borrowers.

- SBA loans: Backed by the Small Business Administration, these loans go through both lender and SBA reviews. They involve more paperwork and time but offer competitive rates and flexible repayment options.

- Business lines of credit: Underwriting for revolving credit focuses on cash flow stability and credit utilization. Lenders may perform periodic reviews to confirm your business still meets risk and eligibility requirements.

- Alternative and online lenders: These use technology-driven underwriting, analyzing real-time revenue and financial data instead of relying solely on credit scores. They can approve applications in as little as 24–48 hours but often charge higher interest rates to offset risk.

Types of business loan underwriting methods

Lenders generally use one of three underwriting methods for business loans. Each approach varies in speed, flexibility, and the amount of documentation required.

| Underwriting method | How it works | Pros | Cons | Common use cases |

|---|---|---|---|---|

| Manual | A human underwriter reviews your full application and financials. | More flexible; ideal for complex or thin credit profiles. | Slower process; may require more documentation. | SBA loans, commercial real estate loans, larger funding requests. |

| Automated | Software analyzes your credit data and financials using preset rules. | Faster decisions; less paperwork. | Less flexibility; harder to explain unique situations. | Small business credit cards, online lender loans, fintech platforms. |

| Hybrid | Combines automated checks with a final human review. | Balances speed with flexibility. | Not as fast as full automation; still requires judgment calls. | Traditional and online lenders offering midsize loans. |

How to improve your chances of approval

Preparing before you apply can significantly improve your chances of business loan approval. Here are a few practical ways to strengthen your application.

- Organize your financial documents: Gather profit and loss statements, balance sheets, cash flow statements, recent bank statements, and professionally prepared tax returns. Lenders rely on these to assess your business’s financial health.

- Check and improve your credit: Both your personal and business credit scores matter. Review your reports for errors, pay down business debt, resolve any collections, and avoid opening new credit lines during the review period.

- Maintain strong cash flow: Keep your business generating more than it spends. Monitor receivables, manage expenses, and maintain enough working capital to cover daily operations and unexpected costs.

- Be transparent and responsive: Respond quickly to lender requests and provide complete documentation. Transparency builds trust and helps your application move faster.

- Build lender relationships: Work with lenders who already know your business. A strong relationship and consistent communication can give your application an edge.

- Understand your loan options: Compare lenders, interest rates, loan types, and repayment terms. Choosing the right product improves both your approval odds and long-term fit.

Common reasons for loan denial and how to address them

Even well-run businesses can face loan denials. Knowing the most common reasons and how to fix them can help you strengthen your next application.

Low credit scores

Lenders rely heavily on both personal and business credit history when assessing risk. Pay down existing debt, correct report errors, and make consistent on-time payments for several months before reapplying.

Insufficient cash flow

If your business doesn’t bring in enough income to cover loan payments, lenders see it as a red flag. Improve your debt service coverage ratio (DSCR)—your business’s income divided by total debt payments—by increasing revenue, reducing expenses, or refinancing debt to boost working capital.

Incomplete or inaccurate documentation

Missing or mismatched financial statements can delay or derail your approval. Double-check that all tax returns, bank statements, and financial reports align and are up to date before resubmitting.

High existing debt

A high debt-to-income ratio suggests repayment may be difficult. Pay off smaller balances, consolidate high-interest loans, and demonstrate steady cash flow to strengthen your financial profile.

Weak business plan or unclear loan purpose

Lenders want to see how loan funds will drive business growth or stability. Update your business plan with specific goals, projected return on investment (ROI), and a funding strategy that aligns with your financials.

Reapplying after denial

If your loan is denied, the lender must provide a reason. Use that feedback to strengthen your next application, and wait 30–90 days before reapplying so financial or credit improvements can take effect.

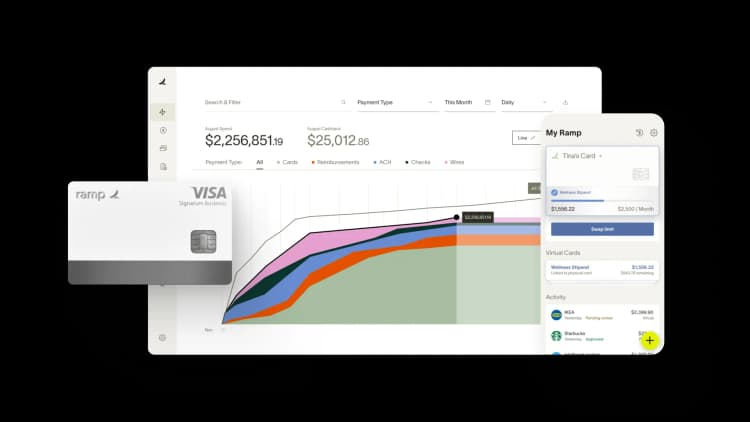

How Ramp streamlines your financial data for stronger loan applications

Getting approved for a business loan often feels like preparing for an audit. You need months of organized financial records, detailed expense reports, and clear cash flow statements ready at a moment's notice. Many businesses struggle with disorganized receipts and manual processes that make it hard to present a clear financial picture to lenders.

Ramp's automated expense management transforms this chaotic process into a streamlined system that keeps your finances loan-ready year-round. When employees make purchases with Ramp cards, transactions automatically flow into your expense management system with merchant details, categories, and digital receipts attached.

This real-time capture means you're not scrambling to reconstruct 3 months of expenses when a lending opportunity arises. Your finance team can instantly generate detailed expense reports showing exactly where money flows, giving underwriters the transparency they need to assess your business's financial health.

Strengthen credibility with real-time insights

Ramp’s advanced controls and approval workflows add credibility to your loan application. By setting spending limits, requiring preapprovals, and flagging out-of-policy purchases, you show lenders the financial discipline they value. These controls create an audit trail that highlights not only what you spend, but also how responsibly you manage company resources.

Perhaps most importantly, Ramp's real-time reporting dashboards give you the same view of your finances that underwriters will scrutinize. You can spot trends, identify areas where spending might raise questions, and address potential concerns before they become reasons for loan rejection.

This visibility transforms loan preparation from a reactive scramble into a proactive process where you're always ready to showcase your company's financial strength.

Commerce sales-based underwriting: An alternative to traditional business loans

While organized financial data strengthens traditional loan applications, high-growth businesses often need immediate access to capital without lengthy approval processes. The Ramp Business Credit Card takes a different path, using your actual sales performance to unlock higher credit limits faster.

Our commerce sales-based underwriting connects directly to your Shopify, Stripe, or Amazon Business accounts to evaluate your real-time revenue. You'll get approved in less than 48 hours with credit limits higher than traditional business cards. No personal credit check. No personal guarantee. Just your business performance speaks for itself.

Learn more about commerce sales-based underwriting and get the working capital you need to keep growing.

FAQs

All business loans, including credit cards, SBA loans, and lines of credit, go through underwriting to assess risk and financial stability. Some alternative lenders use automated or simplified underwriting based on real-time revenue data instead of traditional reviews.

Lenders and insurance companies employ their own underwriters, so you have no choice in who reviews your loan or insurance request. Investment banks and special purpose acquisition companies (SPACs) hire independent underwriters to help set IPO and direct listing prices.

The startup underwriting process can take anywhere from 3–5 business days all the way up to several months. The final duration depends on many factors, including business size and complexity, the underwriter’s process and workload, and the number of documents up for review.

The startup underwriting process can take anywhere from 3–5 business days all the way up to several months. The final duration depends on many factors, including business size and complexity, the underwriter’s process and workload, and the number of documents up for review.

It’s the underwriter, not the loan officer, who makes the decision on whether you’re worthy of a loan. Follow the preparatory steps in this article to increase your chances with them.

The 5 C’s of underwriting are character, capacity, capital, collateral, and conditions. Lenders use these factors to evaluate a borrower’s creditworthiness, repayment ability, financial investment, available assets, and external market conditions before approving a loan. Together, they help underwriters assess overall lending risk.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group