- How are credit card rewards treated in accounting?

- Cashback vs. points

- Sign-on bonuses

- Earned cashback

- Redeeming cashback in a lump sum

- Are credit card rewards taxable for a business?

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

So, you’ve applied for a new business credit card, and you’re ready to start spending and taking advantage of your credit card rewards.

But how do you account for these rewards? Is cashback considered income, a non-expense, or something else? What if you got a welcome bonus? Are there any tax implications there? In this post, we discuss some considerations for dealing with the different types of credit card rewards.

Of course, individual circumstances and card terms will vary, so please consult with your professional advisors when making decisions for your business.

How are credit card rewards treated in accounting?

Generally, credit card rewards are not considered income, so they’re not recorded on a balance sheet. If your credit card has a points-based system or airline miles, then you probably won’t need to report your rewards. Cash rewards are the only exception—if you receive a cash bonus, like a sign-up bonus, then this will be considered other income by the IRS, and so it will need to be recorded on your balance sheet.

There’s no definitive guidance in U.S. GAAP about how to account for credit card rewards on your financial statements, so you will often have to rely on the credit card companies to tell you whether your rewards are considered taxable income. They’ll usually do so by sending you a 1099-MISC form, but only if your rewards exceed $600.

Let’s take a closer look at the difference between cashback rewards and points-based rewards and how to account for each.

Cashback vs. points

Your first choice when choosing a credit card issuer is what kind of loyalty program you want: cashback or reward points. Since cashback is denominated in dollars, it tends to be easier to account for.

Depending on the terms of your card, cashback could be considered an asset that you accrue until you redeem it. The credit card company giving you that cashback may be booking the amount on their balance sheet as a liability to you.

If your rewards are denominated in points—well, what’s a point worth? If the value of a point changes, do you book realized / unrealized gains when you finally redeem them? It’s certainly possible to manage that complexity, but with cash, the value doesn’t change.

Often, accountants don’t put unclaimed cashback or rewards on their balance sheets, and instead only log it when it’s redeemed as a statement credit. But if for some reason you wanted to—perhaps the accrued has ballooned to something material—posting the value of the asset would be quite tricky to do with points, and their value can fluctuate against the US dollar without their rates being reverse-engineered by folks like The Points Guy.

Sign-on bonuses

How might you account for a sign-on bonus, i.e., a reward in cash that you receive for enrolling in a card program? This would be considered a monetary incentive and would need to be treated as other revenue. Several financial institutions are issuing 1099s for any sign-on bonuses they provide, meaning they are being reported to the IRS as taxable income paid to you. You will only receive such a form if your cash bonus exceeds $600 put into your bank account.

In a business’s Chart of Accounts, a sign-on bonus might be recorded as follows, assuming it was received on the day of signup:

Debit | Asset | Checking account | $500 |

|---|---|---|---|

Credit | Revenue | Other revenue | $500 |

Earned cashback

Earned cashback could be treated differently as it is earned as a result of spending money on the card. You might treat it as a cash rebate, as detailed in IRS Publication 525.

For example, if a business goes and purchases computer supplies and then receives cashback as a result of making that purchase, that business could use the cashback to reduce the original purchase price. This wouldn’t increase income directly, but would increase the tax basis because the business expense level has been reduced.

If the business were to purchase $400 worth of computer supplies, and the purchase and cashback were all to happen on the same day, the accounting using the above approach might be:

Debit | Expense | Computer supplies | Purchase | $400 |

|---|---|---|---|---|

Credit | Expense | Computer supplies | Redeemed cashback | $6 |

Credit | Liability | Ramp card | $394 |

Although it is more customary to combine the two expense lines into a single line:

Debit | Expense | Computer supplies | Purchase | $394 |

|---|---|---|---|---|

Credit | Liability | Ramp card | $394 |

In truth, there is likely to be a separation in time between when cashback is earned and when it is redeemed. In that case, a business might want two entries:

Purchase is made

Debit | Expense | Computer supplies | Purchase | $400 |

|---|---|---|---|---|

Credit | Liability | Ramp card | $400 |

Cashback is redeemed

Debit | Liability | Ramp card | $6 | |

|---|---|---|---|---|

Credit | Expense | Computer supplies | Redeemed cashback | $6 |

Card providers often permit cashback to be redeemed several periods later, and after the original purchase period has been locked, even though it is applied to the original purchase. If a business were trying to account for this accurately the journals might be:

Purchase is made

Debit | Expense | Computer supplies | Purchase | $394 |

|---|---|---|---|---|

Debit | Asset | Accrued cashback | Cashback | $6 |

Credit | Liability | Ramp card | $400 |

Cashback is redeemed

Debit | Liability | Ramp card | $6 | |

|---|---|---|---|---|

Credit | Asset | Accrued cashback | Redeemed cashback | $6 |

However, accountants often do not post accrual entries for cashback.

Want to speak to an accounting expert?

Redeeming cashback in a lump sum

In practice, cardholders don’t generally redeem cashback on individual transactions, but they will periodically redeem the cashback that they’ve accrued as a lump sum. How might we think about this?

The concept is no different: the lump sum of cashback is an aggregate discount on all the purchases that have been made on the card over time.

The most common way to manage the accounting is to apply cashback to a single account, i.e., a Cashback Earned account or similar. Some people use an income account, whereas others prefer a contra expense account (i.e., an expense account with a negative balance), but when aggregated with all monthly expenses would result in the right expense value.

Debit | Liability | Ramp card | $500 | |

|---|---|---|---|---|

Credit | Expense/Revenue | Cashback earned | Redeemed cashback (all purchases) | $500 |

Either approach can work, depending on your circumstances and preferences. Adding cashback to income but not expenses should result in the same taxable difference as subtracting cashback from expenses and deducting the result from income. However, a purist may choose to use a contra expense account, especially if they consider cashback a reduction in the cost basis of the original expenses.

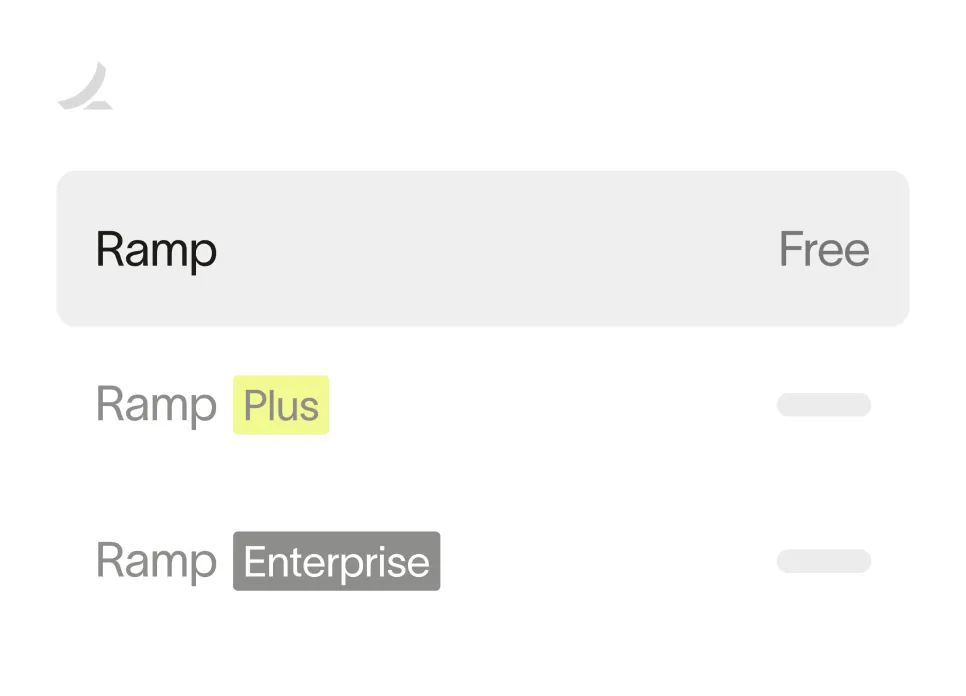

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Are credit card rewards taxable for a business?

Cash rewards are taxable for a business, while other types of rewards are not. So, if you’re earning rewards points or frequent flyer miles, these will not be taxable deductions on your business expenses. Also, cash rewards are only taxable when they’re earned, so they won’t be tax-deductible if you haven’t redeemed them yet.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

It depends on the type of reward and how the company redeems it. If your card offers a $500 dollar sign-up bonus, for example, the IRS could treat that as taxable income. However, if you get $500 as a reward for spending $2,000 in the first month with that credit card account, that perk is viewed as a rebate and not taxable by the IRS.

Don’t forget to:

- factor in your annual fee

- remember what is taxable and what is not

- use accounting software

- always double-check statement credit card charges to see whether they can be written off or not.

Unlike debit cards, credit card companies offer either a percentage of purchases in cashback, or on a redeemable point system that you can use for things like airline travel. Depending on your account type, some cards offer points that can be redeemed for cash. In some cases, the points or miles are more valuable than the cashback amount.

However, cashback can be more consistent, easier to redeem, and more versatile. It really all depends on your business expenses. If you use a lot of gas, taking advantage of cashback on gasoline purchases would be ideal. Or, if you take a lot of clients out to lunch, cashback on restaurants could go a long way.

When a refund is issued to your bank account for a purchase made on a credit card, generally, the points, miles, or cashback will be removed from your rewards balance.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits