Announcing 2022 Q1 Spending Benchmarks: See how your company's finances stack up

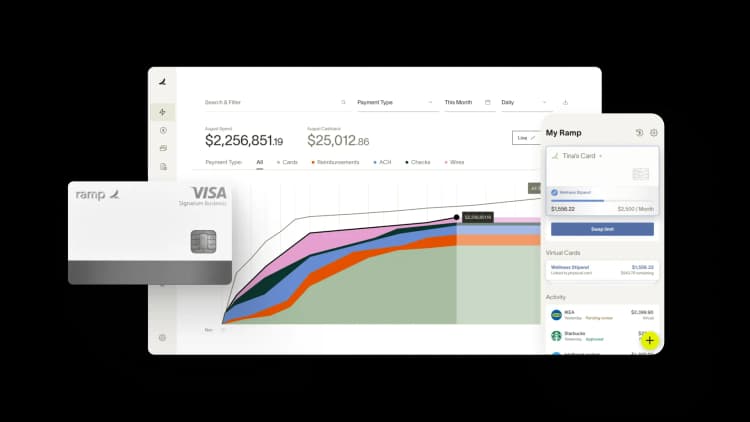

As a business leader, you’re being asked to make tough decisions about your company’s spending these days, with so much volatility in the market. At Ramp we have a unique vantage point and can see where and how companies are spending their dollars in real time. Our mission is to help businesses maximize their most valuable resources—time and capital—so we’re making our insights available today with the release of our new 2022 Q1 Spending Benchmarks report.

The report aggregates anonymized transactions on Ramp cards to identify trends in Q1 (February to April 2022). While transactions recorded on Ramp are just one element in a much larger and more complex story, we can see how companies are adapting to a changing financial landscape, including some shifts that may surprise you. We hope this data will help you make more informed decisions for your business.

What you’ll find

Data on how business spending has shifted since last year

Transaction volume in Q1 of 2022 as compared to one quarter before seesawed between expansion and contraction. Spend data shows the supply chain lagging, while in-person events, meetups and travel are bouncing back, as seen by increased travel and entertainment spend. Check out the full report to see where else business spending rose and fell.

A closer look at T&E spend on Ramp cards over time

Average T&E expenses rose 46% per business in Q1 vs. Q4, with large SMBs seeing the biggest increase. In the full report we compare T&E spend by company size, top industry, and category.

Insights on how companies are adjusting their ad mix

Businesses on Ramp spent less of their budget on ads in Q1 than they did a year ago. Coming out of the Q4 2021 holiday season, the share of spending related to ads decreased from 33.5% of total transaction volume to 28.4%. Download the full report to learn which ad platforms saw the largest increase in spend, and where companies dialed down their budgets.

Trends in software and cloud computing spending

Businesses might have cut back on ad spend in Q1 but spending on software and cloud computing rose, especially for large SMBs. Software spend was driven by increases in industries like diversified consumer services, diversified financials, and software & services. See the full report to find out which ten SaaS vendors captured the most dollars from Ramp customers.

Get the full report

If you want to see how your company spend stacks up against other businesses of your size or industry, download the full report today. Stay tuned for Q2 data coming soon.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits