A business credit card for startups built for fast-growing teams.

Ramp combines corporate cards for startups with finance software—offering higher limits, no personal guarantee, and built-in spend controls.

Get a startup business credit card that scales with you.

Ramp gives your startup everything you need to manage spend—corporate cards, expense tracking, and bill pay—while saving up to 5%1.

A single platform for your startup.

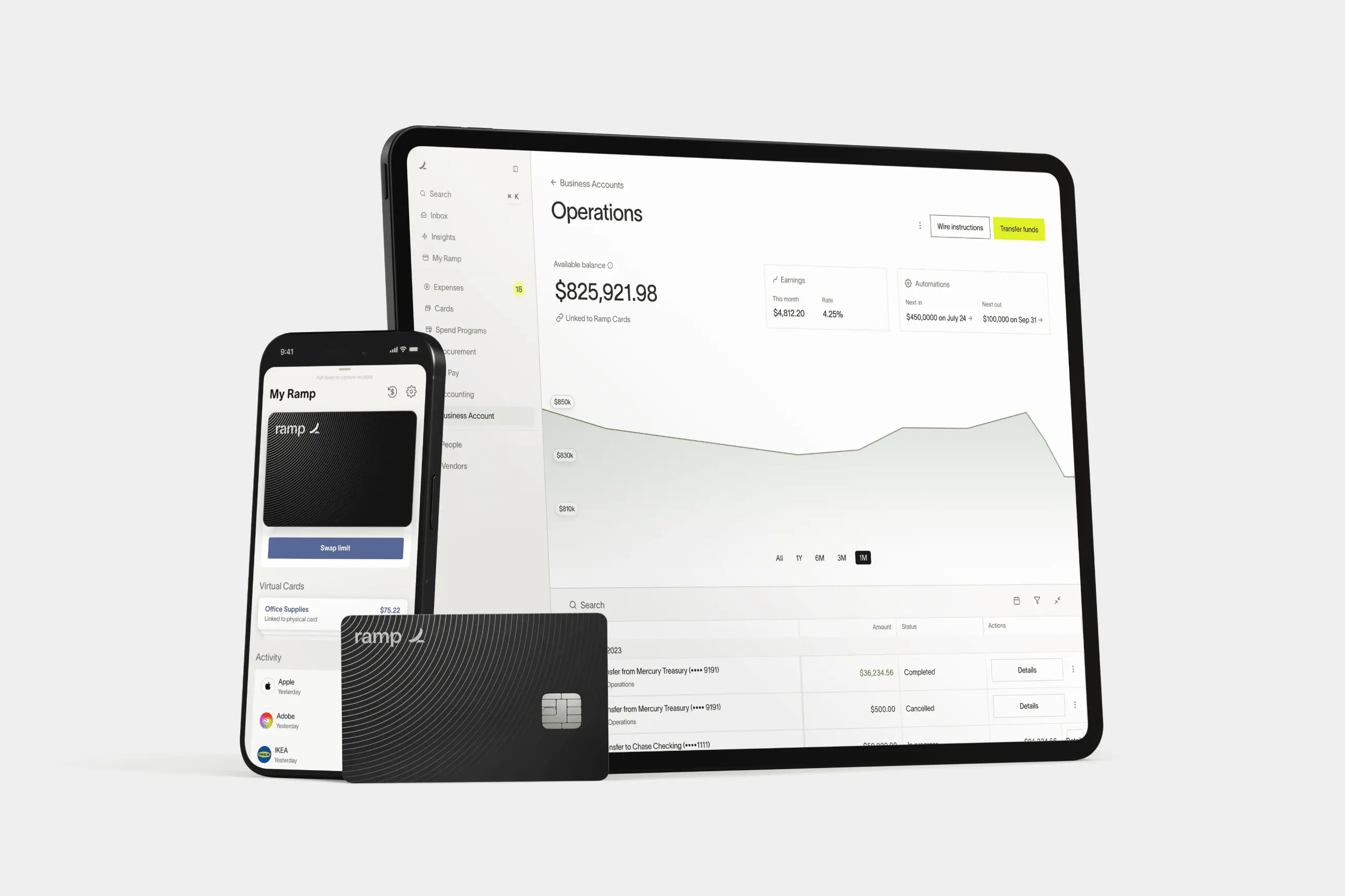

Ramp combines cards, expenses, bill pay, and accounting automation into one platform built for startups. Whether you're just getting off the ground or scaling fast, our startup business credit card helps you stay in control from day one—and grows with you at every stage.

Corporate card

No personal guarantee, built for startups.

Ramp’s business startup credit card is built for founders. No personal guarantee, no hit to your personal credit. We evaluate your company based on its own financial health—so you can focus on growing your startup without risking your personal finances.

Expense automation that gives founders time to build.

Ramp automates expense management for fast-growing companies—so you can skip the back-and-forth. Set policies once, and let Ramp handle the rest, from auto-matching receipts to pre-filled reports pulled from apps like Amazon, Google, and Uber.

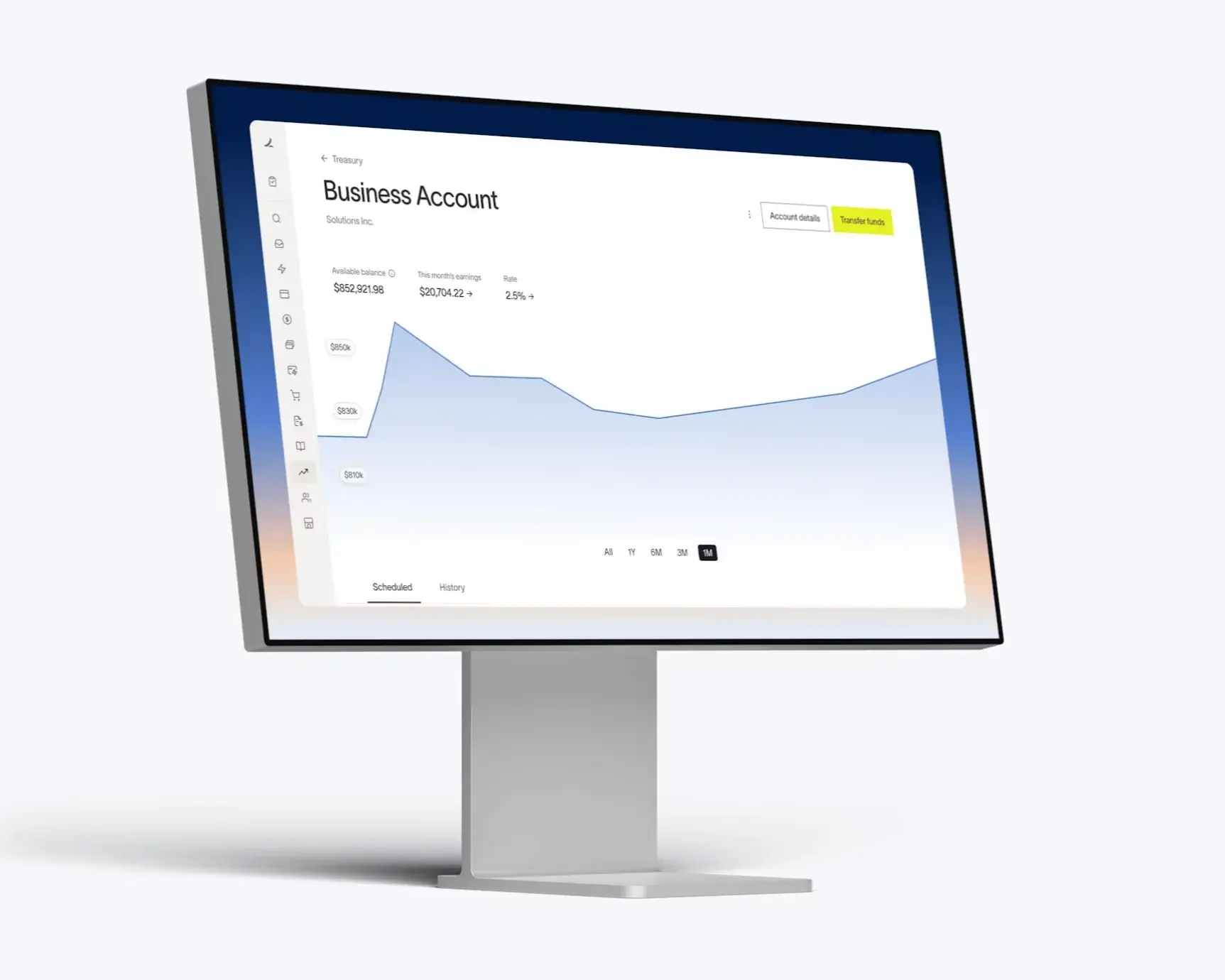

Put your cash to work.

Earn -.--%2 on operating cash in your Ramp Business Account and up to -.--%3 on excess cash—keeping every dollar ready when you need it. No minimums. No fees.

Ramp Treasury

Integrates with your tools, not against them.

Ramp integrates with tools like QuickBooks, Xero, and NetSuite to simplify your month-end. Sync your startup’s card transactions automatically, reconcile with accuracy, and stay audit-ready—no messy spreadsheets required.

The solution that scales with you.

Put cards, expenses, bills, and cash in one system. Pay vendors with free same‑day ACH and wires, and sync every transaction to your books automatically. Start fast and stay on the same workflow while you focus on building.

Six ways our card simplifies spend for growing businesses.

Why startups choose Ramp corporate cards.

See how startups use our corporate card to control spend, save time, and automate the finance work they used to do manually.

FAQ

Key features and benefits include:

- Access to capital. Provides a dedicated credit line to support cash flow, operations, and growth.

- Separation of finances. Keeps business expenses distinct from personal accounts, building financial clarity and professionalism.

- Spending controls. Enables custom limits and policy settings for teams and departments.

- Expense automation. Simplifies tracking, categorization, and reporting with real-time visibility into spend.

- Business credit growth. Helps establish a company credit history through consistent use and timely payments.

- Employee enablement. Allows team members to pay for approved expenses without reimbursement delays.

- Limited personal liability. Typically holds the business—not individual cardholders—responsible for balances.

Ramp offers a startup-friendly corporate card with built-in controls to help you scale efficiently from day one.

With Ramp, founders can apply for a card using their EIN—no personal credit check or personal guarantee required.

- Startups with no personal credit history. Founders can apply using their company's EIN—no personal credit check or guarantee required. Ramp helps new businesses access credit and build a financial track record from the start.

- Venture-backed and rapidly growing companies. Early-stage startups can access limits higher than traditional cards, earn cash back, unlock over $350K in partner rewards, and up to 5%1 savings.

- Startups focused on spend and expense management. Ramp combines a corporate card with built-in spend controls, real-time reporting, and accounting integrations so finance teams can automate expenses and manage company spending in one place.

Most businesses receive approval within one to three business days after applying.

- Secure logins. Single sign-on (SSO) with Okta, Google, and Microsoft Azure, plus mandatory multi-factor authentication (MFA) for all users.

- Fraud prevention. Virtual cards that can be restricted to specific vendors, real-time monitoring, and advanced risk analytics to block unauthorized charges.

- Data protection. Encryption at rest and in transit keeps financial and employee data secure at all times.

- Compliance and audits. Ramp maintains SOC 2 Type II certification and meets PCI standards for secure payment processing.