A small business corporate card that does the heavy lifting.

Get more than just a card - Ramp’s business credit card for small businesses saves time, earns cash back, and automates the busywork you hate.

Simplify spend with a card built for your small business.

Ramp small business corporate cards provide easy-to-use software that helps you manage your expenses, pay your bills and close your books—plus provides an average savings of 5%1.

Get a corporate card with controls and cashback.

Save more with a corporate card and built-in controls that allow you to manage spending down to the vendor, plus simple rewards that put cash back into your bottom line.

Corporate cardGet business credit without risking your personal credit.

Most small business credit cards require a personal guarantee, putting your individual credit and finances on the line. Ramp doesn’t. Our corporate card is designed to support your business on its own merit—no personal credit checks.

That means your business builds credit independently, and you stay protected as you grow.

Manage travel spend from booking to book close.

Set smart approval workflows and customize guardrails—like per diem limits and hotel rates—to prevent out-of-policy spend. Designed to help small businesses stay in control from takeoff to reconciliation.

Travel

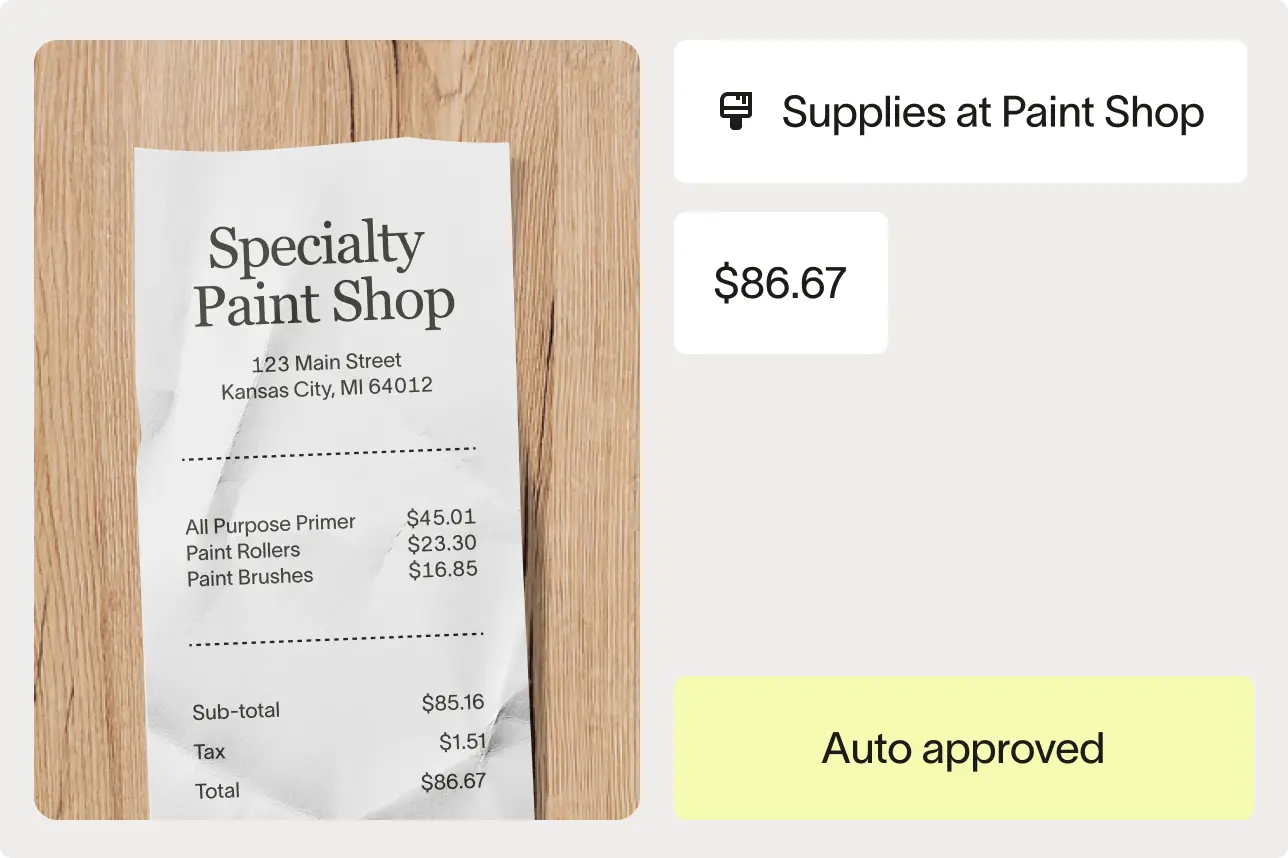

Take the effort out of employee expenses.

Give employees time back and increase accuracy with small business expense management software that simplifies everything—from capturing receipts to categorizing transactions.

Ramp streamlines the entire process so expense submission and reimbursement are fast and accurate.

Automate accounts payable.

Ditch manual entry with AP automation built for small businesses. Ramp extracts invoice details, routes approvals with customizable workflows, and schedules recurring payments—so vendors get paid on time, every time.

Accounts payable softwareMake accounting easy.

Ramp gives small businesses full visibility into every dollar spent and real-time insights through powerful reporting. Close the books faster with built-in integrations for QuickBooks, Xero, and more.

Accounting automation software

Why small businesses love using Ramp.

See why small businesses switched to Ramp—and how our corporate card saves them time and money.

FAQs

With unified tools that eliminate manual work and improve visibility across teams, Ramp helps small businesses scale operations more efficiently while keeping costs under control.

Plus, tools like expense tracking, account summaries, and employee cards with controls make managing your finances much simpler.

However, the best new business credit cards should report to commercial bureaus, keeping your personal and business credit profiles separate. Ramp is one of those options; it does not report to personal credit bureaus, helping small business owners protect their personal credit whilebuilding their business credit independently.