Intake to pay.

Now 3x* faster.

Procure it all, and pay in one place. Automate away the busywork so you breeze through every purchase.

Intake in an instant.

Ramp’s AI kicks off the cycle for you, and cuts out manual work.

Just drop in a contract or screenshot.

Ramp's AI parses through the details and fills out the request form accordingly, so you don’t have to.

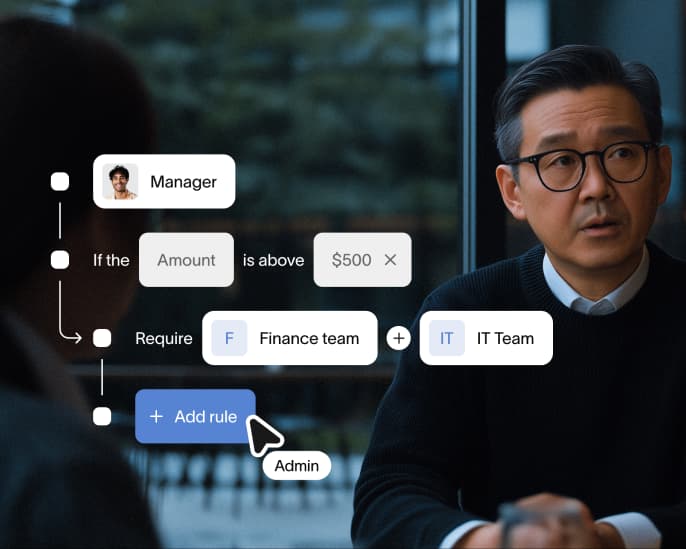

Route approvals to the right place.

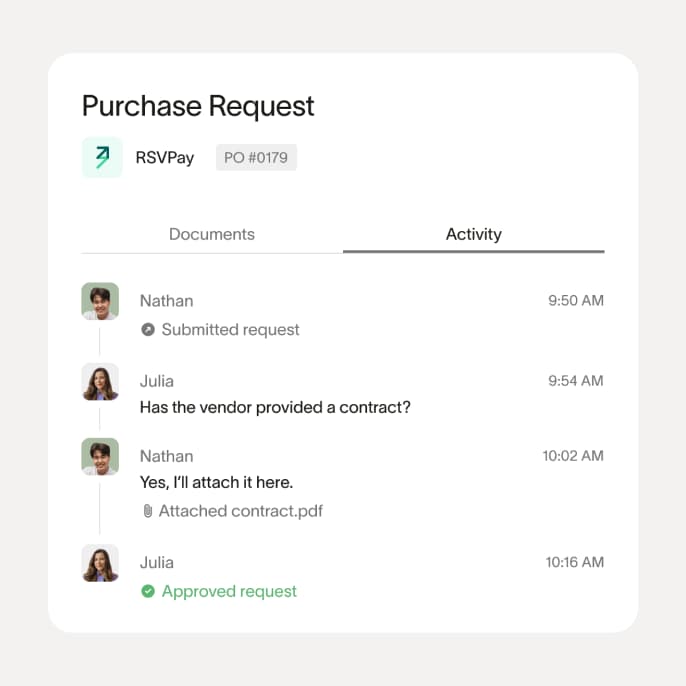

All the context. None of the back and forth.

Audit-proof your process.

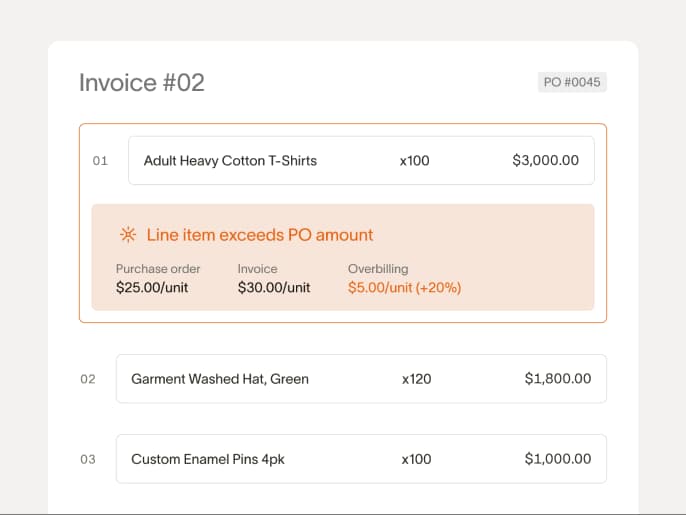

Only pay for what you asked for—Ramp reconciles everything for you.

Know your committed spend.

Don’t get overbilled a cent.

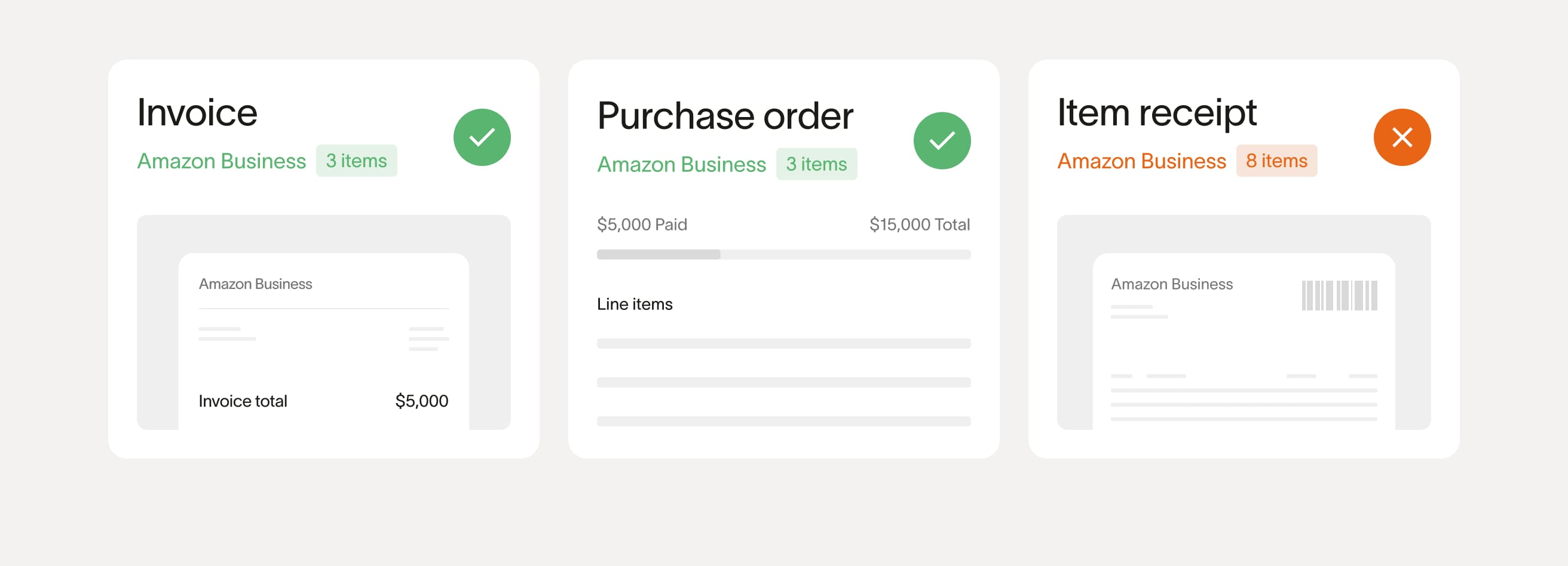

Triple checks, zero losses.

Get the ultimate protection against fraud and errors. Our automated three-way match validates your invoices against purchase orders and item receipts.

“We went from weeks to get approval to about 48 hours. From a timeliness standpoint, clinics can get what they need sooner because their managers are approving their requests on time.”

CFO, Skin Pharm

Process all your AP in minutes.

Automate invoice processing, collect payment and tax information, and pay vendors however you’d like.

Sit back.

Ramp finds savings for you.

No more overlapping services or unused software. Get insights to boost your bottom line.

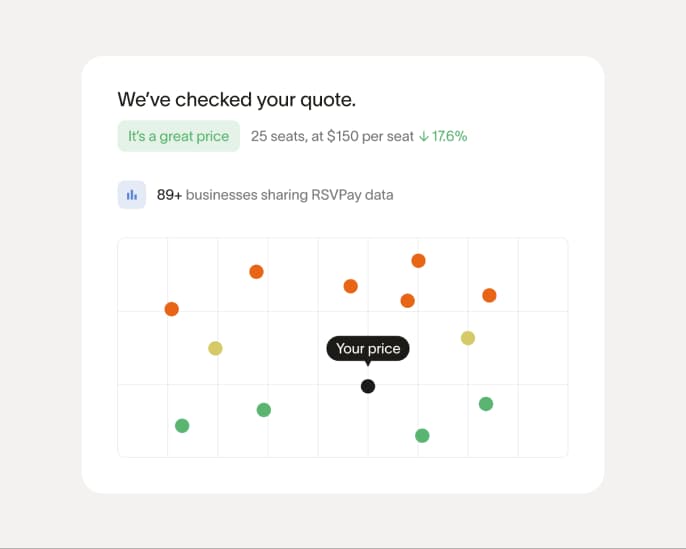

Get the absolute best deal.

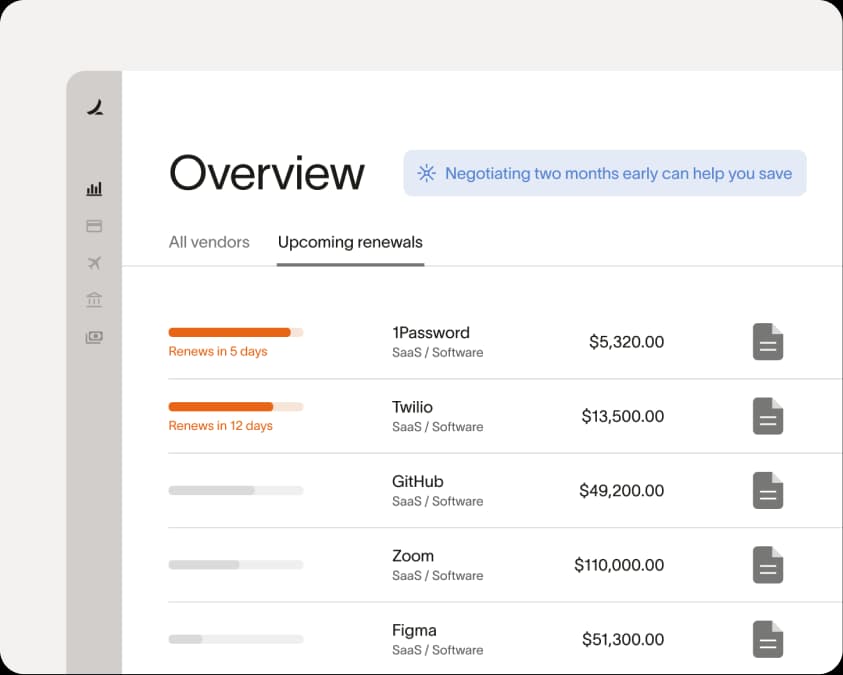

Stay ahead of renewals.

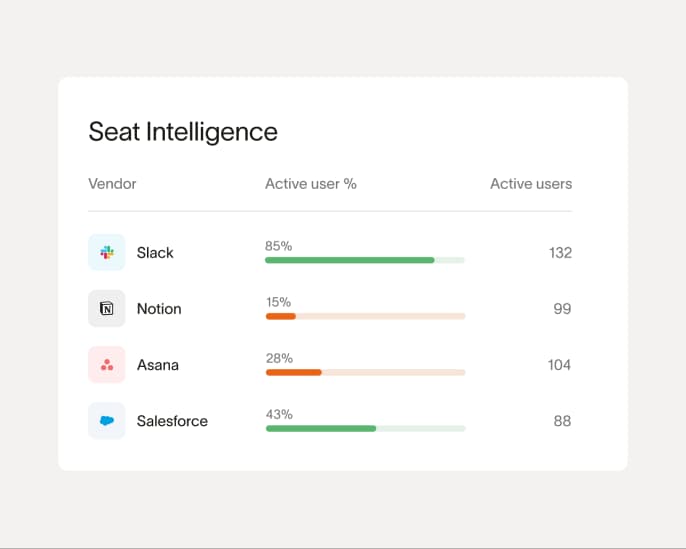

Never pay for an inactive seat.

You name it,

we work with it.

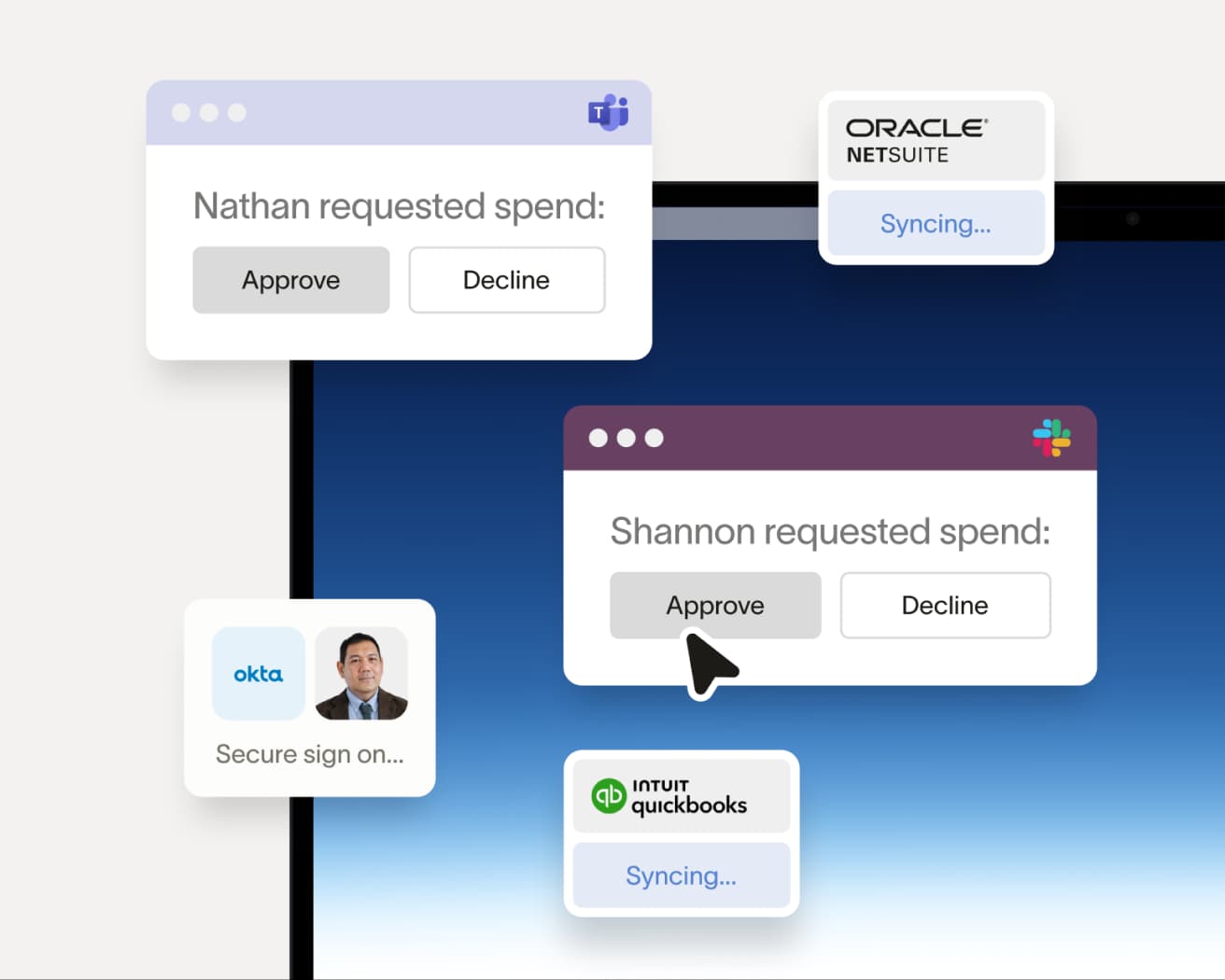

Approve requests directly in Slack, conduct seamless contract reviews with Ironclad, and sync or import purchase orders with NetSuite, plus more integrations. It’s that simple.

FAQ

Employees can submit purchase requests for a wide range of items and services—software subscriptions, contractors, hardware, marketing services, and more. It's completely customizable for your business needs.

Ramp Procurement supports both one-off and recurring purchases, with customizable intake forms tailored to the type of request and business function. Request types can also trigger different approval flows depending on dollar amount, vendor, or department. Learn more.

Ramp Procurement starts with a centralized request form that captures key details like vendor, purpose, cost, and contract terms. From there, it automatically routes the request through custom approval workflows—pulling in stakeholders from finance, IT, legal, or security as needed.

Once fully approved, Ramp automatically generates a purchase order or one-time virtual card. Learn more.

Ramp Procurement is flexible to your workflow and supports 2-way and 3-way matching with records generated in Ramp Procurement or records imported from QuickBooks Online and NetSuite. Learn more.

Yes. Ramp Procurement makes it easy to manage recurring spend and vendor compliance in one place. You can flag recurring vendors, set up automated contract renewal reminders, and route contract renewals through the same intake and approval process as new purchases. Learn more.

Ramp also lets you capture and store vendor contracts, W9s, payment information and compliance forms during intake—so all required files are reviewed by stakeholders before a new vendor is approved. These records stay attached to the vendor profile for easy reference during audits or contract reviews. Learn more.

Ramp's purchase orders sync directly with NetSuite and QuickBooks Online, automatically keeping your records up to date in your preferred accounting system—no manual re-entry needed.

Procurement automation replaces manual purchasing tasks—like collecting requests, getting approvals, and onboarding vendors—with streamlined, software-driven workflows. Instead of relying on emails or ad hoc forms, teams can standardize and speed up the entire intake-to-pay process.

This improves operational efficiency by eliminating delays and guesswork. Employees know where to submit requests, stakeholders are looped in automatically, and finance teams get early visibility into committed spend. As purchasing volume grows, automation helps businesses scale their procurement process without adding complexity or headcount.

Procurement management software standardizes how teams request, approve, and track purchases. It starts with an intake form where employees submit vendor or purchase requests. The platform then routes those requests to the appropriate stakeholders based on vendor type, spend category, or dollar amount.

Once a request is approved, the software can trigger payment workflows, issue virtual cards, or sync directly with accounting and vendor management systems. The full history—from intake to payment—is captured for audit, compliance, and reporting purposes.

The best procurement software centralizes intake, routes approvals intelligently, and integrates cleanly with your finance stack. Look for tools that include:

- Customizable intake forms by department or vendor type

- Dynamic approval flows based on amount, vendor, or request category

- Automated vendor onboarding and document collection

- Integration with accounting systems or ERPs

- Purchase-to-payment audit trails

- Support for recurring requests and renewal tracking

- Vendor management

Procurement platforms like Ramp integrate directly with ERPs and accounting software, ensuring purchase orders flow into the finance system accurately. Once a purchase order is generated in Ramp, customers have the option to sync the purchase order directly into QuickBooks Online or NetSuite.

This connection eliminates duplicate entry and keeps your general ledger up to date.

Procurement software pricing varies widely—many tools charge per user or as part of an enterprise contract. Some also charge additional fees for integrations, customizations, and implementation.

Procure-to-pay starts with a formal purchase order and moves through receiving, invoice matching, and payment. It's common in ERP-heavy workflows. Intake-to-pay starts one step earlier—with a user-friendly request form. It gives teams visibility and control before a PO or payment is created, making it easier to manage all types of spend—not just PO-based purchases.

Ramp follows an intake-to-pay model to support faster, more flexible purchasing workflows that still enforce policy and integrate with your ERP.