Most banks hope you never see this.

Earn -.--%1 in a business account, and -.--%2 in an investment account.

Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC.

Securities products and brokerage services are provided by Apex Clearing Corporation, an SEC registered broker dealer, member of FINRA & SIPC. The Investment Account is not a deposit product, not insured by the FDIC, and may lose value.

Ramp Business Account

Give your company a raise.

Most US businesses still use low-interest checking accounts. Don’t be one of them—start earning -.--%1 on your operating cash with a Ramp Business Account today.

$0/Year$0/Year

vs. national average (0.07%) = $03

Up to hundreds of millions of dollars of FDIC insurance.

Securely store multi-million-dollar deposits in the Ramp Business Account.

Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC. Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Subject to the terms of the applicable ICS Deposit Placement Agreement, First Internet Bank of Indiana, member FDIC, will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

Slow payments,

are old news.

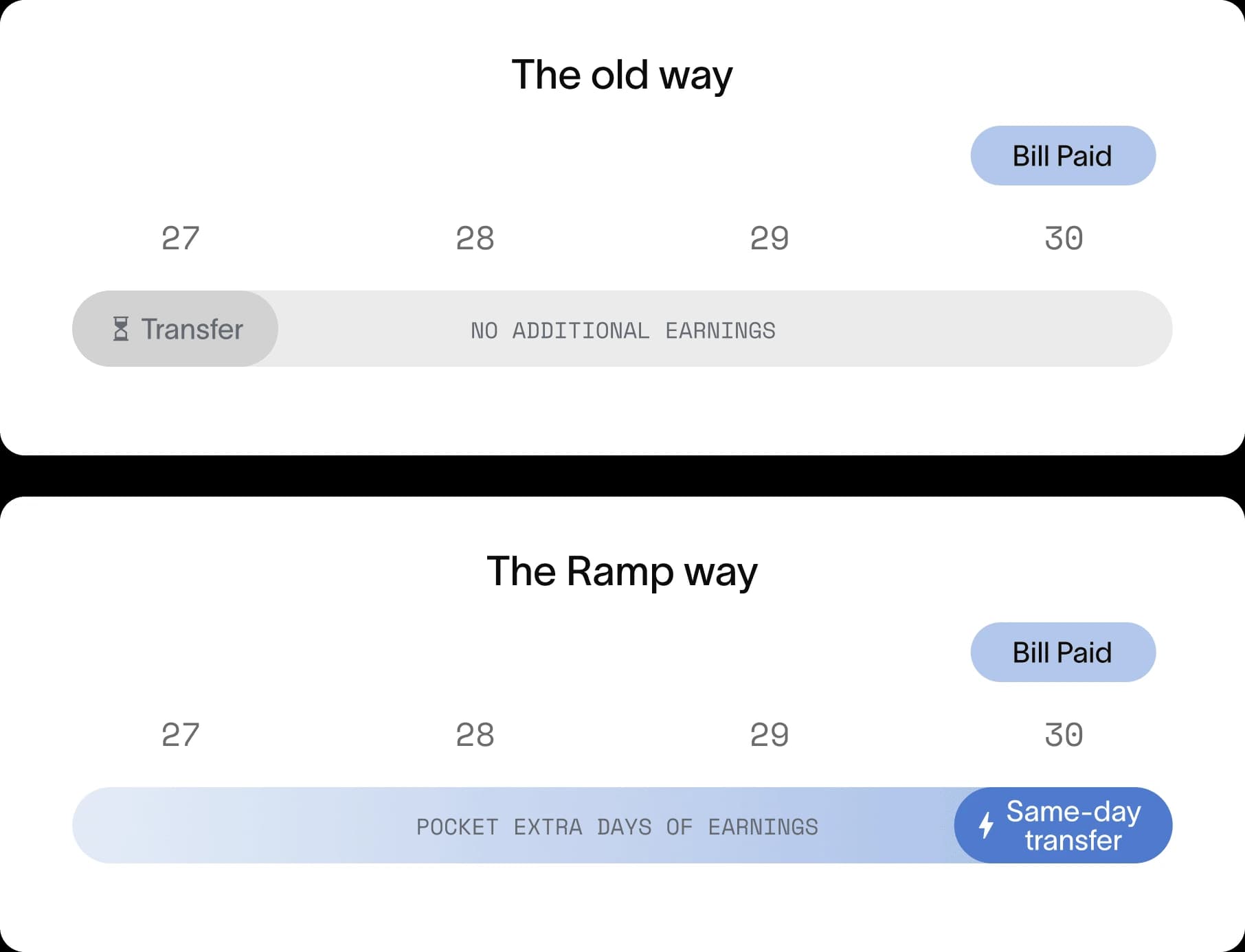

Keep your cash earning longer. Pay bills4 and reimbursements on the day they’re due with free, unlimited same-day ACH.

How do faster payments earn more?

Know exactly what’s around the corner.

Ramp Intelligence automatically alerts you if your balance won’t cover your bills, or if you have extra cash that could be invested.

All the control.

None of the complexity.

Robust money management with beautiful design and thoughtful workflows—that’s just simple to use.

A smarter way to move and manage money.

Stop shuffling cash across accounts. Use a Ramp Business Account as your primary operating account and earn more on all your cash (even payroll funds).

Fully integrated workflows, from beginning to end.

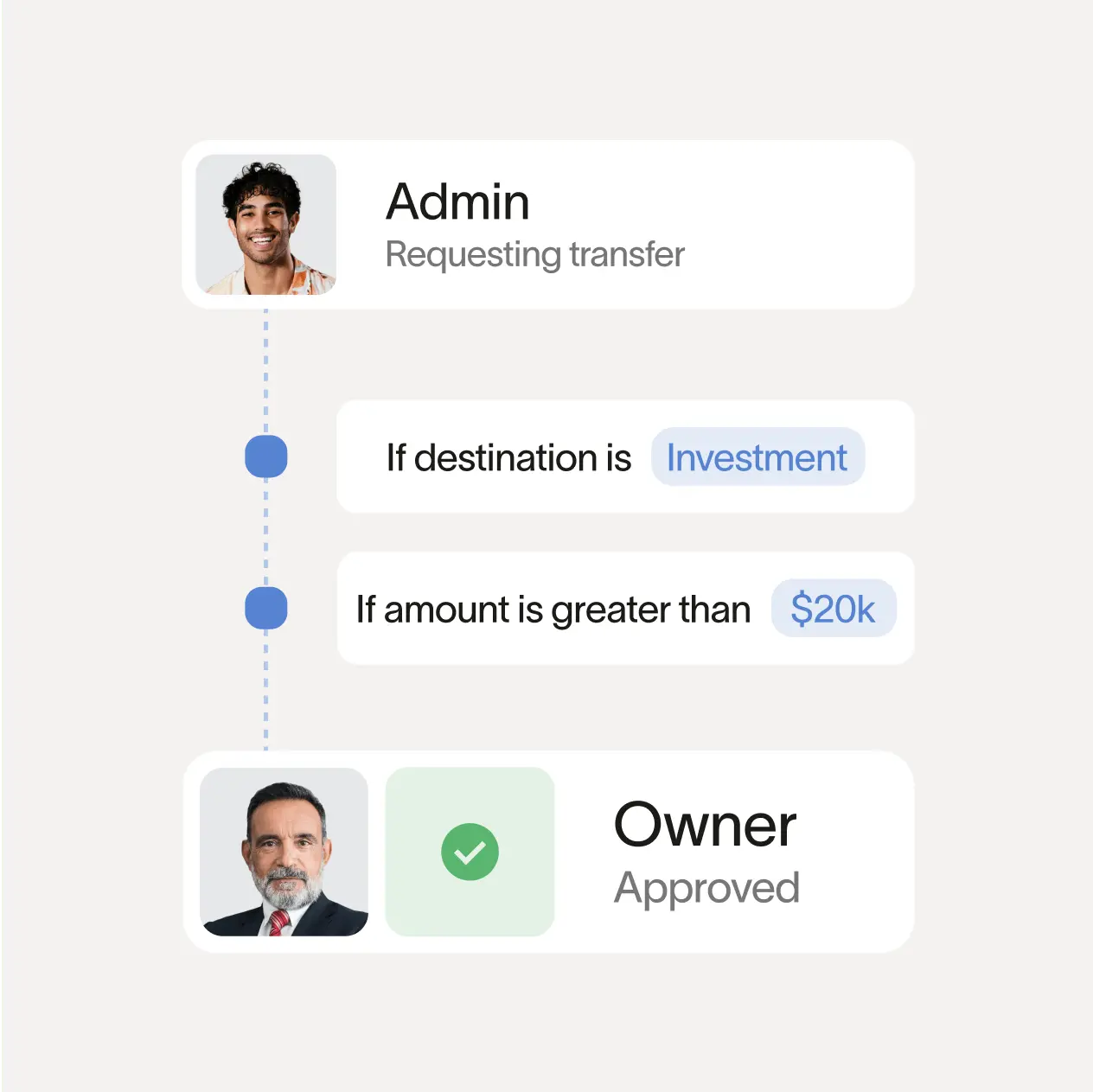

Money won’t move, unless you approve.

Put your morning account checks on autopilot.

Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC.

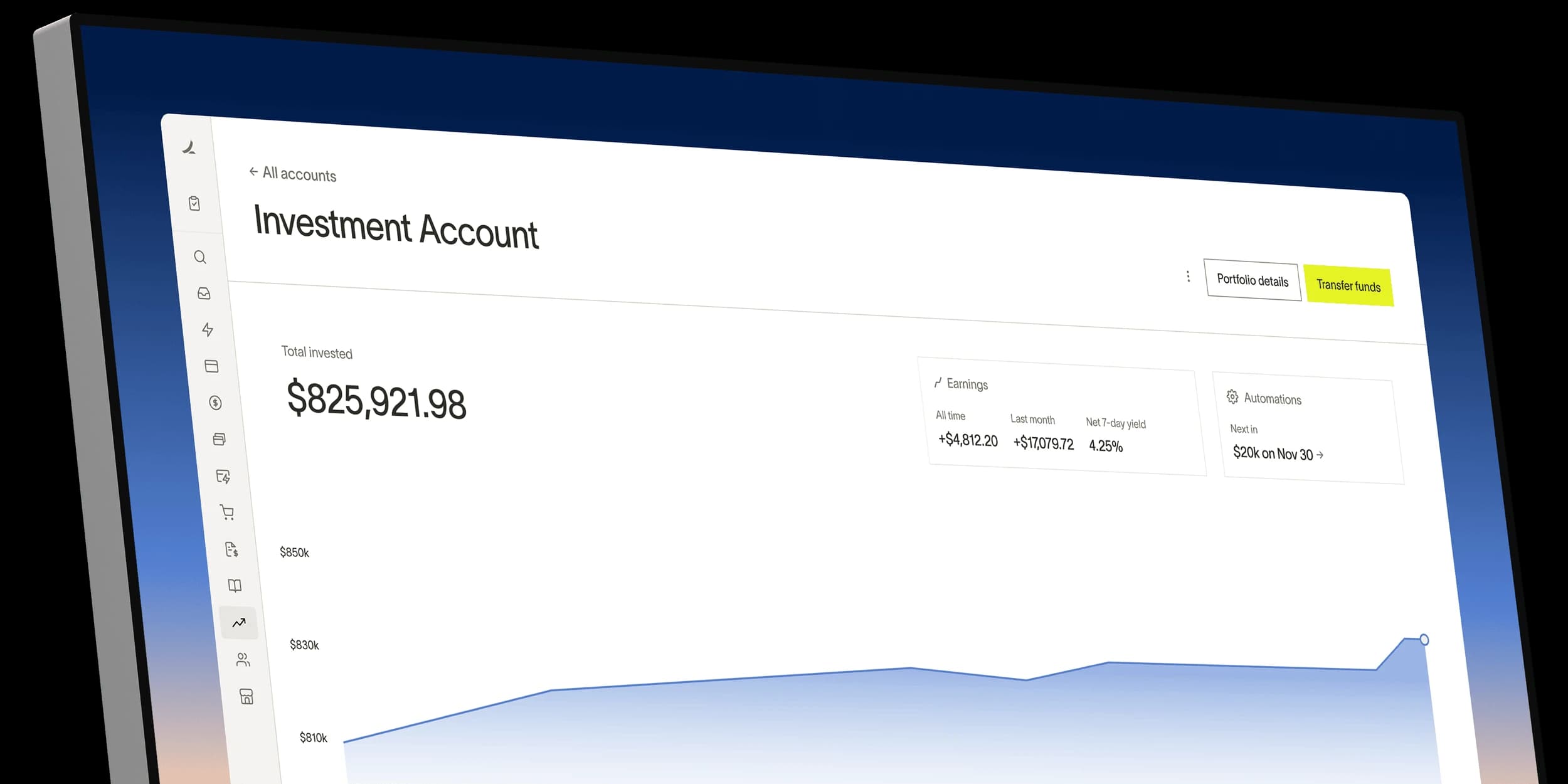

Ramp Investment Account

An investment account that works for you.

Securities products and brokerage services are provided by Apex Clearing Corporation. Apex Clearing Corporation is an SEC registered broker dealer, a member of FINRA and SIPC, and is licensed in 53 states and territories. FINRA BrokerCheck reports for Apex Clearing Corporation are available at: brokercheck.finra.org. The Investment Account is not a deposit product, not insured by the FDIC, and may lose value.

FAQ

The Business Account is a deposit account offered through First Internet Bank of Indiana, Member FDIC. Ramp is not a bank, and bank deposit services are provided by First Internet Bank.

When you open a Ramp Business Account, you are opening a deposit account at First Internet Bank.

Upon opening a Ramp Business Account, Ramp will pay you a monthly cash reward, calculated as a percentage of your deposited funds. You begin earning on the first dollar you deposit, and there is no cap to how much you can earn.

This cash reward is offered and paid by Ramp. It is not an offering by First Internet Bank or a benefit of your deposit account with First Internet Bank. The cash reward is subject to change by Ramp; First Internet Bank does not determine cash rewards.

Earnings are disbursed automatically by Ramp each month. Earnings are paid as cash, and are not statement credits or rewards requiring redeemption. Instead, the customer can transfer earnings from their Ramp Business Account to be used as cash elsewhere.

See Section 4(d) of the Business Account Addendum for more information about rewards.

Yes – deposits in a Ramp Business Account receive FDIC insurance up to tens of millions of dollars per depositor.

Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Ramp is a financial technology company, not an FDIC-insured depository institution. Banking services are provided by First Internet Bank, member FDIC.

Subject to the terms of the applicable ICS Deposit Placement Agreement, First Internet Bank will place deposits at FDIC-insured institutions through IntraFi's ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks.

Certain conditions must be satisfied for "pass-through" FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi's network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage.

Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

Get paid directly into your Ramp Business Account via ACH, wire, or real-time payments. You can easily transfer funds from your linked bank accounts or receive payments from customers and services like Stripe. Payments typically settle the same day but can sometimes take up to five business days. (Transfer times may vary.)

Use your Ramp Business Account to pay all your bills. You'll get unlimited free ACH transfers, domestic wires, and international wires when paying through Ramp Bill Pay or issuing reimbursements. Payments toward your Ramp statements settle instantly. You can also let external services debit your Ramp account directly, making it easy to fund payroll or pay vendors outside Ramp Bill Pay.

For existing Ramp customers, it takes less than a minute to open a Ramp Business Account. Simply navigate to the "Treasury" tab in Ramp, click "open a free account", and input how much money you want to deposit. Once the funds are deposited, you will begin earning and can use the funds to pay your Ramp bills.

If you're not yet on Ramp, you can sign up for free today.

The Ramp Investment Account allows businesses to invest their cash into the Invesco Premier U.S. Government Money Portfolio (FUGXX), a money market fund. See the prospectus here. FUGXX is a government money market fund that seeks to provide high liquidity and a competitive yield while investing in short-term U.S. Treasury obligations and government securities.

Securities products and brokerage services are provided by Apex Clearing Corporation. Apex Clearing Corporation is an SEC registered broker dealer, a member of FINRA and SIPC, and is licensed in 53 states and territories. FINRA BrokerCheck reports for Apex Clearing Corporation are available at: brokercheck.finra.org. The Investment Account is not a deposit product, not insured by the FDIC, and may lose value.

Ramp does not charge account opening or management fees. FUGXX does have expense ratios that impact returns. Please review the fund prospectus for details.