Introducing batch payments, payment step approvals, and more Bill Pay upgrades

- Batch payments: Combine bills, cut fees, and simplify reconciliation (Plus)

- Payment step approvals: Gain total control over the release of funds (Plus)

- Vendor controls: Prevent unauthorized changes to vendor information

- Importing bills: Access more payment methods, faster payments, and seamless reconciliation (Beta)

- Two-way vendor sync: Avoid mismatched vendor records and double entry (Beta)

- Domestic wire: Automate all your wire payments from Ramp (Beta)

- We’re just getting started.

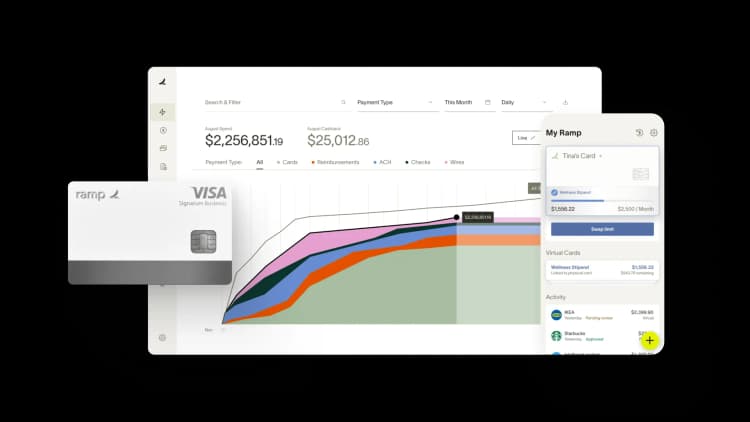

We launched Bill Pay in 2021 with a clear goal: eliminate the repetitive, error-prone tasks that make accounts payable one of the most frustrating and time-consuming functions in finance. Whether it’s extracting line items from invoices, coding bills with incomplete context or pushing urgent payments through approvals, accounts payable (AP) often feels like a task that never ends.

Today, we’ve automated much of that away. More than 60% of bills on Bill Pay are created without entering a single keystroke. Ramp AI significantly reduces the manual effort by capturing invoice details with over 97% accuracy and applying precise coding rules. Approvals are automatically routed according to bill attributes like amount and GL category. And, we’ve returned millions of dollars to customers through cashback—just for paying bills.

“Now, we can just pull an invoice over to Ramp and automatically get all the info. I can do a quick check, click a button, and it’s done”

—Ashli King, Accountant, Smart City

Managing AP is increasingly challenging as a business grows. Stretched finance teams are dealing with more invoices, greater complexity and higher risk. We’ve listened to our customers and learned about the challenges faced when processing hundreds of invoices per month. Scaling requires more than just automation—it takes tools that offer better control, tighter security, and deep integration with your ERP—all without slowing you down.

Recognizing these challenges, we're announcing six major upgrades to Bill Pay:

Batch payments: Combine bills, cut fees, and simplify reconciliation (Plus)

Processing hundreds of payments individually eats up time, increases transaction fees, and makes reconciliation a headache.

Batch payments transform this process by letting you combine multiple bills for the same vendor into a single payment. Select or deselect bills in just a few clicks, and instantly see your total cash outflow. By consolidating transactions, you not only cut transaction fees but also keep statements organized for both you and your vendors.

Tip: Batch payments work seamlessly with the new payer role (see below), and allows them to easily review and release payments that entered the approval queue.

Learn more about batch payments

Payment step approvals: Gain total control over the release of funds (Plus)

As businesses grow, managing cash flow requires tighter controls over who can approve and release funds.

The new “Payer” role introduces a dedicated approval for the release of payments, separate from standard approvals. This ensures that only select team members can authorize payments, adding an extra layer of control and reducing the risk of unauthorized transactions.

Tip: You can customize which bill changes require re-approval. Need the flexibility to update payment methods for suddenly urgent bills? Simply turn off re-approvals for changes to the payment method.

Learn more about payment step approvals

Vendor controls: Prevent unauthorized changes to vendor information

When multiple team members manage vendor information, changes can slip through without oversight. This can easily lead to errors, fraud, and compliance risks.

Vendor controls solve this by introducing an approval workflow for vendor updates. Changes to sensitive details like ACH and tax info are locked until review and approval. Additionally, every proposed change is automatically logged, which ensures there is a clear audit trail.

Tip: When creating a bill, you have the option to select vendor changes that are pending review and they’ll be automatically applied to both the bill and vendor record post approval.

Learn more about vendor controls

Importing bills: Access more payment methods, faster payments, and seamless reconciliation (Beta)

If you’re tied to creating bills in your ERP, you’ve likely faced the hassle of preparing payment files, navigating clunky portals or dealing with limited payment methods.

Now you can leverage Ramp’s robust payment platform, while keeping your existing bill creation process. Simply import bills from your ERP into Bill Pay, choose your payment method, and we’ll take care of the rest, including posting updates back to your ERP.

Tip: Already have vendor information stored in your ERP? Ramp can import it too, so you can start using Bill Pay in minutes.

Learn more about importing bills

Two-way vendor sync: Avoid mismatched vendor records and double entry (Beta)

ERP and AP systems should be in perfect sync—but too often, they’re not, leaving you with mismatched records.

Ramp’s two-way vendor sync eliminates this friction by automatically updating vendor information—like payment details, tax IDs, and addresses—in real time between Ramp and your ERP.

Tip: When vendor controls are enabled, updates made to vendor information in your ERP will require approval in Bill Pay before being applied, ensuring secure and accurate synchronization.

Learn more about two-way vendor sync

Domestic wire: Automate all your wire payments from Ramp (Beta)

Wires are often essential for high-value or urgent transactions, though preparing them can be a tedious process– logging into your bank portal, inputting details and reconciling records takes time and effort.

Now Ramp lets you send domestic wires directly within our platform– complete with payment scheduling, automated notifications to vendors and syncing to your ERP.

Tip: To ensure same-day domestic wire payments, make sure your bills are fully approved by 1:00 PM EST.

Learn more about domestic wire payments

We’re just getting started.

We’ve delivered the most impactful year for Bill Pay since launch—innovating faster and solving key challenges for over 8,500 businesses that run AP on Ramp. We’re committed to empowering finance teams to do more with less—supporting you at every stage of growth, without ever sacrificing control or efficiency.

Bill Pay is included within the Ramp suite. Sign in to explore the latest features, or visit our Help Center and Bill Pay page for more information.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits