How Ramp helped me catch a 300% vendor overspend

The first time I negotiated a SaaS contract, I had no idea what I was doing. I had been leading a data team for a month. All my prior experience was at a mega-tech company where I was nowhere near the room where vendor procurement happened.

We were buying a business intelligence tool, the sales rep told me that I could get a 10% discount as long as the deal closed before the end of the quarter. I asked my CFO if we could sign the contract, he asked me if it was a good deal. At the time, I didn’t even know sales teams had quotas + commissions. I just didn’t want to look like an idiot in front of my exec team. I remember thinking - why is this my job?

Fortunately, there is a better way! Today, I lead the data team at Ramp. We have a lot going on: saving customers time and money, shipping new products, optimizing marketing channels and budgeting, and lots of hiring. Any time I spend comparing line items and negotiating vendor deals comes at the expense of building Ramp.

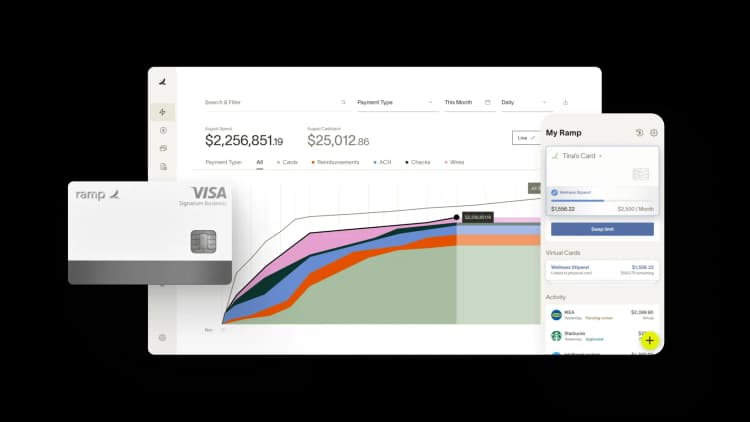

I use Ramp’s procurement features to manage all of my team’s software needs. These automated tools, designed to manage vendors and keep costs in check, bring my accounting workload down to near zero. And this allows me to focus on what I’m good at: my actual job.

Ramp Procurement lets me easily add vendors, automatically match bills against POs, and assign virtual credit cards to monthly spend. It also provides automatic safeguards against unauthorized vendor spend. And, just this week, one of those safety wires tripped and I caught a vendor overcharging us by 300%.

I felt like quite the hero, but really, Ramp did all the work. Here’s how it happened.

Implementing vendor controls

My team uses a handful of vendors to keep the data tubes greased. A few years ago, we adopted a new vendor—we’ll call it Clank—and added them to our Ramp account with a regular billing cadence.

We issued a virtual Ramp card associated with the vendor to automatically approve invoices up to a set amount—call it $1,000—each month. Clank is a vendor that charges by Monthly Active Users (MAU), and since ours doesn’t fluctuate much, we expected the billing rate to be consistent.

Most of our fixed-rate vendors are set up this way. Each month, I get notified when the bill comes in, Ramp automatically approves the payment if everything is correct, and I get back to running the data team

Any transactions that don’t meet the card’s criteria get declined and flagged immediately in my Ramp app and inbox. This had never happened.

Until it did.

Identifying—and resolving—the overcharge

It’s pretty easy to intuit how Ramp flagged the outlying bill. Last month, I got a notification on my phone: the Clank virtual card had automatically declined a transaction. A bill showed up at our doorstep at four times the usual amount.

Perhaps equally interesting, in this case, is that we actually helped Clank by reporting this flag. I sent a note to their team:

“Our most recent Clank invoice is about 4x what we've been paying. The payment was declined because it exceeds the agreed-upon amount. Our bill says we went from 250k to 1.1m MAU. None of our other MAU-based tools have spiked during this time. I can't find anything to indicate why it happened.”

The customer success team responded promptly: this was part of a larger issue. It turns out our MAUs were getting calculated incorrectly, and Clank’s system automatically billed us for the wrong amount. An innocent mistake with no malicious intent. But an important issue to surface, because we—and other customers—could have significantly overpaid.

We’ll never know the magnitude of the problem and how many Clank customers were affected. But I’d like to think that the balance restored by Ramp’s automation in this case helped lower the entropy of the finance world across board—if not just a little bit. With your own automations and safety checks, your workflows may do the same.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°