IRC 45S: Paid family and medical leave tax credit explained

- What is IRC 45S?

- Who qualifies for the employer credit for paid family and medical leave?

- How does the paid family and medical leave tax credit work?

- Benefits and considerations for employers

- Use Ramp’s accounting automation to maximize your tax savings

IRC (Internal Revenue Code) Section 45S lets you claim a valuable tax credit for providing paid family and medical leave (PFML) to their employees. Businesses that adopt these policies often see stronger employee retention, improved morale, and reduced turnover costs. The credit helps offset the expense of supporting workers during critical life events.

IRC 45S was created to encourage more employers to offer PFML, and its relevance continues to grow as workplace benefits evolve.

What is IRC 45S?

IRC 45S is a federal tax credit that incentivizes employers to provide paid family and medical leave benefits to their employees. Sometimes called the FMLA tax credit, it helps businesses offset the costs of compensating workers during qualifying life events.

The credit was first established under the 2017 Tax Cuts and Jobs Act as a temporary measure. It supported lower-earning employees during events like childbirth, adoption, or serious medical conditions. Following the passage of the H.R. 1 bill in July 2025, the employer credit for PFML was permanently extended and enhanced, giving employers long-term certainty when planning benefits strategies.

IRC 45 vs. IRC 45S: What's the difference?

It’s easy to confuse IRC 45 and IRC 45S, but they are completely different tax provisions:

- IRC 45 provides a renewable electricity production credit, offering incentives for generating power from sources like wind, solar, and biomass

- IRC 45S is the employer credit for paid family and medical leave, rewarding businesses that provide written PFML policies for qualifying employees

Who qualifies for the employer credit for paid family and medical leave?

Any employer with a written policy that provides paid family and medical leave can claim the credit. The policy must guarantee at least 2 weeks of annual paid leave to all qualifying full-time employees, with proportional coverage for part-time staff working at least 20 hours per week.

Employees qualify once they’ve completed at least 1 year of service (employers may reduce this to 6 months). To count toward the credit, an employee must also earn no more than $96,000 in the prior tax year (2025 threshold, adjusted annually for inflation). Employers must pay at least 50% of an employee’s normal wages during leave to qualify for the minimum credit.

This incentive is open to businesses of all sizes and industries. There are no restrictions based on revenue, number of employees, or sector, making the benefit equally accessible to startups and large corporations.

What types of leave qualify?

The IRC 45S credit applies to paid leave taken for reasons similar to those covered under the Family and Medical Leave Act (FMLA). You have flexibility in designing your policy, but leave must meet these baseline purposes to count toward the credit:

- Birth of a child

- Adoption of a child

- Foster care placement

- Employee’s serious health condition

- Care for a spouse, child, or parent with a serious health condition

- Armed forces qualifying exigency

- Care for an injured or ill immediate family member who is an active-duty service member

How does the paid family and medical leave tax credit work?

The FMLA tax credit is based on the percentage of wages you pay to eligible employees during leave. To qualify, you must pay at least 50% of normal wages. The base credit is 12.5% of wages paid, and it increases by 0.25% for every percentage point above 50%, up to a maximum of 25%.

Here’s how it works in practice:

| Wages paid | Credit percentage | Weekly credit |

|---|---|---|

| 50% of normal wages ($500) | 12.5% | $62.50 |

| 75% of normal wages ($750) | 18.75% | $140.63 |

| 100% of normal wages ($1,000) | 25% | $250 |

Leave required by state or local laws is not considered when calculating this federal tax credit.

How to claim the credit (Form 8994)

You can claim the IRC 45S credit by filing IRS Form 8994 with your annual business tax return. The form requires details about your leave policy, wages paid, and the employees who took qualifying leave.

Follow these steps:

- Gather your written leave policy and payroll data for employees who took family or medical leave

- Calculate your credit rate based on the percentage of wages you paid (must be at least 50% of normal wages)

- Complete Form 8994 with employee details, weeks of leave taken, and wages paid

- Report your total qualified wages and apply the credit percentage

- File Form 8994 with your business tax return (Form 1120, Form 1120-S, Form 1065, or Schedule C)

In some cases, you may also need to file Form 3800, General Business Credit.

Keep thorough records to protect yourself during audits. Store your written policy, payroll documentation, leave requests, and approval notices for at least 3 years. Strong recordkeeping makes annual filing easier and ensures compliance.

Benefits and considerations for employers

The IRC 45S credit is still underused. In 2021, according to an IRS report, just 490 corporations claimed $112 million. By taking advantage of it, you not only save on taxes but also strengthen your workplace benefits strategy.

Key benefits

- Tax credits offset 12.5% to 25% of wages paid during qualifying leave

- Better employee retention, reducing turnover and training costs

- Stronger recruiting appeal in competitive job markets

- Higher employee loyalty and morale when workers feel supported

- Reduced absenteeism and higher productivity when employees return refreshed

Important considerations

- Credit applies only to wages paid above state or local requirements

- Administrative work of tracking leave, calculating wages, and filing forms

- Upfront cash flow impact before you receive the credit

- Policy must provide at least 2 weeks of paid leave to all qualifying employees

- Credit applies only to employees who earned less than $96,000 in the prior year (2025 threshold)

- Temporary coverage costs for employees on leave

The IRS can audit your leave policy and wage calculations, so maintaining detailed, organized records is essential for compliance.

Use Ramp’s accounting automation to maximize your tax savings

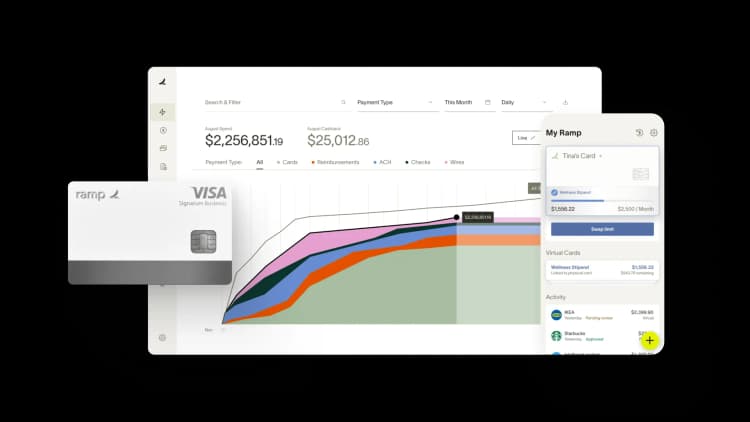

Effectively managing your business’s finances and staying on top of tax planning can be complex, but it’s crucial for ensuring you get the most value from tax-saving opportunities such as IRC 45S. By using the right accounting tools, you can streamline your accounting processes, track payroll, and ensure your business qualifies for appropriate tax credits.

Ramp’s accounting automation software simplifies financial management, helping you maintain accurate records, stay compliant with IRS regulations, and maximize your tax savings. With features that automate key financial tasks and provide real-time insights, Ramp empowers your team to make smarter financial decisions and reduce manual work.

Explore how Ramp’s accounting automation tools can help your business manage finances more efficiently and unlock tax savings.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits