Accounting

Everything you need to know about closing your books accurately and on time. Meet the next generation of accountants driving the profession forward.

Article

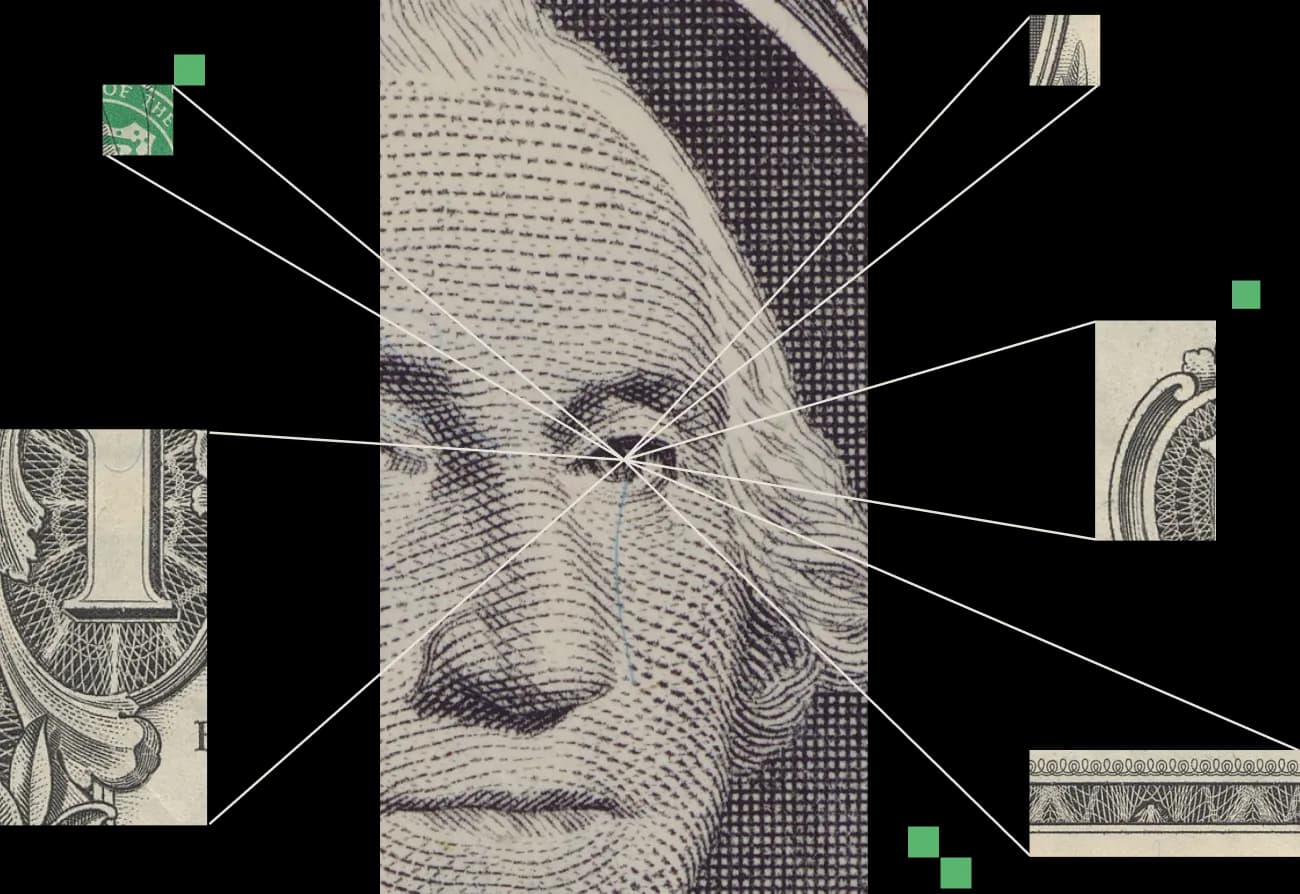

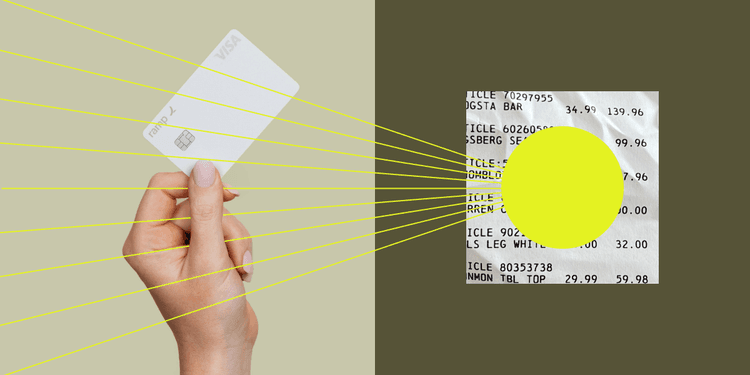

ArticleA guide to accounting for credit card rewards

Matt Vickers

Director of Product, Ramp

Latest

ARTICLE

Cash basis accounting: A complete guide with examples

Cash basis accounting records revenue when cash is received and expenses when paid, offering a simple way to track income and manage taxes.

ARTICLE

Account reconciliation: What it is and how it works

Account reconciliation in accounting is the process of comparing internal records to external statements to ensure balances are accurate and complete.

ARTICLE

What is GAAP in accounting?

GAAP is the standardized framework of accounting rules US companies use to prepare consistent, transparent, and comparable financial statements.

ARTICLE

LLC tax rates and rules for tax year 2025

LLC owners pay federal income tax at personal rates (10–37%) plus 15.3% self-employment tax, with state taxes and fees varying by location.

ARTICLE

How I run finance solo at a hypergrowth startup

James Agius, financial controller for community platform Skool, explains how he's automated away much of the admin work to avoid growing headcount with scale.

ARTICLE

How to calculate cost of goods sold (COGS)

Cost of goods sold (COGS) is the total direct cost of producing or purchasing the goods you sell during an accounting period.

Get fresh finance insights, bi-weekly