Ramp news

How Ramp is leading the way to help businesses work faster and smarter.

Article

ArticleThe end of manual accounting

Victor Pires

Senior Product Marketing Manager, Ramp

Latest

ARTICLE

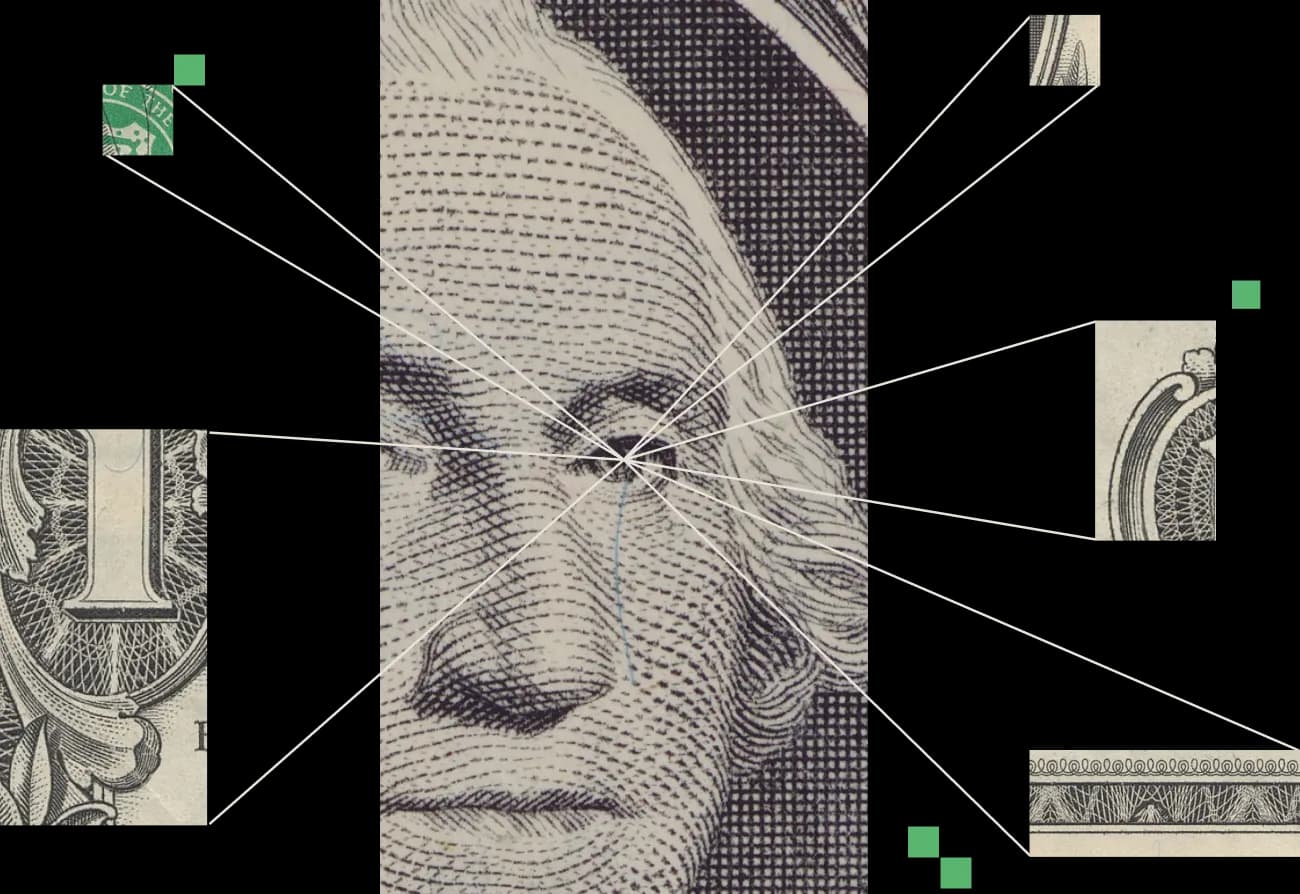

Ramp for Public Sector: because $2.8 trillion in improper payments isn't serving anyone’s mission

Ramp is bringing U.S.-only data residency and FedRAMP compliance to the public sector so control can be built into every transaction, not reconstructed later.

ARTICLE

Will Big Tech AI splurges pay off? New Ramp data shows paid adoption is up

Big Tech is spending hundreds of billions on AI — but will it pay off? New Ramp data shows paid AI adoption is rising, led by spend on OpenAI and Anthropic.

ARTICLE

Planning for 2026, no crystal ball required

We recently teamed up with Thrive Capital for a Ramp Community breakfast featuring candid conversations about goal-setting, assumptions, and the latest tools.

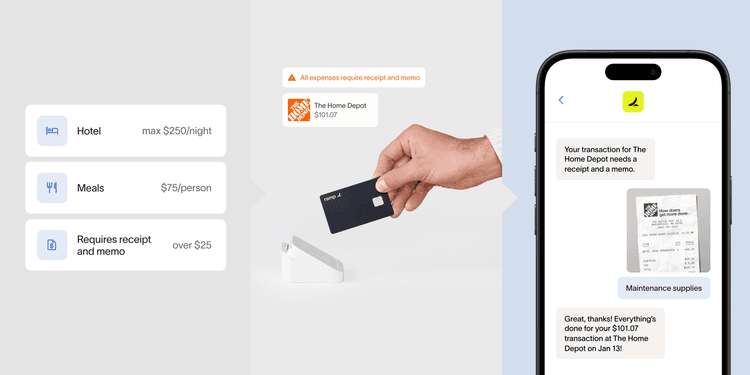

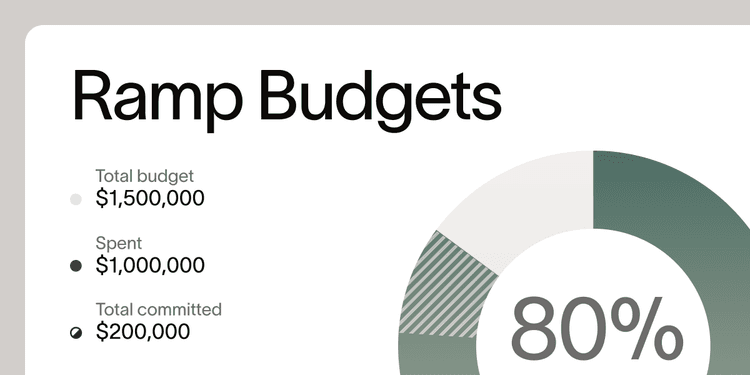

ARTICLE

Ditch the spreadsheet. Track your budgets in Ramp.

Ramp Budgets monitors all your spend, live and integrated into a single platform, closing the loop between planning and execution, for the visibility you need.

ARTICLE

Ramp x MedPro Systems: Automating compliance for life sciences teams

To automate compliance with the Sunshine Act and other transparency laws, Ramp is partnering with MedPro Systems, a trusted source of healthcare provider data.

ARTICLE

What’s next for Ramp Economics Lab

Highlights from Ramp Economist Ara Kharazian's first year and a look ahead at what's coming this year for our economics lab.

Get fresh finance insights, bi-weekly