This month’s drop features something for everyone—whether you’re a CFO looking to earn more on operating cash or a marketer trying to spend less time submitting expenses.

Here’s what’s new.

Maximize returns, pay bills on time, and save hours in your week.

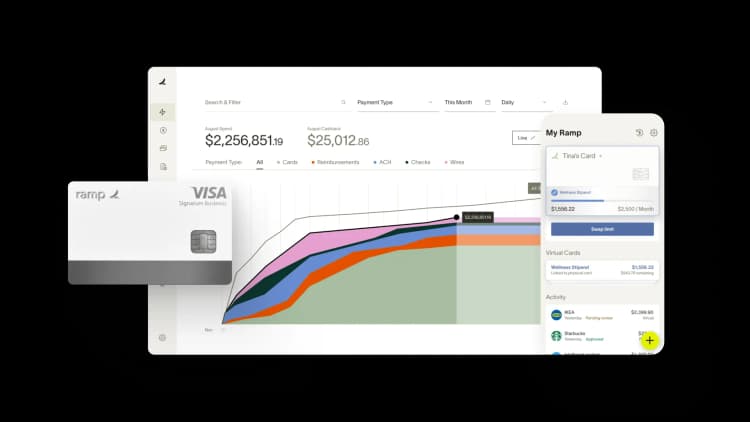

Zero. That’s what 80% of businesses earn on their operating cash. So we built a new kind of cash account that won’t make you choose between high yield and liquidity. It’s called Ramp Treasury, and it allows you to access a Ramp Investment Account that earns 4.3% on excess cash with no minimums, no transfer caps, and next business-day liquidity.

You can also store operating cash in a Ramp Business Account while earning an unlimited 2.5%, then use the funds to pay your bills. Ramp can anticipate cash flow needs, accelerate cross-team approvals, and automate transfers, payments and reconciliation, giving you hours back each week.

Want to learn more? Reserve your seat for our upcoming live webinar on February 20, @ 11 AM PT / 2pm ET.

Automatically categorize expenses over SMS

Most employees have no clue what an accounting category is. And that’s a big problem for accountants—who depend on their employees to correctly categorize transactions to reduce busywork.

Thankfully, Ramp has it covered.

Now, after you submit a receipt, we can suggest accurate accounting categories—or automatically assign one based on your memo. No need to learn complex terminology or project codes. Just five seconds of your time and perfectly filed expenses, every time.

Admins on the go

This month we’re swiping right on simpler expense management. Now admins can approve or decline cards, adjust limits, and manage team spend, all with a single swipe.

Our new mobile updates also make it easy for admins to:

- View employee profiles and see their funds, cards, and flagged activity.

- Issue funds with just one tap.

- Lock, unlock, or terminate cards right from your phone.

What features do you want to see next? Let us know in the Ramp Community Forum.

Legal disclosures:

Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC.

Securities products and brokerage services are provided by Apex Clearing Corporation, an SEC registered broker dealer, member FINRA & SIPC. The Investment account is not a deposit product, not insured by the FDIC, and may lose value.

Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

Before investing in a money market fund, carefully consider the fund's investment objectives, minimum investment requirements, risks, charges and expenses, as described in the applicable fund’s prospectus. You may obtain a copy of the fund prospectus here. Yield rate is the current effective annualized 7-day yield rate for FUGXX as of [February 6, 2025], and is variable, fluctuates, and is only earned on cash invested into money market funds in the Ramp Investment Account. Past performance is not indicative of future results. Investing in securities products involves risk of loss, including loss of principal. This is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security, and no buy or sell recommendation should be implied.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits