How companies are turning to AI in a changing job market

- Mid-market companies cut spending on hiring and recruitment platforms

- SMBs increased spending on contractor platforms

- Growth of AI content-generation tools

- More resources to help you benchmark your spending

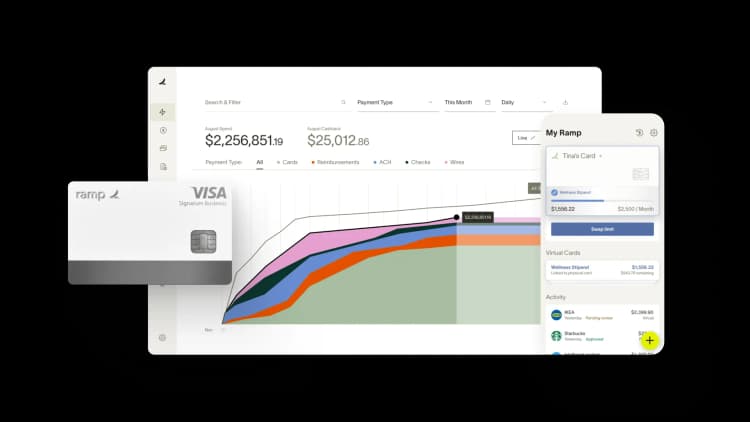

This week, we’re publishing a three-part series on companies’ latest priorities based on billions of dollars processed on Ramp every month. Don’t miss our previous stories on how AI is the fastest-growing expense for businesses and spurring creative work.

This June, unemployment rose above 4% for the first time since November… of 2021. So what contributed to the rise? As always, multiple factors—including ubiquitous (and well-publicized) layoffs from big-name tech companies. With the market flooded with so many skilled workers, the “war for talent” is officially on pause. As the Financial Times puts it, “employers hold the cards now.”

However, things aren’t shaking out quite as expected. Although more job seekers are on the market, businesses seem to be passing on hiring, perhaps influenced by the uncertainty surrounding future market movements, the upcoming election, and rate cuts. Our data provides meaningful insights into the shifting workplace strategies in the job market.

Mid-market companies cut spending on hiring and recruitment platforms

Indeed and ZipRecruiter are two of the most popular recruiting tools among our customers. But in the past quarter, mid-market companies cut spending on these services by 15%, which suggests a slowdown in hiring. SMBs also kept their spending on these platforms low.

Spending on Indeed and ZipRecruiter

SMBs increased spending on contractor platforms

While recruiting spend was low, freelancer and contractor spend was up. Both small and large SMBs increased their spending on Upwork and Fiverr (popular platforms for outsourcing labor). Large SMB spending rose a considerable 9%, while small SMBs saw a whopping 20% QoQ jump.

Mid-market saw spend on these platforms drop quarter-over-quarter. However, by zooming out, we can see that spending remained elevated after two previous quarters of growth. That rise is particularly noticeable across Upwork, which grew 12% year over year.

Spending on Upwork and Fiverr

Growth of AI content-generation tools

We've already covered how companies sharply increased AP and card spend with AI vendors throughout 2024. And the trend continued this quarter. The average mid-market card spend with AI vendors has jumped nearly 30% for two straight quarters.

AI card spend by company size

OpenAI drove much of that increase, but AI tools that boost everyday productivity also contributed to the rise. Employees have been especially drawn to content-generation tools: summarization tools saw a 52% increase in customer count year over year, outpacing even machine learning (ML) operations and platforms. Audio generation and video creation tools also grew 26%.

Change in customer count for top AI vendor categories on Ramp

Source: Internal Ramp data and third-party sources like NFX's Generative Tech Open Source Market Map

But what tools are companies gravitating toward? Here are the most popular AI content-generation vendors on Ramp by customer count:

Some of these tools are evolutions of leading platforms: Grammarly, for example, originally focused on grammar and spelling but now incorporates generative AI to compose or fully rewrite text in a customized voice or style.

Others offer entirely new ways of working, such as Limitless, which runs in the background to capture your audio and screen automatically so you can generate meeting summaries, emails, and more at a later time. Companies like ElevenLabs and Fireflies.ai are booking many times more revenue than they were a year ago.

While we wouldn’t necessarily conclude that AI is replacing jobs, companies do seem especially eager to explore tools that make employees more productive. If they’re successful in that endeavor, we may continue to see a slow pace of hiring.

More resources to help you benchmark your spending

Our spending benchmarks microsite delves into the vendors companies use in even more detail. There, you can browse data by industry and company size, and pick up a free copy of our Summer 2024 Business Spending report.

Methodology: Data come from millions of aggregated, anonymized transactions on Ramp cards and invoices paid through Ramp Bill Pay, as well as trusted third-party sources. For year-over-year comparisons, our sample comprises customers who have been active with Ramp over that entire 12-month period. Quarter-over-quarter comparisons comprise customers who have been active with Ramp over the two quarters analyzed. Small SMBs represent companies with 1-24 employees. Large SMBs represent companies with 25-99 employees. Mid-market companies range from 100 to 999 employees.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits