8 Divvy alternatives for better business spend management

With limited card controls and manual receipt uploads, many companies find themselves needing greater spend management support over time than what Divvy can offer. We’ve pored over G2 ratings, remarks from validated reviewers, and the features of top alternatives to Divvy to help you find a finance platform that can scale with you as your business grows.

Ramp

We’re admittedly biased for including ourselves on this list, but G2 lists us as the number one Divvy alternative too. Here at Ramp, we help founders, finance teams, and employees save time and money. We help you consolidate data and workflows across vendor payments and bills, corporate cards, spend management, and reimbursements.

Key features

- Allow employees to request spending from pre-set budgets and create custom workflows to ensure the right stakeholders are looped in for approvals

- Proactively set auto-enforced limits, controls, and submission requirements on corporate cards and reimbursements—from merchants to categories

- Ramp’s expense software automatically checks every transaction and flags non-compliant expenses so you don’t waste time reviewing every line item

- Reminders for missing items, requests for repayments, and auto-lock cards for non-compliant employees

- Speed up monthly close as Ramp accurately codes thousands of transactions and then syncs directly to your ERP

Why customers pick Ramp over Divvy

“I have used Divvy and many payment solutions as a finance executive. What I like about Ramp: Integration with QuickBooks, ease of use, free ACH payments, great reward program, reimbursements, multiple security options, and robust accounting tools that save time when using rules for merchant transactions.” - April 2023 G2 review

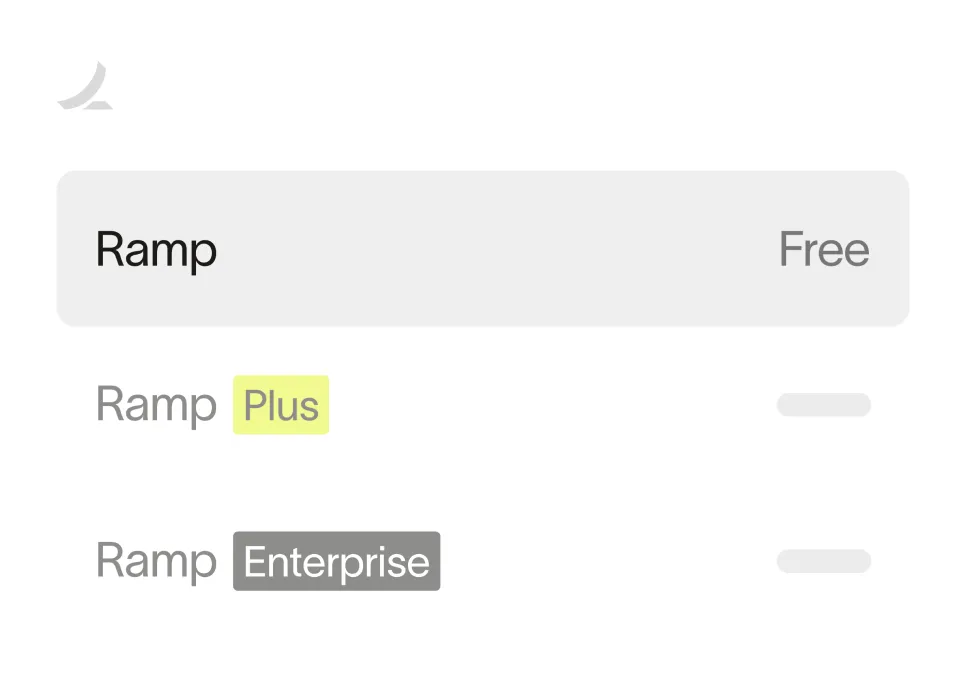

Pricing

Ramp helps you control spend, automate payments, and rapidly close your books—all for free. Ramp Plus is $15 per person monthly, giving you more control and customization.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Airbase

Airbase offers expense management solutions that allow employees to create expense reports and request reimbursements in their local currency. Airbase is rated 4.8 out of five on G2 and is classified as most suitable for mid-market companies.

Key features

- Spending activities are captured in real time

- Receipt management, with a dedicated email for expense submissions

- Set mandatory fields, a time frame for expense submission, and budget caps

- Track time from submission to payment to benchmark reimbursements for best practice

- Capture and record expenses in an audit trail with receipts, notes, and other documents

Why people choose Airbase

Feedback on the business review website G2 suggests that finance teams find Airbase’s accounts payable workflows more user-friendly.

Pricing

Airbase offers standard, premium, and enterprise quotes for firms with 200 to 5,000 employees.

Brex

Brex provides corporate cards, expense management, reimbursements, bill pay, and travel. The company’s customers range from startups to enterprises. Brex is rated 4.7 out of five on G2 and is classified as most suitable for enterprise companies.

Key features

- Automate reconciliation with custom category mapping and integrations to ERPs

- Built-in expense policies, auto-generated receipts, and automated reminders

- Real-time and automated insights from spend reports and alerts.

Why people choose Brex

“It will text you immediately after a transaction asking for a memo, so I can enter it right there on the spot without having to go back and try to remember what all of my transactions were,” said a small business customer in a November 2023 G2 review.

Pricing

Brex’s pricing for mid-sized businesses is $12 per user per month. Global companies can also seek custom pricing.

Navan

Navan is a travel and expenses solution, which allows professionals to easily book, view, and manage trips and expenses. Typical users of the software include executive assistants and finance teams.

Key features

- Controls are enforced at the point of sale to stop out-of-policy spending

- Automated reconciliation to help finance teams track and monitor spend

- Virtual cards tied to each travel booking, removing the need for manual reconciliation

- Reimbursement support for employees across 45 countries and 25 currencies

Why people choose Navan

One G2 reviewer liked that scans of receipts auto-populate the relevant fields, removing the need for them to update each field manually.

Pricing

Navan is free for companies’ first 50 monthly active users, with a fee for live travel agent support. The company can provide custom quotes for companies that exceed those needs.

Center

Center provides software for corporate card, travel, and employee expense management. Customers give it a 4.6 out of five rating on G2.

Key features

- Reconciliation with approval workflows, custom fields, ERP integrations, and CSV export

- Adjustable limits for each corporate card and secure lock cor card not in frequent use

- Real-time visibility, reporting, and auditing of managed and unmanaged spend

- Unlimited itinerary changes and 24/7 support including access to expert travel agents

Why people choose Center

Several G2 reviewers commended Center for its ease of use, user interface, and time-saving features.

Pricing

Center’s pricing is not publicly available on its website or G2.

Spendesk

Spendesk provides company cards and software to help companies manage approvals, budgets, and accounting automation. Customers give Spendesk a 4.7 out of five rating on G2.

Key features

- Real-time spending dashboard displaying online and offline transactions

- Team budgets, request tracking and approvals, and expense reimbursements

- Invoice automation and approval workflows for more control over the invoicing lifecycle

- Single-use virtual cards to reduce fraud risks for one-off purchases, plus dedicated virtual business cards for recurring costs.

Why people choose Spendesk

One G2 reviewer complimented Spendesk for its clear invoice approval records.

Pricing

Spendesk can provide custom quotes to companies of all sizes.

Expensify

Expensify helps businesses with corporate cards, expense tracking, reimbursement, invoicing, bill pay, and travel booking. Expensify is rated 4.5 out of five on G2.

Key features

- Filters to quickly sort expenses by merchant, date range, and approval status.

- One-click receipt scans to auto-capture details and add them to expense reports

- Import personal and business card transactions for receipt merging and coding

- Import general ledger codes from accounting packages to tag expenses with details.

Why people choose Expensify

One G2 reviewer commended Expensify for making it easy to create expense reports, code expenses, and submit each report for review and reimbursement.

Pricing

Expensify’s two priced tiers are $10 and $18 per user per month, respectively.

Emburse

Emburse offers expense, travel management, and AP solutions that cater to CFOs, finance teams, and travelers..

Key features

- Real-time spend management, with automated expense categories and policies

- Mobile expenses application to capture and report staff expenses anywhere

- Automatic matching of corporate card payments with employee expenses.

Why people choose Emburse

“Expense reports are generated automatically with little or no changes needed which lessens the workload and tediousness of the process,” said a G2 reviewer.

Pricing

Emburse can provide custom quotes for companies exploring its solutions.

Manage company and employee spending on your terms

Spend management can be a boon or a burden—depending on how well it is controlled. When spending is better managed, companies gain a real chance of budget oversight, more cashflow visibility, and a culture of responsible spending. See how Ramp can help with our finance platform that has helped over 15,000 customers save 5% on their expenses per year.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°