Expense management & AP software for construction companies.

From job site to back office, Ramp brings field and finance together with full spend visibility and proactive spend controls.

Accounting system automation

Ramp connects directly to your ERP to automate spend classification and job-cost mapping—saving hours of reconciliation and improving project accuracy.

Explore accounting automationSubmit receipts from anywhere

Field teams submit and tag expenses to the right job and cost code at the point of purchase via SMS, mobile app, or email. Ramp captures, matches, and verifies receipts in real time to help eliminate lost paper or late submissions.

Explore expense managementAuto-enforced spend rules

Block spend on unapproved vendors or categories with card-level controls tied to projects, cost codes, or subcontractors. Prevent unauthorized purchases on-site or in the office, automate policy enforcement, and auto-lock cards for noncompliance.

Explore corporate cardSimplify invoicing and get paid faster

Eliminate manual invoicing with Ramp’s automated capture of PO numbers, unit costs, and payment terms. Keep client billing on track by setting up approval workflows and recurring payments that prevent delays.

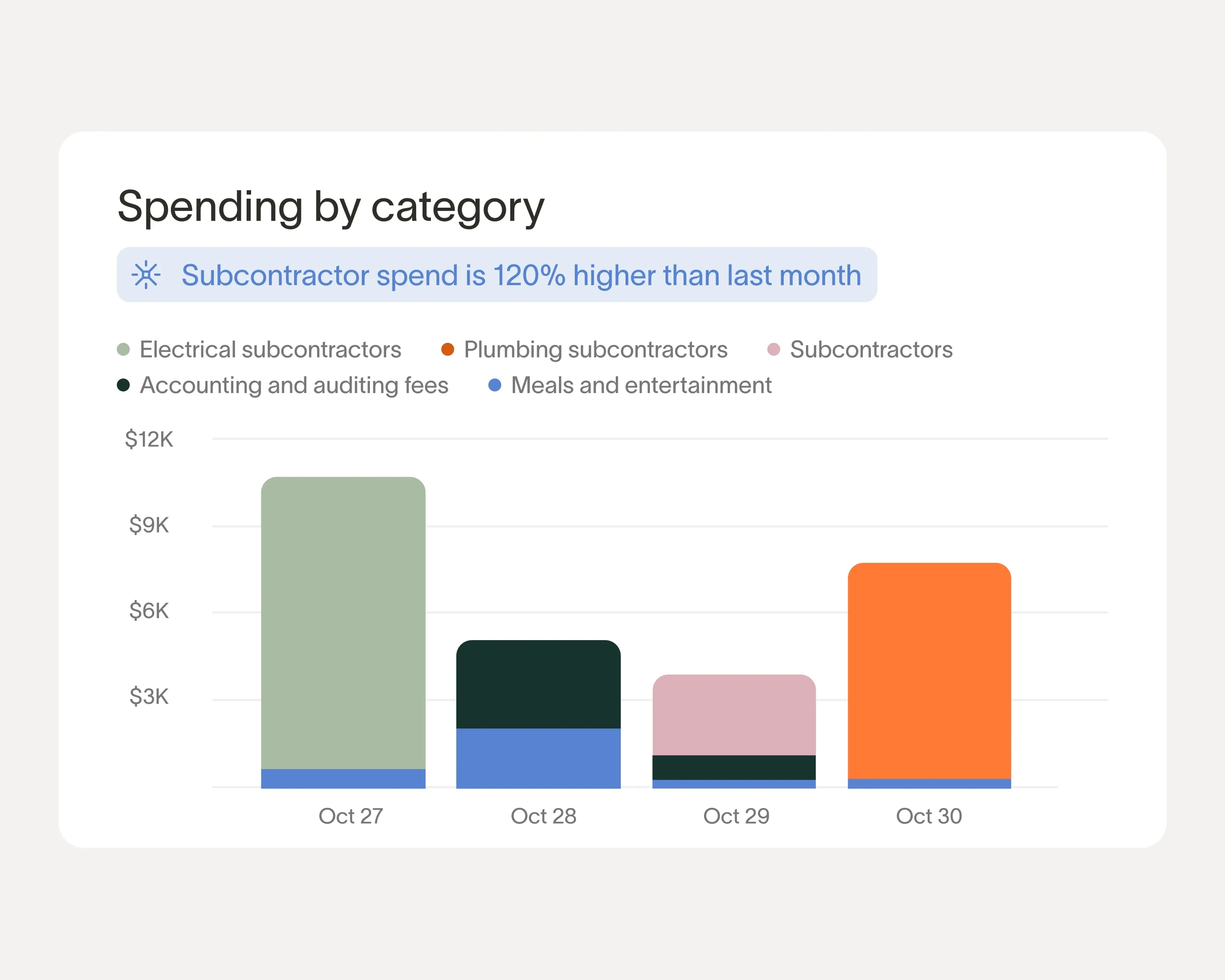

Explore accounts payableTrack against budgets in real-time

Tie off spend to jobs, cost types, phase codes, and more. See spend data and insights across all your projects and teams.

Explore reporting