Ramp Intelligence

Meet your next million hires.

Ramp’s AI agents multiply your output, not your headcount.

Agents,

explained.

Ramp agents

AI built for finance.

Developed by CFOs and controllers, our AI agents are refined through patterns and learnings from over 50,000 Ramp customers.

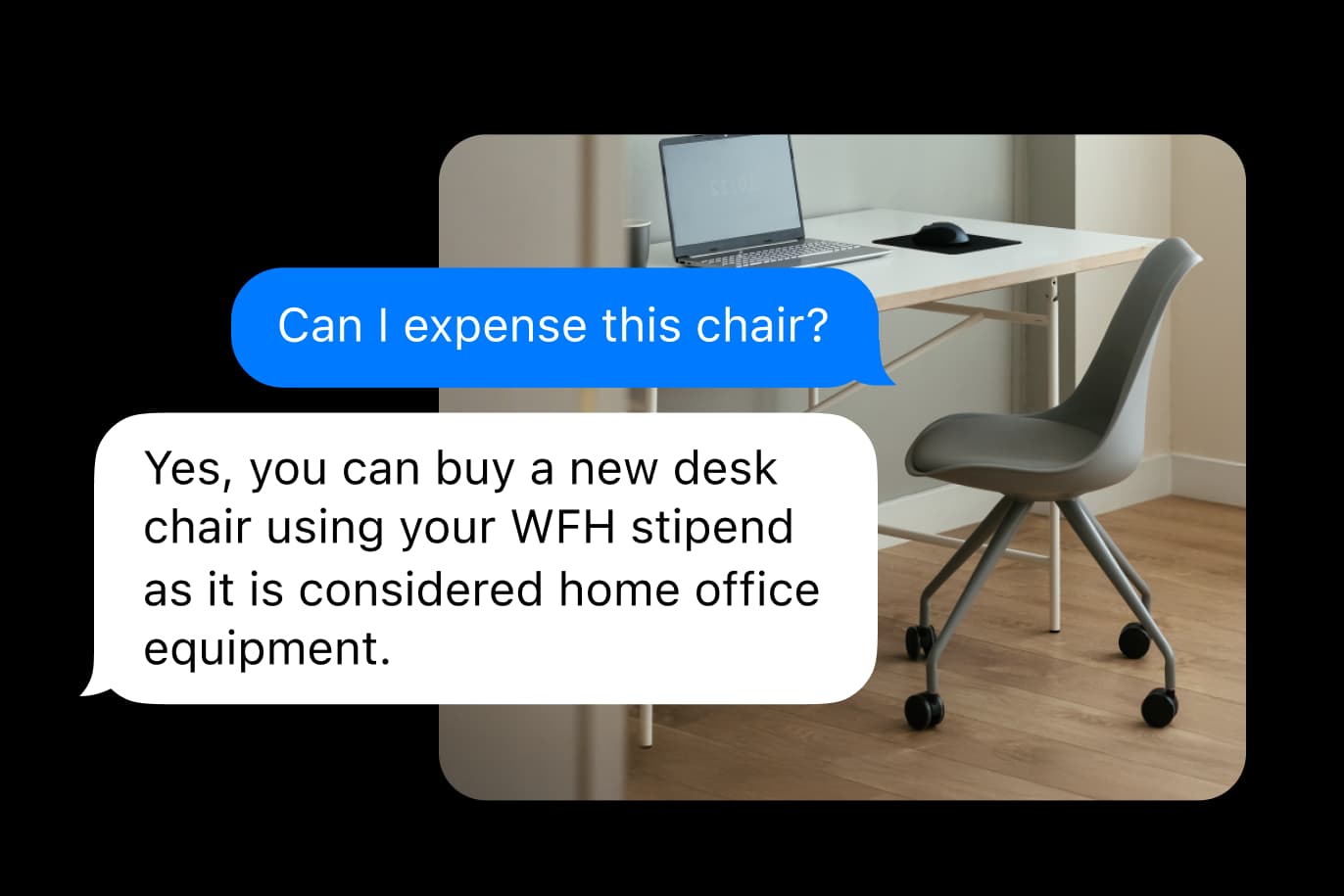

Your policy, auto-enforced.

Approves when it’s safe. Escalates when it’s not.

Answers “is this in policy?” with a text.

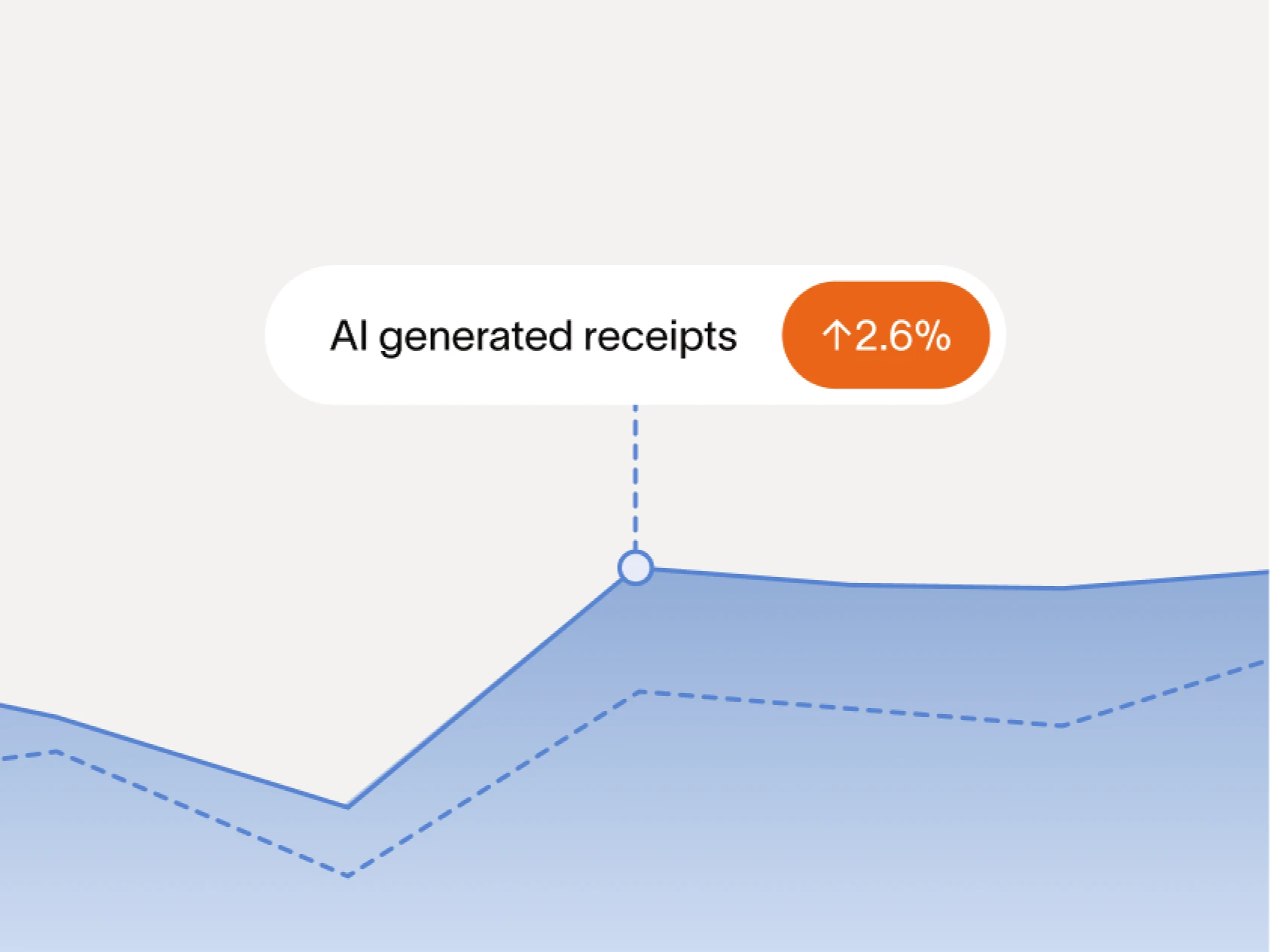

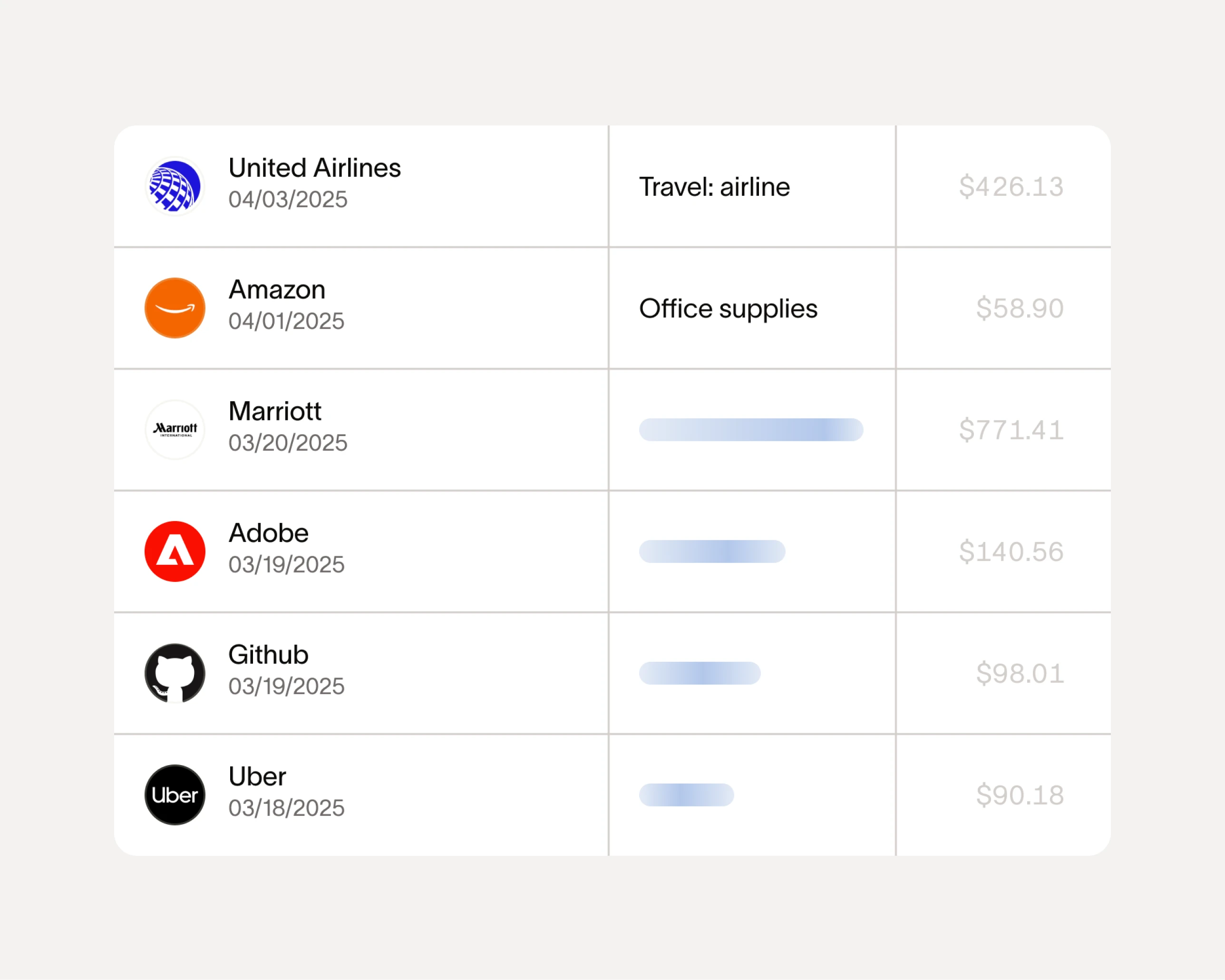

Know exactly what you’re paying for, and why.

Shows you what’s working. Tells you what’s not.

Continuous improvement, built into your policy.

Savings, found for you.

Catch fraud before it costs you.

Triple checks, zero losses.

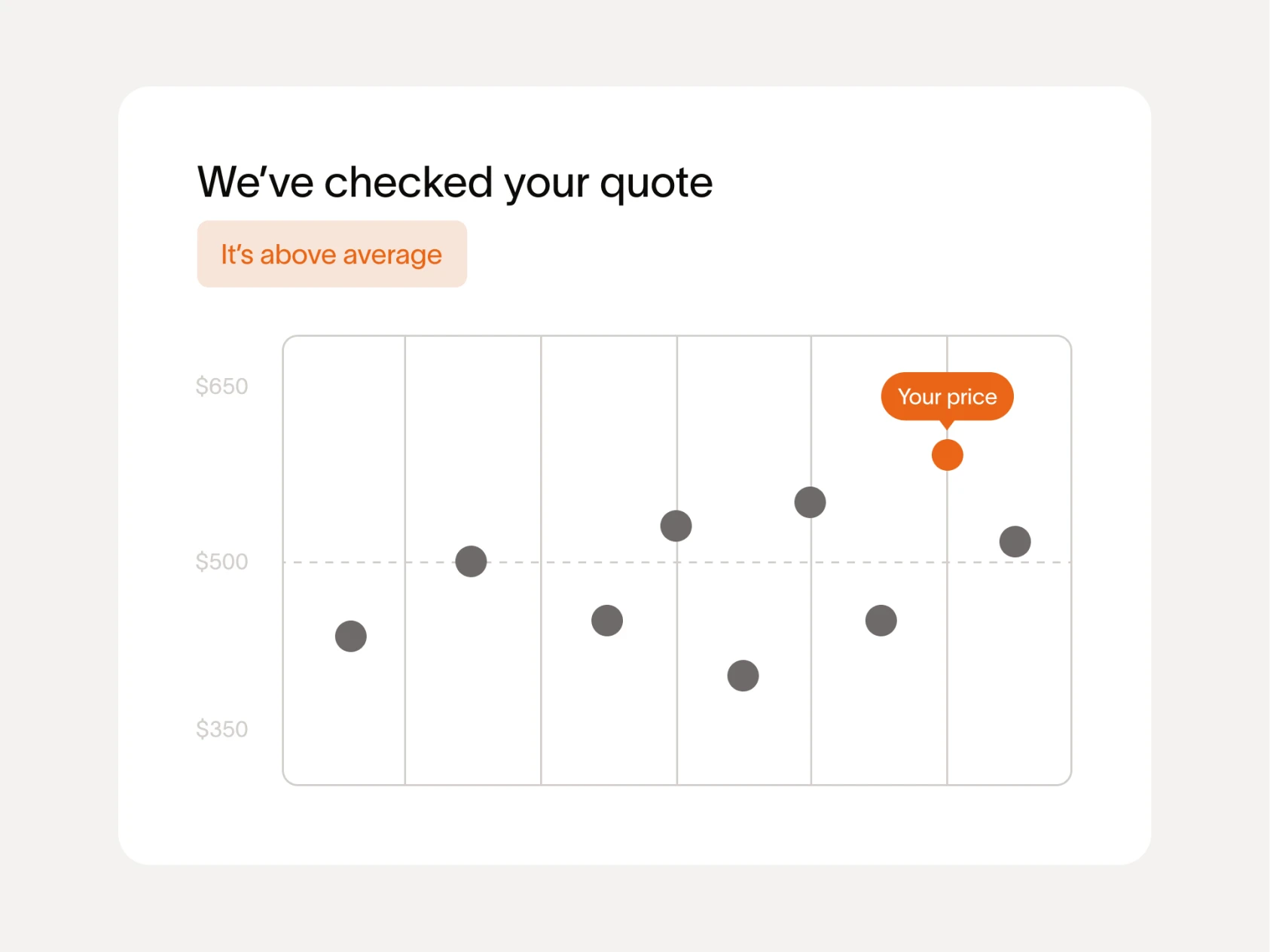

Win every software negotiation.

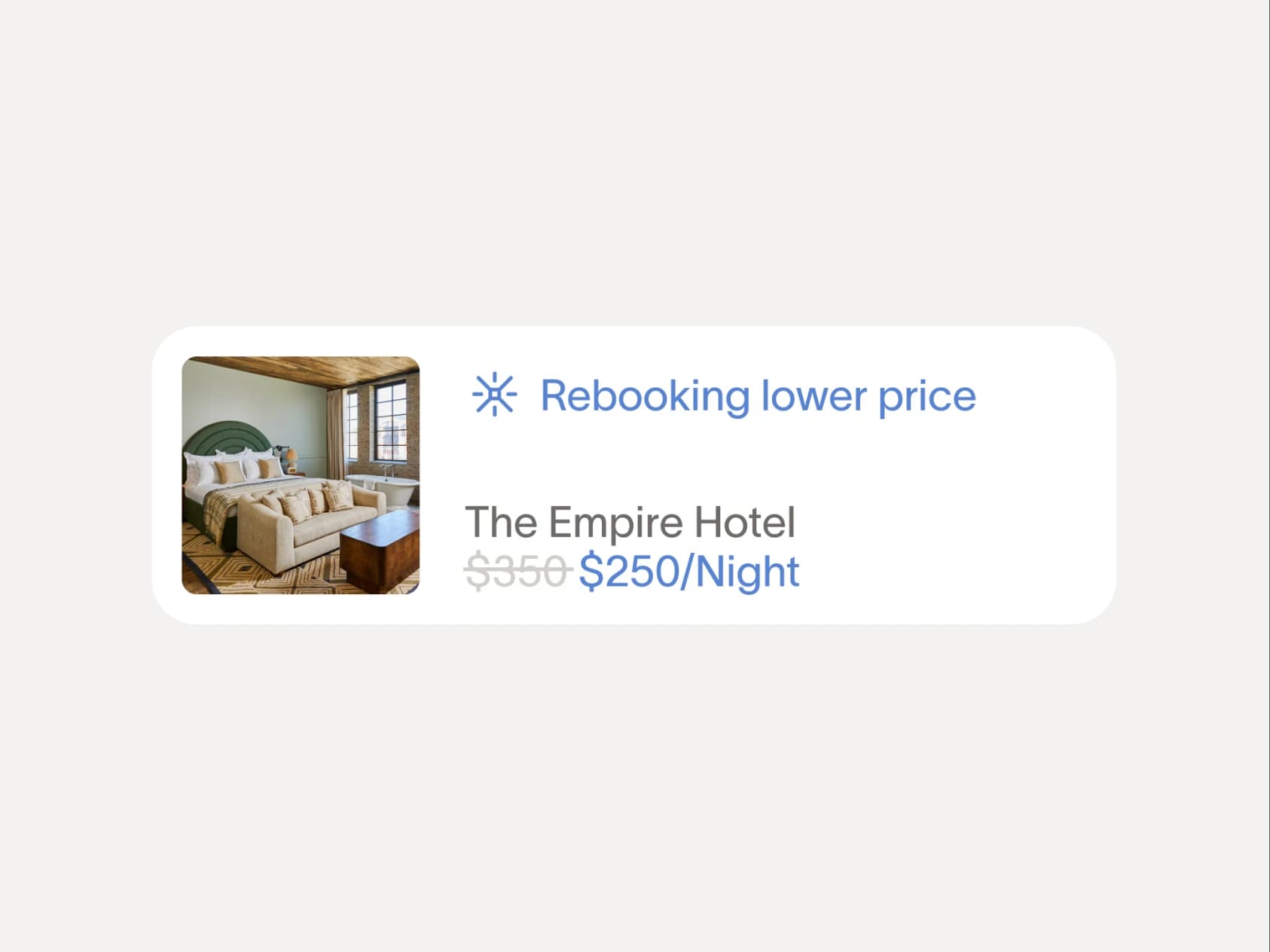

If the price drops, we’ll catch it.

Never fill out a vendor payment portal.

Routine tasks, handled for you.

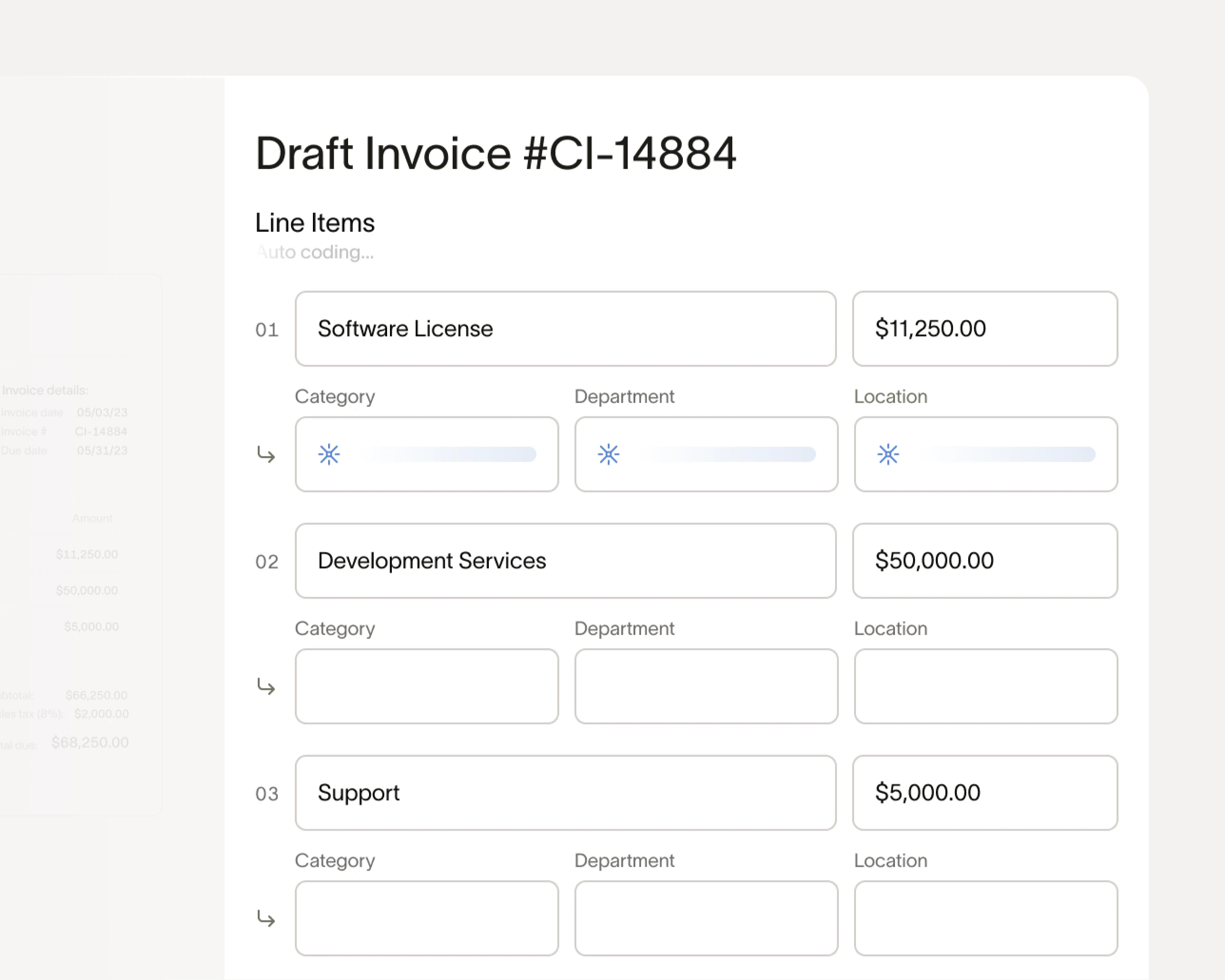

Ramp’s agent knows every code.

Never chase another receipt.

No more manual data entry.

Handle 10x invoices in half the time.

Finance just got faster.

Our customers are proof.

Explore more with AI.

Blog

Ramp agents: Let finance teams do finance

Blog

How to build AI your team can trust.

Blog

You’ve been asked to use AI. This is the answer.

FAQ

Ramp Intelligence isn’t a single product—it’s a layer of AI technology that sits across all our products. We sprinkle AI throughout the experience to make your work smarter, more efficient, and even delightful!

When AI steps in to lend a hand, we’ll make it clear. Just look for the blue Ramp Intelligence icon to see when our AI is working its magic.

Just the boring parts—reviewing expenses, transcribing and coding invoices, chasing receipts— giving you back the time to focus on strategic decisions and big ideas. Let humans do what humans do best.

Think of Ramp agents as the best associates you’ve ever met—fast, accurate, and they never complain about paperwork. They’re AI teammates powered by the best LLMs available, trained on your policies and data, here to handle the mundane, so you don’t have to.

Faster than you think—usually minutes, not weeks. Ramp agents are ready out-of-the-box and instantly learn your company’s specifics. (Yes, seriously.)

Absolutely. First of all, no money ever moves without a human confirmation, and every decision they make is completely transparent, auditable, and adjustable.

Ramp agents are smart—but they know they’re not human. They flag anything unclear or risky immediately for your review. You’re always in the driver’s seat, but Ramp is your alert and focused copilot.

Rest assured, we’re not in the business of selling your data to telemarketers. Instead, we use your data thoughtfully to make your Ramp experience better—and yours alone. Want to know exactly how? Head over to our Trust Center.

Our AI features are designed to help with very specific tasks, like matching receipts to transactions or auto-populating your bills—so they can’t go off script. Unlike open-ended AI tools that can improvise and dream up new ideas altogether, we like to be reliable and precise every time.

Then we admire your patience—maybe we could hire you as an agent. But imagine what you could do with all that free time.