Unlimited virtual credit cards for your business.

Generate virtual credit cards instantly for any vendor, team, or subscription. Set spending limits, control access, and reduce fraud while staying in control of company spend.

A better way to manage business spending.

Virtual business cards make it easy to control subscriptions, prevent unauthorized purchases, and keep vendor spending organized.

Instantly issue virtual cards to your team.

Provide virtual expense cards to employees for travel, software, or one-off purchases. Give your team instant access to funds without shipping physical cards or processing reimbursements.

Control spending with dedicated virtual cards.

Create vendor-specific cards with preset spending limits and auto-expiration dates. Cancel unused subscriptions, block unauthorized renewals, and deactivate compromised cards.

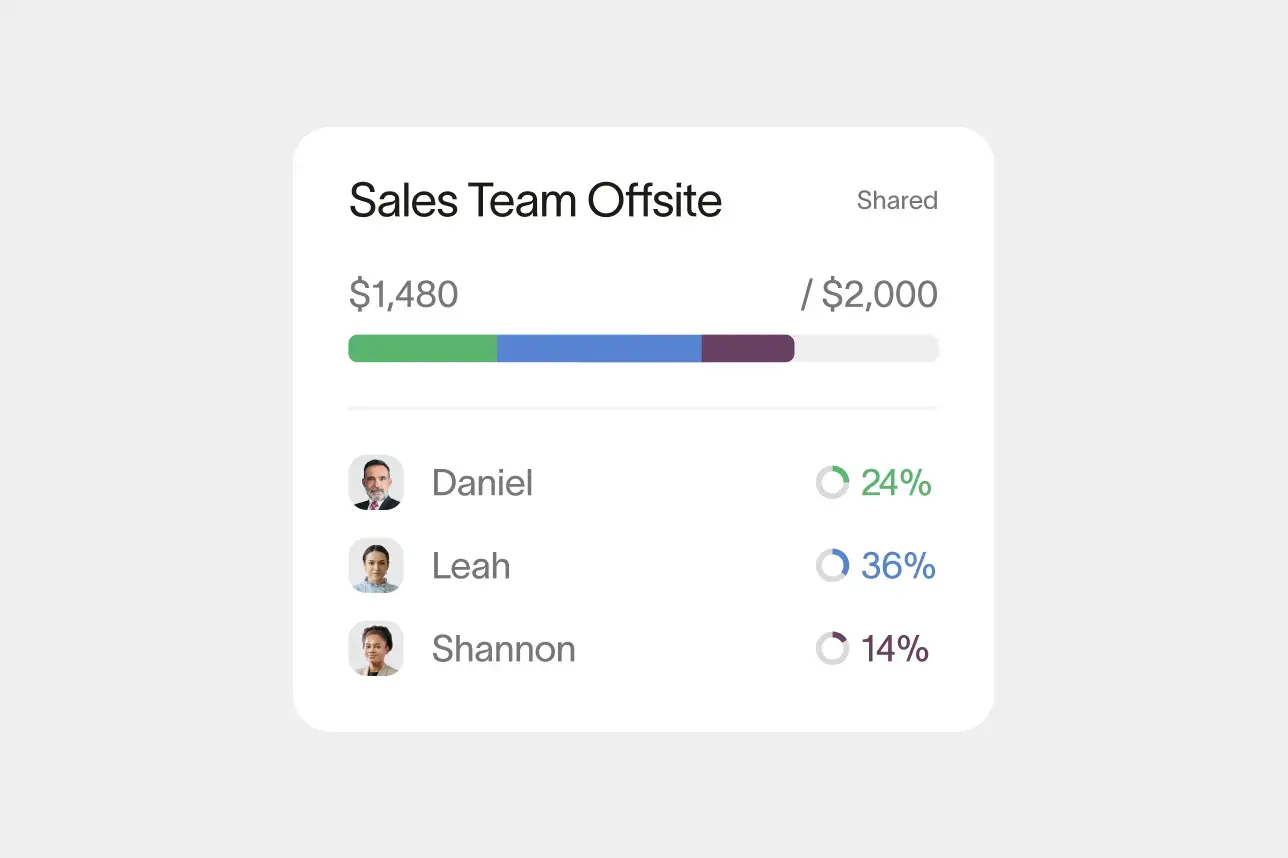

Track team and vendor spend as it happens.

Get real-time visibility into every transaction—organized by team, vendor, or category. Monitor spend, ensure compliance, and keep budgets aligned across departments.

Spend management

“With Ramp's automation, I actually have the time to think about how to improve things, how to make things more efficient, how to make things better for employees.”

Finance Manager, Quora

Sync transactions directly to your accounting tools.

Ramp’s virtual credit cards automatically capture transaction details, and this data flows into your accounting software to eliminate manual entry and improve reporting accuracy.

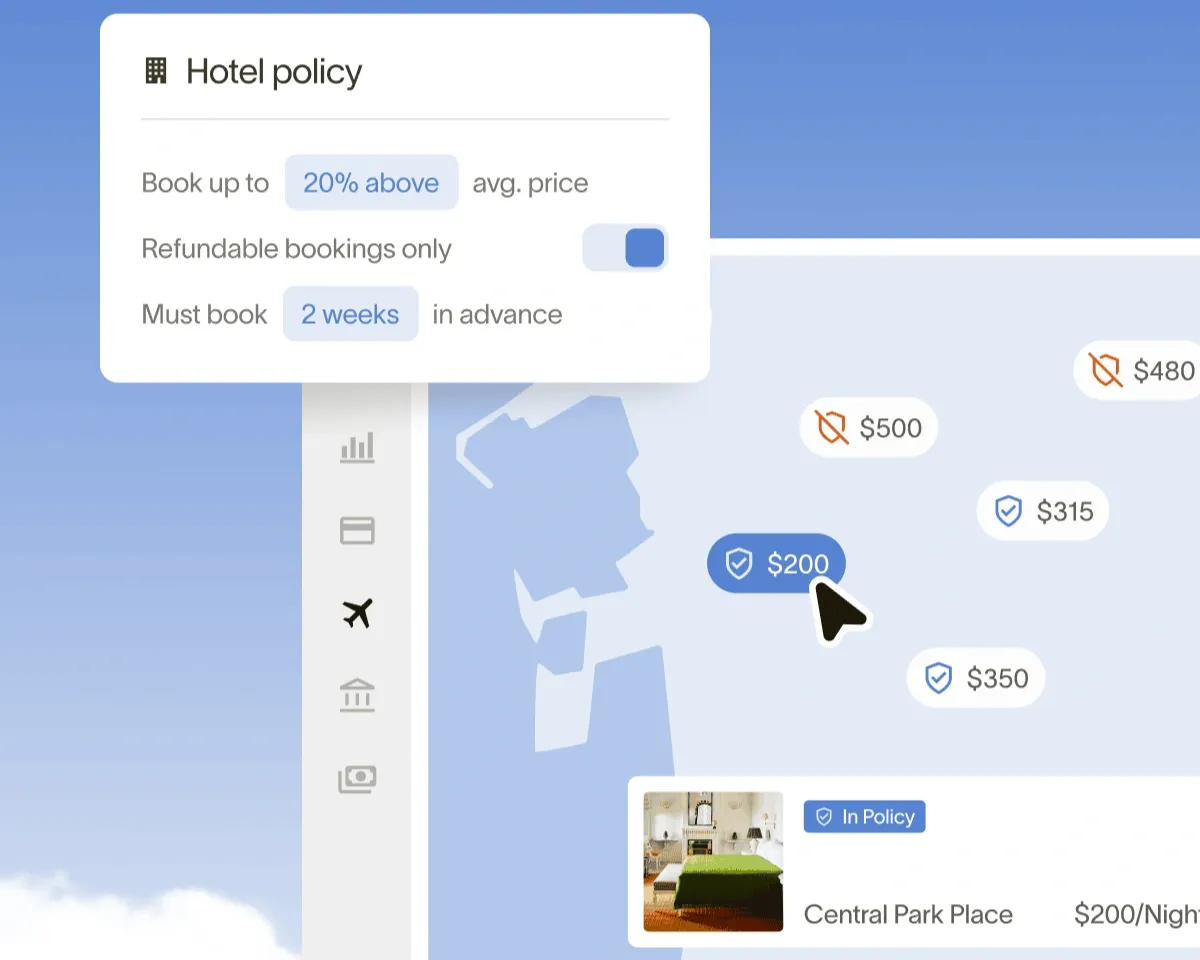

IntegrationsEnforce expense policies automatically.

Set spending rules by amount, merchant category, or team. Auto-approve compliant purchases and flag exceptions for finance to review. Built-in rules ensure every virtual business card stays aligned with budget and policy.

Expense management

Add physical cards when needed.

Connect employees' physical and virtual Ramp cards in one system. Use physical cards for travel, meals, or in-store spend while keeping the flexibility and control of virtual cards. Seamlessly manage digital and physical business cards under one set of controls.

Corporate cards

Reduce fraud and protect your business

Every Ramp virtual card has its own unique number, making it easy to isolate spend and eliminate exposure if a card is compromised. Freeze or delete any card instantly, block restricted merchants, and use auto-expiring cards for one-time purchases.

IntelligenceFAQ

Time is money. Save both.

Article

Are virtual cards secure?

Guide

Virtual credit cards: A complete guide

Article