Reimagine expense management without the busywork.

Automated expense management software built into your corporate card, reimbursements, and more.

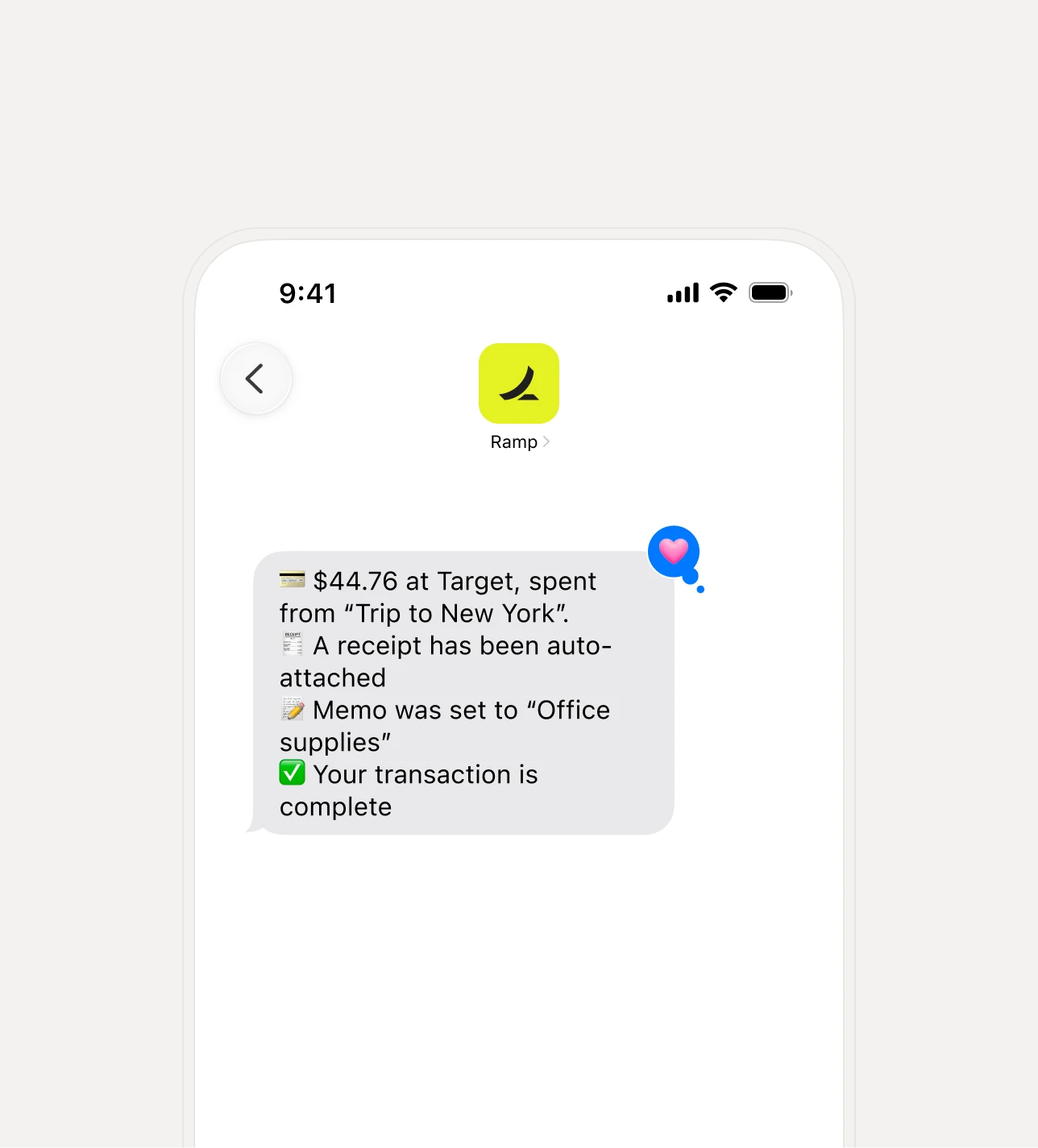

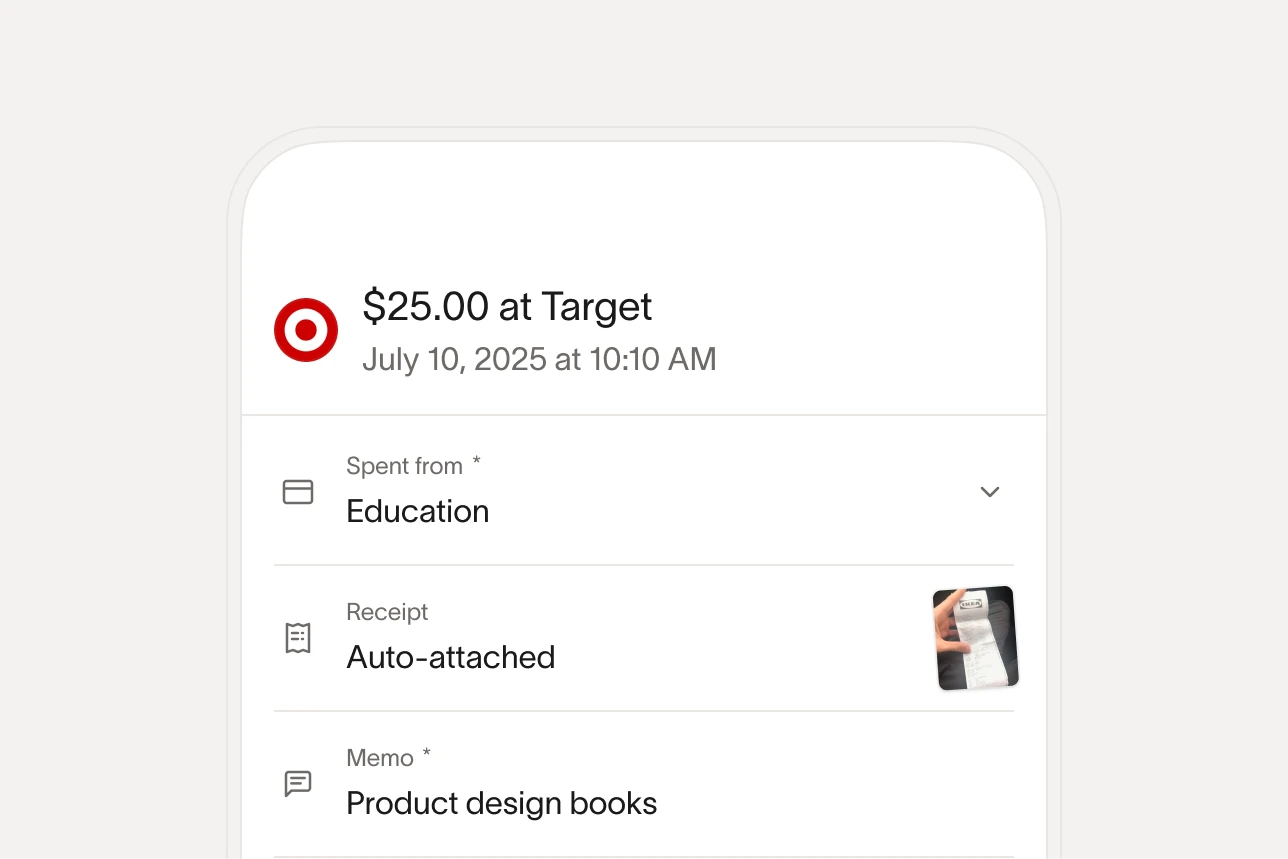

Let Ramp capture receipts, fill memos, and approve in real time.

Free your team from manual work.

The old way.

The Ramp way.

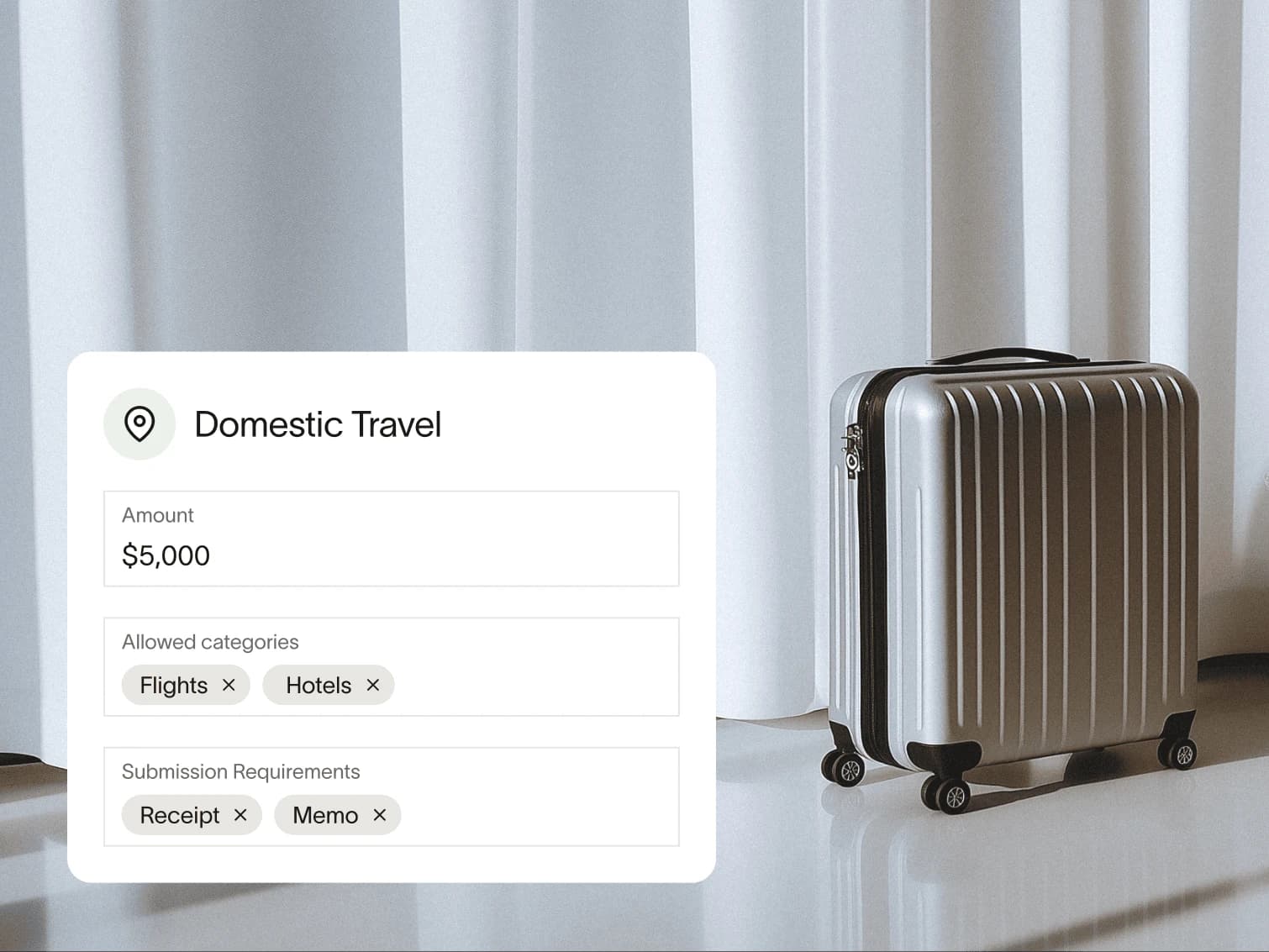

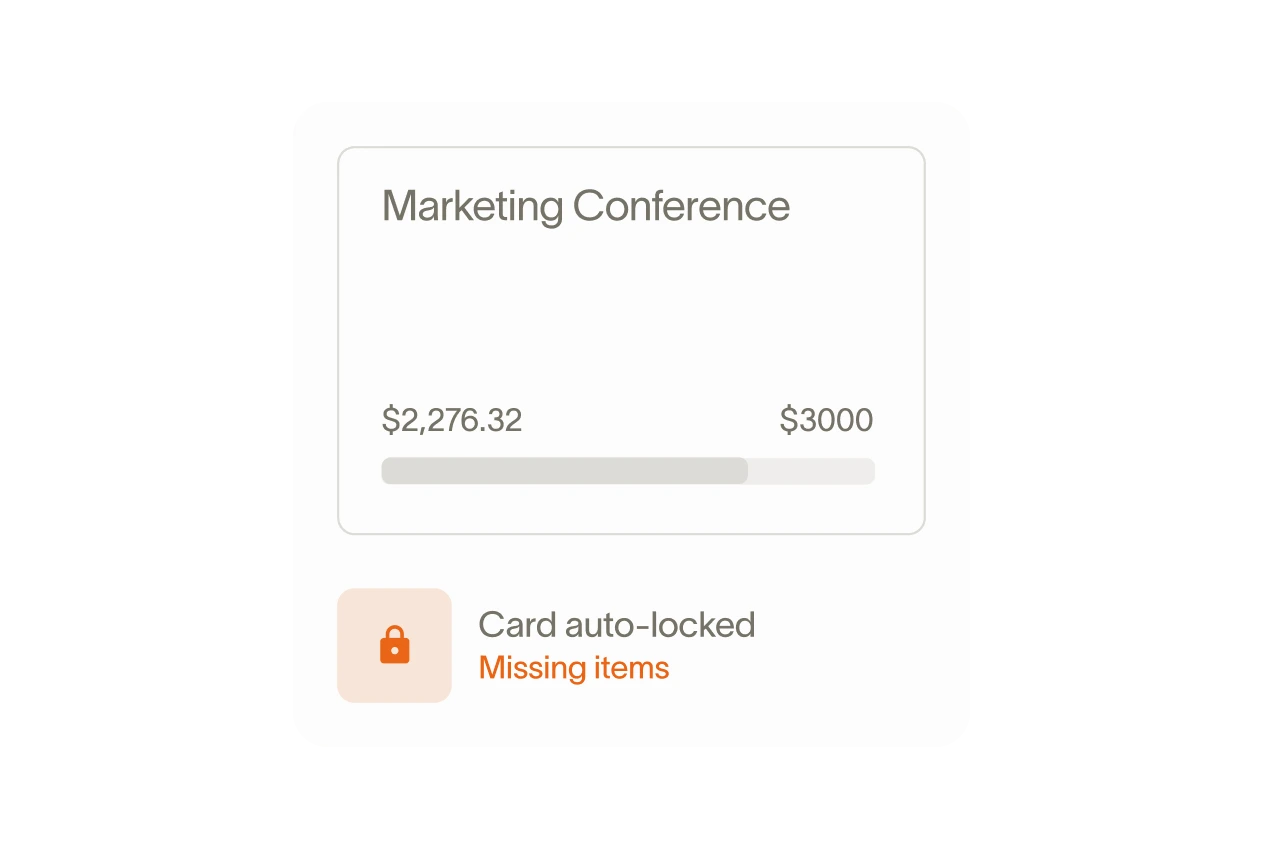

Control spend before it happens.

Give employees cards with policies built in, so you can prevent unapproved spend.

Stay compliant with built-in guardrails.

Set submission requirements, enforce spend limits, and block risky merchants or categories all before spend happens.

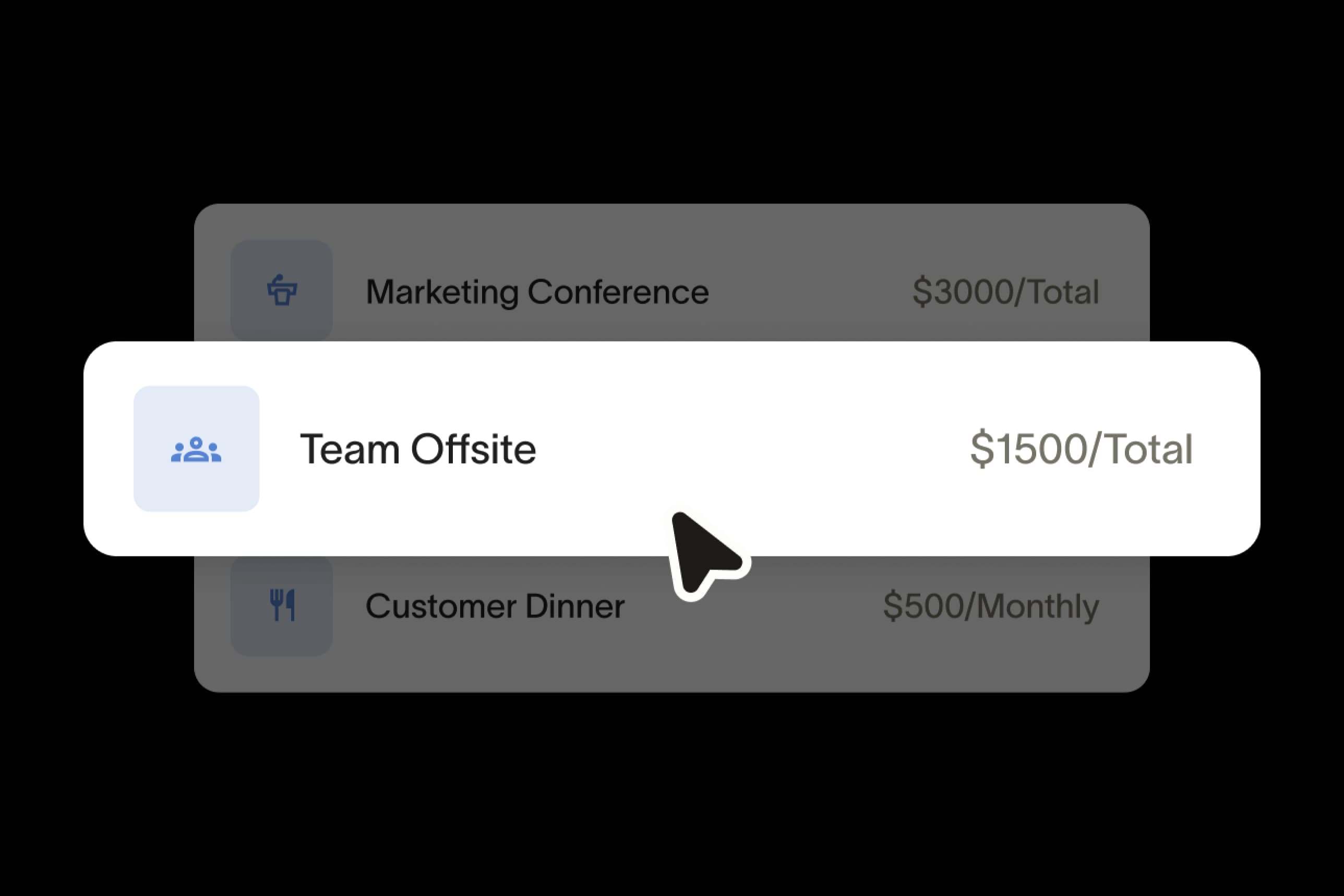

Automate spend setup at scale.

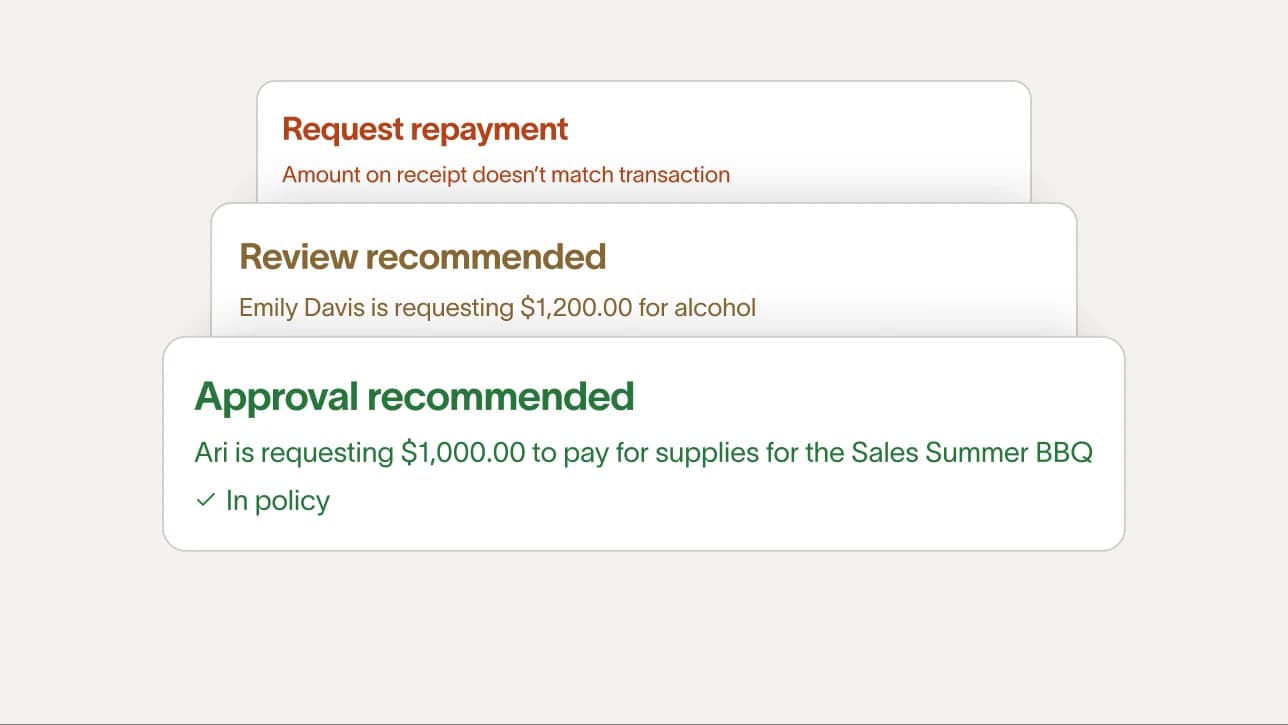

Speed up spend approvals with recommended actions.

Eliminate manual expense reporting.

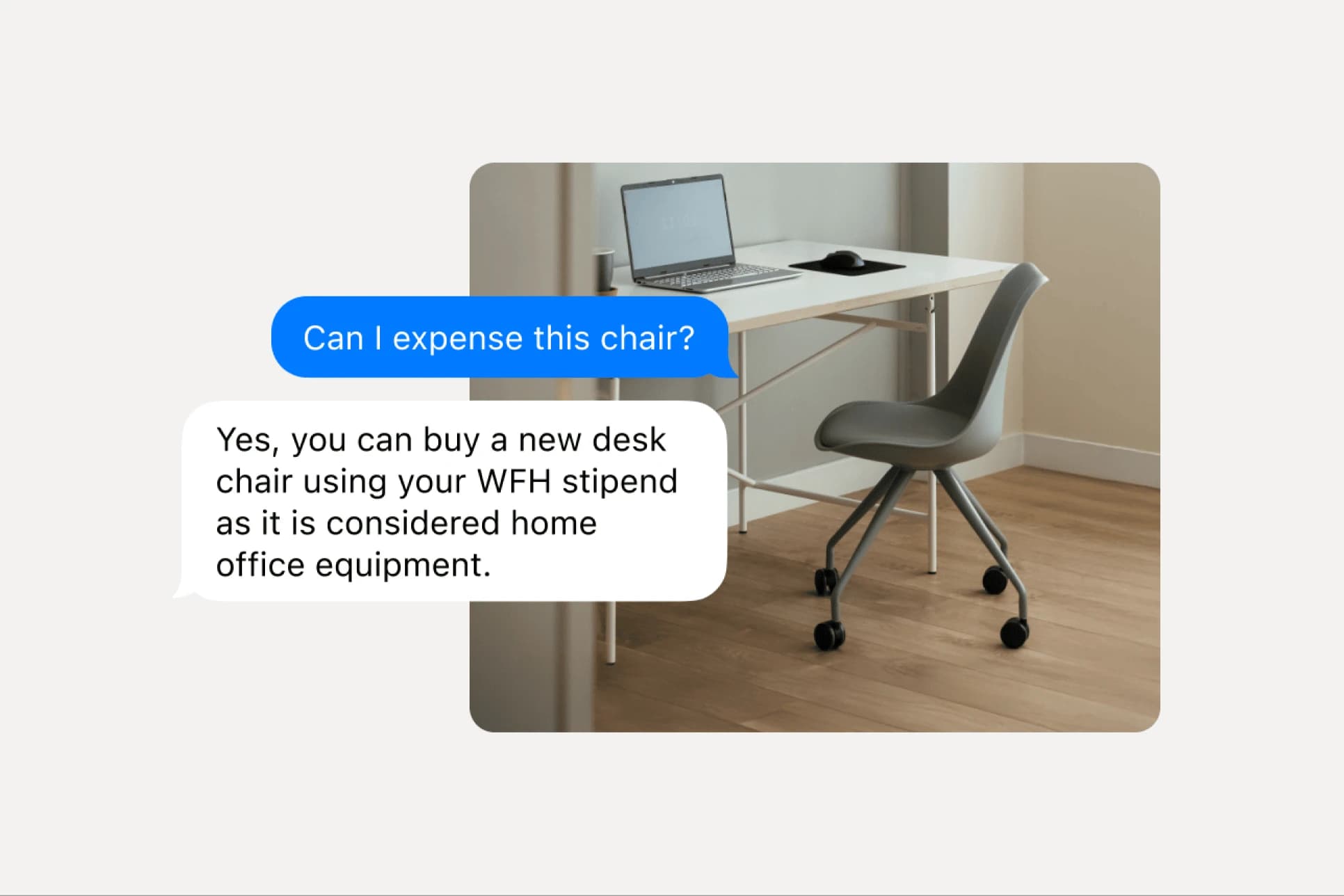

Free employees to do their job without expenses

getting in their way.

Expenses handled automatically.

Your finance assistant, always on.

“Buy-in was quick because it’s so simple to use. Employees can snap a photo of their receipt, and (with pre-hardcoding of required accounting fields) it’s instantly coded to the correct department—half the work is done before they start.”

AP Manager, Pair Eyewear

Let Ramp review and reconcile your expenses.

Scale your team by automating routine work and get time back to focus on strategic work.

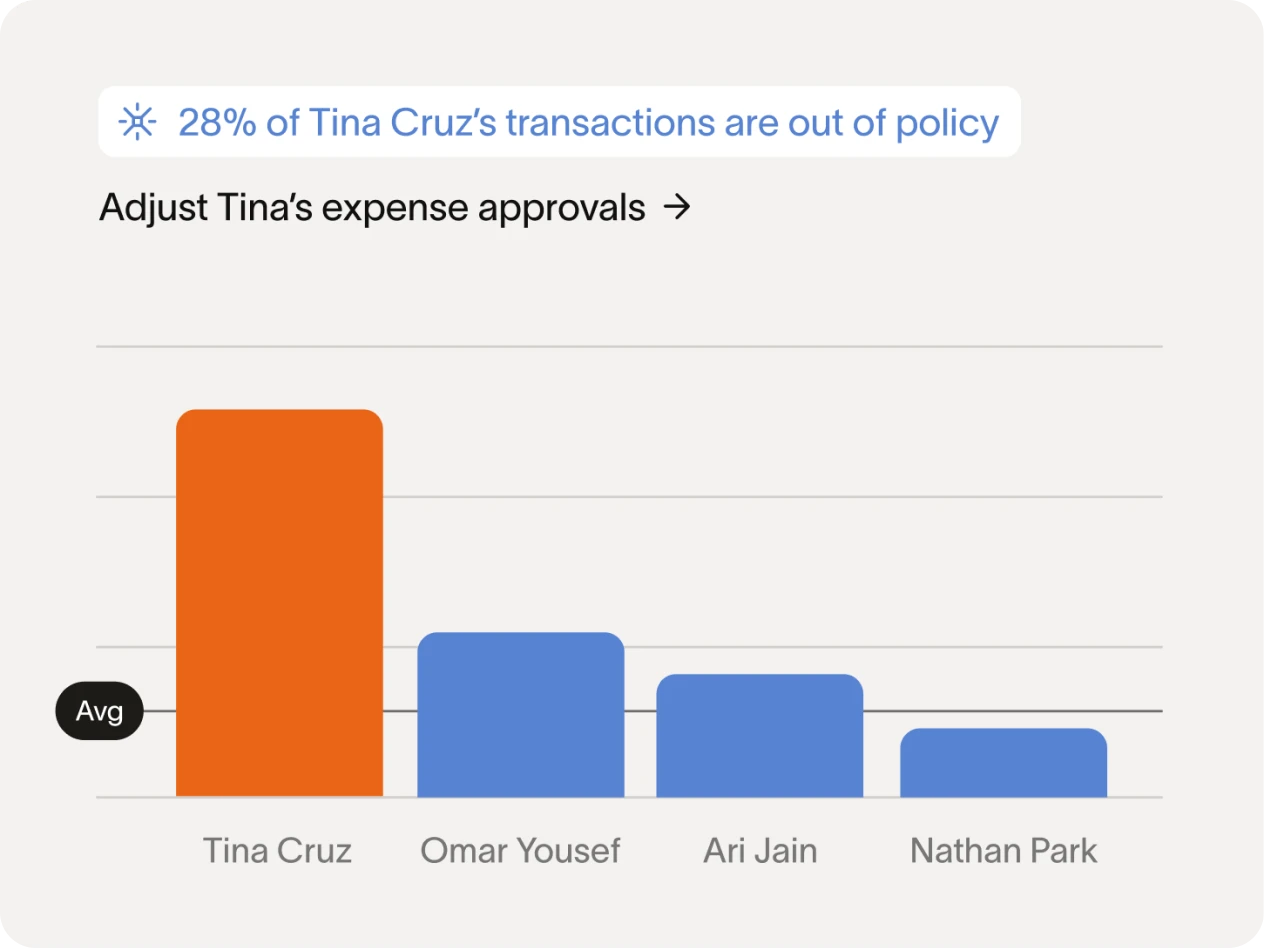

Catch out-of-policy spend without reviewing every line.

Let Ramp’s policy agent review 100% of your expenses, approve what’s compliant, and only flag what needs your attention—always with direct reference to your policy and a full audit trail.

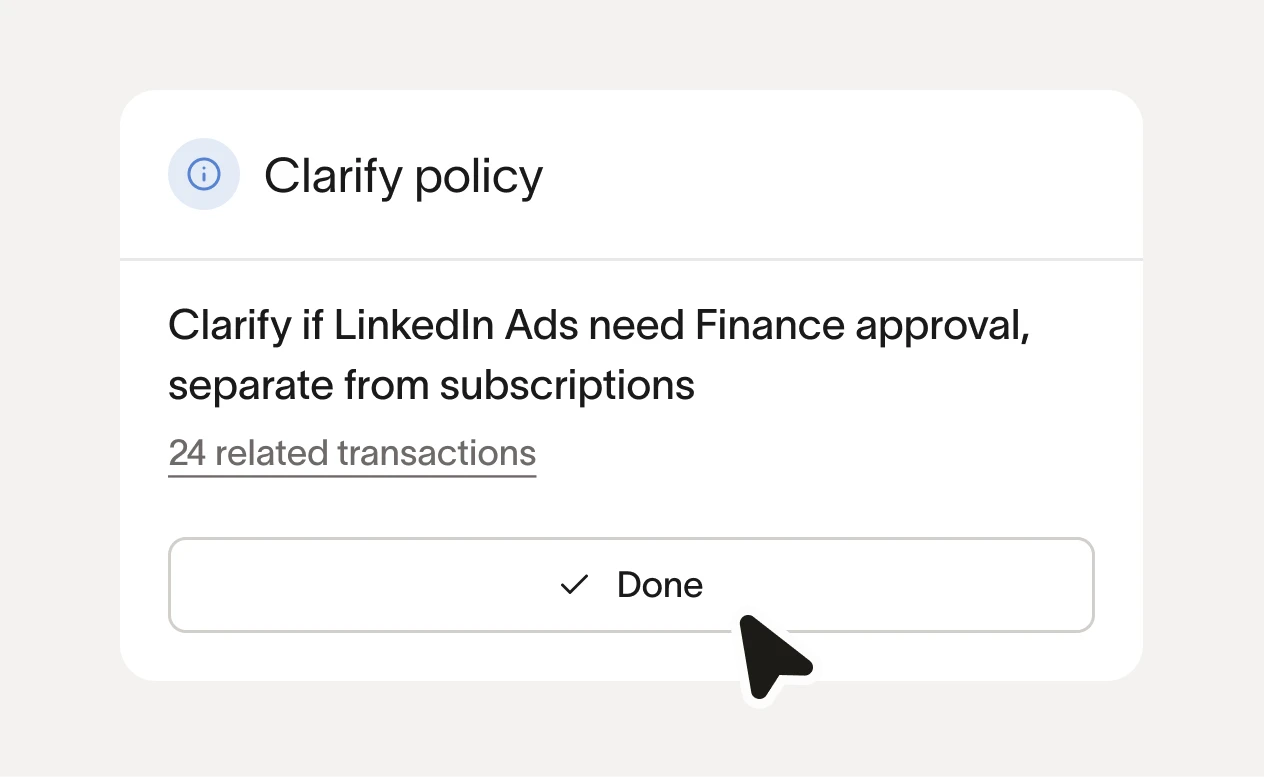

Set policies that evolve over time.

Enforce policies without the hassle.

Reliably sync with your ERP.

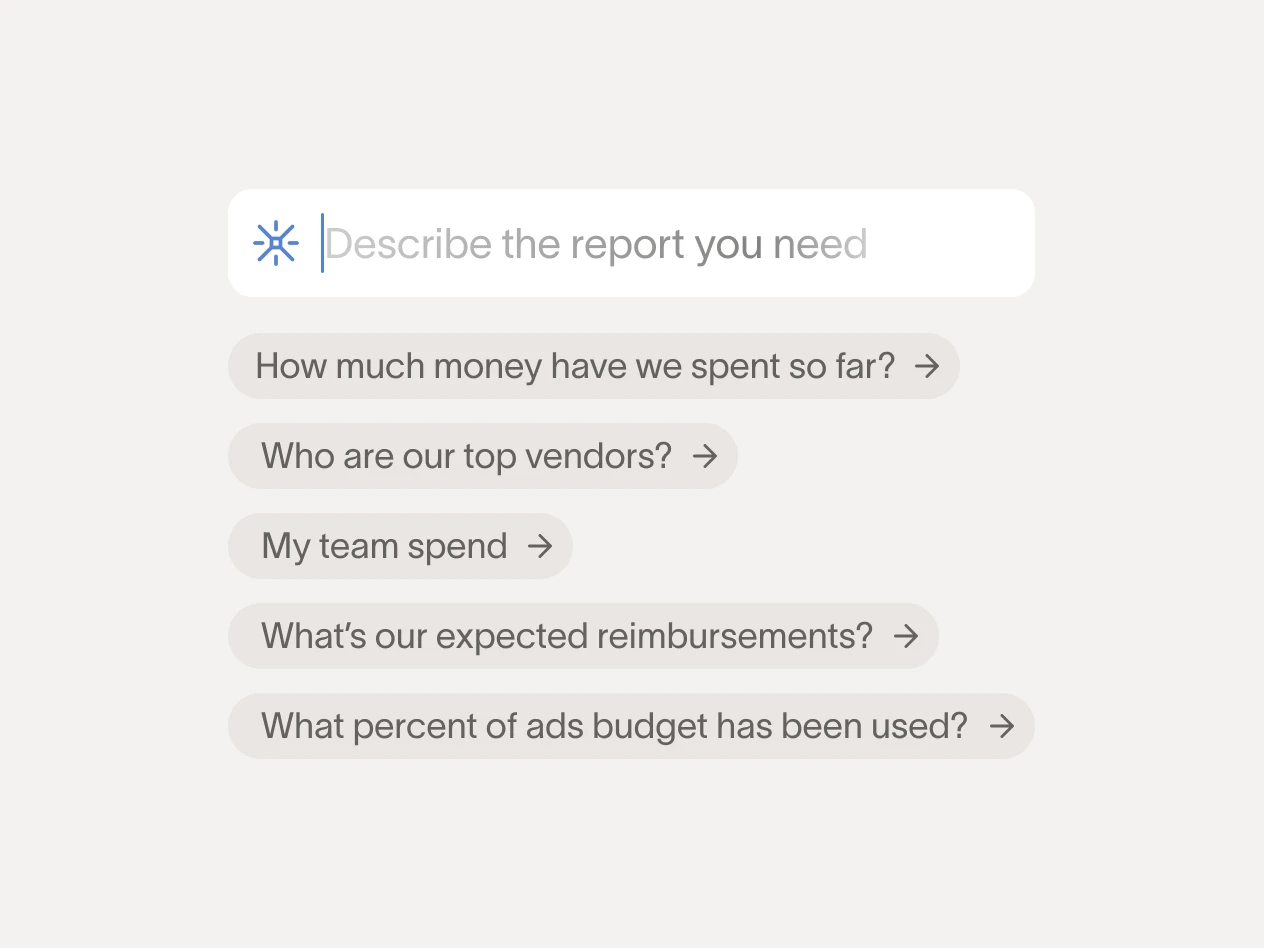

Make strategic decisions with real-time expense reporting.

Instantly access spend data and insight to save money for your business.

Stay ahead of overspend.

Spot risky behaviors before they become issues.