50,000+ finance teams have saved millions of hours with Ramp.

Ramp Product Suite

Get to know Ramp

Replace multiple broken tools with Ramp, the only platform designed to make your finance team faster—and happier.

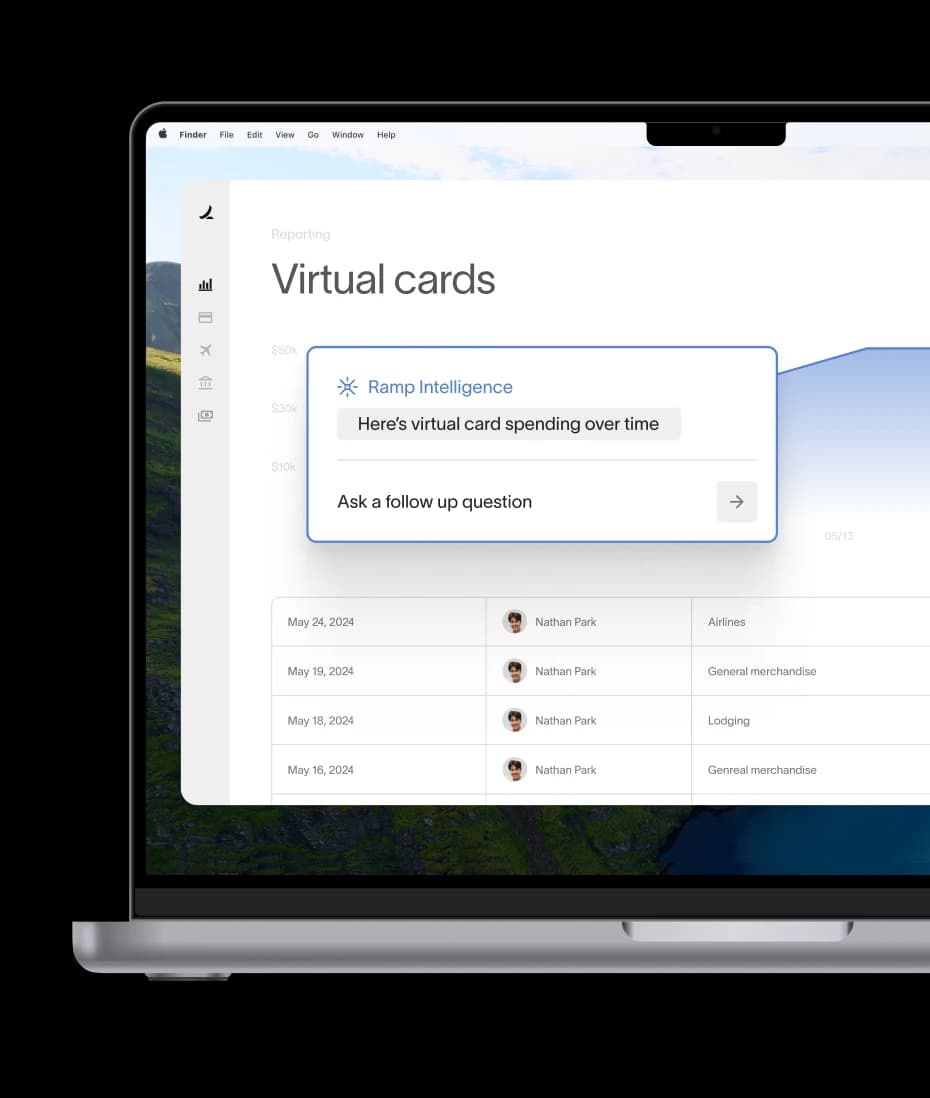

Ramp Intelligence

Put Ramp AI to work for you.

credit_card

Corporate Cards

Control spend before it happens.

pie_chart

Expense Management

Expenses that submit themselves.

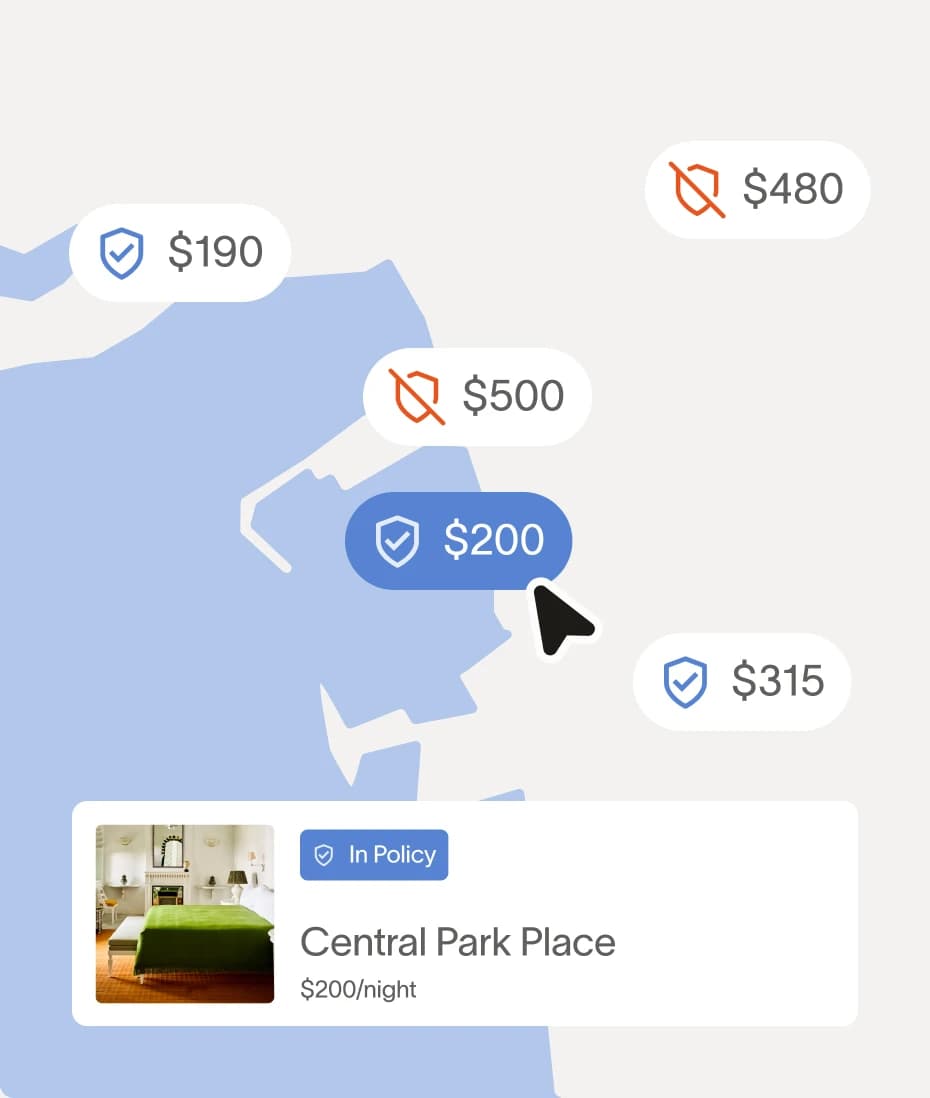

Travel

Travel that's always in policy.

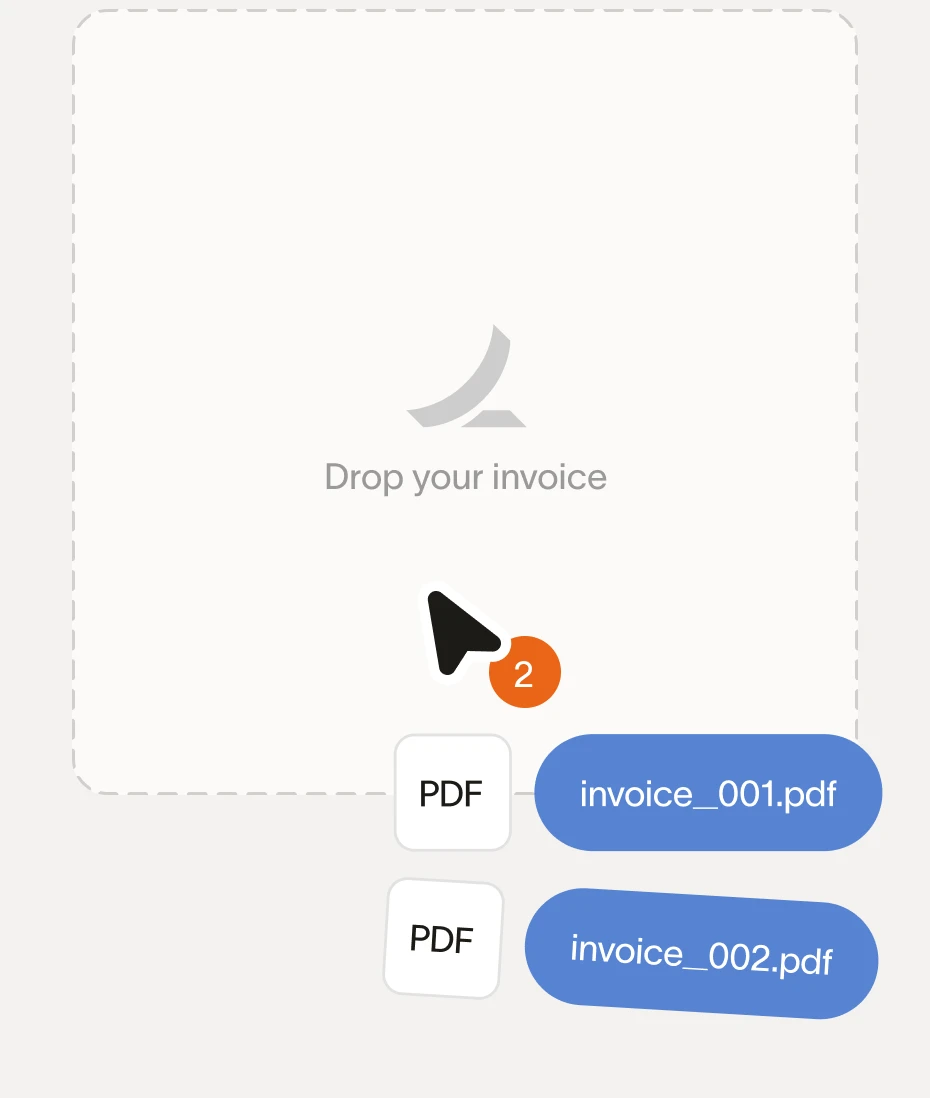

Accounts Payable

Process bills in seconds.

shopping_bag

Procurement

Run intake-to-pay without delay.

Accounting Automation

Accelerate your monthly close.

trending_up

Ramp Treasury

Business accounts that earn more.

Don't just take our word for it.

We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.

Kaustubh Khandelwal, VP of Finance

Ramp is the only vendor that can service all of our employees across the globe in one unified system.

Brandon Zell, Chief Accounting Officer

When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.

Sarah Harris, Secretary

New software shouldn’t take a year to implement.

Here’s what you can get done with Ramp in just 30 days.

Today

Day 5

Day 30

Today

Get started.

- checkConnect your ERP in five minutes

- checkUpload your policy in two minutes

- checkIssue yourself a card in one minute

Day 5

Get comfortable.

- checkConnect to HRIS, email, and 200+ apps

- checkSet up approvals and controls

- checkIssue cards to employees

Day 30

Ask why you didn't switch years ago.

- check100% of business spend moved to Ramp

- checkIntake-to-pay 8.5x more efficient

- checkBooks close 75% faster

Three* ways we save your company both time and money.

*there are many more, but we thought we’d ease you into it.

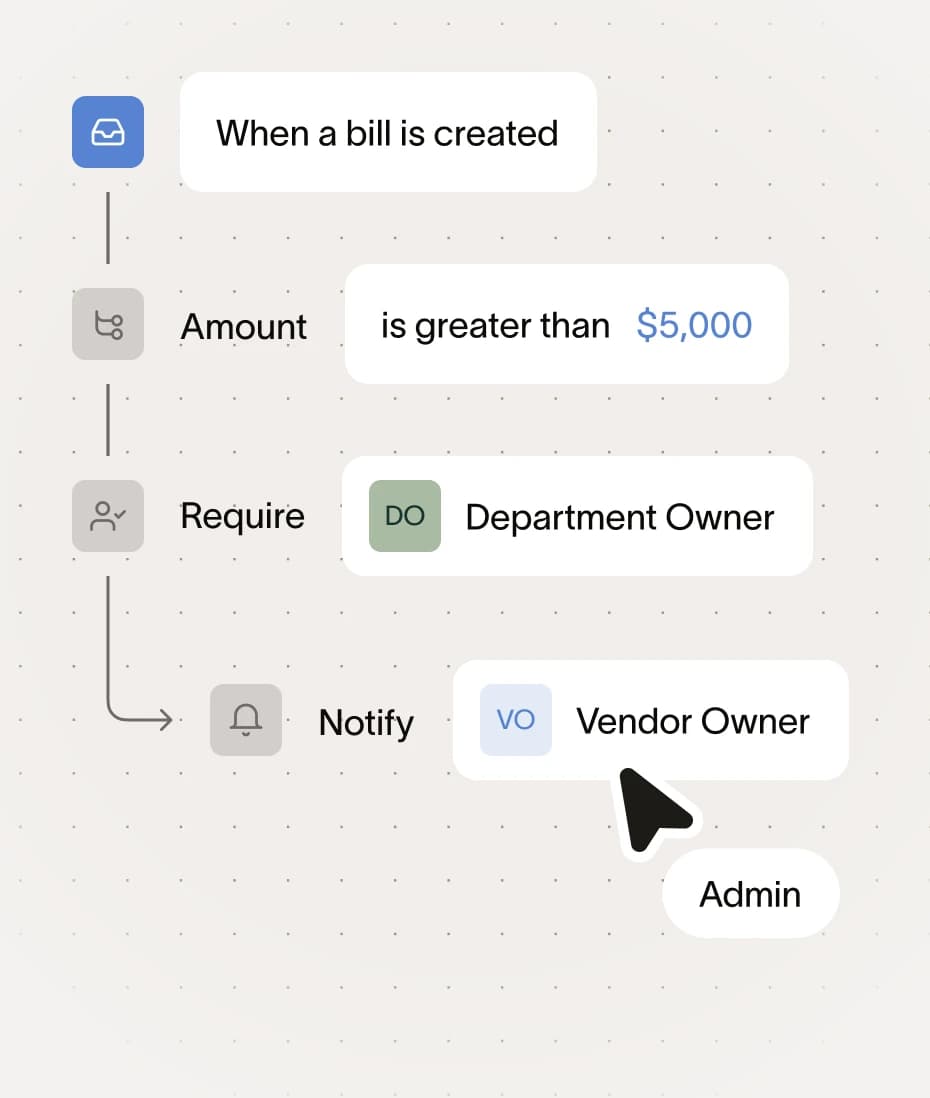

Set policies that enforce themselves.

Customize approval flows, pre-approve funds, issue cards with built-in controls and stop out-of-policy spending.

Expense management

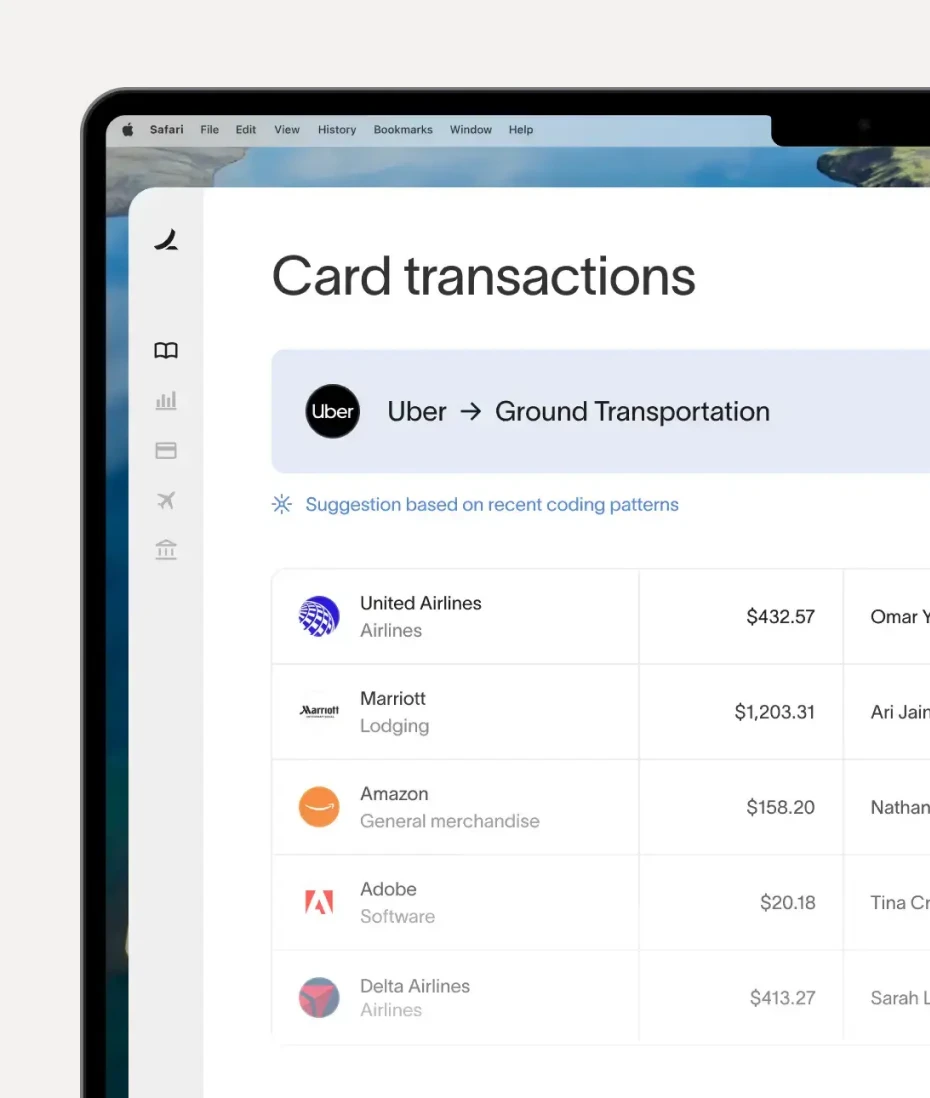

Triple checks are done for you.

Ramp keeps an eye out 24/7 to catch any out-of-policy transactions, uncover errors, and see where you’re overspending.

IntelligenceLeave the busywork to us.

Keep everyone focused on the big picture, and let Ramp automate the rest—expenses, accounting, compliance, and more.

Accounting automationFor startups, global enterprises, and everyone in between.

Simple defaults, direct integrations, and advanced customization means Ramp will scale with you.

Completely flexible.

Customize Ramp to fit your business and give you the controls you need with policies, roles, and approval workflows.

An extension of your team.

Get dedicated support anytime, anywhere.

We're always ready to help.

We're always ready to help.

Integrate and stay synced.

Seamlessly integrate Ramp with your accounting systems and consolidate your finance stack.

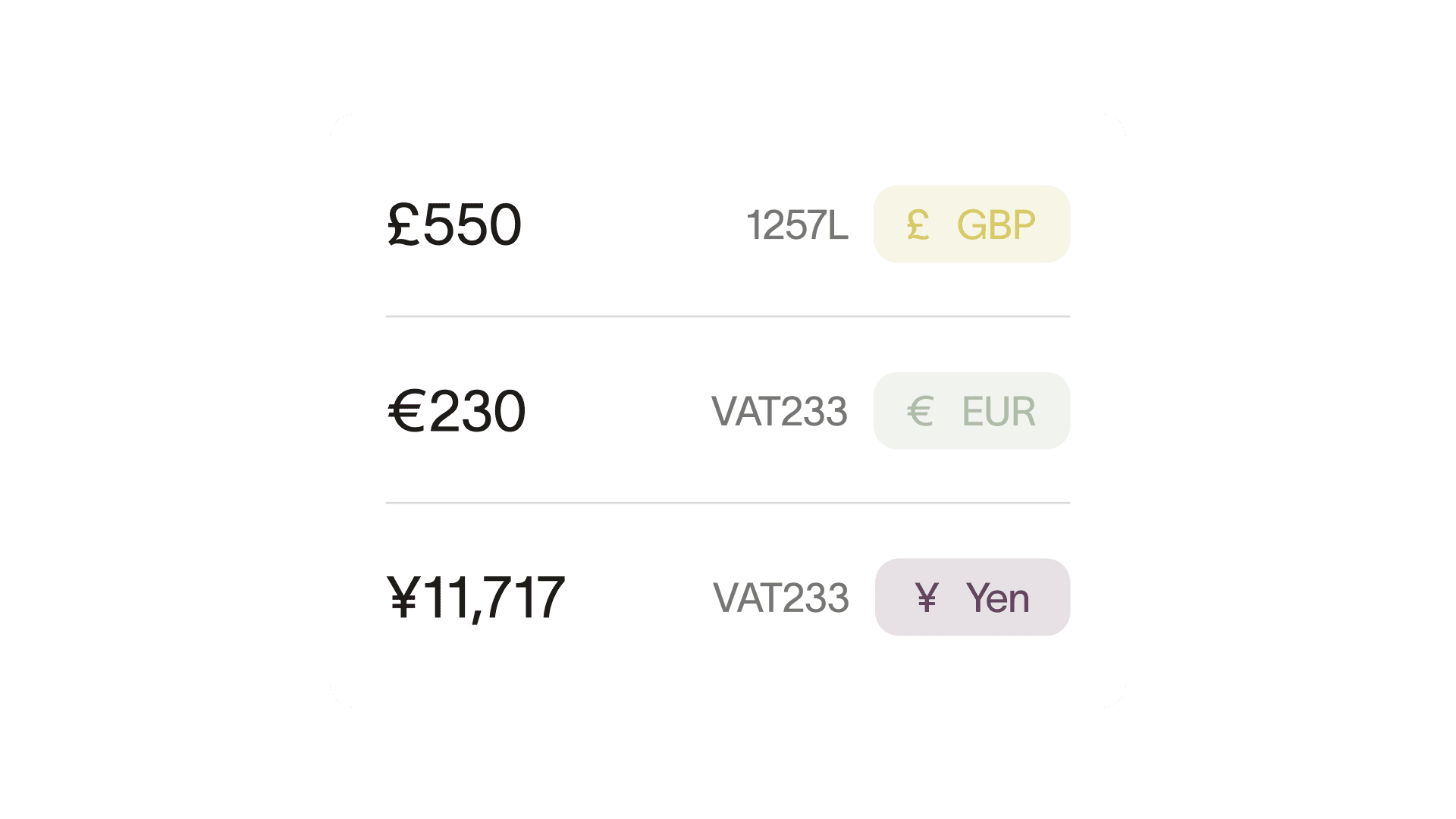

Operate globally.

Send payments to 195 countries in over 40 currencies and reimburse employees in their local currencies within 2 days.

What would you do with more time?

Over 27.5M+ hours saved for 50,000+ customers.

5 star rating

2,000+ reviews