ACH bill payments for businesses

ACH payment processing for businesses that need speed and control. Pay vendors faster, keep everything secure, and manage it all from one smart platform built to scale.

ACH that fits into your

flow—without slowing it down.

From how you schedule payments to how vendors get paid, Ramp makes ACH work the way your business does—fast, flexible, and built to scale.

Standard and Same-Day ACH, on your terms.

Choose standard ACH for routine payments or same-day delivery when timing matters. Ramp supports both with complete visibility at every step.

- Standard ACH: Arrives in 2-5 business days

- Same-Day ACH: Available for eligible bills, with a flat $10 fee or free with a Ramp Business Account

Whether you're paying on a schedule or racing a deadline, Ramp gives you the flexibility to move fast and stay in control.

Send ACH. Skip the fees.

Ramp never charges processing fees for standard ACH payments. The same goes for checks and payments made by Ramp card.

Ramp makes it easy to pay anyone—vendors, suppliers, contractors—without the extra costs.

ACH not enough? Use any method, from one clear view.

Pay vendors however they prefer—ACH, card, check, domestic wire, or international wire—all from one platform.

Ramp never charges processing fees on ACH, checks, or Ramp card payments. Every transaction is tracked in real time, with clear visibility from debit to delivery—and automatic updates that keep vendors in the loop.

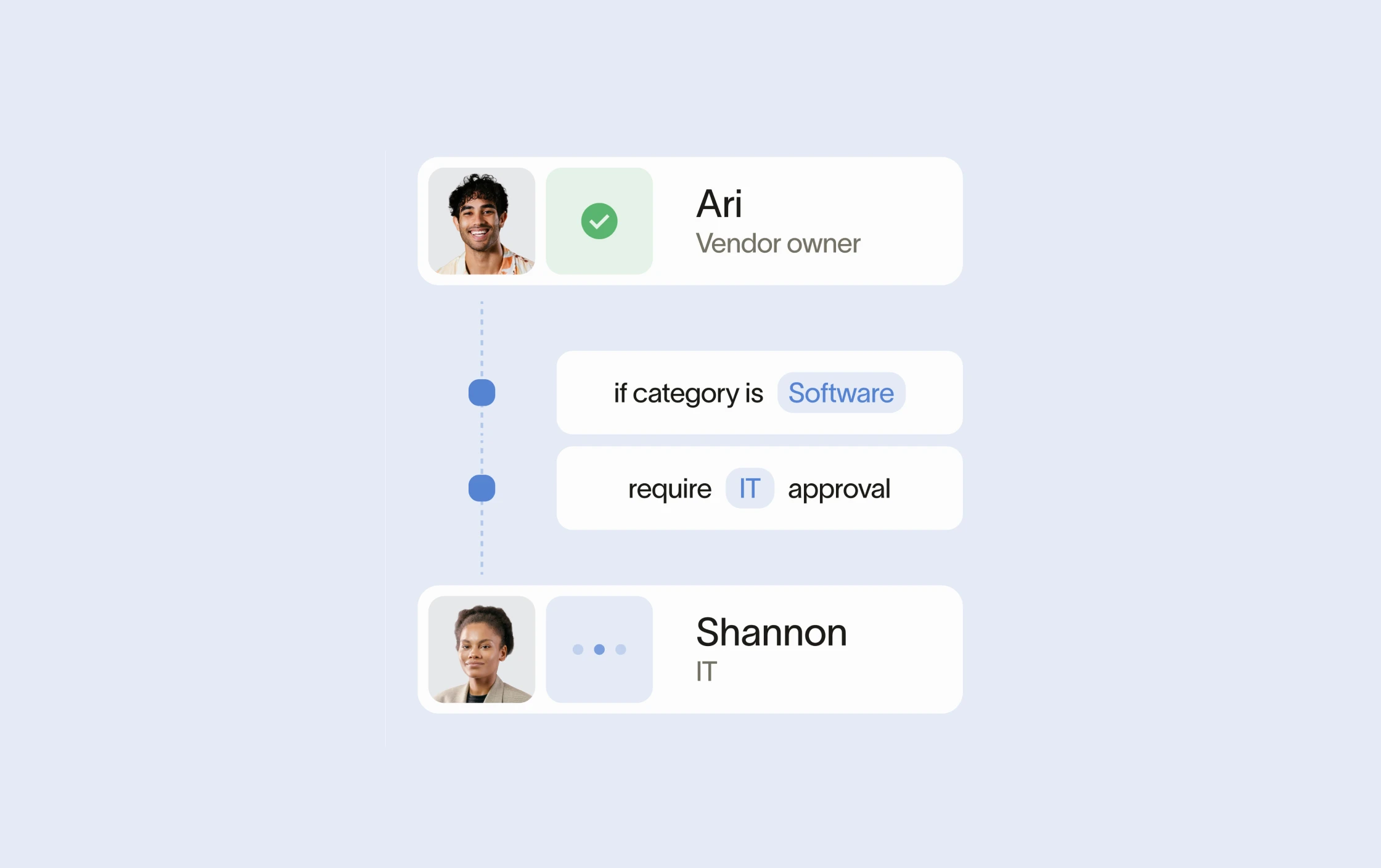

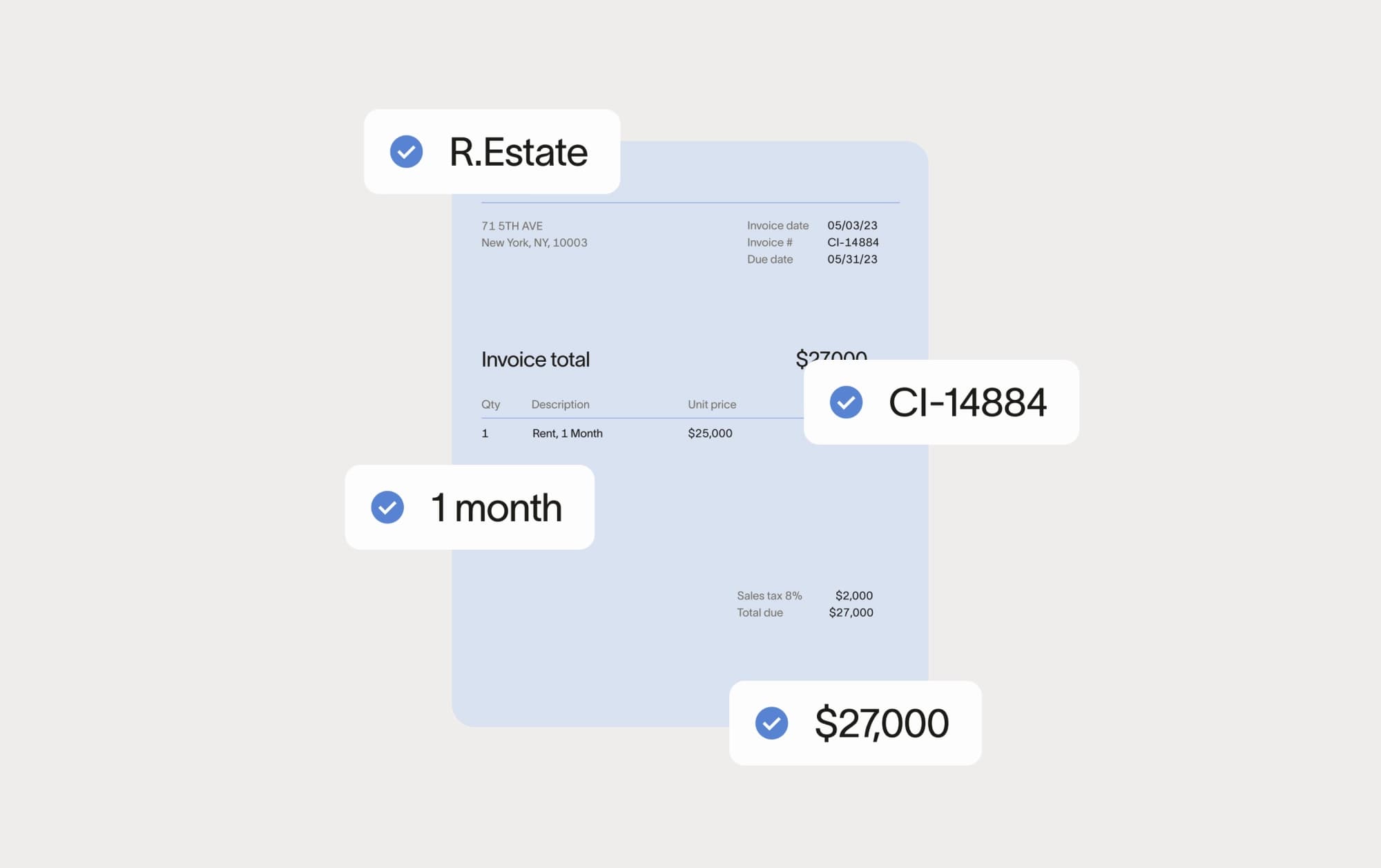

Automate AP and sync everything effortlessly.

Ramp automates the entire bill pay process—from invoice capture to ACH payout—with built-in intelligence and seamless integrations.

- Instantly extracts invoice data with OCR

- Auto-codes line items using AI-suggested GL mapping

- Routes approvals based on your custom workflows

- Syncs to your ERP with NetSuite, QuickBooks, and more

- Keeps vendor info, payments, and audit trails in sync

No more manual entry. No more duplicate updates.

See what our customers have to say about Ramp

Time is money. Save both.

FAQs

ACH payments are a cost-effective, secure alternative to checks and wire transfers. It's typically faster than mailing paper checks and doesn't come with the high fees associated with traditional wires.

Businesses use ACH to pay vendors, employees, and contractors while gaining more control over cash flow, reducing manual entry, and simplifying reconciliation in their accounting systems.

Same-day ACH is available on eligible bills that are fully approved by 4:00 PM ET. Certain exceptions apply—such as recurring bills, high-dollar payments, or vendors associated with high-risk banks. Eligibility may also be limited for new Ramp customers or those with outstanding balances. Learn more.

There's no maximum amount required to send a standard ACH payment through Ramp. Once the funds are withdrawn from your account, the payment is marked as paid in your accounting system—and marked as paid in Ramp once your vendor receives the funds. See more about Bill Pay Accounting.

Free, unlimited free same-day ACH and wires (domestic and international) for Ramp Bill Pay and reimbursements means never missing out on a single day of earning. To unlock unlimited, free same-day ACH, you'll need a Ramp Business Account when you sign up here.

There is no minimum balance or caps requirement and no fees required to maintain the Business Account. Learn more here.

- Domestic wire: If approved before 1:00 PM ET, funds may arrive the same day. Otherwise, delivery can take 0-5 business days. Domestic wires cost a flat $15 fee.

- Check: Ramp withdraws funds via ACH from your connected bank on the scheduled payment date (2-5 business days to clear). Once received, Ramp issues and mails the check within 4-7 business days. If a check isn't cashed within 180 days, Ramp will automatically void it.

- International wire (USD): Ramp first ACH debits your account (1–4 business days), then wires the funds to your vendor (1-5 additional business days).

Ramp automatically notifies AP teams via email and Slack when payments are sent, returned, failed, or modified. You can also track payment status for every bill directly on the platform. Learn more.

Ramp doesn't charge processing fees for standard ACH, check, or Ramp card payments. The following fees apply for other methods:

- Same-day ACH payments: $10 per transaction

- Domestic wire transfers: $15 per transaction

- International wire (SWIFT USD) payments: $20 per transaction

Blog

What are ACH payments? A full breakdown

Blog

Comparing ACH processing fees

Blog