A month of AP done in minutes.

Process bills, accelerate approvals, and manage cash flow 2.4x faster than legacy software.

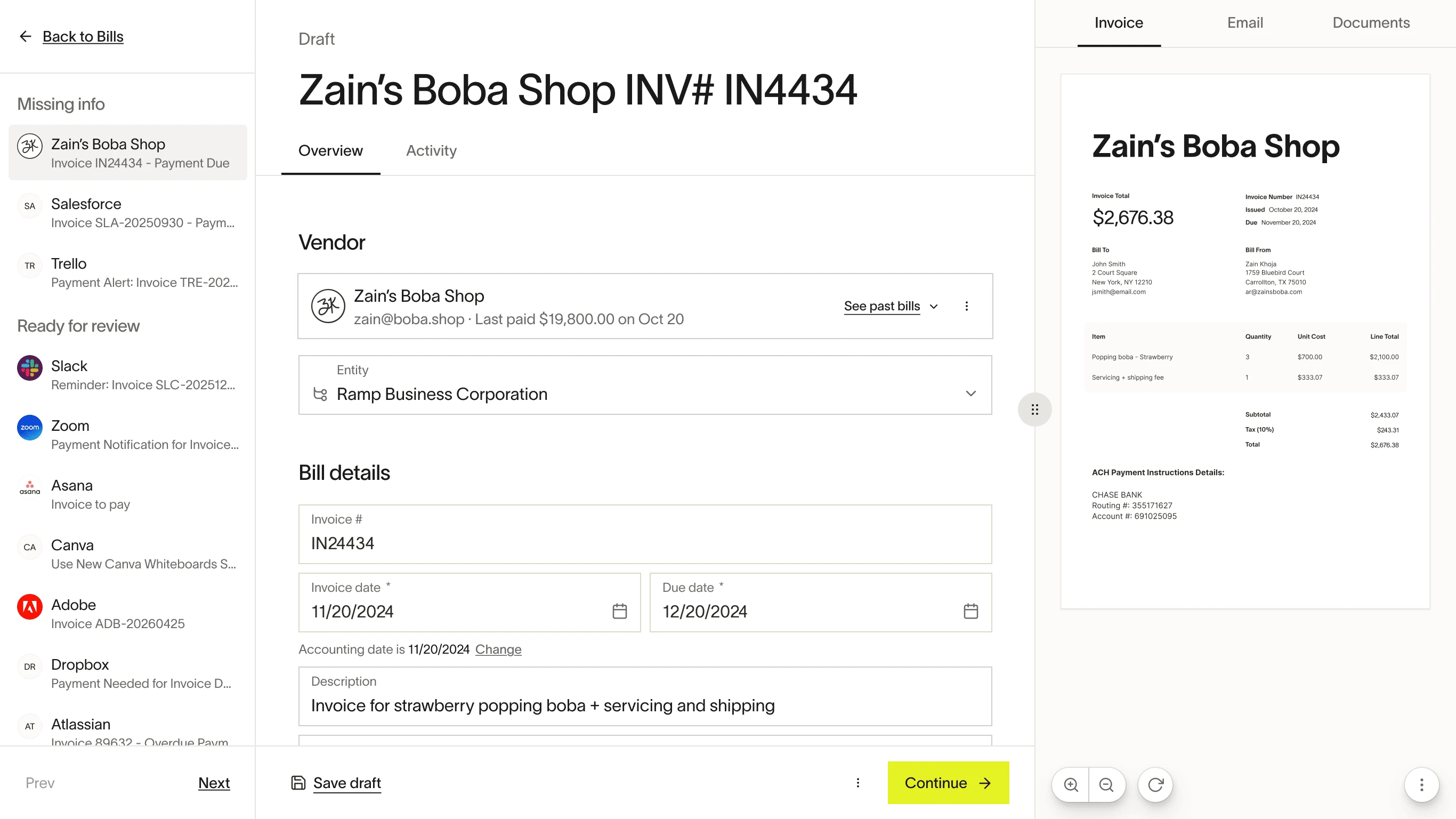

AI-powered Invoice Processing

Drag, drop, done.

Process thousands of invoices in seconds.

Ramp’s agent codes everything for you.

Catch fraud and overbilling instantly.

Keep systems in sync.

Process thousands of invoices in seconds.

Ramp's agent codes everything for you.

Catch fraud and overbilling instantly.

Keep systems in sync.

AP in the age of AI.

By the numbers

Fewer clicks. Faster close.

fewer clicks to process a bill vs Bill.com1

of businesses reported improved visibility2

faster invoice processing than legacy software.3

Approval Orchestration

Customization that keeps you in control.

Approval flows that just flow.

Ramp automatically routes every bill to the right approver—from routine spend to CFO signoffs.

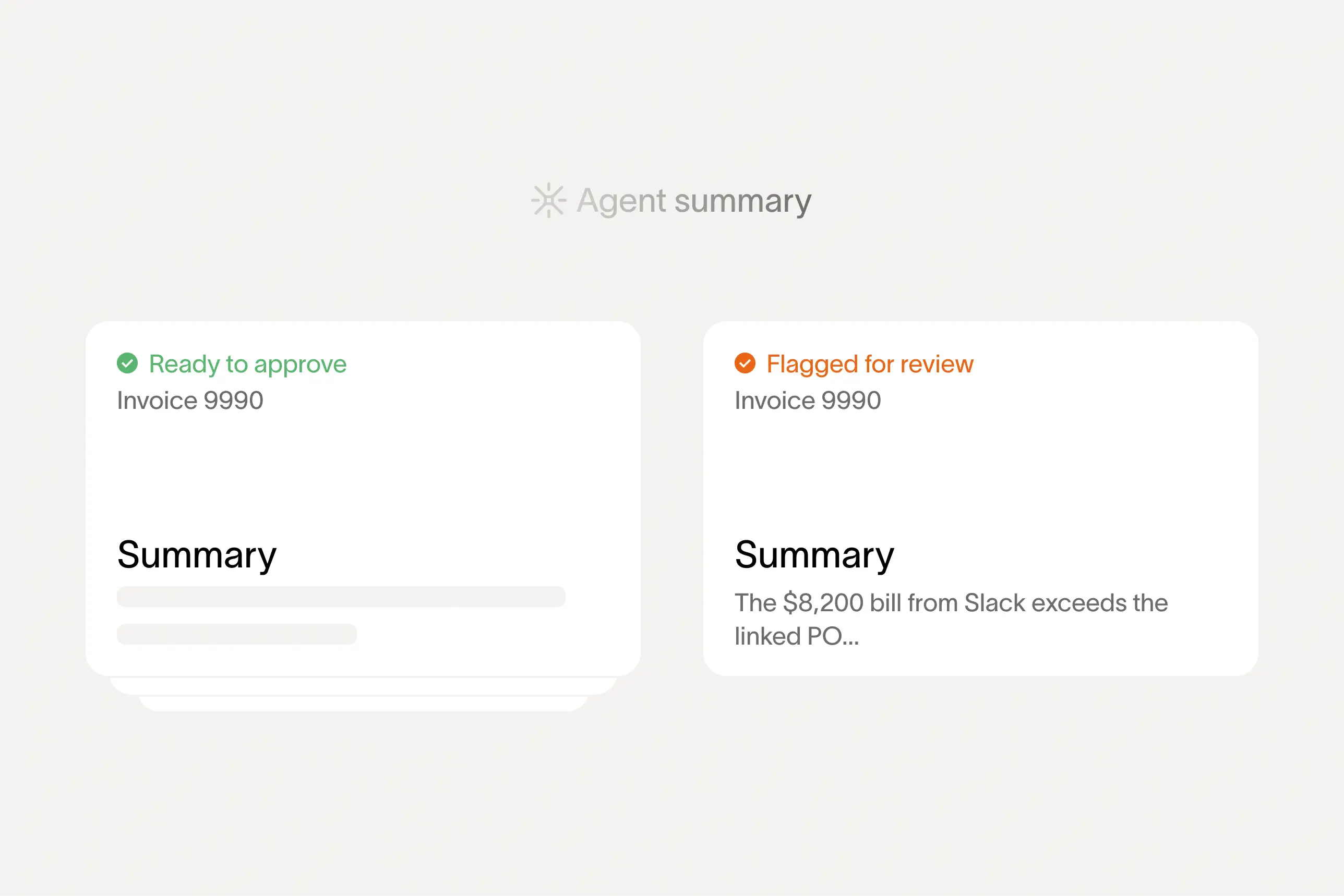

Approve or reject with certainty.

Assign permissions. Avoid errors.

Payments

Your AP system should pay you back.

Earn cashback with no extra steps.

Ramp’s agent spots card-eligible vendors and submits payments for you.

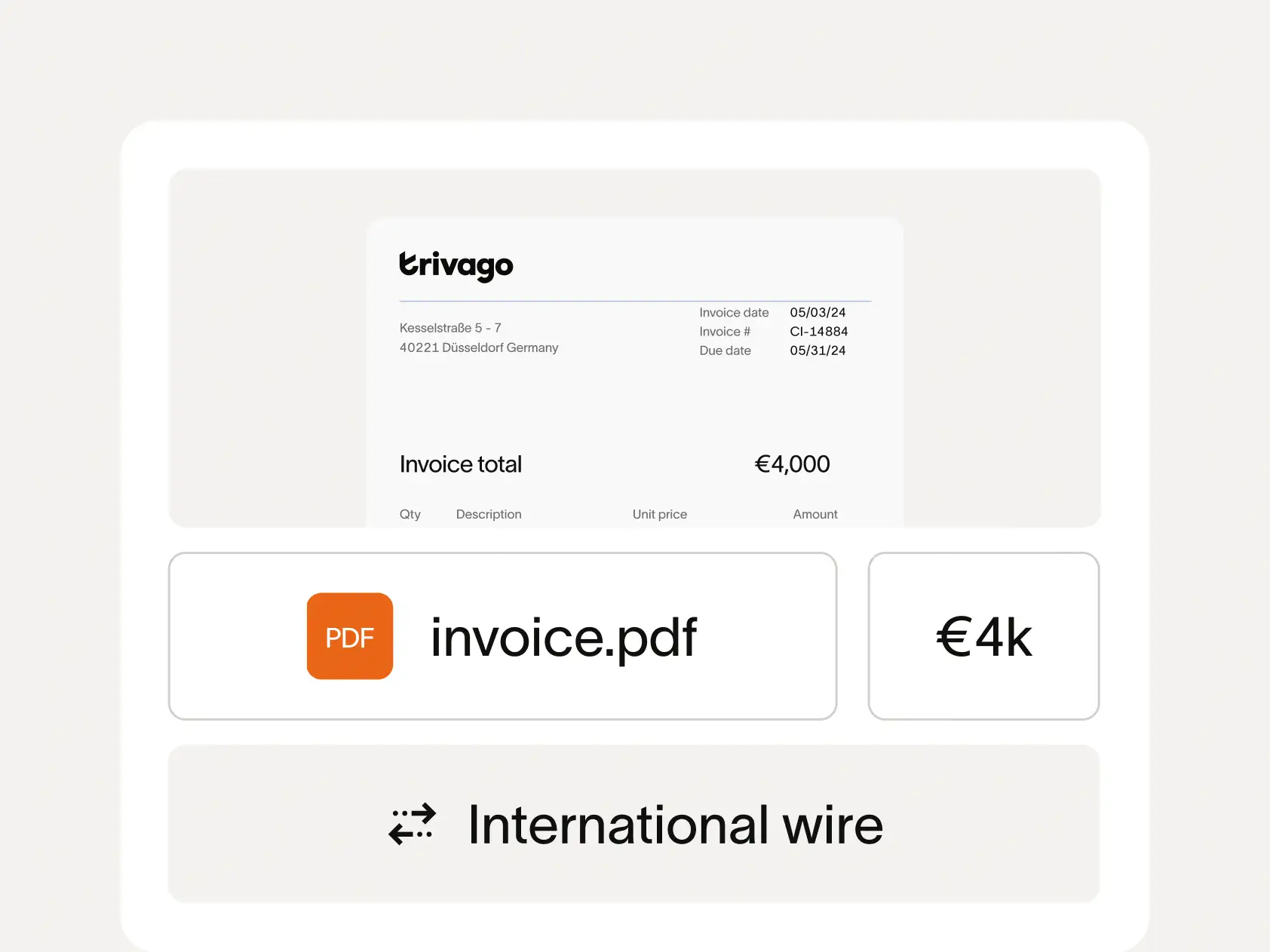

Global payments in one place? Cleared.

Pay any vendor, anywhere in the world, by card, ACH, or wire. All in one place.

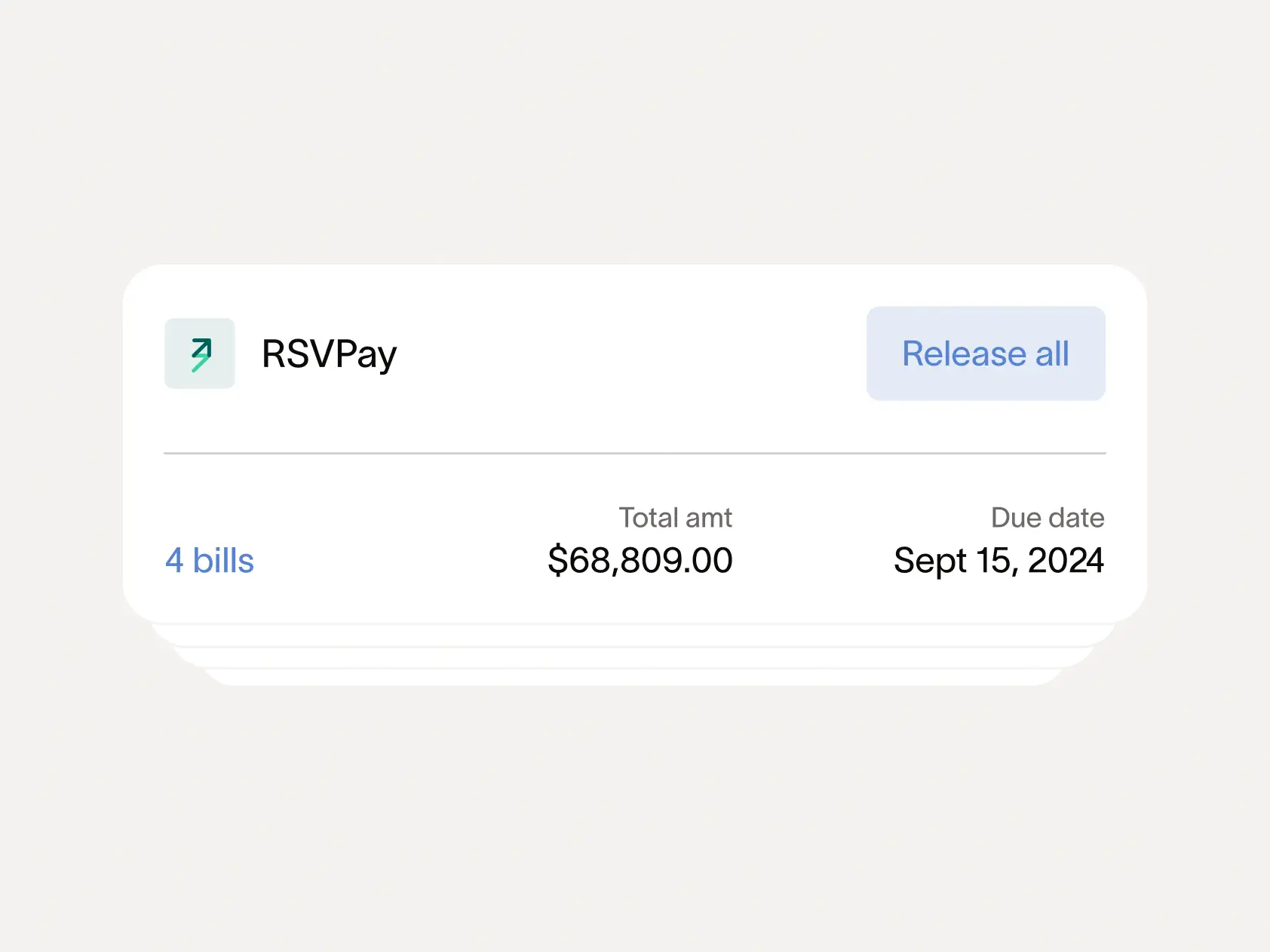

Batch payments made simple.

Whether you’re paying 5 or 500 bills, save time and cut costs by batching vendor payments.

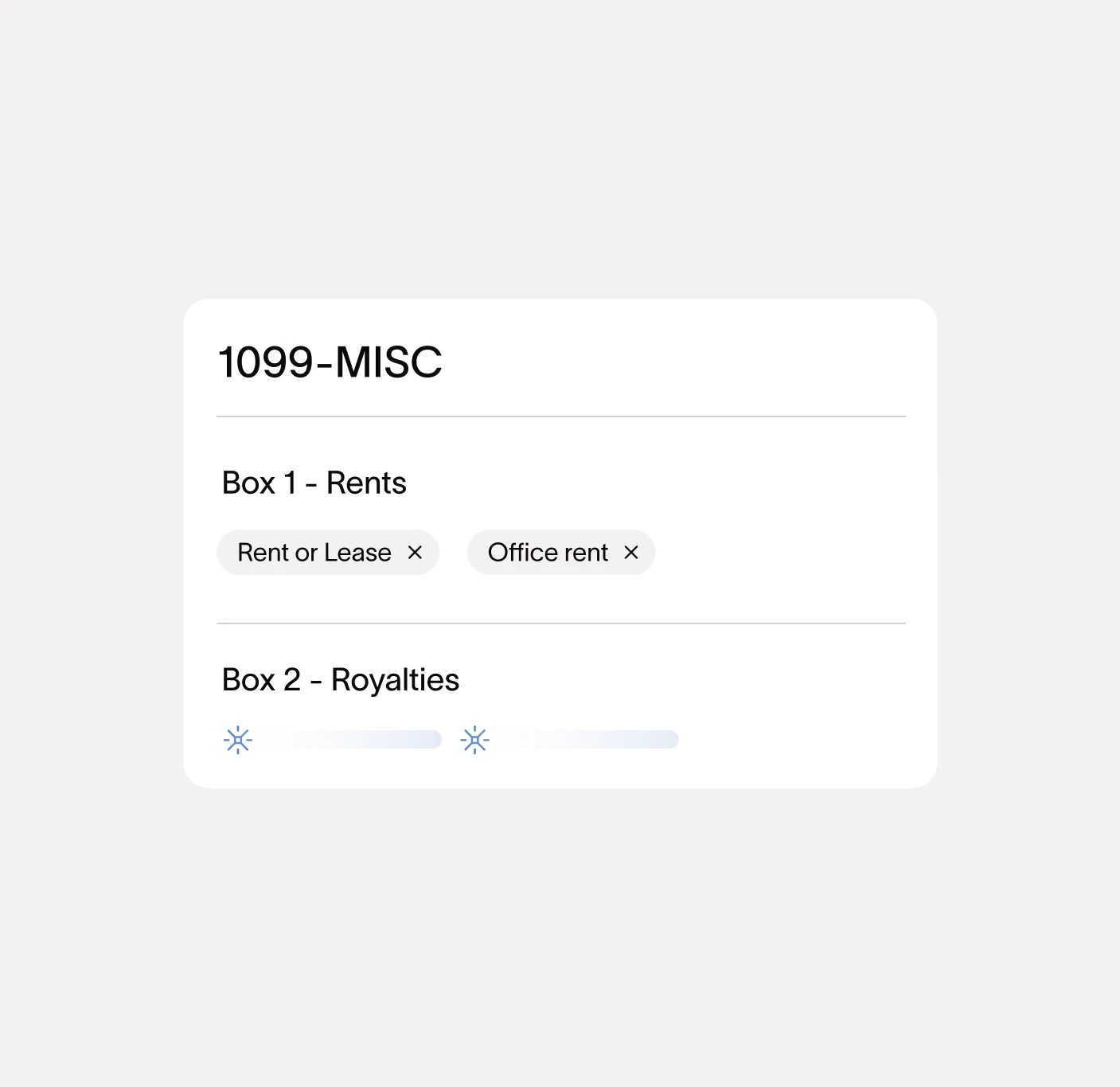

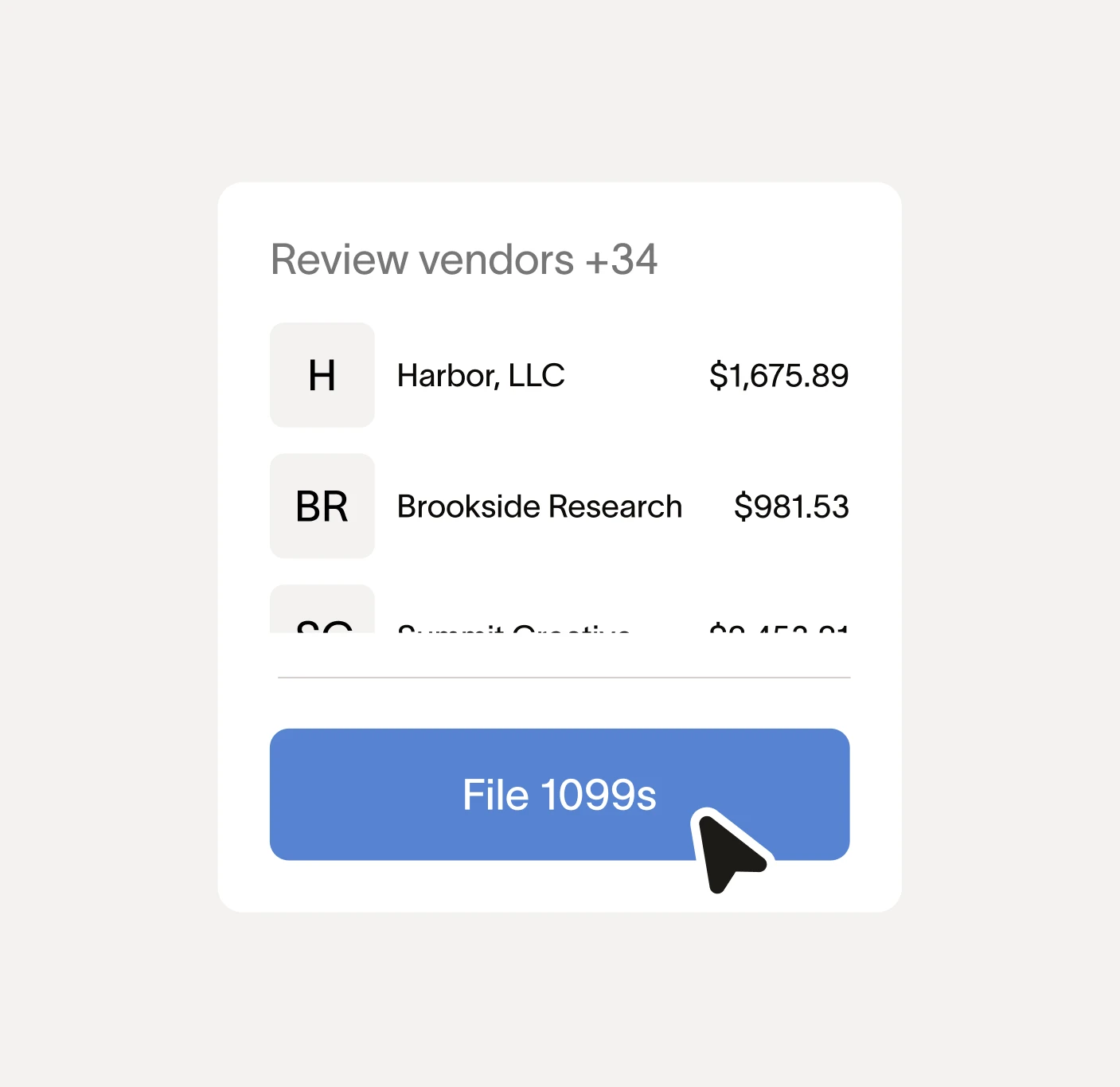

1099 Compliance

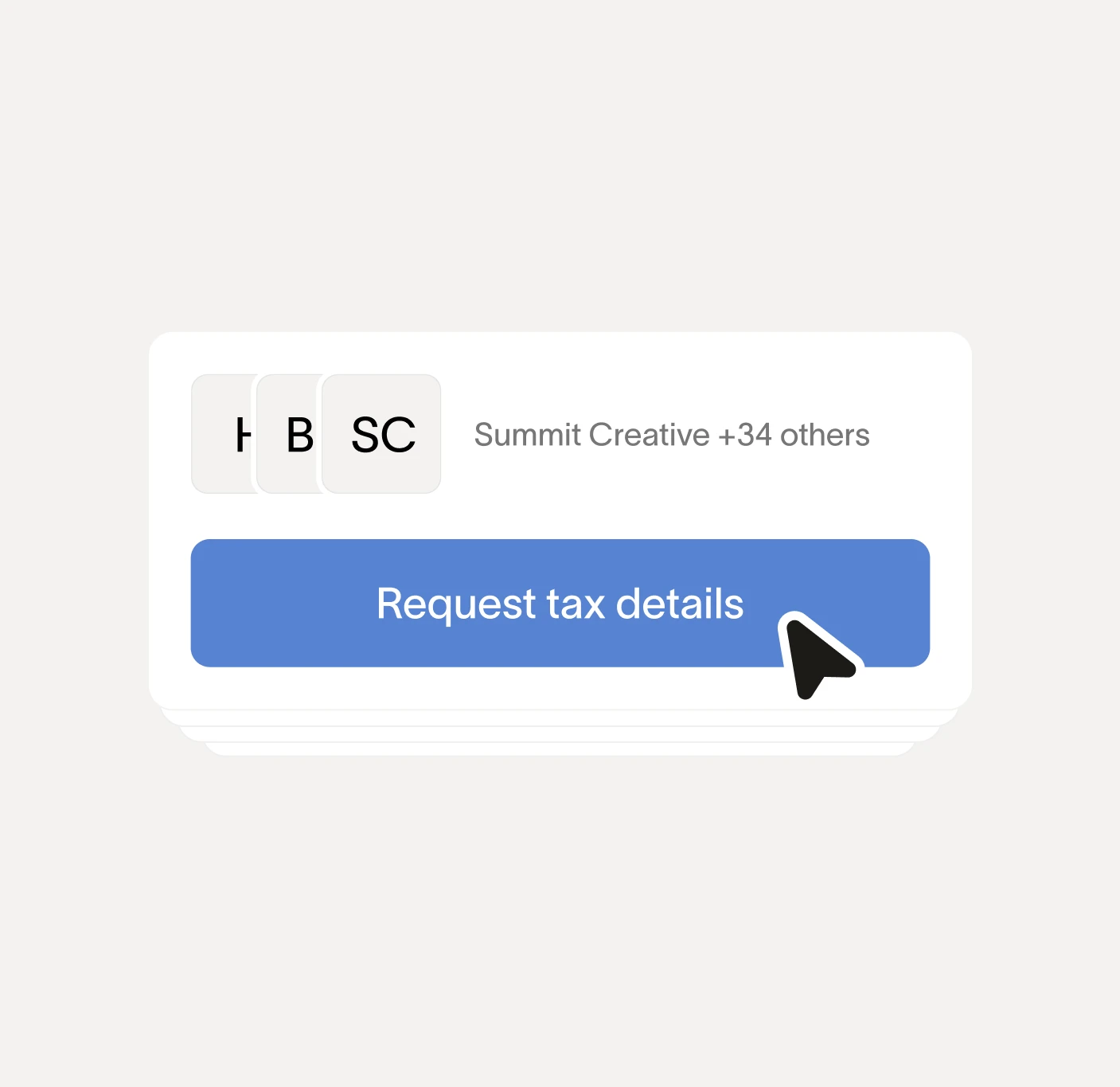

Automate 1099s from start to finish

Collect tax info in bulk

Ramp AI handles the form prep

One-click filing delivery

See for yourself.

Go step by step with our product experts.

How to

How to

How to

How to

How to

One platform for every part of finance—AP, procurement, expenses and more.

Travel

Turn travel policies into guardrails everyone on the team will follow.

Expense management

Automate expense management with Ramp’s corporate card, reimbursements, and more.

Vendor management

Track all your vendor data and discover pricing insights in one convenient place.

Procurement

Intake-to-pay simplified and automated every step of the way.

Integrations

Seamless automation and direct integrations for audit-proof accounting.

FAQ

Accounts payable software is a solution businesses use to process invoices and pay vendors. Instead of manually entering bills, chasing down approvals, and cutting checks, AP software handles the entire invoice-to-payment workflow digitally.

Here's what it does: The software captures invoice details automatically using OCR technology, matches line items against purchase orders to catch overbilling, and routes invoices through approval workflows based on your business rules. Once approved, it schedules payments via ACH, card, check, or wire, then syncs everything to your ERP or accounting system in real time.

The payoff is faster processing, fewer errors, better spend visibility, and stronger financial controls. Modern accounts payable software like Ramp takes this further with AI agents that automate coding, detect fraud, and optimize payment methods—turning manual AP work into touchless workflows that save your team hours every week.

Ramp Bill Pay is an AI-powered accounts payable solution that helps you process invoices, manage approvals, and make payments 2.4x faster than legacy software3. It uses 99% accurate OCR to capture invoice details, automatically matches line items against purchase orders, and routes bills through customizable approval workflows. You can pay vendors via ACH, card, check, or international wire, all while syncing directly with your ERP like NetSuite, QuickBooks, Sage Intacct, and more. Admins and AP Clerks can track, edit, cancel, or archive bills at every stage, with full visibility into bill status throughout the process.

Yes, Ramp Bill Pay works as a standalone AP automation solution. You get full access to invoice processing, approval workflows, vendor management, and payment capabilities without needing to use Ramp's corporate cards or expense management features. The AP platform syncs with 10 ERPs (like NetSuite, Sage Intacct, and QuickBooks) and handles everything from invoice capture to payment execution independently.

Many customers use Bill Pay on its own to automate their accounts payable operations while keeping their current spend management setup.

Getting started with Ramp Bill Pay is quick and flexible. You'll begin by connecting your accounting provider (or opt to skip and set it up later). Ramp can import vendor information directly from your accounting system, alternatively, you can also request vendors to submit their payments directly into Ramp. From there, you'll link a bank account for payments, choose your payment method, and set up approval flows, permissions, and optional automation like invoice forwarding.

Ramp Bill Pay is flexible by design—easy to set up, and ready to scale with your team. Learn more.

Ramp AP agents are agentic AI systems—autonomous agents that can analyze context, make decisions, and take action with little human intervention—built into Ramp Bill Pay to automate end-to-end accounts payable workflows. Instead of requiring manual review, these agents use historical data, vendor checks, and contract details to code expenses, detect anomalies, and route invoices with the right context.

You maintain full oversight throughout: agents handle the heavy lifting while your team retains visibility and control over approvals, exceptions, and payment decisions.

Here's what each agent does:

- Auto-coding agent: Analyzes your organization's historical coding patterns and applies that logic to new invoices automatically, mapping line items to the correct GL codes based on line items, descriptions, and location.

- Fraud prevention agent: Flags suspicious activity—like unexpected changes to vendor banking details or unverified accounts—before payment goes out.

- Approval agent: Summarizes vendor history, contract details, and PO matching to give approvers full context and suggest approval or rejection.

- Automatic payment agent: Identifies card-eligible invoices and can fill card details directly into vendor portals, capturing cashback opportunities automatically.

Together, these agents turn time-intensive AP workflows into touchless processes while maintaining strong financial controls.

Ramp Bill Pay supports a range of payment methods—including standard ACH, Same-Day ACH, Ramp card, check, and domestic and international wire (in USD or foreign currencies)—all within the Ramp platform.

For check payments, Ramp debits your connected bank account on the scheduled payment date and issues a check on your behalf.

If you choose to pay by card, you can use an existing Ramp card or generate a one-time virtual card. One-time cards can be sent by Ramp to the vendor's default contact on the bill's due date or be entered manually. Ramp automatically marks the bill as paid. You control which vendors are paid by card. Learn more.

Ramp collects vendor ACH details in two ways:

- If bank information is included on the invoice, Ramp automatically extracts it—along with vendor data—to create a vendor record

- You can also request ACH details directly from vendors within Ramp Bill Pay

Ramp also supports W-9 collection. You can manually upload W-9s to vendor records or request them from within Ramp. All vendor tax info and payment history can be exported as a CSV to simplify 1099 filing. Learn more.

Vendors also don't need to create a Ramp account to get paid, signing up to the vendor network is entirely optional. Ramp is designed to make payments fast and frictionless for both sides of the transaction. Once your team approves a bill, the vendor receives the payment on the scheduled payment date.

Yes, Ramp supports both recurring bill payments and bill amortization.

You can set up recurring bills directly in Ramp's accounts payable software to automate routine vendor payments. Customize the frequency and ending date and Ramp will handle the rest. Learn more.

Ramp also supports amortization for bills via our NetSuite integration. You can sync existing Amortization Templates from NetSuite and apply them directly to bills in Ramp Bill Pay. Learn more.

Download a CSV AP Aging report directly from Ramp Bill Pay. Get a summary on the status of unpaid bills, showing what you owe, who you owe it to, and how much is overdue. Learn more.

Yes, you can import purchase orders into Bill Pay from NetSuite or QuickBooks, enabling a seamless PO-to-Bill workflow. Ramp also allows you to create purchase orders and item receipts directly within the platform. Ramp performs 2-way (PO to invoice) and 3-way (PO, invoice, and receipt) match, ensuring you are billed correctly. Learn more.

The best AP automation software eliminates busywork, reduces risk, and integrates directly with your accounting systems. Here are the top AP features you should look for:

- Smart invoice capture with OCR: Automatically extracts invoice data—vendor details, line items, amounts—from PDFs, scans, and emails with high accuracy.

- PO matching for fraud prevention: Automatically verify invoice line items against purchase orders and receipts (two-way and three-way matching) to catch overbilling.

- Custom approval workflows: Flexible routing based on invoice amount, department, vendor type, or other business rules. Approvers should get automated reminders and be able to review invoices from mobile devices.

- Real-time ERP integration: Sync bidirectionally with your accounting system—NetSuite, QuickBooks, Xero, Sage Intacct—so bills, payments, and vendor data update automatically without manual reconciliation.

- Multiple payment methods: Support for ACH, card, check, and wire payments, along with multi-currency support and compliance tools.

- Vendor self-service portal: Let vendors submit invoices, update payment details, and check payment status on their own.

- Built-in audit trails: Role-based permissions, approval histories, and detailed activity logs should be automatic to help prevent fraud.

- Real-time reporting: Dashboards that show invoice aging, processing times, and spending patterns help you spot bottlenecks before they become problems.

- Easy to use and fast to adopt: Intuitive interface that finance teams and approvers can pick up quickly.

- Cloud-based and scalable: Handle growing invoice volumes without performance issues or surprise costs as you add users or entities.

Bonus points for AI-driven controls that detect duplicates, flag discrepancies between POs and bills, and automate recurring or amortized expenses. Ramp Bill Pay includes all of these—offering a modern, fully integrated AP automation solution built for speed, accuracy, and scale.

Ramp Bill Pay is a top choice for accounts payable software, delivering touchless AP workflows through AI-powered automation that doesn't sacrifice simplicity. With four specialized AI agents, zero processing fees on domestic payments, and a unified platform that combines AP with corporate cards, you get invoice processing, approvals, payments, and spend controls in one place. No more juggling disconnected tools. When we say a month of AP done in minutes, we mean it. Ramp processes bills, accelerates approvals, and manages cash flow 2.4x faster than legacy software, with 95% of customers reporting improved visibility.2

Ramp Bill Pay delivers touchless AP workflows through AI-powered automation, making it ideal for companies that want to eliminate manual invoice work without sacrificing control. It's best suited for:

- Small businesses and fast-growing companies that need reliable AP automation: As a top AP software for small businesses, Ramp uses OCR with 99% accuracy to capture invoice details automatically, while AI agents learn from your historical patterns to code and route invoices without manual intervention.

- Mid-sized companies streamlining payments across finance tools: Ramp unifies AP, corporate cards, and expense management in one platform—eliminating the need to reconcile bills, card transactions, and reimbursements across separate systems.

- Multi-entity organizations with complex accounting needs: Ramp's unified platform handles sophisticated setups like entity-specific payment tracking, amortization, multi-currency support, and custom fields—especially for NetSuite users. You can manage payments per entity, avoid inter-company transactions, and batch sync across entities while maintaining the controls and reporting each business unit requires.

Yes, Ramp Bill Pay offers a powerful free tier that includes core Bill Pay features. You get invoice automation, approval workflows, vendor management, and payment execution at no cost—with no processing fees for ACH, checks, or Ramp card payments.

For teams that need advanced controls, multi-entity support, or global capabilities, Ramp Plus is available for $15 per user per month. Enterprise pricing is also available for larger organizations with custom requirements.

Unlike traditional AP software that charges per transaction or invoice, Ramp's pricing is straightforward and designed to scale with your team—not your payment volume.