- Ramp

- Cube

- NetSuite

- Accounting Seed

- Anaplan

- Planful

- Prophix One

- Datarails

- Lucanet/Casual

- GTreasury/CashAnalytics

- Agicap

- Workday

- Centage

- Abacum

- Tesorio

- Ease of use

- Cost

- Customization

- Security

- Automation capabilities

- Integration capabilities

- Manage your cash flow with Ramp

Without access to cash when you need it, even successful businesses will fail. Unfortunately, cash flow can be a difficult concept to understand. In a recent BlackLine survey of nearly 1,500 C-suite executives and finance and accounting professionals, 98% of respondents said that they weren’t fully confident in the visibility they had over cash.

When you manage your cash effectively, your business can more easily:

- Meet its payment obligations

- Build quality connections with third parties (vendors, suppliers, lenders, etc.)

- Take calculated risks (like expanding into new markets or testing new product lines)

- Make better long-term decisions

Fortunately, there are tools you can use to gain a better understanding of your cash position.

What is cash flow management software?

Cash flow isn’t as simple as “cash in minus cash out.” Cash is a cycle, and effectively managing that cycle is essential. Cash flow management software are tools that helps businesses do just that.

Most cash flow management software will help you in the following ways:

- Track cash balances in real time: Being able to see current cash balances at any moment — and knowing those balances are accurate — can be useful when you need to make a quick business decision.

- Forecast the balances (and the flow) of cash: Forecasting cash flow can tell you when it’s the best time to make purchases or pay invoices. This can help you avoid overdrafting your account or depleting cash reserves unnecessarily.

- Budget: Business sectors and departments can more effectively budget if they know what their cash balances will be throughout the month.

- Estimate future cash needs: If you know when payments are coming due, you can ensure you have the liquidity to cover those costs.

- Build decision-useful scenarios: A high-quality software can simulate different financial scenarios, which can help you flesh out your long-term business strategy.

15 cash flow management tools

Not all cash flow management software is created equal. It can be overwhelming to choose one when so many high-quality tools are on the market. Let’s go over 15 of the most popular cash flow management tools to help you make a more informed decision.

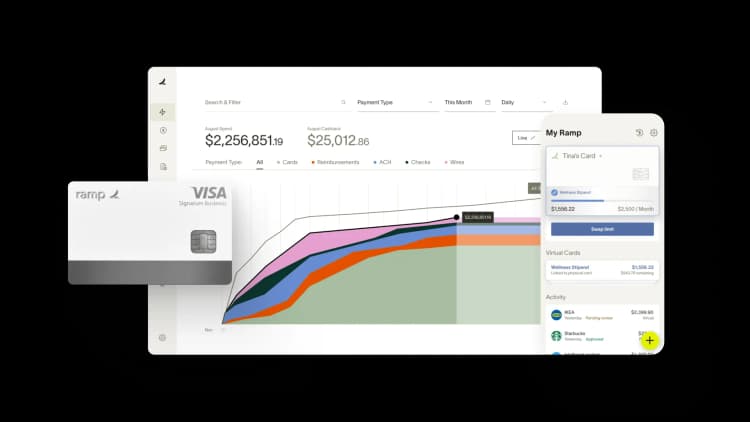

Ramp

Ramp is an all-in-one financial operations platform. It’s designed to save businesses time and money by replacing multiple different workflows. Users can work within one, easy-to-use platform to manage corporate spending, bill payments, accounting tasks, and so much more.

Key Features:

- Spend and expense management

- Smart transaction coding

- Accounts payable automation

- Managing and onboarding vendors

- Flexible and dynamic reports

- Procurement assistance, like quote comparisons and enforcing spend limits

Pros:

- Centralized platform: Eliminates the need for multiple tools and apps by combining multiple accounting functions into a single platform

- Integration capabilities: Easy to integrate with other ERP technology and applications

- Offers rewards: Offers several rewards programs for corporate card users, including cashback on purchases

- AI-powered insights: Identifies ways to save money and prevent overspending and improve profitability

Cons: Ramp is always improving its software, and the changes can be difficult for existing clients to follow.

Pricing: Pricing begins at $0 per user for basic features and rises as you add services or users. Learn more about Ramp’s pricing here.

Cube

Cube is a financial planning and analysis (FP&A) software platform that plans, forecasts, and analyzes the financial performance of its users by integrating with existing spreadsheets.

Key Features:

- FP&A automation

- Real-time insights

- Forecasting and scenario planning

- AI risk identification

- Customizable dashboards, reports, and workflows

- Report customization

Pros:

- Integrates with Excel and Google Sheets: Lets users continue using existing spreadsheets

- Real-time reports: Generates reports in real time, freeing users from the obligation to manually consolidate data

- Simple user interface: Clean, intuitive interface that makes it easy to learn the functionality of the software

- Unlimited users: No limit on users, which is useful for businesses looking to scale

Cons: Though the platform works within existing spreadsheets, users may need to alter their spreadsheets to optimize performance with the software.

Pricing: Prices depend on customization, but plans start at $2,000. Learn more about Cube’s pricing here.

NetSuite

NetSuite is a cloud-based business management suite by Oracle that covers financial planning, customer relations, and ecommerce services. It helps businesses understand future cash flow by automating core processes and providing real-time visibility into financial performance.

Key features:

- Performs functions for multiple subsidiaries, business units, and legal entities and can combine and consolidate seamlessly

- Automates financial processes

- Gains visibility over inventory, warehouse efficiency, and supply chain

- Consolidates invoicing for a better experience for a business’s customers

Pros:

- Embedded AI: AI is embedded throughout the platform, suggesting ways to simplify tasks

- Transparency: Allows users to drill down to underlying details

- Real-time metrics: Lets users access real-time data to help in strategic planning

- Role-based dashboards: Dashboards can be customized to each user

Cons: Migrating to the NetSuite/Oracle platform can be lengthy and require extensive customization.

Pricing: NetSuite is a subscription-based service, but prices vary based on business needs. They offer a referral program that offers a 10% reward off their first year’s license. Request more information here.

Accounting Seed

Accounting Seed is a cloud-based enterprise resource planning (ERP) system fully native to Salesforce. While it has many more uses, it helps users in cash flow management with AP automation, cash flow projections, and the ability to create decision-useful financial reports.

Key features:

- Automates recurring accounting tasks like billings, journal entries, and reconciliations

- Connects sales, operations, and finance data to gain a real-time view of business performance

- Automates AR and AP tasks like recording payments and matching invoices to payments

- Integrates seamlessly with the Salesforce CRM

- Financial reporting dashboards help users monitor the health of their business in real time

Pros:

- Customer support: Provides guides, training resources, and articles, but also offers in-app AI assistance and an online portal available during business hours

- Collaboration: Ability to share vital information across the business

- Customizable reports: Reports can be created within the application, preventing the need for

- Visual storytelling: Financial analytics help users gain deeper insights into the organization’s data

Cons: If users aren’t already using Salesforce, they cannot benefit from Accounting Seed.

Pricing: Accounting Seed is available as a monthly subscription, but pricing is only available upon request. More information about pricing can be found here.

Anaplan

Anaplan is a financial services app for businesses looking to make better decisions. Its suite of tools includes AI-enabled scenario planning and an analysis platform to give users insight across all areas of business, including finances, sales, marketing, supply chain, and HR.

Key Features:

- Sales planning

- Sales insights

- Budgeting and forecasting

- Spend analysis

- Inventory management and optimization

- FP&A automation

Pros:

- Industry-specific solutions: Has built-in solutions specific to certain types of industries

- Predictive insights: AI-led predictions provide leaders with useful insights

- Web-based: Its cloud-hosted system is easy to access

- Customizable solutions: Has multiple use cases for many types of businesses

Cons: The program can be slow as more users are added, and its customer support has shown to be lacking.

Pricing: Cost varies based on company size and needs. Contact Anaplan for pricing options.

Planful

Planful is a financial performance management platform. It streamlines business-wide planning, budgeting, reporting, and analytics, increasing productivity and helping finance and accounting professionals make better decisions.

Key features:

- Scenario analysis

- Rolling forecasts

- Month-end close automation

- Prepares internal and external reports

- Marketing budget management and ROI calculations

- Builds dashboards for each budget owner

Pros:

- Web-based: Its cloud-based software is simple and quick to access

- AI-enabled tools: Uses AI to identify trends, adjust goals, and better manage seasonal changes

- Frictionless user experience: Easy for all key stakeholders to use and manipulate so boost transparency among decision makers

- Powerful analytics: Intuitive reports and dashboards help users see financial standing in real time and better plan for the future

Cons: Though some platforms can be integrated with Planful, not all can, and customers have been disappointed with integration capabilities.

Pricing: Pricing varies based on number of users and features purchased. Reach out to Planful for pricing options.

Prophix One

Prophix is a single platform, financial planning & analysis solution that eliminates manual and error-prone tasks so that users can get an accurate view of your financial performance. It profides a full-service financial analysis solution, from month-end close, to forecasting, to consolidation, to financial reporting.

Key features:

- Reconciliation capabilities

- Budgeting and planning

- Reporting disclosures

- Cross-company planning and team collaboration

- Personalized dashboards

- Scenario planning and sales forecasting

Pros:

- Single platform: Consolidates nearly all finance processes into one platform

- Real-time insights: On-demand reports empower decision makers to grow the business

- Collaboration capabilities: Its one, simple-to-use, cloud-based platform encourages seamless collaboration among finance team members

- Integration capabilities: Integrates with other ERPs so teams can share data quickly without errors

Cons: Users have reported that there’s a steep learning curve with Prophix, especially when manipulating large data sets.

Pricing: Cost of Prophix software varies based on number of users, applications, and integrations. Learn more here.

Datarails

Datarails is an AI-powered FP&A platform that consolidates nearly all financial data into one eye-pleasing dashboard. By integrating with existing spreadsheets, users can continue to use the Excel documents they love but have access to decision-useful data.

Key features:

- Automate month-end close and reporting

- Budgeting and forecasting

- Scenario modeling

- AI customer support assistance

- Colorful and dynamic charts and graphs

Pros:

- KPI tracking: Dashboard shows KPIs and progress toward reaching those goals

- Maintains detail: Detail is hidden, but users can drill down to get the answers they need

- Conversational AI: Makes it easy to get answers to questions without waiting in a queue

- Data visualization: Builds graphs and charts useful in making better financial decision

Cons: Businesses looking to overhaul their financial reporting may not like that Datarails still heavily relies on existing spreadsheets.

Pricing: Custom-fit packages vary in price depending on reporting needs and analysis goals, and based on the number of users and integrations. Learn more here.

Lucanet/Casual

Lucanet is a cloud-based global SaaS platform with integrated solutions for CFOs and decision makers. It recently expanded its FP&A solutions by absorbing Casual, which was (and still is) a financial planning platform that focuses on forecasts, financial models, and business plans.

Key features:

- Automates many financial and accounting tasks

- Integrates with Stripe, a payment processing solution, to provide useful revenue metrics

- Integrates with common accounting systems like QuickBooks Online and Xero

- Creates side-by-side comparisons for budgeting and forecasting

- Pulls live data from accounting systems and data warehouses

Pros:

- Consolidation: Consolidates data from multiple entities

- Restricts user access: Allows for collaboration but shows sensitive data only to predefined users

- Audit trail: Creates an audit trail to prevent product misuse

- Integration: Works with many common technologies including spreadsheets, accounting and ERP systems, CRMs, data warehouses, and more

Cons: There may be some hiccups in the future as Casual FP&A software is fully absorbed into Lucanet.

Pricing: Users can try the software for free. Pricing varies depending on the features selected, number of entities to consolidate, and number of users. More information about pricing can be found here.

GTreasury/CashAnalytics

CashAnalytics is an all-in-one cash flow forecasting software and cash reporting platform. It helps treasury departments by replacing cash flow spreadsheets with software that connects directly with ERPs and banking apps to automate most of the cash reporting process. CashAnalytics was recently acquired by GTreasury, a global treasury solution for CFOs.

Key features:

- Seamless connectivity with banking apps

- Working capital analytics

- Customizable reports

- Scalable for growing businesses

- Forecasts cash needs

- Part of a large network of financial services through GTreasury

Pros:

- Simple set-up: Roll-out only takes a few days

- Intuitive: Users report the interface is easy to use

- Summaries: Summarizes cash accounts from multiple different banks all in one place

- AP and AR analytics: In-depth analysis of AR and AP data to help with collections and payables

Cons: As GTreasury onboards all CashAnalytics clients, there may be some disruption to services.

Pricing: GTreasury offers custom pricing options. Learn more by contacting GTreasury and the DataAnalytics team here.

Agicap

Agicap is a cash flow planning solution for small businesses and mid-market firms based in the UK. It offers cash flow forecasting, management, and analysis and automates a number of financial operations to improve cash flow management.

Key features:

- Offers visibility into cash with a treasury management solution

- Cash flow forecasting

- Expense management and reporting to control spending

- Automated payment processes

- Receivables collection and customer analytics

- Mobile application available on the App Store and Google Play

Pros:

- Connectivity: Connects to banks and ERPs to automatically pull data

- Payment planning: Suggests payment timing based on cash flow projections

- Automated matching: Automated invoice matching during the AP process

- Single platform: Reporting and data is shown on a single and easy-to-use platform

Cons: Users have reported that it can be difficult to edit a transaction or fix a mistake that has already occurred.

Pricing: Agicap pricing is only available upon request. Find more information here.

Workday

Workday is an enterprise-level all-in-one software to be used by members across the organization. Workday Adaptive Planning helps streamline enterprise performance management (EPM) tasks like financial, workforce, and operational planning using AI and machine learning.

Key features:

- Financial planning using AI-driven budgeting and scenario planning

- Workforce planning to support a business’s HR function

- Automates and streamlines month-end and year-end close tasks

Pros:

- Adaptive modeling: Users can model even complex scenarios as the business grows

- Easy to implement: Average deployment time is 4.5 months for even the largest companies

- Integration capabilities: Integrates with existing CRM, ERP, HCM, and other systems

- AI and machine learning: Its built-in AI, Illuminate, analyzes performance to track progress toward goals

Cons: Users report that there is a steep learning curve and takes lots of training to know how to use optimally.

Pricing: Free to try for 30 days, but full product pricing will vary based on the needs of the business. Learn more here.

Centage

Centage is a cloud-based software that is designed to support every task in the FP&A process. Financial teams and business owners can use Centage reports to make short-term decisions, to assess the long-term health of the company, and even to ensure GAAP compliance.

Key features:

- Collaborative and multidimensional budgets

- Helps build actionable financial plans using forecasting models

- Explores “what if” scenarios to help leaders make better decisions

- Consolidates financial reports across multiple entities

- Simplifies workflows for workers and leaders alike

Pros:

- Expert-level support: In-house advisors can help users setup and integrate the system and offer support even after deployment

- AI-powered support: An in-app AI assistant can help with simple tasks and offer insights for faster decision making

- GL integration: Pulls general ledger data from any ERP or GL on the market

- Reduces financial errors: Eliminates human error to create more accurate budgets and forecasts

Cons: Exporting data from the application to Excel can be clunky.

Pricing: Pricing is based on many factors, but is often less costly than other alternatives. To learn more about pricing, contact Centage for a demo.

Abacum

Abacum is an FP&A platform that boasts flexibility and ease of use for its users. It automates reporting, scales planning workflows, and models any scenario to help leaders make better decisions.

Key features:

- Automates month-end reporting

- Builds scalable, multi-dimensional budgeting models

- Scenario modeling with results in seconds

- Manages multiple scenarios simultaneously to aid in decision making

- Uses AI to summarize financial performance, create analyses, and take note of key trends

Pros:

- Faster forecasting: Shortens the planning cycle and increases the forecasting frequency

- Focuses on goals: Identifies the goals most important to an organization and lets AI suggest ways to reach those goals

- Intuitive modeling: AI completing the formulas the user wants to see

- Collaborative among team members: Budget owners can seamlessly roll their suggestions up to management to make final approvals

Cons: Abacum’s software is not Excel native, making it difficult for users who like the familiarity of Excel.

Pricing: Pricing options vary and can be on monthly or annual subscription basis. Learn more about Abacum’s pricing by contacting them for a product demo.

Tesorio

Tesorio is an AI-driven financial operations platform and AR collections software. It aggregates, structures, and analyzes primary source data from ERP systems and banking applications to provide actionable insights to its users, and to improve the efficiency of cash workflows.

Key features:

- AR automation to accelerate collections

- Payment portal so customers can pay invoices securely

- Consolidates bank data to better manage cash flow

- AP and AR forecasting to predict cash inflows and outflows

- Automatically matching invoices to payments and posting to ERP

Pros:

- Visibility: Connects your ERP to your CRM, billing software, and banking apps to provide real-time visibility to cash

- Leverages AI: Uses AI to analyze financial data in real time and offers actionable insights

- Automation: Automates labor-intensive bookkeeping tasks like collections, cash collection, and journal entries

- Benefits multiple users: Not just for finance leaders, but also benefits AR and AP teams, the controller, the CAO, and anyone else in the treasury department

Cons: Tesorio’s integrated inbox does not seem to function as well as other email systems, so many users don’t use that solution.

Pricing: Pricing for Tesorio varies, but users who want to learn more can contact a representative for a free demo of the product.

How to choose the best cash flow management software

When choosing between software, map what traits are most important to you. Rank what characteristics are most valuable to your business, and you’ll easily narrow down your choices. Some traits and capabilities to consider in your cash flow management software are:

Ease of use

Look at user reviews to see not only how easy the software is to use, but also how easy it is to implement. If a software has a steep or long learning curve, your employees may push back, preventing you from using it to its full potential.

User reviews are important, but you can also look at:

- User interface: If you don’t like the look of the program, you and your team won’t want to use it. Make sure that the software you choose is pleasing to look at and is easy to understand even at a first glance.

- Customer support: If you have a problem, you want a customer support team ready and available to troubleshoot your problems.

- Cloud-based capabilities: Not all software packages run in the cloud, and cloud-based software is so important in today’s environment. Cloud-based software allows for collaboration among system users, no matter where they’re located. It also typically lets more than one person work at the same time, preventing bottlenecks in workflows.

Cost

Software costs are important to think about, but don’t just compare the cost you see for the software on the website; you also need to consider cost savings generated.

Most likely, your goal when purchasing software is to save you time. That time savings is a measurable financial benefit. You may, for example, be able to hire fewer workers, pay less overtime, or let your current workforce do value-added tasks in lieu of the manual tasks now being performed by the software. Software can also save you money by preventing errors and mistakes. So when you consider the cost of software, also think about how that software will translate to additional cost savings.

Customization

Software packages may be sold as one size fits all, but that isn’t necessarily the case. Not all businesses have the same software needs. Some businesses need help in only one or two areas, and others want their software to take over more processes. A software package that can be customized to your unique needs is going to be the most cost effective and the simplest to implement.

Security

Your organization is only as secure as your third-party software. Even if your business’s internal controls are robust, your business will be at risk if your third-party software fails to protect your or your clients’ data. To figure out how secure they are, you can ask some of the following questions:

- How do you monitor suspicious behavior?

- What past cybersecurity incidents have you encountered, and how did you handle them?

- How frequently do you review controls?

- Do you have a Chief Information Security Officer (CISO)?

- What is your data breach escalation protocol?

- What tests do you run to check for data leaks?

You can also verify that the software you’re using is following compliance frameworks like ISO or NIST.

Automation capabilities

Automation is the way of the future, and most likely, you are looking for software so that you can automate at least some of your workflows and processes. When looking for cash flow management software, you’ll want it to automate some of the following tasks:

- Pulling new data from your accounting software (like purchases, AP and AR activity, and other transactions) into your cash flow management software

- Reconciling bank statements to cash balances shown on the books

- Generating reports for management’s review

- Notifying leaders and managers when cash is getting low

- Reminding customers when payments are due

- Bank transfers between accounts

- Accounts receivable process

- Accounts payable functions

Be sure that the software you select has the automation capabilities you’re looking for.

Integration capabilities

Implementing new software will be simple at first, but as you integrate more software into your workflow, you run the risk of piecemealing your operations. You want, instead, to find software programs that work together. If your software can speak to other programs you’re using, you’re much more likely to find it useful.

Cash flow management software should easily integrate with other systems, like:

- ERP

- CRM

- POS

- Payroll

- Financial management

- Accounting

- Banking

Manage your cash flow with Ramp

Ramp’s all-in-one financial operations platform can deliver on all these fronts. The software is easy to use, cost-effective, easily customized to fit your needs, secure, and provides both automation and integration capabilities.

Aee a demo of how our software can help with your cash flow management here. And when you’re ready to take the next step, consider Ramp’s corporate treasury management solution, Ramp Treasury1. With Ramp Treasury, you can store operating cash in a no-fee, FDIC-insured2 Ramp Business Bank Account that helps you earn on idle cash.

Legal disclosures:

1. Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

2. Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC. Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits