Introducing Ramp Treasury: Most banks hope you never see this.

- Maximize earnings without compromise

- Automation that follows your lead

- Keep your cash growing from payday to due day

- Get Started with Ramp Treasury in 60 seconds

If you are reading this, your business is probably earning nothing on your operating cash. Here’s why that matters: by lunch time today, Ramp could be paying your business an extra ~$25003 a year for every $100,000 you have. Instead, our data shows that 80%4 of operating deposits, held across 30,000+ sophisticated businesses, sit in cash accounts earning zero. Not some. Not a little. Zero.

Many banks make money by making their clients worse off – offering yield only if you lock up your cash with restrictions, minimums, transfer limits or brokerage sweeps with fees. So businesses face a rough trade: earn 0% to keep cash accessible to pay bills, or lock it away to earn returns. Incentives of both parties - banks and customers - are misaligned.

The result? A compromise. Either billions in lost earnings or hours spent manually shuffling money between accounts.

We’re changing that today. We’re delivering an industry-first product that makes customers better off.

Maximize earnings without compromise

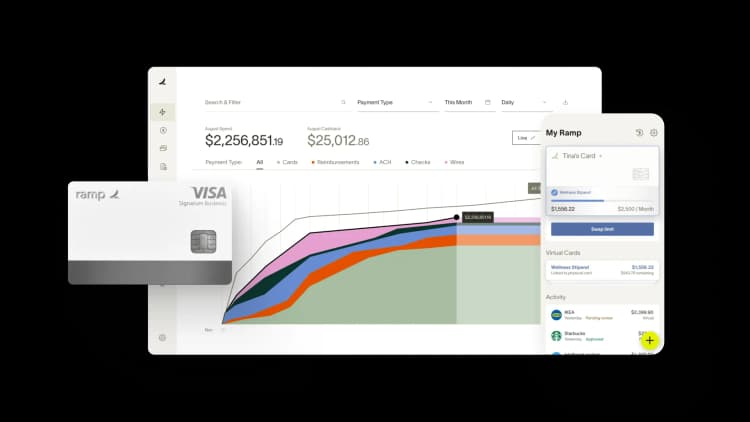

With Ramp Treasury, you can store operating cash in a free, FDIC-insured Ramp Business Account,5 where it earns 2.5%1 (that’s 35x more than the national average6). Invest excess cash in a money market fund via the Ramp Investment Account,7 with rates currently as high as 4.38%.2

No fees. No minimum deposits.2 No transfer limits. Your cash is always available when you need it.

Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC.

Securities products and brokerage services are provided by Apex Clearing Corporation, an SEC registered broker dealer, member FINRA and SIPC. The Investment Account is not a deposit account, not insured by FDIC, and may lose value.

Automation that follows your lead

Finance teams that want to take advantage of higher yield products traditionally spend hours each week manually shuffling cash between accounts to make sure they meet their business obligations. They log into slow, antiquated bank portals, pull AP aging reports from clunky AP tools, use Excel to model upcoming payments, derive precise cash flow needs and only then manually execute trades. This fragmented process eats up precious time that could be spent on more strategic initiatives.

We’ve woven cash management into your AP workflow, so every dollar you’re not spending is earning — automatically. By applying intelligence to operating funds, Ramp helps you be more productive with your time and capital:

- End the multi-tool shuffle: Manage all treasury and AP workflows in one place, not dozens of bank portals and payment systems

- Set custom approval gates: Create multi-step approval flows and let Ramp handle the rest

- Lock down access with precision: Only authorized team members can view and manage cash accounts—protecting your company's funds

- Money moves only when you say so: Money moves only when approved signers give the green light

- Earn on autopilot: Set your rules and let Ramp optimize your earnings while keeping your operating funds liquid

- Perfect books, automatically: Every transfer and every payment syncs to your ERP with the right coding against the right bill—no manual reconciliation needed

Keep your cash growing from payday to due day

Every day your money sits in limbo waiting to settle is a day of missed earnings — hidden costs that quietly chip away at your bottom line. Here’s how AP meeting Treasury on Ramp flips that script:

- Instant settlement: Free, same-day payments for all bills and instant card payments when paid from your Ramp account—no waiting periods

- Maximum earnings: Your money keeps earning interest until the second it needs to move

- Perfect timing: Pay vendors on time and exactly when their bills are due

The result? It's like getting three extra days of earnings on every payment, automatically. Your vendors get paid right on time, and your cash never stops earning.

Same-day transfers and payments keep your money available and growing until the day bills are due.

Get Started with Ramp Treasury in 60 seconds

Stop leaving money on the table. Switch to Ramp Treasury and start earning 35x6 more—without sacrificing instant access.

Ramp Treasury is now available for all customers. If you’re already on Ramp, you can open and fund a free business account in under a minute.

Legal disclosures:

1. Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

2. Before investing in a money market fund, carefully consider the fund's investment objectives, minimum investment requirements, risks, charges and expenses, as described in the applicable fund’s prospectus. You may obtain a copy of the fund prospectus here. Yield rate is the current effective annualized 7-day yield rate for the Invesco Premier U.S. Government Money Portfolio fund (FUGXX) as of [January 21, 2025], and is variable, fluctuates, and is only earned on cash invested into money market funds in the Ramp Investment Account. Past performance is not indicative of future results. Investing in securities products involves risk of loss, including loss of principal. This is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security, and no buy or sell recommendation should be implied. The Investment account is not a deposit product, not insured by the FDIC, and may lose value.

3. Earnings calculated based on an earn rate of 2.5% offered and paid by Ramp Business Corporation on the Ramp Business Account. This comparison is between a bank interest rate and the Ramp Business Account earn rate, paid in the form of cash rewards.

4. Based on a Ramp internal analysis conducted on 10/10/24, evaluating connected deposits and bank account data for all Ramp customers as of 9/10/24, and considered balances for the prior 90 days (6/12/24.)

5. Ramp Business Corporation is a financial technology company and is not a bank. Bank deposit services provided by First Internet Bank of Indiana, Member FDIC. Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

6. Earnings calculated based on the national average rate on interest checking accounts of .07% published by the FDIC as of 12/16/24, and an earn rate of 2.5% offered and paid by Ramp Business Corporation on the Ramp Business Account. This comparison is between the bank interest rate and the Ramp Business Account earn rate, paid in the form of cash rewards.

7. Securities products and brokerage services are provided by Apex Clearing Corporation. Apex Clearing Corporation is an SEC registered broker dealer, a member of FINRA and SIPC, and is licensed in 53 states and territories. FINRA BrokerCheck reports for Apex Clearing Corporation are available at: http://www.finra.org/brokercheck. The Investment account is not a deposit product, not insured by the FDIC, and may lose value.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits