When and how to file a currency transaction report

- When is a CTR required?

- What information is included in a CTR?

- How to file a CTR in banking

- What happens if a CTR is not filed properly?

- How accurate CTR filing protects your business from risk

- FAQ

A CTR must be submitted any time a customer makes one or more related cash transactions totaling over $10,000 in a single business day. The rule applies to all businesses that handle cash, including casinos, money service businesses, and other financial institutions.

A CTR is a legal requirement to prevent money laundering and other financial crimes. Missing or filing a report incorrectly can lead to audits, fines, and reputational risk.

Currency Transaction Report

A currency transaction report (CTR) is a compliance document that financial institutions must file when a customer conducts cashtransactions over $10,000 in a single business day. This applies whether the customer deposits, cash withdrawals, exchanges, or pays with physical currency, including coins and paper bills.

The CTR rule is part of the Bank Secrecy Act (BSA), a federal law designed to help detect and prevent financial crimes like money laundering and tax evasion. The CTR must be submitted to the Financial Crimes Enforcement Network (FinCEN), which collects and analyzes financial data to spot illegal activity.

Filing a CTR is not optional. If your business falls under the definition of a financial institution, you’re legally required to file when the conditions are met. This includes banks, credit unions, money service businesses, and casinos with over $1 million in annual revenue.

Each CTR includes specific details about the transaction: who initiated it, how much was involved, and how the cash was handled. FinCEN uses that data to identify suspicious trends or attempts to avoid detection.

Over 20.8 million CTRs were filed in 2023 alone. That number reflects how frequently high-cash transactions occur and how critical CTRs are to financial monitoring in the U.S.

When is a CTR required?

A currency transaction report (CTR) is required when a customer conducts over $10,000 in cash transactions in a single business day. The $10,000 threshold isn’t based on a single type of transaction. It includes deposits, withdrawals, exchange of currency, loan payments, or any other activity involving physical U.S. currency.

The rule applies whether the customer is an individual or a business. If someone conducts a transaction on behalf of another person or company, that also qualifies. Even if multiple employees at your institution handle different parts of the activity, the institution as a whole is still responsible for identifying the total and filing the report.

How CTR rules apply to cash deposits, withdrawals, and exchanges

The $10,000 threshold applies to cash transactions where physical currency changes hands. This includes any time a customer deposits cash into an account, withdraws cash from a teller or ATM, or exchanges one currency for another. The rule also applies to purchases made in cash, such as buying a cashier’s check or repaying a loan with physical money.

Transactions must involve U.S. coins or paper bills. Checks, wire transfers, ACH payments, and other non-cash methods do not trigger a CTR, even if the total exceeds $10,000.

Your responsibility as the financial institution is to identify when these thresholds are met. Even if the customer doesn't ask for a receipt or acknowledge the amount, you must still report it.

Aggregated transactions

CTR rules do not just apply to single large transactions. If a customer makes several smaller cash transactions in one business day that add up to more than $10,000, those must be aggregated and treated as a single reportable event.

Aggregation prevents structuring, which is a tactic used to avoid detection by breaking up large transactions into smaller, less noticeable amounts. For instance, if a customer deposits $6,000 in the morning and another $5,000 in the afternoon, you must file a CTR, even if the transactions occurred at different branches. The same applies to withdrawals, currency exchanges, or loan payments.

Financial institutions must set up systems to detect these patterns. Aggregation applies when you know, suspect, or have reason to believe that multiple transactions are part of a single business day’s activity by the same person or entity.

It also applies across different accounts if the same customer is involved. Those must be combined if someone makes several deposits to different accounts under their name or under accounts they control.

What information is included in a CTR?

A currency transaction report (CTR) captures a detailed snapshot of a cash transaction. Every field is required for regulatory reporting under the Bank Secrecy Act and is used by FinCEN to detect financial crime patterns. When you file a CTR, you're expected to include the full scope of information related to the transaction.

- Information about the individual conducting the transaction. You must collect the person’s full legal name, residential address, date of birth, and occupation or type of business. This identifies who physically handled the cash. You also need a government-issued ID, such as a driver’s license or passport, along with the ID number and the issuing authority.

- Details about any business or entity involved. If the transaction is made on behalf of a company or organization, you need to record the entity’s full legal name. You must also explain the individual's relationship to that entity, such as employee, owner, or agent, and describe the nature of the business.

- Clear description of the transaction itself. The report must state the total amount of cash involved and indicate whether it was a deposit, withdrawal, currency exchange, or payment. If the transaction involves multiple types (like a deposit and an exchange), each must be listed separately. You must also specify whether your institution received or disbursed the funds.

- Account numbers tied to the transaction. The account numbers must be included if any accounts were credited or debited. If the person conducting the transaction isn’t a customer and does not use an account, the report must reflect that as well.

- Information about your financial institution. This includes the name and location of the branch where the transaction occurred, internal identifiers for that location, and the names or employee IDs of staff who processed the activity. Each branch or employee must be listed if more than one branch or employee was involved.

- Method of transaction delivery. You need to document whether the transaction was completed in person, through the mail, or by someone acting as an intermediary. This helps clarify how the funds entered or exited the institution.

- Date and time of the transaction. The exact date the transaction occurred must be recorded. In some cases, the time may be required to support review or investigation.

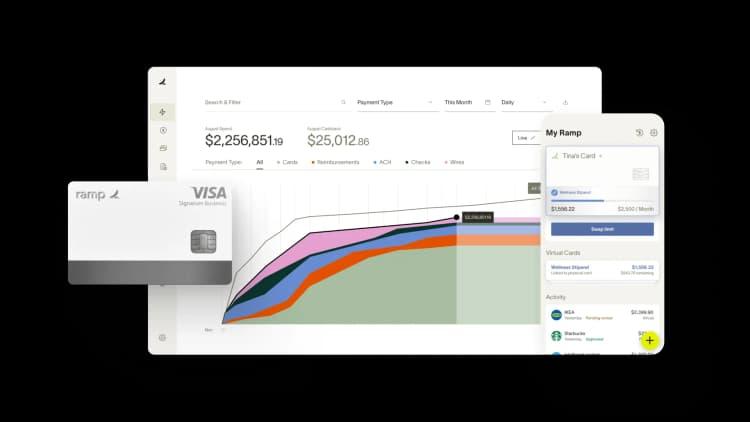

Filing accurate CTRs starts with accurate transaction data. Ramp Treasury integrates directly with your ERP to help you capture and sync every cash movement across your accounts. Transactions are tracked in real-time, reducing manual work and helping you ensure every required detail is ready when you need it.

How to file a CTR in banking

Filing a currency transaction report (CTR) usually falls to your compliance team, operations staff, or a designated BSA officer. The process must follow strict rules. All CTRs are filed electronically through FinCEN’s BSA E-Filing System. Paper submissions are no longer accepted. The report must be submitted within 15 calendar days of the transaction date.

- Step 1: Collect transaction details. Start by gathering the full picture of the transaction. Record the total amount of cash involved, the date and time, and the type of transaction, such as a deposit, withdrawal, or currency exchange. Note whether the funds were received or disbursed. If the transaction is tied to an account, document the account number. If not, make sure that’s clearly indicated.

- Step 2: Verify customer and entity information. Confirm the identity of the person conducting the transaction. You will need their full legal name, residential address, date of birth, and a valid form of government-issued ID. If the person is acting for a business, collect the entity’s legal name and business type and clarify the individual’s role.

- Step 3: Log in to FinCEN’s BSA E-Filing System. Use the BSA E-Filing portal to access FinCEN Form 112, the official CTR form. Register for an account and assign the appropriate roles if your team doesn't have access yet. The system supports manual entry and batch uploads for institutions filing at scale.

- Step 4: Complete FinCEN Form 112. Enter all required data directly into the online form. This includes personal identifiers, transaction details, and information about your institution and the staff involved. The structure of the form mirrors the information you have gathered in the earlier steps. Be sure every field is complete and consistent with your internal records.

- Step 5: Review for accuracy. Before you submit, double-check the entire form. Confirm that names, amounts, account numbers, and IDs match your source documents. Inaccurate or incomplete filings can result in fines or trigger audits. Use a second set of eyes if needed as part of your internal review process.

- Step 6: Submit and retain confirmation. Once verified, submit the CTR electronically. The system will generate a confirmation receipt and timestamp. You should save both as part of your compliance records. Retain a copy of the filed report and supporting documentation for at least five years, as the Bank Secrecy Act requires.

What happens if a CTR is not filed properly?

If you don’t file a currency transaction report (CTR) correctly, your institution is exposed to fines, audits, and possible enforcement actions. Late filings, missing information, or incorrect data can all count as violations. FinCEN tracks every submission and compares it against your institution’s activity patterns. That gap can trigger an inquiry if something does not match, like a flagged transaction with no corresponding CTR.

You can face civil penalties even if the mistake was unintentional. Failure to file or properly complete a CTR can result in a fine of up to $5,000 per violation. If regulators determine the violation was willful, penalties can escalate along with potential criminal charges.

Regulatory agencies will not just look at one missed report. They will review your entire process, including how you identify reportable transactions, how your team reviews data, and how you manage deadlines. If they find that your internal controls are weak or inconsistent, that’s a separate compliance failure.

You are also required to retain records. If you can’t produce a filed CTR during an audit, that’s treated the same as if you never submitted it.

How accurate CTR filing protects your business from risk

Filing a currency transaction report is a legal obligation that protects your business from regulatory exposure. When cash transactions cross the $10,000 threshold, you are required to file a complete and accurate CTR within 15 calendar days. Missed deadlines, incomplete forms, or inconsistent reporting can trigger civil penalties, enforcement actions, and reputational harm.

A strong CTR process reduces audit risk, keeps your institution aligned with federal regulations, and shows regulators that your internal controls are working. By building accuracy into your workflow, you protect your business from fines and from being flagged as a compliance risk.

Ramp Treasury gives you control over your cash position, helping you monitor large transactions as they happen. By automating cash tracking and syncing earnings and transfers to your ERP, Ramp strengthens your compliance posture and helps you file CTRs accurately and on time.

FAQ

Do I need to file a CTR for international cash transactions?

If a customer conducts a qualifying cash transaction within the U.S., even if the funds are intended for international use, you must file a CTR. The report is triggered by the physical movement of cash, not its destination.

Can a single transaction require both a CTR and a SAR?

You may need to file both reports if a transaction involves more than $10,000 in cash and appears suspicious. Each serves a different purpose and must be submitted separately.

Are cashier’s checks and money orders subject to CTR reporting?

Only if they are purchased with cash. The transaction must be reported via a CTR if a customer uses more than $10,000 in cash to buy a financial instrument like a cashier’s check or money order.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits