How to build an available funds report

- What is an available funds report?

- Components of an available funds report

- How to build an available funds report

- Take control of your cash flow with Ramp

You probably don't leap out of bed excited about financial reporting such as accounts payable reporting. But learning how to build an available funds report? That's something that deserves your attention.

These reports cut through the financial haze, delivering crystal-clear insight into your company's liquid assets and cash position at any moment. This clarity translates to power—the power to make confident decisions about operations, investments, and your financial future.

Here’s how you build an available funds report and overcome common challenges in the process.

What is an available funds report?

An available funds report calculates and presents the difference between what your organization is authorized to spend and what you've already spent or committed to spend. Think of it as your financial GPS, showing you exactly how much money you can access right now for ATM withdrawals, debit card purchases, check writing, transfers, and bill payments.

Available funds aren't the same as your current balance. While your current balance often includes pending transactions that haven't cleared, available funds represent only the money you can access right now.

These reports aren't just paperwork—they're decision-making tools. They provide crucial data for both short-term and long-term planning, helping you allocate resources and set spending priorities. They're your first line of defense against overdrafts and cash shortages.

With these reports, you can track spending against budgets and quickly spot areas where you're spending too much or too little. They give you the real-time visibility needed to make nimble decisions and direct resources where they'll have the most impact. Regular reporting also reveals spending patterns that can improve the accuracy of your financial forecasts.

Why an available funds report is important for small businesses

For small businesses, these reports are vital. These reports provide the financial clarity you need to make intelligent decisions about spending, investments, and commitments, helping you to enhance cash flow.

Without this visibility, you risk overextending your finances or missing opportunities because you mistakenly thought cash was tight when it wasn't.

They're also powerful instruments for budget control. Regular review helps you track spending against budgets and address issues before they escalate into emergencies. This level of oversight is crucial when operating with narrow margins and limited cash reserves.

Perhaps most significantly, these reports strengthen your decision-making capability. The real-time insight they provide helps you confidently evaluate whether you can take on new projects, make investments, or navigate unexpected challenges. That information is essential for maintaining stability while planning for growth in today's competitive landscape.

Components of an available funds report

An available funds report gives you a multi-dimensional view of your organization's financial liquidity. Understanding each component helps you navigate cash flow management and financial planning with confidence, and emphasizes the importance of financial reporting.

Cash on hand

Cash on hand is money you can use right now—the most liquid assets your organization has. This includes physical currency, balances in checking and savings accounts, and investments you can convert to cash within 90 days (like money market accounts or short-term government securities).

Most organizations try to keep enough cash on hand to cover 3-6 months of operating expenses. Maintaining sufficient free cash flow gives you financial stability, letting you handle surprises or seize opportunities without disrupting normal operations or borrowing in a panic.

Accounts receivable

While cash on hand is what you have now, accounts receivable shows what's coming soon. This is money owed to your organization for goods or services you've already provided but haven't been paid for yet.

A good accounts receivable section breaks down aging (typically as 0-30 days, 31-60 days, 61-90 days, and 90+ days overdue). This aging report helps you gauge both when cash will likely flow in and how likely collection becomes as invoices age.

Line of credit availability

Beyond what you have and what you're owed, there's what you can borrow. This section shows borrowed funds your organization can access as needed, up to the limit set by your lender.

Your line of credit availability is your total credit limit minus any outstanding balance. While this isn't actual cash but potential cash, it's an important safety net for managing cash flow gaps or unexpected expenses. Unlike your other assets, using a line of credit creates a liability with interest costs attached.

Projected income

Complementing your current liquidity options, projected income looks forward to future cash inflows. This component estimates expected money coming in from sales revenue, scheduled contract payments, investment returns, and planned asset sales.

Since projected income involves uncertainty, it's often presented with varying confidence levels or multiple scenarios (best case, likely case, worst case). When reviewing this section, examine the assumptions behind the projections and consider how changing business conditions might affect these figures.

Good projections are conservative and based on reliable historical data and current business indicators.

How to build an available funds report

Building an effective available funds report crafts a financial compass for your organization. Let's break this down into manageable steps.

1. Gather financial data

The foundation of any valuable report is robust data. You'll need to collect comprehensive financial information from across your organization: current account balances for all cash and investment accounts, accounts receivable aging reports, accounts payable records, budget data, historical cash flow statements, and details of any loan agreements or credit lines. Your report will only be as insightful as the data you incorporate.

Establish a standardized process for collecting this information. By engaging with all relevant departments and ensuring you organize business receipts, you'll gather the most current data possible, creating a reliable foundation for analysis.

2. Calculate current available funds

With your data in hand, calculate current available funds by adding all cash and cash equivalent balances, including any immediately available credit lines, and subtracting restricted funds or reserves that can't be accessed. Adjust for outstanding checks or deposits in transit to get an accurate picture of what's truly available right now.

This calculation gives you a clear snapshot of your current financial position. Document all assumptions made during this process to maintain transparency and allow for adjustments if conditions change. This current position becomes the starting point for future projections.

3. Project future cash flow

Forecast expected cash inflows from sales, receivables, and investments while estimating upcoming outflows for expenses, payroll, and debt payments through cash flow forecasting. A thorough cash flow analysis will account for planned financing activities and major expenditures, often creating multiple scenarios to prepare for various outcomes.

You can use either direct methods (tracking individual transactions) or indirect methods (starting with net income and adjusting for non-cash items) for these projections, depending on your specific needs and data granularity. These projections form the core of your available funds report, revealing not just where you stand, but where you're headed.

4. Create the report

Finally, compile your data and analysis into a clear, actionable report. Include a summary of current available funds, projected cash flow statements showing inflows and outflows, graphical representations of cash trends, scenario analyses showing potential cash positions, and explanations of key assumptions and risks.

Tailor the report to its audience, whether that's executive leadership, board members, or department managers. Using thoughtful data visualization and clear explanations makes the information accessible and actionable. A well-designed report doesn't just present numbers—it tells the story of your organization's financial trajectory in a way that drives informed decisions.

Take control of your cash flow with Ramp

By consistently monitoring essential cash flow metrics, you gain deeper insights into your financial operations, optimize liquidity, and make informed decisions to support growth and stability.

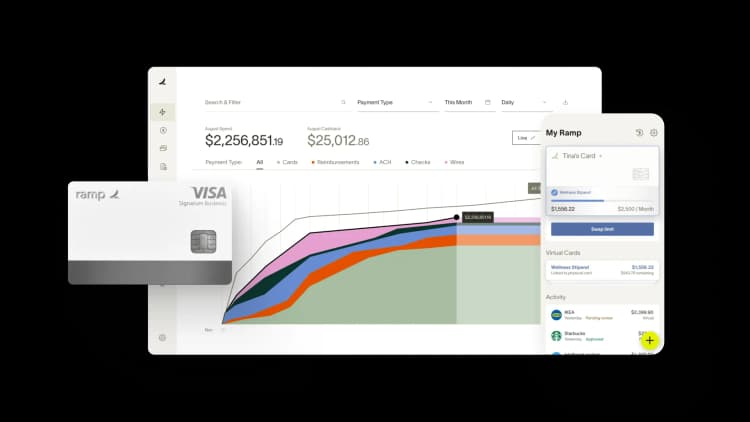

At Ramp, we've seen how businesses transform when they gain clarity on their cash flow metrics. You can eliminate the manual tracking of these metrics by automatically organizing your expense data and syncing with your accounting software. Ramp Intelligence flags out-of-policy spending and identifies optimization opportunities that directly impact metrics like operating cash flow and burn rate.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits