- Retailers on track to exceed 2023 ad spend

- Brands grow Amazon, TikTok, and other social ad spend

- Beyond advertising: strategic investments in AI

- Explore more spending trends

This week, we’re highlighting the most interesting trends from our newly released Fall 2024 Spending Report. See our stories on the latest AI software that companies are buying and business travel spending trends.

Retailers are competing for $1.59 trillion in holiday retail sales this year, according to Deloitte—an increase of up to 3.3% over last year thanks to rising disposable income and declining unemployment.

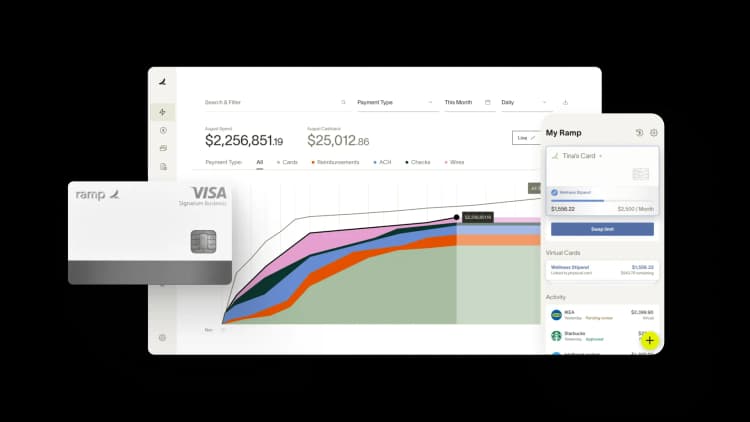

How are they positioning themselves to come out on top? Ramp’s spending data for thousands of B2C businesses show retailers experimenting with new tactics—from leaning into non-traditional channels to testing new AI software—as they ramp up for Black Friday and Cyber Monday.

Retailers on track to exceed 2023 ad spend

If year-to-date card expenses are any indication, companies will spend more on their end-of-year advertising on platforms like Amazon Ads and Facebook Ads than they did in 2023. In Q3, B2C businesses spent an average of $121k on advertising, compared to $110k during the same time last year, representing a growth of 9%.

However, we see a notable slide in retailer ad spending as the 2024 presidential election nears and consumer attention shifts to campaign ads.

2023 vs. 2024 B2C spending on advertising channels

Brands grow Amazon, TikTok, and other social ad spend

Major platforms like Facebook, Google, TikTok, Microsoft, and Amazon remain dominant in ad budgets, but changes in how consumers discover products are influencing exactly how those dollars are spent.

Top 5 ad channels for retail companies

- Amazon ad spend soars: Average spending on Amazon Ads grew 192% year over year, propelling the retail giant into the #1 spot by mean card spend. Retailers are following in the footsteps of consumers, as research shows more people starting their buying journey on the e-commerce platform.

- TikTok is trending: With a 135% year-over-year increase in mean ad spend on the platform, retailers appear eager to tap into TikTok’s highly-engaged user base and younger consumers.

- Fewer Google searches: Google’s recent payment policy changes may be accelerating retailers’ declining card spend on the platform. Businesses are shifting from traditional search ads as buyers gravitate towards AI and social media for product recommendations.

More surprising is the growth of X ads among retailers. Despite persistent headlines about advertisers exiting the platform, our data show that, by customer count, it’s the fastest-growing platform this year. The number of retailers spending on the platform grew 58% year over year and spending soared even more. Retailers are also betting on Reddit: its advertiser count grew 29% year over year and average spending on the forum 3xed. While spending on these platforms pales in comparison to spending on the top 5, their rise underscores the impact of social media advertising for media, where brands can engage passionate, niche audiences.

Beyond advertising: strategic investments in AI

Retailers are also making strategic AI investments to speed up ad creation, enhance customer interactions, and create new digital experiences.

Anthropic saw an incredible 914% increase in retail customer count this past year. That growth comes on the heels of its Claude 3 launch, suggesting companies are putting new AI models to the test for everything from predicting consumer demand to enhancing product pages with customer reviews, and auto-generating product descriptions.

They are experimenting with new design tools that help accelerate ad creation. Year-over-year customer count jumped for video generation tool (and Tiktok subsidiary) Capcut (380%), music-for-ads service Artlist (114%), and ad workflow solution Foreplay (100%).

Unity’s impressive 304% growth in mean card spend indicates B2C businesses may be exploring virtual experiences, such as 3D showrooms and fitting rooms, as a means of differentiation.

Customer support investments round out the list. Chatbot platform ManyChat saw a 69% increase in customer count and phone support tool OpenPhone saw average spending grow 71%. These purchases underscore how retailers are improving their ability to interact with customers at scale and at a low cost.

Explore more spending trends

Our newly released Fall Spending Report contains even more insights on how businesses are transforming their operations with cutting-edge software. Grab your copy today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits