Finance roundtable: How business spending has changed with inflation

- Growth spend is gradually recovering from the impacts of inflation

- Managing travel spend effectively is more important than ever

- Strong appetite remains for generative AI and SaaS procurement

- The role of the CFO is becoming more strategic

Over the past two years, many businesses have been cutting back on spending wherever possible in light of rising inflation and interest rates. However, as the 2024 fiscal year unfolds, we are starting to see indicators of a return to growth, albeit one marked by careful decision-making and adoption of new tools, including generative AI.

Our Head of Data Science Ian Macomber recently joined Perk's CFO Roy Hefer, Zendesk’s VP of Finance and Strategy, Steve Taylor on Nasdaq TradeTalks to unpack these trends and discuss how businesses can continue to manage costs without sacrificing opportunities for growth. You can watch their discussion here:

Here are some key takeaways from the conversation.

Growth spend is gradually recovering from the impacts of inflation

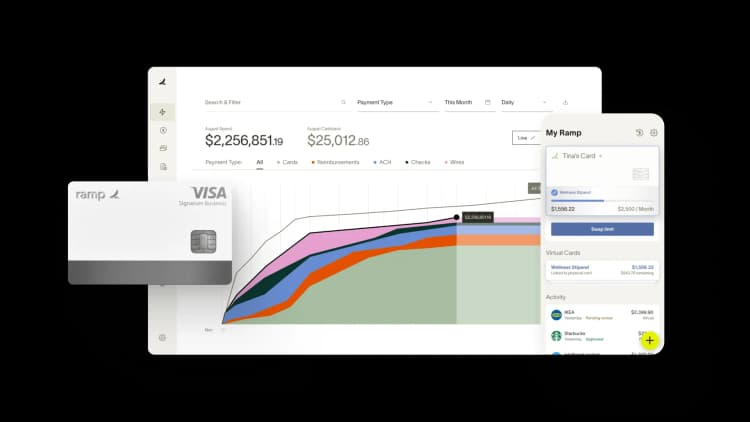

Drawing from Ramp’s deep visibility into corporate card spend and accounts payable, Ian pointed out that marketing and advertising budgets appear to be back on the rise following a significant pull-back, in which ad spend had fallen all the way from 30% to 15% in response to rising interest rates.

“Of all the spend habits that people have on Ramp, marketing dollars are usually the first thing to go when you see the interest rates spike,” he said. “And we’re just starting to see that come back now.”

This has also been uniquely apparent to Zendesk’s Steve Taylor. The company has seen improvements to the buying environment as its customers look to reinvest in growth. However, he also noted that finance leaders are being more cautious with their review and approval processes to ensure employee spending is as impactful as possible.

"The buying environment became a lot more measured in 2022. But what we've been seeing over the last six to nine months is there's definitely been a pick-up. There’s a definitely a lot of appetite right now," says Steve, "But there’s also a few more gates of reviews, approvals, and overall consideration.”

Managing travel spend effectively is more important than ever

According to Roy Hefer, who has virtually unparalleled insight into business travel trends as the CFO of Perk, there’s no question that business travel is making a serious comeback from the lows of the past few years. However, Roy also pointed out the myriad ways in which travel has shifted due to the impacts of COVID-19, widespread inflation, and even an influx of weather related disruptions.

More specifically, the normalization of remote and hybrid work has increased the need for employees to travel for in-person meetings and to build company culture, which has led to companies shifting real estate costs into travel spend. But at the same time, finance leaders must also factor in higher costs due to a near 20% rise in average booking value over the past two years, in addition to a 30% year-over-year increase in the adoption of tickets with flexible cancellation or change policies.

“Essentially, travel is becoming more frequent, more expensive, and more unpredictable, and it’s more important to get right because of the rising cost of capital,” Roy noted. “So people are paying much more attention to how they’re managing their business travel due to the impact on both P&L and the employee experience.”

Strong appetite remains for generative AI and SaaS procurement

It would be impossible to have a conversation around business spending trends without covering the rapidly growing demand for advanced SaaS solutions, particularly those whose capabilities have recently been bolstered by the integration of generative AI.

Whereas AI was primarily considered a buzzword as recently as two years ago, finance leaders are now seeing the actual benefits behind the hype. For example, Ian shared his excitement around the use of data alongside large language models (LLMs) to improve procurement, making it easier for businesses managing an increasing number of SaaS tools to compare prices, review contract terms, and make overall smarter decisions.

“By arming customers with lots of data points on contracts, as well as LLMs to understand the important parts like specific terms and platform fees, I think we are going to see much smarter decisions being made around procurement in the years to come.”

Additionally, Roy shared his own experiences utilizing AI-powered solutions at Perk, more specifically toward enhancing internal workforce productivity to the benefit of customers.

“We actually managed to nearly double our gross profits last year by leveraging AI and technology, enhancing the productivity of our workforce while continuing to improve the customer experience,” he said. “It’s really essential in order to improve the output of your business.”

The role of the CFO is becoming more strategic

Finally, all panelists agree that easier access to real-time data and emerging SaaS tools over the years has gradually reshaped the role of the CFO within an organization. CFOs are now expected to help the entire business work more strategically, not just finance.

For example, rather than setting aside a set travel budget every quarter for employees, Ian pointed out that CFOs can now use SaaS tools to get more context on why employees are traveling and advise on the ROI of different activities. Instead of simply allocating travel dollars, CFOs should find ways to influence business decisions and guide employees to get more out of their budget.

Steve noted that at Zendesk, their procurement and finance teams have gotten more involved in customer-facing processes to help their sales team articulate the value of the customer support platform. "I still think it's a healthy buying environment," Steve said, "But there is a greater opportunity for the CFO to help bridge with the customer facing teams to demonstrate value. I'm seeing a lot more of that as time passes.

Similarly, Roy reflected on the fact that the CFO role has become considerably more strategic and forward-looking than in previous decades. Instead of being mostly focused on accounting, Roy believes that CFOs are increasingly expected to understand and ensure what everyone needs to do and deliver in order for the company to reach its goals. “I see the role today as much more of a business performance officer than a pure finance officer,” he said, “And by the way, I love it, and would probably not have taken the role of CFO 20 years ago.”

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits