How I built it: Ramp's 'Coffee with a Colleague' spend program

It turns out that a Grande Iced Caramel Macchiato with oat milk, extra caramel drizzle, two pumps vanilla, one pump hazelnut, light ice, double-blended, topped with sweet cream, cold foam, and a sprinkle of cinnamon costs… a lot.

Thanks to this venti-sized inflation, we recently set up a $10 “Coffee with a Colleague” spend program. The idea is simple: give every employee a budget to grab a coffee or a small snack with another Rampling.

But this isn’t just about caffeine. We give new hires at Ramp a challenge: try to break Ramp. Push the limits, test different flows, and report anything that seems off. The best way to improve the product is to use it exactly as our customers might.

These moments allow us to actively use our own product to uncover bugs, test new features, and improve the experience for cardholders and admins.

How the spend program works

1. Set an amount and frequency

Each employee gets $10 per week, and the balance automatically resets every Sunday.

2. Decide how funds are issued

Funds are auto-issued to every employee and appear instantly upon onboarding, so new hires can start using Ramp right away.

3. Set restrictions

The fund isn’t shareable, but otherwise, there are no restrictions. Employees can use their Ramp card in person, order ahead with a virtual card, or reimburse themselves for out-of-pocket purchases.

4. Set accounting rules

Every transaction is automatically booked to the “company meals” general ledger account in NetSuite. Since we’ve already mapped these transactions to the appropriate accounting category, we mark them “ready to sync” to the GL. This helps us close the books faster.

5. Enable auto-approval and post-purchase requirements

After the purchase, employees submit receipts and memos. The system auto-approves card transactions, and reimbursements go to managers for approval. If someone loses a receipt, employees can submit a missing receipt affidavit.

Spend programs that scale

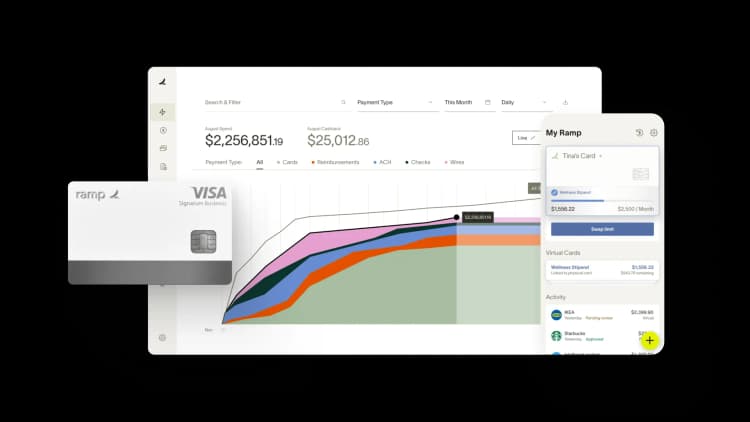

Ramp’s Spend Programs feature is one of the most versatile features in our product. It makes it easy to issue and manage company money at scale, whether for coffee, wellness, remote work, travel, or company events.

We use Ramp every day—not just to manage spend, but to strengthen the product from the inside out.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°