Guide to international per diem rates for corporate travel

- What are international per diem rates?

- Per diem vs. actual expense reimbursement

- How international per diem rates are determined

- 2026 international per diem rates by region

- IRS per diem rates and tax implications

- How to calculate international per diem for your trip

- Managing international per diem best practices

- International per diem: Common mistakes

- How Ramp simplifies international per diem compliance and expense reporting

International per diem rates are daily allowances businesses use to reimburse employees for lodging, meals, and incidental expenses when traveling abroad. They help you budget accurately, stay compliant with government rules, and simplify expense reporting across countries with very different cost structures.

Managing international travel expenses isn’t simple. Different destinations, fluctuating currencies, IRS requirements, and multiple rate sources can complicate reimbursements, but understanding how per diem works makes those challenges easier to manage.

What are international per diem rates?

International per diem rates are flat daily allowances businesses use to reimburse employees for lodging, meals, and incidental expenses during overseas travel. Instead of tracking every receipt, per diem provides a fixed amount based on the destination, making reimbursements more predictable and easier to manage.

Domestic per diem rates, such as those set by the U.S. General Services Administration (GSA), differ from international rates. The U.S. State Department sets foreign per diem allowances, which are typically higher to reflect differences in cost of living, lodging prices, and local expenses outside the U.S.

International per diem key components

Before reviewing specific rates, it helps to understand what international per diem typically covers. Most per diem allowances include:

- Meals: Daily meal costs for breakfast, lunch, and dinner, set by location and paid as a fixed amount

- Lodging rates: A maximum reimbursable nightly rate for hotels or other accommodations

- Incidentals: Small out-of-pocket expenses such as meal tips, hotel porter services, or laundry during longer stays

Each component has a maximum allowance, and receipts usually aren’t required as long as spending stays within the published limits.

Per diem vs. actual expense reimbursement

Per diem and actual expense reimbursement both cover business travel costs, but they operate very differently in practice. Per diem reimburses employees a fixed daily amount based on location, while actual expense reimbursement pays employees back for the exact costs they incur and document.

The right approach depends on how much predictability, flexibility, and administrative overhead your organization is willing to manage. Per diem typically works best when you want consistency and faster reimbursements, while actual expense reimbursement offers tighter control over individual spending categories.

| Method | How it works | Best for |

|---|---|---|

| Per diem | Fixed daily allowance based on destination | Standardized reimbursement with minimal receipt tracking |

| Actual expense | Reimbursement of documented costs with receipts | Situations where costs vary widely or require close oversight |

International per diem pros and cons

Per diem can streamline international travel reimbursements, but it comes with tradeoffs around spend visibility.

Pros of per diem:

- Simpler administration by reducing receipt collection and review

- More predictable budgeting across destinations and trips

Cons of per diem:

- Less precise cost tracking for meals and incidental expenses, which can limit detailed cost analysis

- Risk of over- or under-reimbursement if local prices differ from the allowance

Actual reimbursement pros and cons

Actual expense reimbursement provides greater accuracy but increases operational effort.

Pros of actual reimbursement:

- More accurate reflection of what employees actually spend

- Detailed spend visibility through receipts, which supports audits and vendor negotiations

Cons of actual reimbursement:

- Higher administrative burden due to receipt collection, review, and approval

- Slower reimbursement timelines that can frustrate travelers

How international per diem rates are determined

International per diem rates are set by the U.S. Department of State’s Office of Allowances. The agency surveys lodging and meals and incidental expenses (M&IE) across countries and cities to establish maximum daily allowances, which are published in U.S. dollars and updated monthly.

Rates vary widely by location and are designed to reflect the typical cost of business travel in each destination. Because prices change frequently, businesses should always rely on the most current rates rather than annual averages or historical figures.

Key factors affecting per diem rates

International per diem rates are not arbitrary. They are adjusted to reflect real-world travel costs and conditions that influence how expensive it is to stay and eat in a given location.

Several factors influence how rates are set and updated:

- Location and city tier classifications, with major metropolitan areas typically carrying higher allowances

- Seasonal variations that affect hotel availability and pricing

- Currency exchange considerations that influence local purchasing power

- Special circumstances such as major conferences or international events that temporarily raise costs

2026 international per diem rates by region

International per diem rates for 2026 vary widely depending on the country and city. Major business hubs typically have higher daily allowances than smaller cities or secondary markets, and rates can change month to month based on local costs.

The examples below highlight how per diem rates differ across regions. These figures are illustrative and reflect combined lodging and meals and incidental expenses (M&IE). Always verify current rates using the State Department’s official tables before applying them to reimbursements.

Europe

| City | Estimated daily per diem |

|---|---|

| London | ~$598 |

| Paris | ~$684 |

| Zurich | ~$675 |

Asia-Pacific

| City | Estimated daily per diem |

|---|---|

| Tokyo | ~$483 |

| Hong Kong | ~$535 |

| Beijing | ~$385 |

| Singapore | ~$464 |

North and South America

| City | Estimated daily per diem |

|---|---|

| Toronto | ~$466 |

| Rio de Janeiro | ~$372 |

| Buenos Aires | ~$392 |

IRS per diem rates and tax implications

For U.S. tax purposes, IRS per diem rules determine whether international travel reimbursements are treated as tax-free business expenses or taxable income. In practice, this depends on whether your company uses an accountable plan and whether per diem payments stay within federal limits.

Under an accountable plan, employees must substantiate their travel and return any per diem paid above the allowable rate. When those requirements are met, per diem reimbursements are generally excluded from taxable wages.

Substantiating travel requires employees to document:

- Time of travel

- Place of travel

- Business purpose of travel

Receipts are not required for per diem amounts at or below federal limits, but documentation supporting when and why the travel occurred is still mandatory.

Does the IRS set per diem rates for domestic business travel?

Yes. The IRS allows employers to use high-low per diem methods for domestic travel, applying one rate to high-cost locations and another to all other areas. This simplified approach reduces complexity while still meeting compliance standards.

Tax-free per diem requirements

To keep international per diem reimbursements tax-free, your policy must meet IRS criteria and align with IRS receipt requirements:

- Travel must be business related

- Expenses must be substantiated

- Any amount above government rates must be returned

If these conditions are not met, per diem payments may be treated as taxable income.

Reporting and compliance

Employers carry most of the reporting responsibility for per diem compliance. You must ensure reimbursements align with published federal rates and that employees provide sufficient documentation to substantiate travel dates, locations, and business purpose.

If an employee receives more than the allowable per diem and does not return the excess, the excess amount becomes taxable income. In those cases, employers must include the excess on the employee’s W-2 and withhold applicable payroll taxes.

Employees generally do not file Form 2106 for unreimbursed expenses under an accountable plan. Proper policy design eliminates unnecessary tax reporting and keeps reimbursements compliant.

How to calculate international per diem for your trip

Calculating international per diem requires applying location-based rates to each day of travel, including special rules for travel days. Following a consistent process helps ensure accurate reimbursements and compliance with IRS guidelines.

Use this general approach:

- Look up lodging and meals and incidental expenses (M&IE) rates for each destination using the State Department’s database

- Determine which days qualify as full travel days and which qualify as travel days

- Apply full lodging and M&IE rates to full days and prorate M&IE for travel days as needed

- Account for currency differences when employees spend in local currency

Repeat this process for each city if the trip includes multiple destinations.

Assume a five-day business trip to London with the following rates: lodging is $424 per night and M&IE is $174 per day:

Full travel days (3 days):

Lodging ($424) + M&IE ($174) = $598 per day

$598 * 3 = $1,794

First and last travel day (2 days):

Lodging ($424) + 75% of M&IE ($130.50) = $554.50 per day

$554.50 * 2 = $1,109

Total per diem for the trip = $1,794 + $1,109 = $2,903

Per diem calculation tools and resources

International per diem calculations become more complex with multi-city trips, proration rules, and currency considerations. Using reliable tools helps apply rates consistently and reduce errors before reimbursements are processed.

Useful resources include:

- The U.S. State Department’s per diem lookup tool

- Official government spreadsheets

- Travel expense tools that automate rate application and currency tracking

Government databases provide authoritative rate data, while modern expense tools automate calculations and flag exceptions based on dates and locations.

Special circumstances and adjustments

Not all trips fit a standard per diem model. Mixed business and personal travel requires excluding non-business days from reimbursement calculations, which makes clear itineraries essential.

Most organizations reimburse 75% of the M&IE rate on the first and last day of travel. This approach recognizes reduced meal availability without overpaying.

Extended international assignments may qualify for reduced lodging allowances or negotiated corporate rates. Applying those adjustments consistently can significantly lower overall travel spend.

Managing international per diem best practices

Effective per diem management depends on consistency. When rates, rules, and approval processes are applied uniformly, employees know what to expect and finance teams avoid unnecessary exceptions.

Clear documentation standards matter just as much. Even when receipts are not required, you still need accurate records to meet IRS substantiation requirements and support audits.

Finally, expense automation plays an increasingly important role. Manual tracking struggles to keep pace with monthly rate updates and multi-currency travel, increasing the risk of errors and noncompliance.

International per diem: How to create an effective policy

A strong international per diem policy clearly defines allowable expenses, applicable rates, proration rules, and documentation requirements. Employees should understand the policy before booking travel, not after submitting expenses.

An effective policy typically includes:

- Standard rate tables

- Documentation requirements

- Rules for exceptions and approvals

Balancing cost control with employee comfort is critical. Policies aligned with realistic travel costs reduce out-of-pocket spending and improve compliance.

Ongoing communication helps keep policies effective. Regular reminders and refreshers ensure employees stay current as rates and tax rules change.

Technology solutions for per diem management

Expense management software can simplify international per diem by automating rate application and enforcing policies consistently.

Key capabilities include:

- Expense management software that applies per diem rates by location and date

- Automation that handles first- and last-day proration and flags excess per diem

- Integration with accounting systems to sync approved expenses into your general ledger

International per diem: Common mistakes

Even well-designed per diem policies can break down in practice. These are some of the most common mistakes businesses make when managing international per diem and how to avoid them.

Using outdated per diem rates

Relying on outdated rates can lead to overpayments or under-reimbursements. Because international per diem rates change frequently, using old figures also increases compliance risk. Prevent this by assigning clear ownership for rate updates or using tools that automatically refresh rates as they change.

Failing to substantiate business travel

Per diem does not eliminate substantiation requirements. Employees must still document the time, place, and business purpose of each trip. Missing documentation can cause otherwise tax-free reimbursements to become taxable income. Standardized travel logs and consistent expense workflows help reduce this risk.

Mixing personal and business expenses

Combining personal travel days with business per diem often results in over-reimbursement. Without clear separation, audit reports become more complicated and time-consuming. Clear itineraries and automated proration rules help ensure only eligible business days are reimbursed.

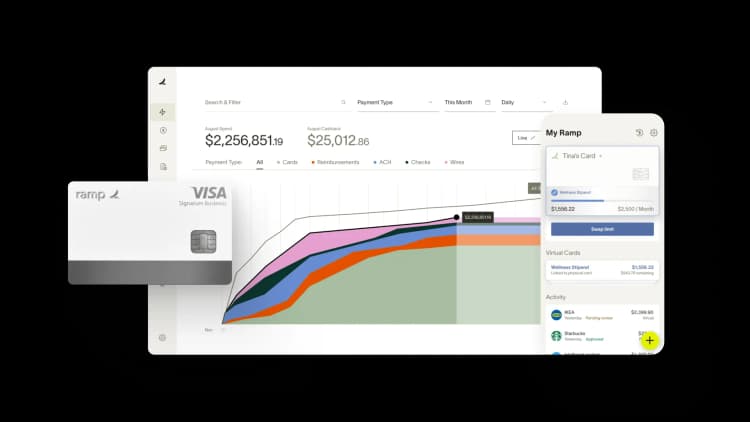

How Ramp simplifies international per diem compliance and expense reporting

Managing per diem rates across multiple countries is a major challenge. You're juggling different allowance rates for each destination, tracking which employees qualify for what amounts, and ensuring your expense reports align with local tax regulations—all while trying to close the books on time.

Ramp's expense management software transforms this complex process through intelligent automation and real-time policy enforcement. The platform automatically applies location-based per diem rates based on employee travel destinations, eliminating manual calculations and reducing compliance risks. When an employee submits expenses from Paris, Ramp instantly recognizes the location and applies the correct daily allowance rate for France, factoring in both meals and incidental expenses according to your company's policy.

The system's customizable policy engine lets you set specific per diem rules by country, employee level, or department. You can configure different rates for major cities versus rural areas, establish maximum daily limits, and create approval workflows that trigger when expenses exceed per diem thresholds. Real-time expense tracking provides complete visibility into international spending patterns. Your finance team can monitor per diem utilization across all traveling employees, identifying trends and potential policy violations before they become compliance issues.

This automated approach doesn't just ensure compliance—it dramatically reduces the administrative burden on your finance team. Instead of manually checking each expense against country-specific rates, you can trust Ramp to enforce policies consistently while maintaining complete documentation for tax and regulatory requirements.

Streamline your entire travel program with Ramp

Beyond per diem compliance, Ramp Travel simplifies every aspect of corporate travel management. Book flights and hotels at competitive rates through our Priceline partnership, all within a single intuitive interface that enforces your travel policies automatically.

The platform's integrations with Uber, Lyft, Gmail, and Outlook eliminate receipt chasing by automatically capturing and categorizing travel expenses as they occur. Combined with automated per diem tracking and multi-currency support, Ramp gives you complete control over international travel spend.

Try an interactive demo and discover why Ramp customers save an average of 5% across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits