Expense management

Skip the mind-numbing expense reports and chasing people for receipts. Learn smarter ways to manage expenses.

Article

Article35 essential business expense categories for businesses of all sizes

Fiona Lee

Former Content Lead, Ramp

Latest

ARTICLE

How to build a managed travel program

A managed travel program centralizes business travel booking, policy enforcement, and expense tracking to reduce costs and improve visibility.

ARTICLE

What is a travel management company (TMC)? Services, benefits, and how to choose one

A travel management company handles corporate booking, policy enforcement, and spend tracking. Learn what TMCs do, how they save money, and how to choose one.

ARTICLE

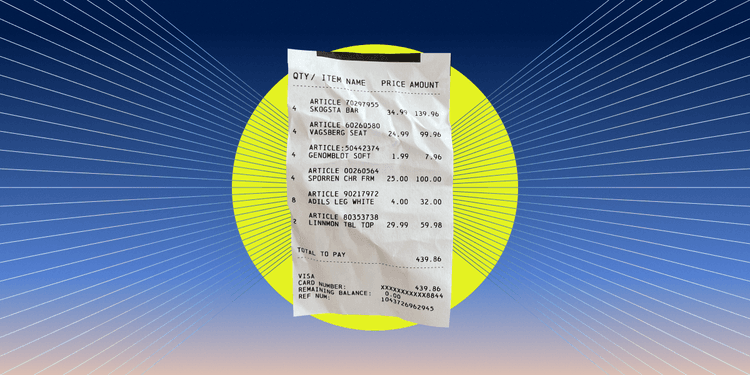

Expense management: A comprehensive guide

Expense management is the process of tracking, controlling, and analyzing employee spending to improve compliance, visibility, and cost control.

ARTICLE

What is cost control? Methods, examples, and best practices

Cost control is the process of tracking business expenses against a budget and taking corrective action to prevent overspending and protect profit margins.

ARTICLE

Non-cash expenses: Definition and common examples

Non-cash expenses are income-statement costs with no cash outflow—for example, depreciation, amortization, bad debt, impairment, and stock-based compensation.

ARTICLE

Expense vs. expenditure: Differences and definitions

Expense and expenditure affect statements, cash flow, and taxes differently. Track each accurately for better financial reporting and spending decisions.

Get fresh finance insights, bi-weekly