Ramp raises $300M to build its finance automation platform and acquires Buyer to offer negotiation-as-a-service

AUGUST 24, 2021, New York, NY - Ramp, the first corporate card designed to help businesses spend less, today announced $300M in Series C venture funding at a $3.9B valuation. Founders Fund led the round, with participation from Redpoint Ventures, Thrive Capital, D1 Capital Partners, Spark Capital, Coatue Management, Iconiq, Altimeter, Stripe, Vista Public Strategies, Lux Capital, A* Partners, Definition Capital, Honeycomb, Kinetic, and other existing investors. Ramp has raised over $620M to date in a mix of equity and debt financing.

Over 2,000 US businesses are now using Ramp as their primary spend management solution leading to a tripling of transaction volume on Ramp corporate cards since the company’s $115 million Series B announced in April 2021, which valued the company at $1.6 billion.

Ramp intends to use the new financing to accelerate development of its finance automation platform, designed to help businesses save time and money. On average customers save 3.3% annually by switching their corporate card spending to Ramp. Finance teams who use Ramp are able to account for and record all their business expenses at month end in just over 2 hours in most cases, representing a 90% reduction in time.

“It’s rare to find a company like Ramp whose growth is actually accelerating as they scale. Ramp’s vision of helping businesses spend less is clearly resonating with customers, so we are delighted to be leading this round.” said Keith Rabois, Partner, Founders Fund. “The upside for Ramp is huge given the rapidly growing B2B payments opportunity and the ongoing consolidation of financial software in the enterprise.”

Already the fastest growing US corporate card ever, Ramp has continued to grow rapidly this year with the number of cardholders on the platform increasing 5x since Jan 1. Growth has been driven by Ramp’s superior software and user experience—it has an industry-leading customer satisfaction score (CSAT) of over 95 and is rated Easiest to Use on G2.com in both expense management and spend management categories.

“We founded Ramp with the intent to empower businesses. Ramp’s mission is to save our customers time and money so they can focus on their mission,” said Eric Glyman, co-founder & CEO, Ramp. “Frankly the current state of finance tools and legacy card programs is not acceptable. They trap finance teams into doing unproductive ‘busy work’. This funding will allow us to automate away even more of those tasks so that finance teams can focus on being more strategic.”

To deliver that vision even faster, today Ramp is announcing the acquisition of Buyer. Buyer is the first negotiation-as-a-service platform that saves its clients an average of 27.3% on big ticket purchases such as annual software contracts. With the addition of the Buyer team, Ramp will be able to offer a customized and proactive approach to savings on large purchases, which goes beyond the generic perks and discounts that most corporate cards offer today.

In the longer term Ramp also intends to expand its product offering as a result of the Buyer acquisition. By combining Buyer’s team with benchmarking spend data from millions of transactions on its platform, Ramp wants to help its customers negotiate the best rate on anything that can be purchased with a card—from travel to software—with the goal of shifting purchasing power back into the hands of buyers.

“Over the course of the pandemic software spending ballooned. It is now the second largest line item for companies. By finding better value on these purchases, we’ve been able to have a meaningful impact on the bottom line for many businesses,” said Kimia Hamidi, Founder and CEO of Buyer. “We couldn’t be more excited about joining the Ramp team, because both of our companies care deeply about helping our customers achieve more through savings. Joining Ramp will allow us to scale this vision.”

Proving that business savings are a universal value proposition Ramp has attracted some of the fastest growing startups and unicorns like Ro, DoNotPay, Better, ClickUp, and Applied Intuition, in addition to established businesses across the US including Bristol Hospice, Walther Farms, Douglas Elliman, and Planned Parenthood.

About Ramp:

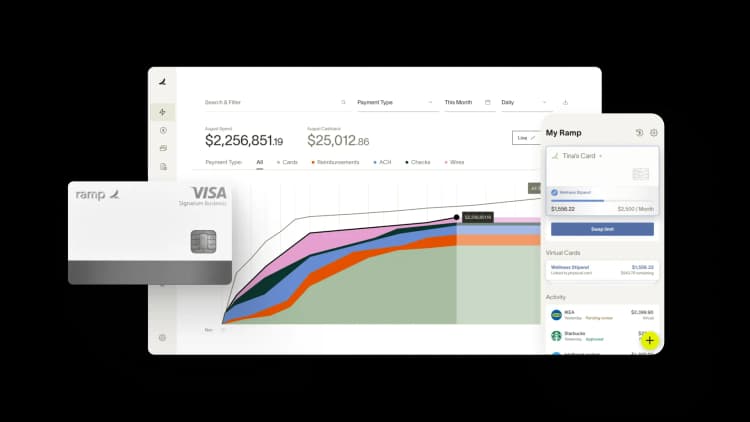

Ramp (ramp.com) is the world’s first finance automation platform. With Ramp, businesses get corporate cards and payments with built-in expense and accounting automation software — all in one free and simple solution.

Unlike legacy financial service providers, Ramp designs its products to help companies spend less. Customers save an average of 3.3% by switching their spending to the Ramp platform and are closing their books 5 days earlier each month. Founded in March 2019, Ramp is America’s #1 rated and fastest-growing corporate card.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits