3 updates that make expenses simpler and more efficient for everyone

- Fast-track expenses, from start to finish

- Expense automation just got even smarter

- Ramp up your employees faster

- Free your team from manual expenses

From day one, our goal has been to make managing expenses effortless, so you can focus on growing your business—not chasing expenses. Every improvement, big or small, adds up to save valuable time across your organization.

Now, we’re making expense management even simpler and more efficient with three key updates, designed to get employees in and out of Ramp—and back to the work that matters. During our beta, customers saw meaningful improvements to their workflow:

- 20% of memos now powered by Ramp AI suggestions

- 33% faster transaction review, allowing managers to quickly clear their approvals backlog.

- 50% faster repayment of non-compliant spent, thanks to streamlined resolution between reviewers and employees

We’re excited for you to experience these updates yourself. Read on to learn more about how these updates will benefit your team.

Fast-track expenses, from start to finish

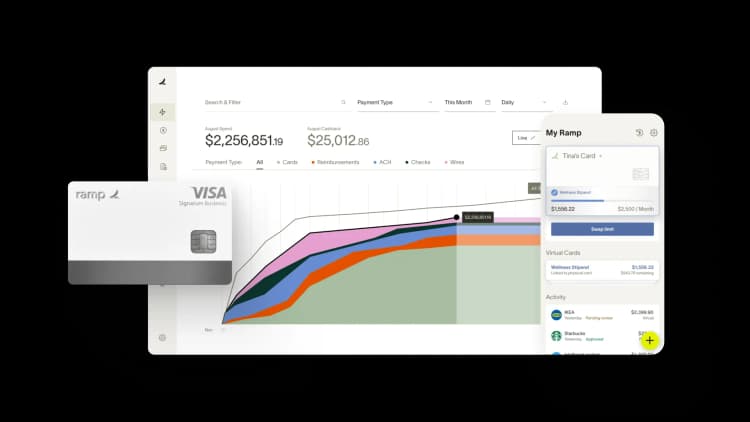

Your team’s time is valuable—and every second counts. That’s why we’re introducing a new homepage that streamlines all an employee’s tasks and notifications in one place, giving them a single place to focus and power through their to-do list in Ramp.

Got a stack of receipts piling up? Simply drag and drop them in bulk, and Ramp will automatically match them to the correct transactions or create reimbursements. After employees clear their to-do list, an easter egg awaits to keep them motivated and striving for inbox zero 🐍 (Hint: They’ll need a coin.)

Once expenses are submitted, the next step is approvals. To speed this up, we've streamlined the review experience by providing a new inbox-style view, designed for maximum focus and efficiency.

Key details—like policy violations or missing items—are front and center, so reviewers can quickly approve or send transactions back to employees for changes or repayment. As transactions move through the approval chain, everyone has full visibility into the status and knows exactly who needs to act next, ensuring nothing gets stuck in limbo.

With faster submissions and more efficient approvals, expenses run like clockwork—ensuring you have everything you need for a smooth monthly close.

Availability: The redesigned homepage for employees is now available to all customers. Streamlined approvals will start rolling out next week.

Expense automation just got even smarter

The longer an expense goes untouched, the risk of late submission grows exponentially. That’s why Ramp handles expenses in real time, automating as much as possible from the moment a card is swiped.

With our new Google Calendar integration, expense automation is now even smarter. Each event—whether it’s a team dinner, offsite, or client meeting—provides valuable context that Ramp’s AI can cross-reference with transactions to suggest more detailed memos via SMS.

Looking ahead, the Google Calendar integration will help automate nearly every step: auto-coding transactions and matching them to the correct funds, adding event attendees to relevant transactions, and dynamically routing approvals to a delegate if the assigned reviewer is out of office.

And now with expanded SMS capabilities, submitting reimbursements is just as easy as submitting expenses. You can text Ramp a receipt or link from Square or Toast, and we’ll draft the reimbursement and suggest memos. Missing a receipt? Simply reply with “OOPS” to request an exception.

Availability: These features are live for all customers.

Ramp up your employees faster

As your organization scales, policies often become more complex, leaving employees juggling their Ramp card, spend limits, and virtual cards, unsure which to use, and when. We heard your feedback and simplified the spending experience, so Ramp is intuitive for anyone to learn without needing extra support.

Here’s what’s changing:

- More user-friendly language to make spending with Ramp more intuitive. Terms like “spend limits” will be replaced with more familiar terms, like “funds”.

- One card to streamline spending. Employees will no longer second-guess which card to use. For most purchases, they can simply default to their Ramp card, and transactions will automatically get matched to the correct funds.

- Virtual cards kept separate from physical cards. Virtual cards will now be reserved for online-only purchases like software or digital advertising, providing greater control and enhanced security, whether you need to lock, terminate, or reassign a card.

Spend programs will also be easier to set up, making requesting funds painless for everyone. Admins will be guided step-by-step in setting controls, defining approval chains, auto-coding transactions, and more. With a clear process in place, funds are deployed efficiently—helping the entire business move faster.

Availability: You'll start to see new terminology, consolidation of funds, and changes to virtual cards rolling out in the next month. Streamlined spend program setup is coming early next year.

Free your team from manual expenses

Finance teams deserve better than legacy tools that turn them into IT support and require them to spend time troubleshooting clunky software and fielding employee requests.

That’s why we’re laser-focused on making expenses effortless for employees, so you can stay focused on growing your business. Thank you for trusting Ramp to help run your business. Your feedback drives everything we do.

Not yet on Ramp? Sign up for free today and see how we can help you modernize your finance function.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits