How a laser focus on ROI and savings can help your startup weather a downturn

Current market conditions are forcing many startups to rethink how they spend. With debt a less viable option owing to rising interest rates, a volatile stock market, and crypto in freefall, startups will need to focus on ROI and savings to weather this economic storm. As a 2x startup founder, I’ve experienced firsthand the detrimental effects of market volatility. My most recent company Buyer was started during the early, crazy days of the pandemic in June 2020. I have found that a focus on strategic negotiations, staunching cash flow, and excluding anything that isn’t essential are key to surviving downturns. By crystallizing goals, auditing, renegotiating contracts, and taking asymmetric risks, you’ll place yourself in a solid position to navigate these unpredictable times.

A framework to increase ROI and savings

The following steps will help you successfully navigate a downturn.

1. Crystallize your goals

Since every business is different, I divide up the different recession strategies according to a business’s underlying goal, organized by lowest to highest agency.

- Avoid death by trying to make it to the next funding round.

- Get to a breakeven point.

- Control your own destiny and become profitable (the best case scenario).

These scenarios are all driven by your burn rate, which tells you how long you have until you run out of money. The basic equations are:

- Burn Rate = (Starting Balance – Ending Balance) / # Months

- Runway= Total Cash/ Burn Rate

The category your business falls into is largely up to you and your business objectives. Here’s a simple way to think about the three main scenarios:

- Survival: You have less than 12 months of runway in the bank and/or are not driven by cash flow. Example: You’re in the early days of building your product and are probably not generating a lot of cash flow. Your goal is business momentum and cutting costs until your next round.

- Get to breakeven: You have over a year of runway in the bank and your company is not profitable but has a line of sight to generate cash flow. Example: You are creating a product management tool that is per-seat pricing. You have a clear way to generate revenue (get your customer to pay upfront for the year) and have a timeline on how long you can operate for.

- Control your own destiny: You have a clear line of sight toward profitability. Example: you have 18-24 months of runway in the bank and/or are profitable.

Survival

If your goal is survival to the next round of funding, you need to minimize your costs and stay scrappy to extend your runway while demonstrating both growth and customer love.

These two attributes can take the form of a few different metrics, such as:

- High NPS

- Retention

- User referrals

- Increase in revenue

Ultimately, it’s outlining why your customers/users love your business and showing investors why they should be doubling down on what you are building.

Breakeven

If your goal is to breakeven, it’s time to focus on cost-effective growth. Eliminate anything superfluous that isn’t boosting your overall ROI.

For example, do you really need to be doing R&D for the next two years if you only have seven paying customers? Focus instead on how you're growing and how you're spending your money in service of growth. At the end of the day, cash flow allows you to control your own destiny. Spend time thinking about how you can generate revenue in non-obvious ways. Examples include:

- Partnerships

- Adding in an implementation fee

- Asking for the annual contract up front while offering a 10% discount for prepayment.

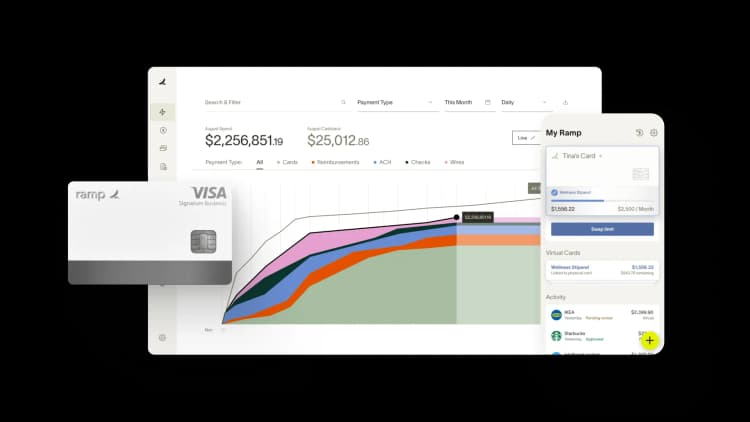

Cost controls and spend visibility are key. Connect your cards to a single reporting platform, because where you start to die on your breakeven goal is death by a thousand cuts. The small, seemingly innocuous expenses start to add up to be a big problem.

Profitability

If your goal is profitability, congratulations. You’re out of the woods and ready to move to increase your capital. Downturns are an incredible time to seize new opportunities, so adopt a growth mindset and think about other ways you can increase your cash flow, e.g. selling adjacent services and establishing new partnerships.

2. Engage in a ruthless cost audit

Once you’ve identified whether you’re in survival or breakeven mode, it’s time to engage in a ruthless audit. Your ROI will be your north star for culling anything that isn’t essential for your business. And if you’re in survival mode, you’ll have to be extra judicious in your eliminations.

I should mention that this isn’t limited to your vendors. This audit should include literally everything that you spend on. For example, is there a lower cost benefit provider you can switch to so your team has the same coverage that costs the company less?

After Ramp acquired my company, Buyer, I began leading the Savings Team, where we help thousands of customers audit and renegotiate contracts. Based on our experience, the best place to begin your audit is by taking a deep look at every expense, then prioritizing your plan of action based on the impact to business. Do a business case evaluation and see if the value is really there. Ask yourself:

- Can you cut the cord without experiencing any negative consequences?

- Is there a better vendor you could try to renegotiate with?

- Is there another tool with similar functionality that comes with a lower price tag?

Based on analyzing hundreds of millions in spend, sales and marketing tools are often the biggest culprits of wasted spend. I recommend you start there.

Question whether losing it would mean a material loss to your business or your path to break even/growth. This question should get ratcheted up depending on your timeline. For example, if your goal is to reach a breakeven point within 4 months, this escalation could resemble the following:

- Month one: Evaluate which tools/services you think provide value.

- Month two: See what you can do without. Restructure and negotiate.

- Month three: Start eliminating what you don’t need or can’t negotiate to better terms.

- Month four: See if your cost-cutting has yielded the desired results. If your savings aren’t quite where you want them to be, begin the process over again.

Vendor management is critical to this step of the process. While cutting costs is the first step, the ability to maintain cost control comes next. You’ll want to look for tools that can help you stay on top of vendor costs. I would lean into either evaluating new tools that will give you more visibility and control or cutting other tools to allow you to keep your full array of finance solutions. Otherwise your cost-cutting may have the opposite intended effect, as it’s impossible to control what you can’t see.

3. Renegotiate vendor contracts

Everything is negotiable in a downturn. Everything. Renegotiating contracts for vendors can be mutually beneficial for both parties. You’ll have the opportunity to update your contracts for more favorable terms that can result in increased profitability. We saw this ourselves during the COVID-19 crisis, where many companies were willing to extend payment terms, offer 1-time discounts, or give other concessions. Your vendor would almost always prefer to retain a loyal customer and avoid having to spend time, money, and considerable effort during a downturn to acquire a new customer. If there is strong proven ROI, you should work with that vendor to restructure your contract in your favor.

Remember to treat your vendors as partners and respect the fact that they have the same goals as you: to maintain a successful business with strong margins. Note that cash flow is your number one goal, so it’s better to try and push for payments quarterly, not annually (though if you can secure a great annual contract with delayed payments, that’s also worth considering). Our Savings guide can provide your team with some helpful tips on confidently negotiating software congrats and reducing SaaS expenses.

4. Take asymmetric risks

My last tip is to take asymmetric risks, which our co-founder and CTO, Karim Atiyeh, defines as bigger, bolder bets that have the potential for a very high magnitude of impact. Playing it safe and exclusively attempting to minimize risk might seem like the smarter option, but this approach will ultimately lead to stagnation, leaving your business at risk of being overshadowed by other companies who decide to take said risks.

I should mention that obviously not all risks are created equal, and the ability to make intelligent risk management decisions is crucial. If the cost of making a mistake is a hundred times bigger than the reward, then it isn’t a risk worth taking. One example of a personal risk I took, where the calculated reward was substantially greater than the possible downside, was my hiring methodology.

Core to Buyer scaling was transitioning me out of being a negotiator. If I couldn't do that, the business was going to die. When it was finally time for me to hire a negotiator, I almost brought on a senior, seasoned B2B negotiator who had tons of experience and looked great on paper. Their salary requirements were high and it would have been a stretch, but we could have afforded it. All common sense said they were a sure bet. But I didn't make the hire.

Instead, I pivoted to hiring someone less experienced from an adjacent industry. I was taking a bet on unconventional hiring to see if I could achieve even greater ROI. I believed we could train someone in a completely different industry about software negotiations. I first hired Bobbi, an oil and gas negotiator. She knew almost nothing about software, but I was relying on her core negotiation skill as being more important than domain expertise.

I took a risk to reduce my overall costs, and Bobbi now leads our procurement services team and has personally saved companies tens of millions of dollars. My latest hire, a civil engineer with no software experience, is an incredible product operator with a strong systems based approach to problems proving that asymmetric risks can be an excellent path toward profitability.

Another risk I took was intentionally avoiding raising VC money. I knew being in control from the beginning would set me up for success to play the infinite game of company building and weather any storm. I could have gone big and raised traditional VC funding but when I started Buyer it was literally just me. This allowed me to control my destiny, meaning I could get to profitability WAY faster but more importantly set the roadmap and expectations.

My asymmetric bet was to optimize for control and have an infinite runway.

Follow the ROI to succeed in a downturn

My favorite quote comes from Jensen Huang, CEO of NVIDIA. He says, "My will to survive is greater than others' will to kill me." In the context of today’s economy, it means doing anything it takes to not let the market beat you. While we are currently navigating uncertain economic conditions, taking steps to increase your returns and negate costs will help your business stay alive and, in some cases, capitalize on market volatility.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits