How we built Ramp by taking asymmetric risks, and why you should, too

Let's start off with a little backstory. Born and raised in Lebanon, I came to the US to study but ended up deciding to stay long term to find work. After graduating from Harvard, I moved to New York and started doing some consulting work but very quickly found myself wanting to go back to writing code and building software, which I had been doing for years up to that point.

This led me, along with our CEO Eric Glyman and Gene Lee, to start a company in 2014 called Paribus, where we focused on helping consumers save money. The Paribus value prop was simple: whenever the price of something a customer had bought online dropped, we'd notify them and automatically give them a refund of the difference.

At the peak of it, we were saving about 10 million customers millions of dollars a year on their online purchases. Three years later, after much success, we decided to sell the company to Capital One. We spent a bit of time in the card industry and finally decided to leave Capital One after two years. Fast forward a few years to 2019 and that's when we started Ramp.

The Ramp mission

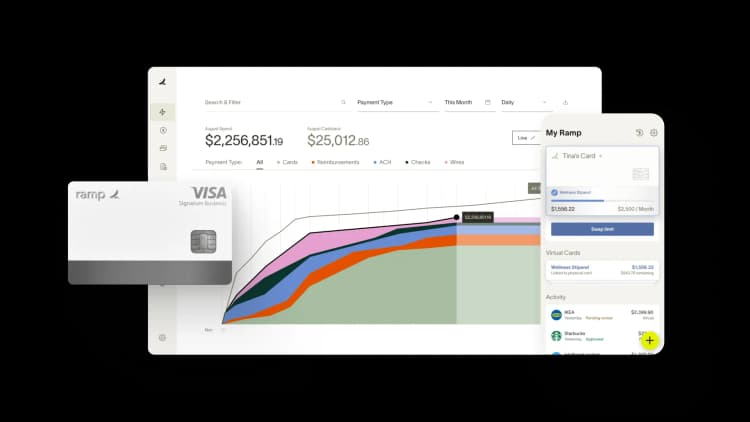

At Ramp, we're focused on helping businesses save money, so the mission is very similar to that of Paribus, but is slightly more nuanced. We save businesses money by helping them understand their spend, control their spend, and reduce their spend in negotiations through real-time expense tracking, integrations with popular SaaS products, finance automation and more. Today, Ramp is a $4 billion dollar business. We've raised about $600 million dollars in outside funding, have grown to over 170 employees and counting, and are helping more than 2,000 businesses save money on their spend.

Along the way, we've experienced some amazing growth. It's incredible to think about: in the time it took us to build and sell Paribus, we were able to achieve an outcome that was about a hundred times the size and in two years with Ramp.

How did we do this? One of the unique ways in how we approached growth was the way we scoped bets. How do we look for and make bets that have the potential for a very high magnitude of impact as opposed to playing it safe and trying to minimize risk?

I'm sure you've heard this stat before: when it comes to startups, 90% of them don't make it. It's like a plane is crashing and you're trying to rebuild it before gravity pulls you down. In business, you only have a limited amount of time to make a couple of smart bets. You want to focus on the ones that have the biggest potential.

Asymmetric risks and outcomes

Instead of asking people for advice and looking for the average of all the advice you get, you should probably be taking bigger, bolder bets.

If the average is failure, you don't want to implement average advice. The way we refer to this concept at Ramp is asymmetric outcome.

So what is an asymmetric outcome? What are asymmetric risks? If you've played poker, I'm sure you’ve been in a situation where you've drawn a pretty bad hand and you say to yourself, “Well, my hand is not that great. But there's enough in the pot, so I might as well take a risk.” This is exactly what asymmetric risk is. Sometimes you're not dealt a very good hand, but the potential reward at the end is enticing, so you might as well just try and give it a shot.

Another analogy is if you were playing a game where you're flipping a coin and, in the case of heads, you win a thousand dollars, but if you get tails, you lose a thousand dollars. In this case, the outcomes are perfectly symmetrical. So if your goal was to play that game until you earn $100,000 dollars, you would have to play at least a hundred times. And that's if you're extremely lucky.

Now, imagine a game where if you flip heads you win $100,000, but if you flip tails you lose $10,000. That's a much better game to play. The outcomes are asymmetrical, but there's a catch. You need to be able to lose $10,000 to be able to play.

You want to look for outcomes where, in the case of success, you have the potential for a 10x payoff. On the other hand, if you fail, maybe it's a 1x loss. You don't want to limit your downside but you want to maximize your upside.

You can do this across different aspects of building and scaling your company:

- Choosing your problem space

- Hiring your early employees

- Picking your vendors and partners

- Building a product and fundraising

Choosing your problem space

If you're trying to build a company that launches rockets into space, it's hard to do that on $1 million of seed funding. But if you're able to raise more money, you're able to go after bigger problem areas where the barriers to entry are high but the outcomes are massive.

Take banks for example. It's no coincidence that many of the most respected financial institutions are over a hundred years old. Amex, who I would say is the incumbent in our space, is 171 years old. At this point, in financial services, there are high barriers to entry. You need to be able to convince banks to work with you, card manufacturers to make cards for you, and so many other things just to get off the ground.

So the fact that we were second-time founders with Ramp allowed us to raise an outsized seed fund. As a result, we decided to go after a bigger space, where it's harder to gain your footing. The same applies to other businesses: the more upfront funding you acquire, the bigger bets you can make. If you want to compete in a space with established players, you have to be willing to jump over the high barriers to entry.

Hiring your team

Generally, advice on hiring goes something like this: create a checklist of competencies you're looking for and mark them off one by one, trying to make sure that all of your candidates check all the boxes.

The problem is most people who are exceptional at what they do tend to be very spiky. They don't have an evenly distributed skill set. This approach makes it very easy to find flaws and disqualify candidates. On the other hand, it also makes it very hard to find people who have 10x potential and can grow with you.

At Ramp, we were lucky to have worked with great interns early on. One of them had sold his company to Apple when he was a freshman at Stanford. He was exceptional at writing iOS code but he had zero fintech experience. The other was extremely quick at building software but he also had no fintech experience and lacked the communication skills of a more experienced engineer.

But, despite conventional wisdom, these are the types of people that we chose to hire early on, not because they had the experience and were the lowest bets, but because they had the slope that we were looking for. When you hire people like these, they scale with you and the company, making it much easier to grow your company and product.

Picking your vendors

The same applies to vendors. Of course, if you want to limit your downside, no one's going to blame you. But the problem with making the really obvious, safe choice is you miss out on opportunities to work with up-and-coming vendors that can really alter the trajectory of your company.

If everything works out when you're in an early stage, the cost of having gone with an up-and-coming vendor is very small, and you can monitor vendor performance with vendor scorecards to make sure things are going as planned. On the other hand, if things don't work out, the switching costs are usually manageable and you have two or three accounts to replace. So why not give it a shot?

Shopify and Lyft, two giants in their respective spaces, made bets on Stripe very early on. At the time, it was a very non-obvious choice. Stripe was a small company, but they had something that they did very well: they made it very easy for developers to get started.

At Ramp, we thought that one of our competitive advantages was speed. So when we looked at issue tracking software that was available to us, we ended up going with Linear. They didn't have all the features that JIRA had, but they allowed us to move quickly and that advantage compounded over time.

When you're working with scrappy, early-stage vendors, not only are you able to build relationships, but you can help shape their product vision. In essence, you become invested in each other's success. So it makes things a lot smoother and allows you to move a lot faster.

Building product

No one wants the faster horse—people want a car. If you keep listening only to solutions that your customers propose to you, you're likely not going to end up with that 10x product that's going to alter the trajectory of your company.

Take the example of the remotes above. With the one on the left, maybe you went to your customers and asked them which buttons they needed. But if you make big, bold bets and listen to your customers’ problems, not their solutions, you're able to achieve big leaps and let your product actually help you win in the market. That’s how you get a result like the remote on the right.

Fundraising and selecting investors

Meeting investors and fundraising is part of the startup process and getting it right can be a huge boost, especially early on. But it's easy to get drawn in by the headlines of large rounds and think that price is everything. In reality, price is almost never a good indicator of how well a fundraising round went. Finding reputable investors who give you clean terms gives you the best potential for asymmetric outcomes.

There's a lot that goes into fundraising, and the terms that you raise at are extremely important, particularly when you're raising your first institutional round. If you're able to attract a reputable investor early on with clean terms, you avoid things like liquidation preferences, weird covenants, or giving up too many board seats early on. This kind of setup makes every other fundraising conversation down the line much easier.

Reputable investors also help you attract angel investors, who are likely to turn into beta customers for you. In turn, not only are they giving you the capital to grow, they’re also providing some important feedback to make your product better.

So instead of focusing on optimizing that first fundraising round, you want to think about all the other rounds you're going to have to raise in the future, especially if you're trying to go after a big outcome.

Negative asymmetric outcomes

But in some cases there is potential for negative asymmetric risk. And this type of risk tends to grow as your customer base grows. At Ramp, we give people credit. We give customers the ability to spend on our cards and they pay us at the end of the month. But our business model is such that our revenues are about 1% of what we lend out.

So for every mistake that we make, we need one hundred customers to pay us back. This is an area where we decided to not take any risk because the cost of making a mistake is a hundred times bigger than the reward if we get it right.

So as a business owner you should think about the risks that would be detrimental to your company and avoid those areas. Figure out the areas where you can take a lot of risk and make these big bold bets and isolate them from the ones where you shouldn't be.

Don’t be afraid to take chances

In the end, bigger bets don't have to be scary. In reality, they tend to be less risky, especially if you look for opportunities to have an asymmetric outcome.

If you want to learn more about how we built Ramp using asymmetric outcomes, and why I highly recommend you do, too, you can watch my SaaStr 2021 keynote below.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits