A corporate card designed for modern finance.

Save money and time. All with one corporate card.

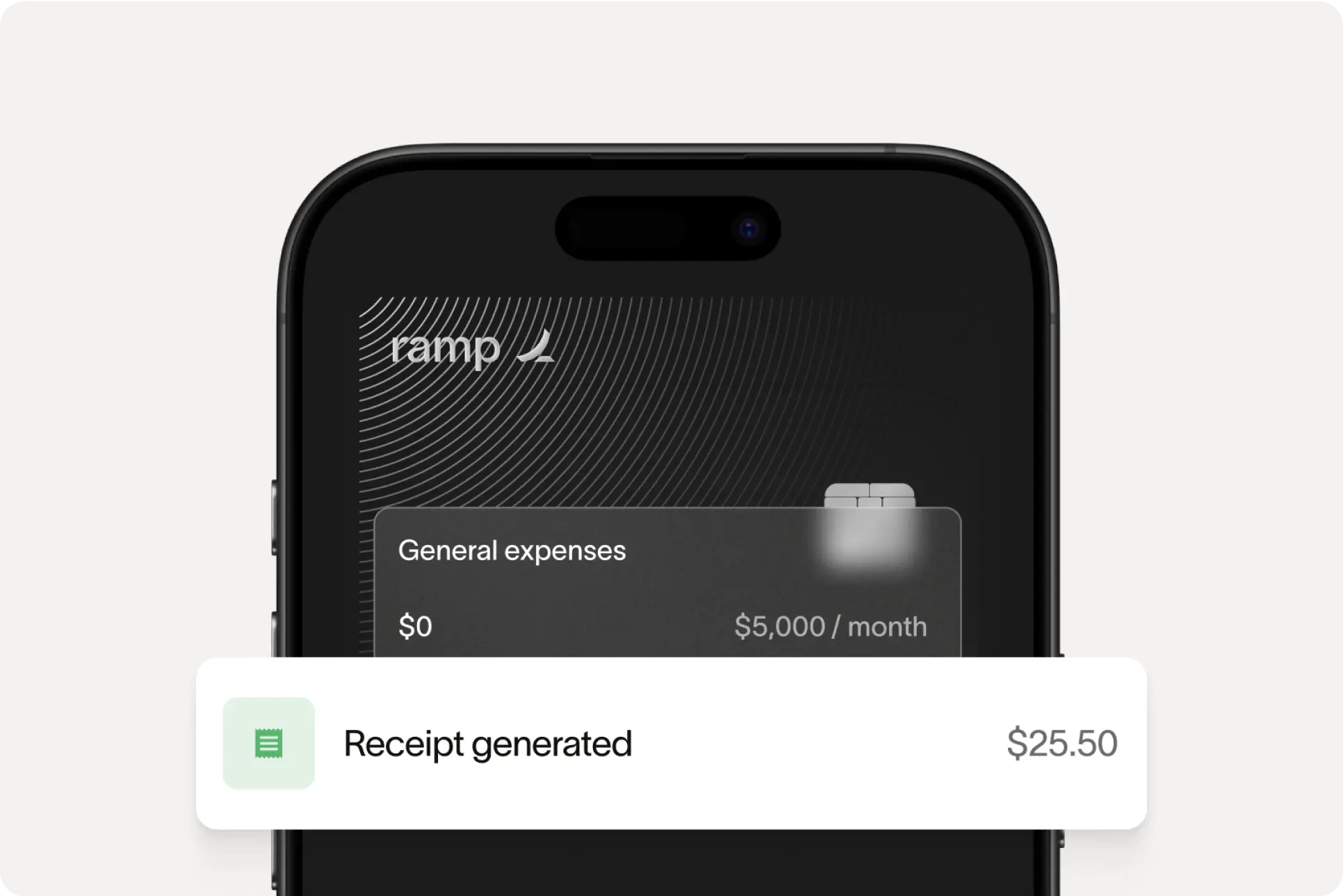

Build control into the

card, before spend

even happens.

virtual card

Don't compromise on growth or control.

Create custom virtual cards and set permissions for everything from ad marketplace spend to remote work stipends, for individual teams or your whole company.

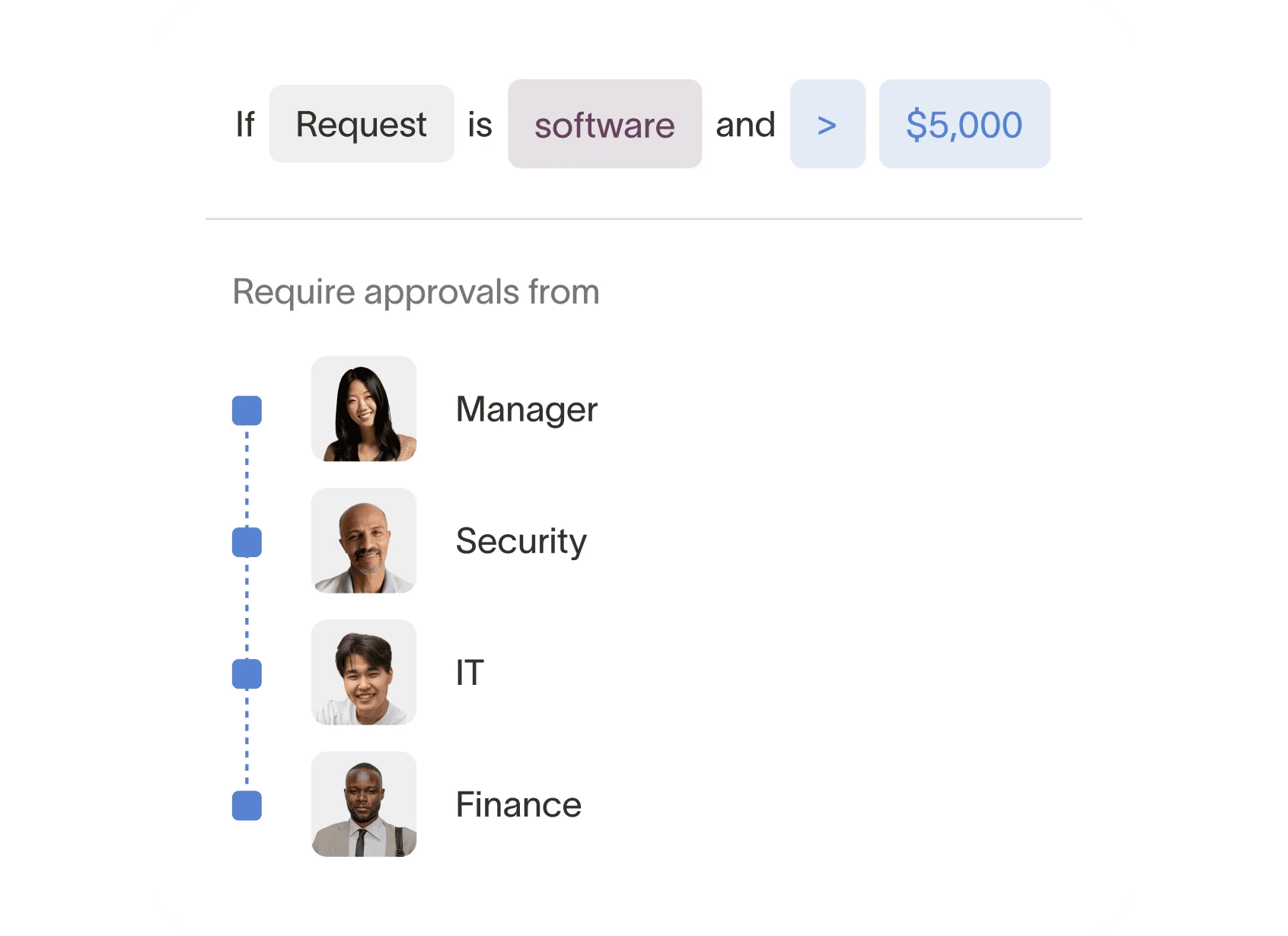

Get ahead of out-of-policy spend.

Add restrictions to automatically prevent specific categories and merchants. Not sure if it's out of policy? Questionable vendors are always automatically flagged for approval.

More visibility, more

time back.

Simplify approvals and share accountability.

Focus on your work, not follow ups.

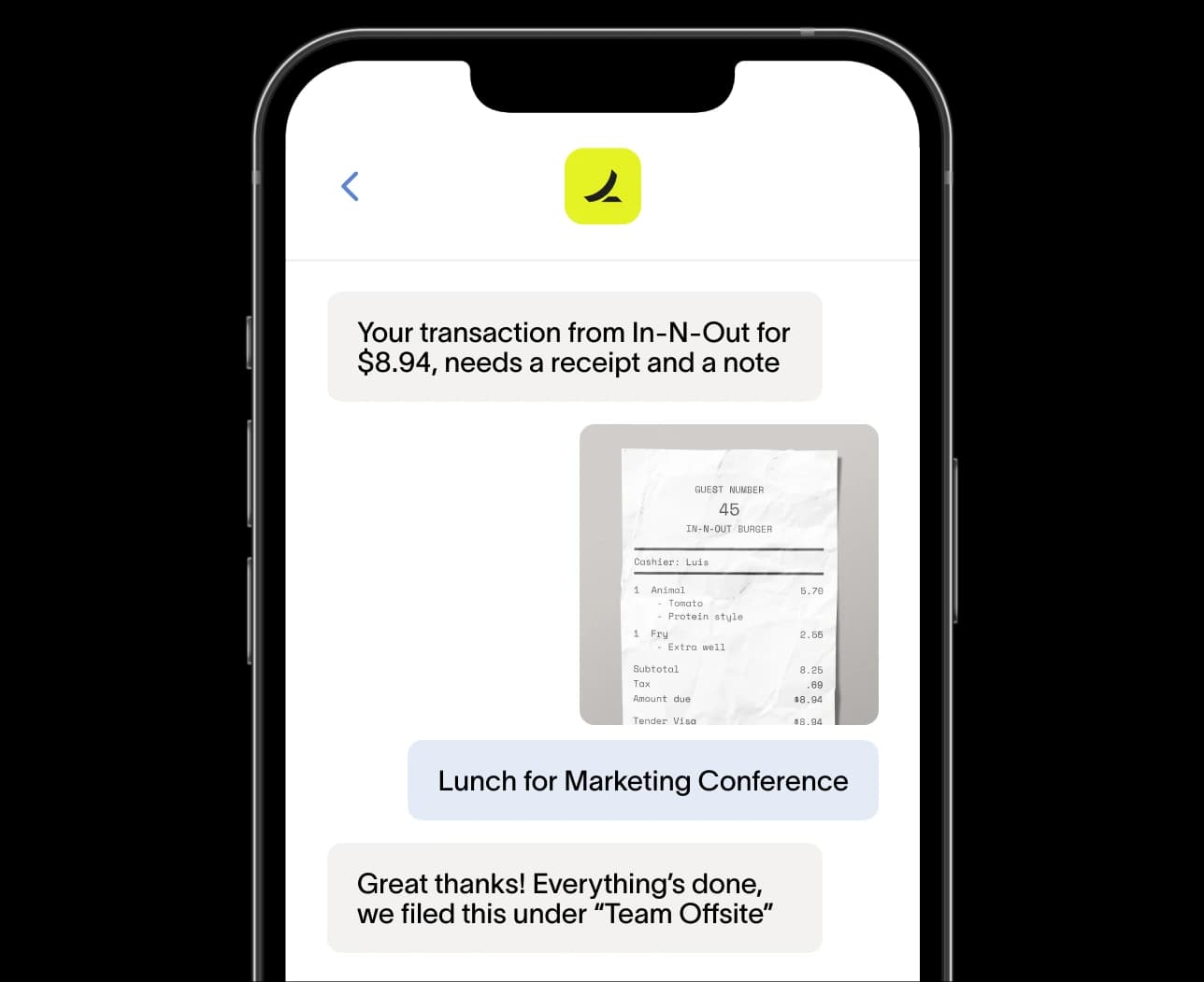

Effortless expenses

for

employees

(and managers).

Don't sweat a missing receipt.

Swipe, then submit on the go.

"Ramp has been a major upgrade for our accounting team to efficiently and effectively track spend."

Joseph HornVP Controller

Automation, control,

and

rewards in

one place.

Spend to get cashback.

Over $350k in partner offers.

No personal credit checks

Easy, secure payments

Works wherever you go

Seamlessly integrates with your existing tools.

Streamline your finance operations by integrating Ramp with your existing apps.

Centralize your spend on

one intuitive platform.

Travel

Turn travel policies into guardrails everyone on the team will follow.

Expense management

Automate expense management with Ramp’s corporate card, reimbursements, and more.

Vendor management

Track all your vendor data and discover pricing insights in one convenient place.

Procurement

Upgrades the entire procure-to-pay process, eliminates approval bottlenecks, and prevents out-of-policy spend before it happens.

Accounts payable

Automates your entire accounts payable workflow to record, approve, and pay every bill without any data entry or repetitive tasks.