Finance automation for healthcare.

More time for care, fewer hours on paperwork.

Time back to spend with your patients.

Smart corporate cards, intuitive bill pay, and a host of modern accounting tools power an all-in-one finance operations platform that helps healthcare businesses save time and money.

Centralize your daily finance operations.

Ramp’s all-in-one finance platform provides the critical insights necessary for timely decisions. Corporate cards, expense management, bill pay, and procurement all work in concert to provide serenity amidst the hustle of busy healthcare operations.

Platform overviewPay vendors on time.

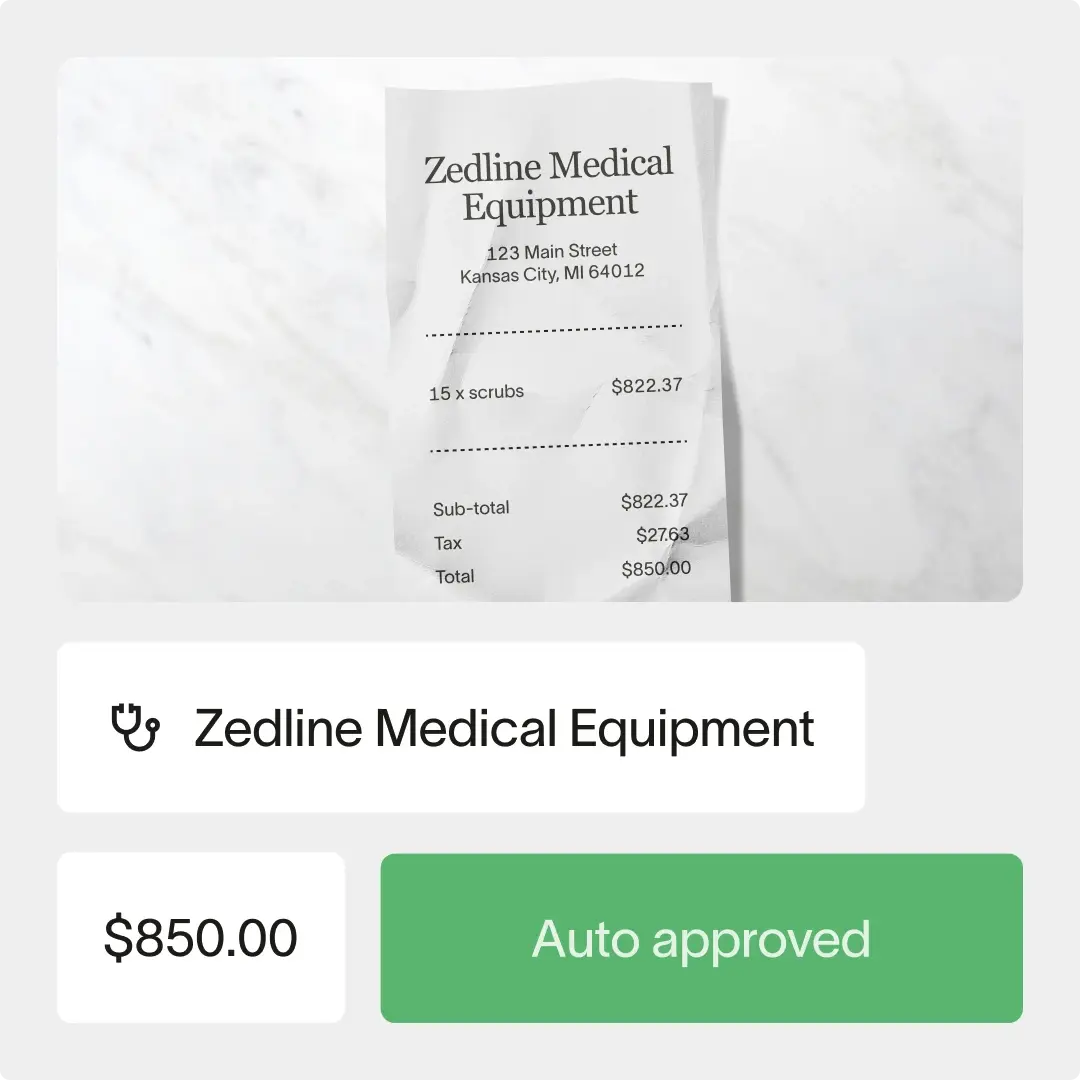

Ramp automatically processes every invoice, extracting and coding each line item, matching it to the corresponding purchase order, and routing it for approval. Built-in two- and three-way matching ensures tight control and full visibility across your payables.

Ramp Bill PayImprove spend visibility across your practice.

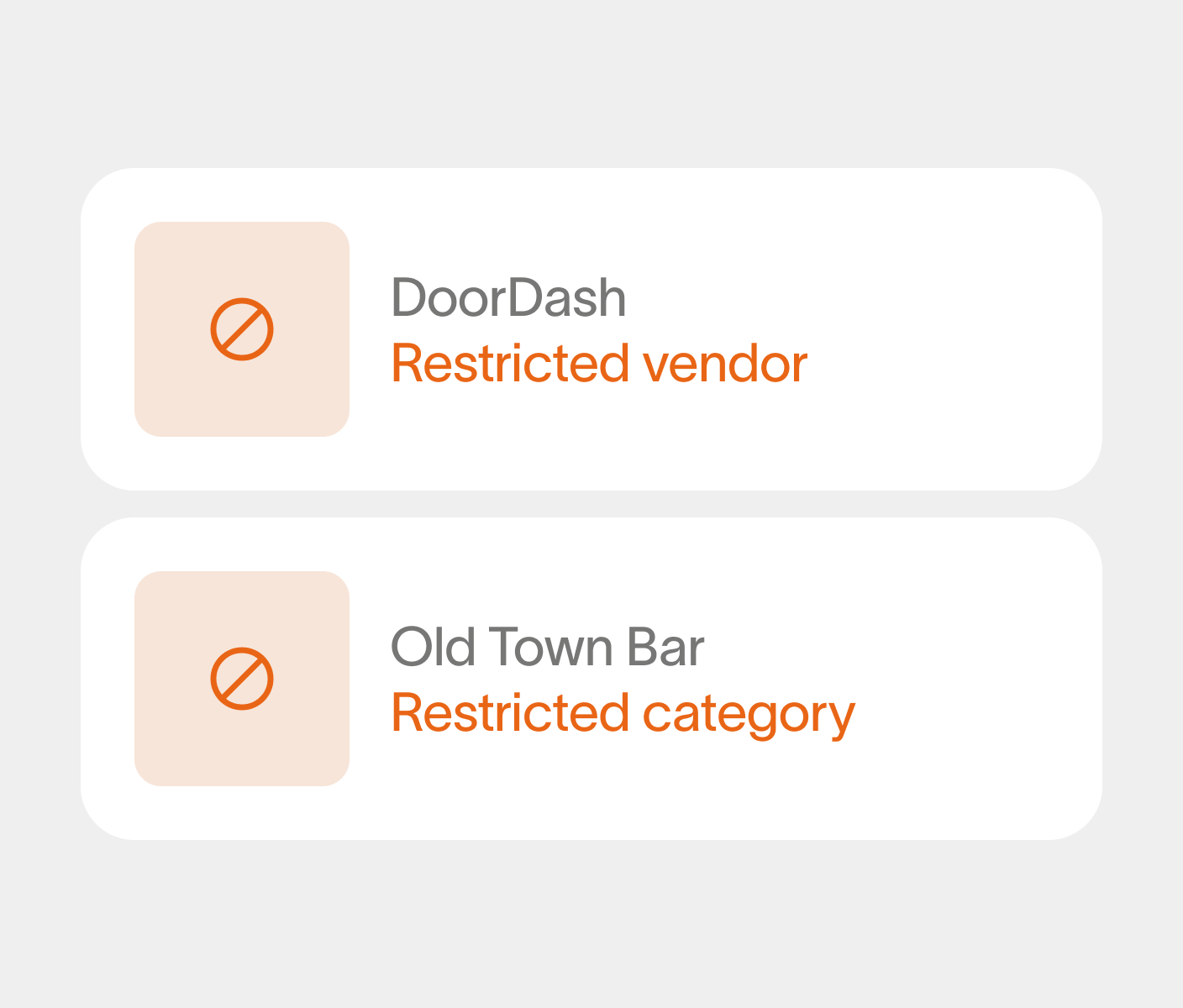

Through automation, Ramp unlocks seamless deployment and reconciliation across multiple business units and teams. Control virtual cards to limit teams or vendors; then sync everything to your accounting system.

Expense Management

Streamline expenses with smart corporate cards.

No more hours of wasted time making employees file paperwork. Issue smart corporate cards with Ramp to keep spend in check, and never chase down a receipt again.

Corporate Cards