Calculate Connecticut’s per diem allowance for your business travel

Managing travel expenses effectively requires a solid understanding of per diem rates. These rates provide standardized reimbursement amounts for lodging, meals, and incidental costs, ensuring fair compensation for your employees while helping you control overall expenditures.

In Connecticut, where travel costs can vary by city, it's essential for your business to be aware of these differences. Clear per diem guidelines help simplify expense reporting and ensure compliance with federal regulations.

Connecticut per diem calculator

Enter the dates of your business travel, along with the location, county, and city, to calculate your per diem allowance while traveling in Connecticut.

Connecticut per diem rates

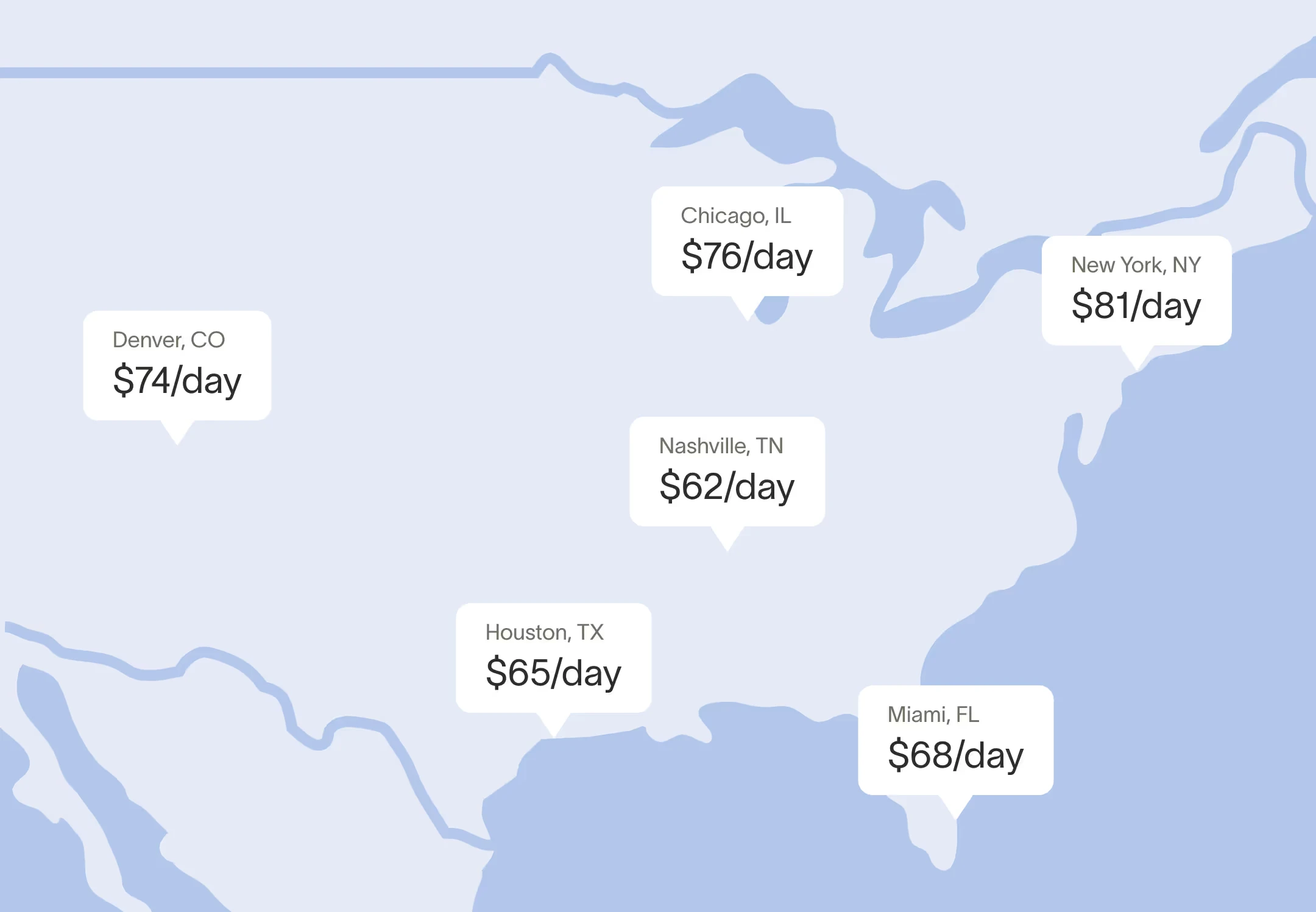

If you're traveling to a city in Connecticut without a specific per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply. These rates are set by the General Services Administration (GSA) and are effective from October 2025 to September 2026.

For cities with location-specific rates, the GSA provides fixed per diem amounts to account for cost variations. Here are the Connecticut cities with specific per diem rates:

| County | Oct 2025 | Nov | Dec | Jan 2026 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Default* | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 | $110 |

| Fairfield | $146 | $146 | $146 | $146 | $146 | $146 | $146 | $146 | $146 | $146 | $146 | $146 |

| Hartford | $138 | $138 | $138 | $138 | $138 | $138 | $138 | $138 | $138 | $138 | $138 | $138 |

| New Haven | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 | $130 |

| New London | $124 | $124 | $124 | $124 | $124 | $124 | $124 | $124 | $124 | $124 | $124 | $124 |

| County | M&IE Rate |

|---|---|

| Default* | $68 |

| Fairfield | $86 |

| Hartford | $80 |

| New Haven | $80 |

| New London | $86 |

Effortlessly manage business travel, from booking to tracking

Adhering to per diem rates is crucial for businesses to meet state and federal regulations, significantly reducing the risk of non-compliance. Effective per diem practices create a transparent framework for travel expenses, benefiting both your company and employees by minimizing potential conflicts.

Ramp revolutionizes business travel by enabling precise, location-specific per diem rates, simplifying compliance and expense management. Employees can easily track their allowances, staying within budget and fully understanding their financial entitlements.

With features like GSA rate integration and customizable multipliers, Ramp simplifies per diem management for both administrators and employees, fostering a seamless and efficient process for managing travel expenses.

Simplify your business travel from booking to expense tracking with Ramp