- What’s considered a business travel expense?

- Essential business travel expenses list

- Managing travel expenses

- Tracking business travel expenses

- How Ramp prevents travel overspending before it happens

- Automate your business travel expense management

Business Travel Expenses

Business travel expenses refer to the necessary costs employees incur while traveling for work, specifically related to their job duties and responsibilities.

Whether your team travels for conferences, client meetings, or scouting new business opportunities, business travel expenses can quickly add up if you’re not careful.

In fact, according to the Global Business Travel Association, business travel spending was up 11 percent in 2024 and is forecasted to top $2 billion by 2028.

That means that planning for and managing business travel expenses without cutting corners or impacting employee morale requires a strategic approach.

In this article, we define business travel expenses, including a list of common expenses, and share tips for managing and tracking expenses effectively.

What’s considered a business travel expense?

Business travel expenses are ordinary and necessary expenses incurred while traveling away from your normal work location, or your tax home, for business purposes.

As a business owner, it’s important to understand what qualifies as business travel expenses, since they could be necessary business tax deductions. Some of the criteria the IRS considers for a business trip are:

- Travel is primarily for business purposes

- You’re away from your usual place of business outside of regular working hours

- You need to spend the night to meet your job duties while away

For your team, these expenses could be paid via corporate credit cards, post-trip reimbursements, per diem rates, or cash advances specific to the business trip.

Essential business travel expenses list

Managing travel expenses is simply budgeting for them as part of your T&E (travel and expense) budget. Common deductible travel expenses to consider that you can claim on your business tax returns include:

- Transportation: Airfare for domestic or international flights, baggage fees, train tickets, bus fare, rental cars, taxis, or rideshares. If you use your personal vehicle, you can deduct the actual expenses or the standard mileage rate and other common business travel deductions, like gas, tolls, and parking fees.

- Hotel or lodging expenses: Accommodation costs during business travel, including room rates and applicable taxes

- Meals expenses: You can deduct 50% of the costs of meals while traveling for business

- Incidental expenses: Incidental expenses like gratuities, laundry, and dry cleaning charges

- Communications costs: Any costs you incur related to staying connected, including business calls, internet access, or even faxes for business needs

- Shipping: Costs associated with shipping equipment, materials, or other things you need between your business destinations

- Business-related expenses: Any other expenses directly related to conducting business, such as conference registration fees, client entertainment, equipment rental costs, and more

Remember, to deduct business travel expenses, they must be completely related to business activities and meeting your company's business goals, even if you’re self-employed.

What’s not a valid business travel expense?

You can’t claim an expense for personal purposes or that benefits you personally more than your business. Examples of expenses you can't claim include:

- Personal vacation days or leisure activities while traveling for business

- Traveling with a spouse or companion

- Personal expenses like gifts or souvenirs purchased during the trip

- The cost of commuting to your normal place of work

Managing travel expenses

The most important part of business travel expenses management is proper documentation. These are a few things you can do to make sure you’re staying on top of your costs:

The most important piece of managing your business travel expenses is proper documentation. These are a few things you can do to make sure you’re staying on top of your costs:

1. Establish a clear T&E policy

Creating a travel and expense policy is probably the important step in effectively managing travel expenses. It’s more than just a set of rules. It’s a guide that helps everyone in the organization understand how to handle travel-related decisions and spending.

It should outline your approved business travel expenses list, travel booking guidelines, expense reporting and approval process, documentation requirements, and reimbursement timeline. A thoughtful travel policy prevents confusion, ensures fair treatment of employees, and safeguards the company against unnecessary costs.

2. Use a travel management platform

A travel management platform streamlines the travel booking process, reins in out-of-policy spend, and provides a better travel experience for your team. Look for a tool that automatically enforces your T&E policy and reports on your travel expenses.

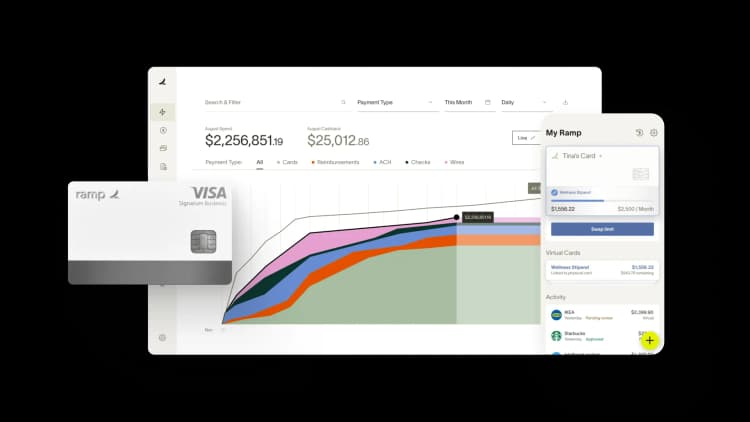

You could also opt for an all-in-one platform that centralizes your finance workflows. For example, Ramp handles travel booking, expense management, accounting, accounts payable, and more. Your employees can use a single app to manage T&E expenses, while your finance team gains greater control and visibility over company spending.

3. Issue corporate cards

Modern corporate cards offer a variety of custom controls, particularly the ability to enforce spend limits at the card, employee, or department level. For example, you could issue corporate cards with a spend limit that only covers an employee’s per diem, making billing for business trips much easier.

Virtual cards are another great method for controlling costs. You can spin up custom, single-use virtual cards to cover the cost of specific trips, which helps avoid the risk of expense fraud or misuse.

4. Keep expenses down

Business travel should produce some type of return for your company. If the cost of business travel exceeds the ROI from the trip, you need to reevaluate your travel expenses and look for ways to reduce costs. Here are some tips to consider:

- Plan ahead: Booking flights and hotels early usually gets you better rates. Flexibility with your travel dates can save you even more.

- Use loyalty programs: Sign up for airline and hotel rewards programs to earn points you can use for free or discounted flights and hotel rooms

- Opt for economy: Stick to economy class flights and budget-friendly accommodations—within reason. Consider allowing exceptions for flights longer than six or seven hours

- Negotiate corporate rates: If you travel to the same places often, try negotiating better rates with hotels and car rental companies

- Be smart about ground transport: Use public transportation or rideshares instead of pricier options like taxis or corporate car services

- Set clear policies: As discussed above, having a straightforward travel policy helps keep expenses in check and avoids any surprises

Tracking business travel expenses

When you track how much money you’re spending on business travel, you can report on your finances and project future costs accurately. Here’s a quick breakdown of how to calculate and track your business travel expenses:

- Record and classify expenses: Keep comprehensive and detailed records of every expense made during a business trip and tag each expense for easy sorting. Depending on your reporting needs, you could classify expenses by trip type, expense type, or department level. This is another area where expense management software will really help your efforts.

- Calculate the entire trip’s expenses: After the end of a business trip, tally the total expenditure before splitting expenses into discrete categories. This data aids in setting budgets for future travel and spotting any obvious outliers.

- Categorize your travel expenses: Split each expense into its corresponding business expense category. Your expense management or accounting software likely has preloaded categories for transportation, meals, accommodation, and so on. Studying these categories helps you understand where to allocate funds for business travel. This step is also important for identifying and tracking tax-deductible expenses.

With all this information recorded and ready to analyze, you can plan more accurate budgets for future business travel and identify areas where you could potentially reduce costs.

If business travel is a major part of your operations, you might want to consider using a managed travel service. These services essentially manage your travel expenses by following your expense policy and only booking trips that fall within it, saving you time and money.

How Ramp prevents travel overspending before it happens

Business travel expenses can spiral out of control faster than you realize. Between last-minute flight changes, client dinners that exceed budgets, and employees booking premium hotels without approval, travel spending often becomes a black hole in your budget. By the time you catch overspending in monthly reports, the damage is already done.

Ramp tackles this problem head-on with real-time spending controls that work automatically. When you use Ramp Travel to book flights and accommodations, you can set precise spending limits by category—$200 per night for hotels, $300 for flights, or whatever fits your policy. These aren't just guidelines; they're hard stops. If an employee tries to book a $300 hotel room when their limit is $200, the transaction simply won't go through. No awkward reimbursement denials, no policy violations to address after the fact.

The platform's automated receipt matching takes the administrative burden off your team while ensuring compliance. As soon as an employee swipes their Ramp card for that client dinner, they get a text requesting the receipt. The system automatically matches receipts to transactions and flags any missing documentation, eliminating the end-of-month scramble to track down expense reports. This real-time visibility means you spot unusual spending patterns immediately—like when someone's daily meal expenses suddenly triple—rather than discovering them weeks later.

Ramp's merchant-specific controls add another layer of precision. You can block entire categories of merchants (goodbye, in-flight Wi-Fi charges) or set different limits for different vendors. Need to ensure employees book with preferred hotel chains? Set higher limits for those specific merchants while restricting others. These granular controls transform travel expense management from reactive damage control into proactive spending optimization, giving you peace of mind that your travel budget stays exactly where you planned it.

Automate your business travel expense management

Ramp's modern finance operations platform helps you control travel spending before it even happens. With expense management automation that enforces your T&E policy, you can be confident your team won't overspend on travel and blow your budgets.

Try an interactive demo and see why customers who use Ramp for their travel and expense management save an average of 5% a year.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits