Forecasting and spend management in a cash-tight environment

- Pinpoint your latest business priorities

- Get accurate forecasts by connecting your data

- Stress-test your strategies with what-if scenarios

- Enforce your budget with spend management tools

- How Ramp helps you navigate cash-tight environments with precision

- Modernize your forecasting and spend management

At Acuity, we advise hundreds of small businesses on their finance and accounting operations. This past year, I’ve been telling our clients that the cheese has moved. Capital’s high cost means business leaders can no longer afford to focus primarily on growth. You need to keep a tight lid on your operational costs to stretch your runway.

As a former CFO who became a business owner, I empathize with the challenge of driving revenue without losing sight of expenses. The right tools and processes can go a long way to alleviating the pain. Here’s how we guide our clients to strike a healthy balance.

Pinpoint your latest business priorities

When was the last time you and your department heads revisited the top 10 needs for the area? It's my favorite question to ask clients because it often sparks a rich discussion with a business owner, the CEO, or a department head. It’ll inform what you need to be measuring and how often you need to run your reports.

Get accurate forecasts by connecting your data

Accurate data is key to your financial management. My clients like to use financial planning and reporting software like Jirav to model various scenarios because it lets them easily link data from different systems.

Jirav’s Senior Director of Professional Services and Support Adrianna DeLorenzo shared great advice in our recent webinar. She said, “You want to look at things like your balance sheet and general ledger, housed in QuickBooks, Xero, or other similar software. Bring in additional data from your CRM, be it HubSpot or Salesforce, to give you an idea of pipeline as you work through a revenue analysis.”

Linking your HR data can help you gain a more granular understanding of how your customer acquisition costs will shift over time. Adrianna’s tip: “QuickBooks is going to tell you your staffing expenses—but it's not going to tell you the individual people. Look at the individual employees, their roles, their departments, their start dates, and their wages as you plan.”

But avoid using spreadsheets for this kind of work. They won’t let your finance team connect data sources for more accurate forecasts. Manipulating raw data across disparate systems will chew up a lot of time and resources. It takes work to transition your spreadsheets to a financial tool, but when done well, you can be rewarded with broader visibility and more manageable month-end reporting. The rest of your organization will find it much easier to stay aware of your actuals.

Stress-test your strategies with what-if scenarios

I advise clients to track three reports at all times: 1) your annual budget 2) your quarterly forecast and 3) your live re-forecast that should be constantly updated as actuals come in. These views will allow you to easily report against how you thought you would do and help run your business day-to-day.

What-if scenarios help you further fortify your forecasts by modeling the impact of different business levers on both your revenue and expenses. In a tight macro climate, here are four key ones to consider:

- Revenue patterns: Let’s start with days sales outstanding (DSO) ratio first, because it lets you check if you need to tighten billing and collections processes. Can you accelerate collections to improve cashflow?

- Customer acquisition costs: If your goal is revenue growth, are you accounting for associated costs? Do you need sales headcount to close more deals? Do you need to increase your marketing spend to get leads for those reps?

- Customer attrition: Your new business could be thriving, but are you keeping your retention rates in check? Can you reduce your churn to drive revenue further?

- Software subscriptions: Ramp’s Q4 2024 spending data showed companies spent more on software and cloud computing vendors for six consecutive months. If you haven’t reviewed your subscriptions in a while, confirm whether each one is still necessary. For those you need to keep, consider renegotiating terms if your usage has grown or declined consistently.

Source: Jirav

Enforce your budget with spend management tools

Once you have your budget set, it’s time to give your teams the resources to execute—without losing control. Again, the right tools can help you do this efficiently.

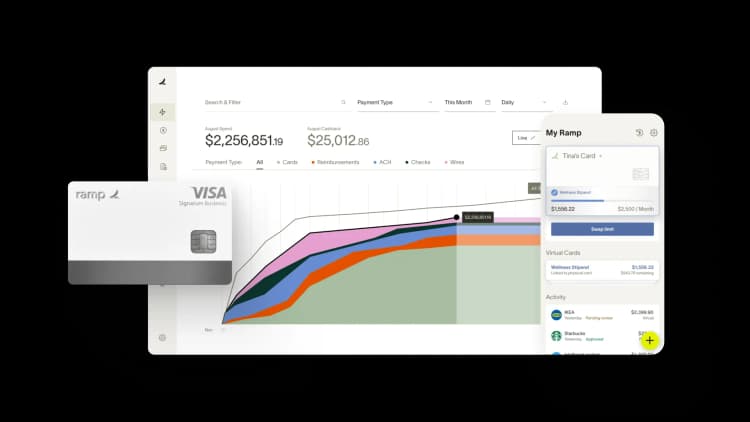

I recommend giving each department two Ramp cards to help them separate one-off charges from recurring subscriptions. This allows department heads to closely monitor ‘one-time’ charges, ensuring they align with budgetary constraints and business needs. Dedicate a separate card to managing recurring subscriptions, such as sales and marketing tools. By using spend limits and vendor controls on this card, you can prevent budgetary ‘scope creep’ and tightly control fixed expenses.

The dual card approach gives you a structured way to review and adjust subscriptions based on actual business requirements and staffing changes at a granular level. Within Ramp, you are able to project our month-end expenses down to the department level—a good way to see how actuals tally with previous forecasts. You can also upload software contracts to benchmark costs. Ramp can extract pricing details and compare against other Ramp transactions for the same vendor to let me know if you have room to negotiate.

How Ramp helps you navigate cash-tight environments with precision

When cash is tight, every dollar counts—and you need complete visibility into where your money is going. Finance teams often struggle with delayed expense reporting, surprise overspending, and forecasting blind spots that make it nearly impossible to maintain control when margins are thin.

Ramp's all-in-one finance operations platform eliminates the guesswork from cash management. Instead of waiting weeks for expense reports to trickle in, you see every transaction as it happens. When an employee makes a purchase with their Ramp card, the expense appears instantly in your dashboard, complete with merchant details and spending category. This immediate visibility means you can spot concerning trends before they become cash flow crises.

The platform's automated spend controls act as your first line of defense against overspending. You can set precise limits by category, vendor, or time period, and Ramp enforces these rules automatically. Need to restrict software subscriptions to $5,000 per month? Done. Want to limit travel expenses to approved vendors only? Ramp handles it. These controls prevent budget overruns before they happen, protecting your cash reserves without requiring constant manual oversight.

For accurate forecasting, Ramp's AI analyzes your historical patterns and surface actionable intelligence. The platform identifies recurring expenses you might have forgotten about, flags unusual spending spikes, and helps you understand your true burn rate. Armed with this data, you can build forecasts grounded in reality rather than optimistic projections. When every dollar matters, Ramp ensures you know exactly where each one goes—and where the next one should.

Modernize your forecasting and spend management

Finance teams face a challenging balancing act—controlling costs while maintaining growth momentum. The right combination of strategic planning and modern tools can help you master this dynamic. Try an interactive demo and see why businesses that choose Ramp save an average of 5% a year across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits