How forward-thinking businesses are preparing their finance teams for the future

- Key takeaways

- 1. Double down on automation

- 2. Unlock intelligent AI

- 3. Address the talent crunch through creativity

- 4. Prioritize cost optimization and efficiency

- Getting started checklist

The best finance teams have solidified themselves as strategic resources for the entire business. But to get to that point, leaders have to totally rethink what a finance team does. That means: More automation, better insights, sharper talent, and smarter spend.

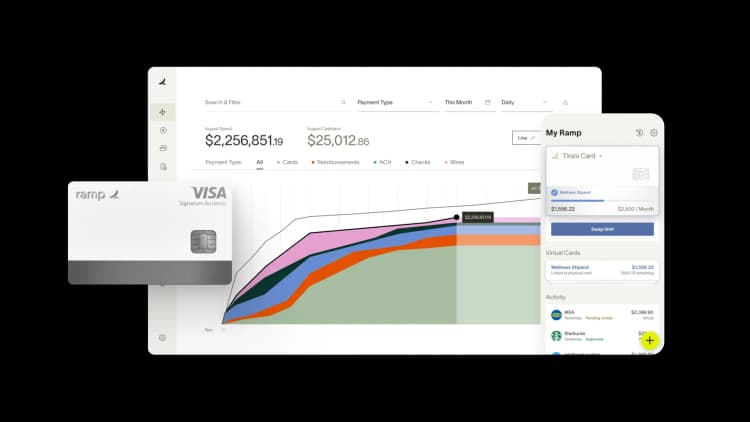

As many companies look for ways to remake the finance function, technology sits at the forefront. In fact, digital transformation ranked as the top priority for CFOs in a 2024 Gartner survey. Leaders from Ramp, AirCFO, and Puzzle explored the trends changing finance in a recent workshop, How to Build a Modern Back Office.

Key takeaways

- There’s a gap between automation ambition and reality. While nearly all CFOs have invested in automation, they’re still leaving major efficiency gains on the table.

- AI is already reshaping finance. Almost half of finance teams are using AI to automate tasks and uncover insights, freeing up time for more strategic work.

- Talent crunch demands new strategies. Automating routine work and investing in employee growth can make the workplace more appealing to strategic talent.

- Cost optimization remains mission-critical. Top CFOs use technology to monitor results in real time and proactively stay ahead.

Here’s how the best midsize companies are evolving their finance teams to lead in 2025 and beyond:

1. Double down on automation

Increased automation continues to be a major priority for midsize companies as they look to improve back-office efficiency. Though 98% of CFOs report they have invested in digitization and automation in a recent McKinsey survey, 41% of respondents said they’ve only automated less than 25% of their finance processes. Only 1% of finance heads have automated more than three-quarters of processes, indicating there’s plenty of room for progress.

Underpinning any automation effort is a foundation of comprehensive, accurate, and up-to-date data. This means integrating disconnected data sources—and reducing reliance on spreadsheets, which 90% of companies still rely on.

“I think finance or accounting professionals should be spending very little time month to month moving numbers around inside of spreadsheets and keying things in manually, and they should be reallocating that time toward helping company leadership understand that financial picture and then making decisions that improve business performance,” AirCFO CEO Alex Wittenberg said during the workshop.

Initiate targeted automation projects

Start with low-friction, high-volume tasks such as invoice entry, bank reconciliations, or accounting categorization. Test out technologies that could automate these processes and measure before and after time savings and error rates. Then share these results broadly to win buy-in for additional automation investments.

2. Unlock intelligent AI

AI is a top priority for CFOs today because it opens the door to intelligent automation and has the potential to boost productivity in a big way. Adoption is rising quickly—Ramp’s Spring 2025 Business Spending Report showed 35% of all U.S. businesses using AI, with the technology and finance sectors leading the way.

The top use cases include process automation, error and anomaly detection, and analytics such as forecasts and budget vs. actual reports, per Gartner. Many finance tools now include embedded AI to help automate:

- Invoice processing and AP—Extract and validate data from invoices, automatically match them to purchase orders and receipts, and route them for approval.

- Expense report reviews—Flag duplicate expenses, detect policy violations, and identify anomalies in employee spending patterns before releasing funds.

- Reconciliations—Match transactions from bank statements with your accounting system, speeding up the month-end close and reducing errors.

- Financial forecasting and scenario modeling—Analyze historical and real-time data

“Now we're getting to a point where we can encode much more complex rules and sets of guidelines to hand over to these AI agents,” Wittenberg said, with GAAP accounting standards and internal process documentation being examples of the guidelines AI can understand. “So if you think about any given role as a bundle of tasks, I do think that a large percentage of that bundle will be performed by an AI agent in the not-too-distant future.”

Start experimenting with AI tools

Start with rules-based tasks in your finance operations like expense audits or invoice matching. Pick one high-volume use case and see how AI tools can help in a non-production environment. Track improvements in time, accuracy, and exceptions flagged, using early wins to justify future AI investments.

3. Address the talent crunch through creativity

Automating much of the mundane, transactional work will help finance leaders determine what roles and skillsets will remain critical in the future.

But finding talented finance professionals is increasingly difficult, and competition will be especially fierce for those with strategic finance experience. Almost 85% of CFOs struggle with significant talent shortages, particularly in accounting and financial planning roles, according to Avalara. What’s drained the talent pool? Retirements, fewer accounting graduates, and an industry exodus—more than 300,000 individuals left the accounting field from 2019 to 2021.

Know that embracing technology makes your workplace more appealing to the top candidates. The best candidates are looking for the most innovative cultures. Environments that will help them regularly add new skills.

"I think that folks who are earlier in their career are in a fantastic position to be able to rise really quickly in this space because of how important the tech adoption piece is going to be to the future success of accounting professionals,” Wittenberg said.

If your business needs help with more clerical work, consider outsourcing or cosourcing specific finance functions. Among midsize companies, 45% now outsource accounting work to some degree.

Develop comprehensive talent development programs

Explore ways to uplevel existing employees. Build a laddered skill development path starting with courses or certifications that align with your tech stack and reporting needs. Assign mentors, provide dedicated learning time, issue annual professional development budgets, and celebrate progress.

4. Prioritize cost optimization and efficiency

CFOs who take the previous steps are well-positioned to deliver on companywide mandates to do more with less. Cost optimization remains a top goal for CFOs, and tariffs and recession fears mean this will continue to be an area of focus.

“You can’t manage what you don’t measure, and you can’t optimize what you don’t control."

—Dave Wieseneck, Ramp

Technology is an essential tool in helping you reduce expenses across major categories such as vendor spend, SaaS, and T&E. Look for solutions that have real evidence of helping businesses:

- Reduce operational spend—Closely monitor real-time AP, T&E, and procurement data to catch or quickly respond to unnecessary or out-of-policy spend.

- Optimize cash flow—Track the movement of cash in and out of your business and project future cash positions to proactively avoid cash shortfalls.

- Rationalize the tech stack—Audit all software subscriptions to spot overlapping functionality and unused seats to generate immediate savings.

- Centralize procure-to-pay—Put all POs, invoices, vendors, and contracts in one place to gain complete visibility into spend and tighten cost controls.

“You can’t manage what you don’t measure, and you can’t optimize what you don’t control,” Ramp Expert-in-Residence Dave Wieseneck said. “The best finance teams aren’t just tracking spend—they’re putting the right systems and guardrails in place so they can actually do something with that data and drive smarter decisions.”

Regularly check in on vendor spend

Audit expenses on at least a quarterly basis to catch excess or inefficient spend with vendors. Send these questions to department heads:

—Does this list reflect all the vendors your business is using?

—Do any costs look off or unfamiliar?

—Are you considering not renewing with a certain vendor and switching to a different tool? Moving to a higher or lower tier?

—Are there any new software or services you’re considering purchasing?

—Do you have any upcoming renewals and have you kicked off negotiations to get the best possible deal?

Getting started checklist

- Identify top three repeatable tasks that can be automated

- Run a two-week AI tool pilot on one of those tasks

- Launch a talent development initiative aligned with your must-have skills

- Schedule a cost optimization review for Q3

CFOs at midsize businesses who modernize their back offices now can enhance their financial resilience, drive operational efficiency, and position themselves for sustainable growth. Through proactive leadership and technology that supports the mandate for finance to be a strategic partner, senior leaders can significantly elevate the value of their teams.

Looking for more on how AI is reshaping finance? Check out the new Ramp AI Index.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits