AI's impact on the future of accounting

- How AI is transforming accounting?

- The influence of AI on big 4 and smaller accounting firms

- Benefits of AI in Accounting

- Challenges of AI in Accounting

- How Ramp Intelligence is Changing the Accounting Process

Artificial Intelligence (AI) has emerged as a game-changer, revolutionizing industries across the globe. Often perceived as traditional and resistant to change, the accounting sector is no exception to this transformative wave. As AI continues to make significant strides, it is crucial to examine its role and potential impact on the future of accounting.

Integrating AI in accounting promises to streamline processes, enhance efficiency, and unlock new possibilities for professionals in the field. From automating repetitive tasks to analyzing vast amounts of data with unparalleled accuracy, AI is poised to redefine how accountants work.

In this article, we'll explore how AI is changing the accounting industry. We will delve into the various applications of AI in accounting, discussing how it can optimize operations and improve decision-making.

How AI is transforming accounting?

Artificial Intelligence (AI) has already made significant inroads into the accounting industry, transforming various aspects of the profession. Its applications range from automating routine tasks to enhancing financial reporting and fraud detection. Let's look at how AI is currently leveraged in accounting.

- Automation of routine tasks

AI-powered systems can efficiently handle data entry, invoice processing, and bookkeeping, freeing valuable time for you and your accounts team to focus on more strategic and analytical work. By automating these routine tasks, you improve the overall efficiency and reduce the likelihood of human errors, ensuring greater accuracy in financial records.

- Enhancements in financial reporting and fraud detection

With the help of machine learning algorithms and data analytics, AI systems can analyze vast amounts of financial data, identifying patterns and anomalies that may indicate fraudulent activities. These systems continuously learn and adapt, becoming more effective at detecting fraud.

For example, AI can flag unusual transaction patterns or inconsistencies in financial statements, alerting accountants to potential issues that require further investigation.

- AI-driven predictive financial analysis

By leveraging historical data and advanced algorithms, AI tools can assist accountants in budgeting, tax compliance, and audit support. These tools can forecast financial trends, predict cash flow patterns, and identify potential risks and opportunities.

The insights provided by AI-driven predictive analysis enable you to make data-driven decisions, optimize your financial strategies, and proactively address potential challenges.

- Real-time data processing and financial insights

Accountants can access up-to-date information on a company's financial health at any moment. This real-time processing allows for timely decision-making and agile financial planning.

For instance, AI can monitor financial transactions, providing instant alerts and notifications for any discrepancies or potential issues. This enables accountants to take prompt action and make informed decisions based on current financial data.

The integration of AI in accounting is streamlining processes and elevating the role of accountants. By automating routine tasks and providing advanced analytical capabilities, AI empowers accountants to focus on higher-level strategic thinking and advisory services.

- Streamlined data management

AI tools excel in swiftly processing and synthesizing financial information, generating comprehensive summaries and detailed insights that help decision-making. This advanced data handling minimizes manual efforts, and enhances the reliability of your financial reports.

The influence of AI on big 4 and smaller accounting firms

Deloitte

Deloitte has developed several AI-driven solutions to enhance its service offerings. One notable example is the Automated Document Review platform, which uses cognitive technologies and natural language processing (NLP) to efficiently process and analyze documents. This platform can review large volumes of contracts and other documents, extract key information, and identify potential risks with greater accuracy and speed than manual methods.

Deloitte also launched NavigAite, a generative AI solution that accelerates document review, personal information identification, and compliance processes. This tool can work with multiple languages and integrates seamlessly with RelativityOne to provide cost efficiencies and deeper insights.

Ernst & Young (EY)

Ernst & Young (EY), have developed EY.ai, a holistic platform that combines their experience in strategy, transformation, risk, assurance, and tax with technology platforms and AI capabilities. This platform is designed to help clients transform businesses through the confident and responsible adoption of AI.

PwC

PwC has launched a UK tax-trained AI model as part of its technology push. This AI model is designed to generate tax content by cross-referencing and being trained on case law, legislation, and other underlying sources, along with PwC UK’s intellectual property.

KPMG

KPMG has developed KPMG Ignite, an AI-driven platform that aids in data analysis and enhances the quality of insights provided to clients. By leveraging AI, KPMG offers predictive insights, identifies trends, and provides strategic guidance beyond traditional accounting.

How Smaller Firms Leverage AI for Efficiency Gains

- Despite resource constraints, smaller accounting firms are leveraging AI to automate tasks such as data entry, invoice processing, and bookkeeping. This automation improves efficiency and reduces operational costs.

- AI tools in smaller firms are focused on specialized areas like tax research and preparation processes, allowing these firms to offer competitive services without the need for large teams.

- In financial audits, AI aids smaller firms by automating the analysis of financial statements and transaction data, making the audit process faster and more accurate. This allows smaller firms to maintain high audit quality standards with fewer resources.

Benefits of AI in Accounting

- As mentioned before, you can automate repetitive tasks like data entry, invoice processing, and bookkeeping, significantly reducing your manual workload and minimizing the risk of human errors. AI-driven systems enhance the accuracy of your financial records by precisely coding and categorizing transactions based on historical data and learned patterns.

- AI offers predictive analytics for budgeting, tax compliance, and financial planning, helping you forecast trends and manage risks more effectively. It also assists in maintaining compliance with ever-evolving regulations by continuously monitoring and adapting to new rules, ensuring your business stays on the right side of the law.

- With AI, you'll gain access to real-time financial insights, enabling you to make timely and informed decisions based on up-to-the-minute data processing.

- AI allows you and your accounting team to allocate resources better. You can easily scale your accounting processes, as AI systems can handle increasing volumes of data and transactions without the need for proportional increases in manual labor.

- Enhance your client services by providing more personalized and accurate financial advice, improving client satisfaction and fostering stronger relationships.

- AI-driven analysis reduces the impact of human bias in decision-making, leading to more objective and reliable financial insights.

- AI speeds up processes such as monthly closes and final reviews.

- One of the best parts? AI systems constantly learn from new data, refining their performance and accuracy over time, so you'll benefit from continuous learning and improvement.

Challenges of AI in Accounting

- Implementing AI solutions requires substantial financial investment in advanced technology and the training of staff. This can be particularly challenging for smaller firms with limited resources.

- AI systems process large volumes of sensitive financial data, making them prime targets for cyber attacks. Ensuring robust data privacy and security measures is crucial to protect against breaches.

- Relying heavily on AI for decision-making can lead to a reduction in human oversight. This raises ethical concerns, especially if AI systems make errors or exhibit biases due to flawed algorithms. The potential for ethical dilemmas increases if AI decisions negatively impact stakeholders.

- The rapid advancement of AI technology may outpace the ability of experienced professionals to adapt. New entrants into the accounting field require specialized training to effectively use AI tools, leading to a potential skills gap in the industry.

- The fast-evolving capabilities of AI pose challenges for regulatory compliance. Legal frameworks may struggle to keep up with technological advancements, creating potential compliance risks for firms. Adapting to new regulations and ensuring AI systems adhere to these standards is essential.

- Integrating AI with existing systems can be complex. Ensuring interoperability between AI tools and traditional accounting software requires careful planning and execution.

- Building trust in AI systems is critical. Accountants need to be confident in the reliability of AI outputs, which can be challenging if there are issues with transparency or explainability of AI decisions.

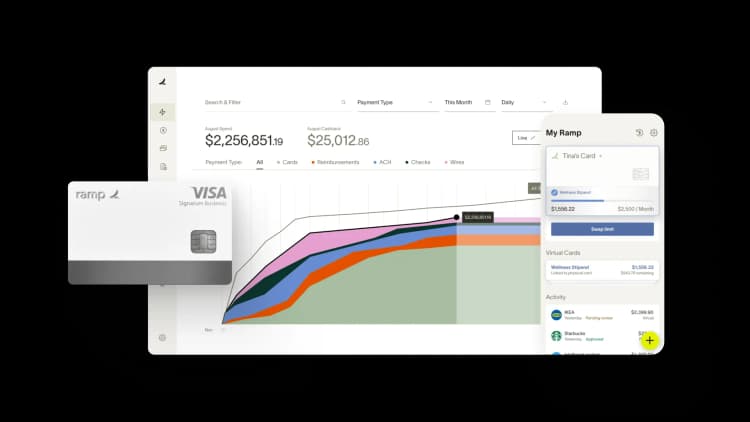

How Ramp Intelligence is Changing the Accounting Process

Ramp Intelligence is revolutionizing the accounting landscape by introducing smart, AI-driven solutions that enhance efficiency and accuracy. Here’s how Ramp Intelligence is transforming the accounting process:

Smart Accounting: Ramp's smart accounting features expedite the monthly closing process. By automating the coding of transactions, Ramp significantly speeds up bookkeeping and reduces the manual workload. This allows businesses to close their books faster each month.

Accurate Coding: Ramp automates collecting, coding, and categorizing every employee receipt. This automation ensures that all entries are accurately recorded in the financial statements, minimizing errors and ensuring compliance with accounting standards.

Streamlined Bookkeeping: Leveraging AI, Ramp learns from user actions and the insights of expert accountants to suggest precise coding for financial transactions. This not only streamlines the bookkeeping process but also enhances the accuracy of financial records.

Faster Final Review: Ramp processes transactions efficiently, requiring human intervention only when it flags issues. This feature allows accountants to focus on critical issues rather than getting bogged down by routine reviews.

As Ramp Intelligence integrates into your accounting workflows, it acts as a co-pilot for all your financial operations, from managing expenses to vendor management. Its AI-driven capabilities ensure that your business can maintain accurate books effortlessly.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group