Christian Wattig explains how modern finance leaders empower other teams

- 1. Don’t wait to be brought in

- 2. Speak their language, not just yours

- 3. Build trust through curiosity rather than control

- 4. Use technology to free up time for strategy

- Get more actionable advice

Finance leaders at many organizations have successfully recast themselves as strategic partners who bring unique and valuable perspectives to key decisions. But for finance professionals trying to step out of the back office and grow their influence, leading finance voice Christian Wattig has this advice: rethink your approach to cross-functional collaboration.

Wattig, a former FP&A professional who now leads the FP&A certificate program at The Wharton School, shared his playbook for how top current or aspiring leaders can build credibility, foster trust, and create real influence across the organization. Here are five tips from his recent workshop with Ramp Director of Product Finance and FP&A Patrick Yang:

👉 Watch the full conversation on-demand here.

1. Don’t wait to be brought in

The best finance teams embed early in the planning cycle and contribute to strategy from day one. Too often, finance is looped in at the end of the process—when the numbers are locked and finance can only approve or push back. That’s why finance teams need to get involved early, Wattig said, especially at growing companies that are still ironing out their processes.

"If you're only interacting with other cross-functional leaders during the time of the month-end close or the monthly business reporting meeting where you need inputs, that's not enough,” Wattig said.

Action item: Ask product, marketing, and sales leads to invite you to their next roadmap or planning meeting—not to oversee, but to contribute and strengthen relationships. To encourage early collaboration, you could also add a Finance 101 class to new-hire onboarding covering the team’s key responsibilities, goals, and how they help other functions (with real examples of success).

2. Speak their language, not just yours

Finance often relies on complex models, ratios, and jargon. But to build influence, you need to speak and share information in a way someone without a finance degree can understand. Use the simplest possible terms. Rather than drowning stakeholders in dashboards and detailed models, distill information down to the data and insights that audience really needs.

“Finance leaders have to play the role of filtering, of determining what are the metrics that really do matter right now, that leaders need to pay attention to,” Wattig said.

Action item: Create a one-pager or slide with three to five metrics that matter to each department, and update it monthly. Aim for just one sentence to explain why each one matters.

3. Build trust through curiosity rather than control

For many, corporate finance teams bring visions of rigid policies and centralized control. But top finance leaders are replacing enforcement with curiosity. Wattig suggested adopting a learning-first mindset to understand the “why” behind other teams’ choices. This shift has the dual benefit of improving relationships and finding better, more collaborative solutions.

Action item: The next time you’re tempted to reject a budget or purchase request immediately, schedule a 15-minute conversation to understand their thinking. Then explore alternatives together.

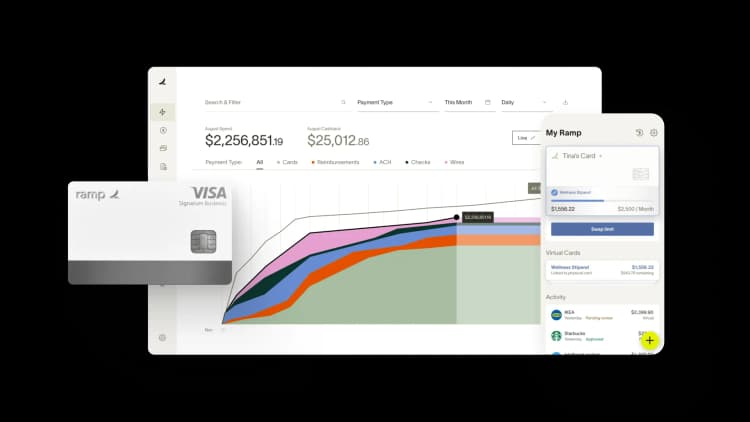

4. Use technology to free up time for strategy

Even with an endless selection of tools available today, Wattig still encounters many finance departments that primarily operate out of Excel. Finance teams bogged down in spreadsheets have little time to build deeper partnerships. So technology that powers increased automation isn't just about getting work done faster—it’s about freeing up time to contribute cross-functionally.

“The modern tools that you can find on the market now, you can implement them without much IT support and in a much shorter time than you would think,” Wattig noted.

Action item: Audit the repeatable tasks that drain the most time from your team this month. Identify one manual task you can automate or eliminate, reinvest that time in cross-functional collaboration, and report back on the impact it drove.

Get more actionable advice

Wattig’s tips make finance more impactful. When teams across the organization trust finance, value their perspective, and feel supported—not policed—the entire organization makes better, faster decisions. For the full playbook, watch the webinar on demand above!

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits