How businesses can save their most valuable assets: Time and capital

- A new approach to FinOps changes everything

- Why you should join the FinOps revolution

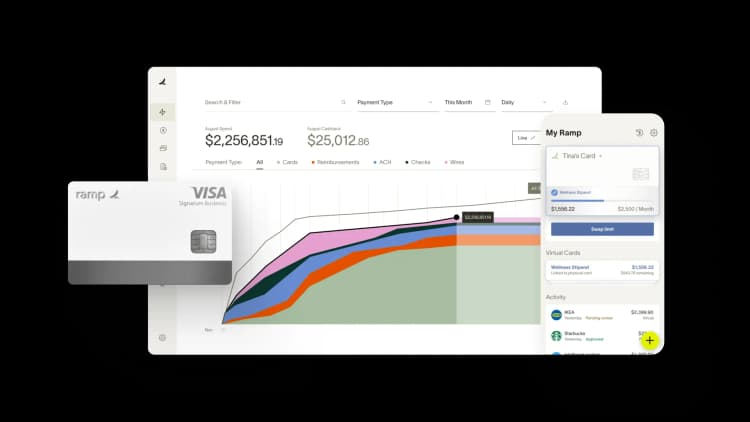

- Ramp is betting on FinOps as an essential component of any successful business

In recent years, a class of companies have gained attention in the industry for how well run their operations were. Names like DoorDash, Amazon and Uber (in the early days at least). Companies that are just radically more productive and efficient than the competition. They took ideas that were previously seen as impractical, or tough to make the economics work, and turned them into runaway successes.

So what’s their secret? What’s the common denominator helping these companies separate themselves from the pack?

I believe it’s by viewing financial and operational excellence and efficiency as two sides of the same coin (FinOps). These companies are stratospherically more successful due to a laser focus on unit economics and ROI, through a deeper integration of finance and business operations and operational rigor. They measure not just the cost of every dollar, but every hour too. They deeply consider the interplay.

By setting up systems that allow them to measure and improve financial and operating efficiency, they’re able to spend their time on strategic collaboration and working on the business, rather than just working in it. By approaching finance and operations as closely tied functions, or one broader function—FinOps—high performance teams are able to get much more ROI on every dollar and hour.

A new approach to FinOps changes everything

Finance functions historically were optimized to help make the most of each dollar. Operations functions are often designed to get the most of each hour. It turns out, these are highly interwoven. A “FinOps” approach holistically considers the maximization of both time and money (after all, employees’ time quite literally costs money), considers the interplay, and sets up holistic systems to make the most of both.

Put differently, when finance and operations are approached as fully separate functions, inefficiency is the norm. The good news is that advances in finance automation have made it much easier to bring these two functions together under the umbrella of FinOps. Modern automation enables finance teams to optimize company spending in the most efficient way possible for the entire organization.

This new paradigm of FinOps and automation means that finance can finally become a strategic partner and enabler for the rest of the business. That’s something successive generations of finance technologies had promised but failed to fully deliver. They left finance as a bottleneck for organizations, forced into being the “bad cop” that told their business partners why things weren’t possible.

When combined with automation and applied rigorously, FinOps best practices can save hard-pressed teams significant amounts of time. As a result, finance professionals can finally get the breathing room needed to become strategic partners, not bad cops. This new paradigm is what we’re calling finance-led growth and we’re building tools to put it in reach of all businesses.

We’re certainly not alone in thinking that a rigorous FinOps function is essential for businesses that want to be successful in the coming decade. The team at a16z also recently published an article on how FinOps presents a massive opportunity “to rethink the way businesses manage their money by streamlining, automating, and optimizing existing work while giving the entire organization a real-time view of a business's financial health.” We repeatedly hear from customers, prospects, and partners that they want to automate low value tasks and get disjointed systems to communicate. The goal is much more sophisticated financial oversight.

Why you should join the FinOps revolution

With companies and teams now distributed more than ever, finance processes have become increasingly more complicated to administer and manage. In addition, the move to flexible working requires similar flexibility in employee spending. FinOps allows finance teams to support more decentralized spending while maintaining cost controls.

Many finance leaders profess to have a FinOps function in place already but I urge them to scrutinize what that function is truly tasked with. If I had to guess, most FinOps teams are still focused too narrowly on optimizing company dollars, at the expense of operational efficiency. Modern FinOps focus on both.

When done right, FinOps helps businesses mandate the introduction of systems thinking to the finance function. It pushes you to review and assess the efficacy and impact of all your tools and workflows. You can quickly identify where FinOps needs to be applied by asking yourself some fundamental questions:

- What are the right systems for the business?

- How do we correctly implement them?

- How do we manage change efficiently?

Rigorous answers to these questions will lead to outcomes like the following chart. It shows the number of hours required to collect receipts and memos before and after implementing Ramp, and as Ramp has shipped more features to help companies increasingly automate their processes. Expenses missing receipts are down by 90%. The time to complete expenses is down by 90%. The average time to achieve policy compliance is now under 4 days, as opposed to 1-3 months on Expensify. FinOps paired with finance automation like Ramp helps companies get the visibility and detail they need, much faster:

By automating the repetitive tasks that were the de facto way to control costs in the past, FinOps can allow your business to:

1. Improve visibility: Setting up new financial and technical systems allows you to measure your business in real time, giving business leaders the ability to generate more accurate insights, receive actionable feedback, and move quickly to improve their operations.

2. Gain clear business insights: You’ll have access to the agile, real-time insights you need to make intelligent business decisions that can make a difference to your bottom line.

3. Save time: Both visibility and insights connect back to what business leaders want most: time. Sure, they’re still obsessing over critical measures of financial health such as ROI, cost of acquisition, LTV/CAC, etc. But more thought and value are being given to time. FinOps can help streamline your processes to help you save this scarce resource.

4. Empower your employees: Why are some of the smartest and most financially savvy people chasing receipts, hacking together data from disjointed systems and updating the same spreadsheet ad nauseam? Why aren’t they using their skills to improve the core of the business? Giving your employees the opportunity to work on challenging but impactful projects, instead of tedious work, will help them feel more invested and empowered in their jobs.

Ramp is betting on FinOps as an essential component of any successful business

In Zero to One, Peter Thiel explains that a company with an improper foundation is doomed to failure. The founding question of Ramp was how do we help our customers do more with their two most scarce resources–their time and their shareholders’ capital. Enabling our customers to do that is something that Ramp has been focused on from day one (we’re now at Day 1043). We believe that adopting FinOps is now essential for any business that wants to save time and money in a meaningful way.

Without adding a FinOps framework, you’re planning for your business to fall behind the competition. At Ramp, we’re betting on FinOps as an essential component for any business that wants to succeed and achieve greater longevity. That’s why we’re focused on building a finance automation platform that will facilitate the coming FinOps revolution.

Interested in adding FinOps to your organization? We’d love to help. Sign up for Ramp below and we’ll make sure an expert from our team gets back to you soon. Get ready to see exactly how FinOps can transform your finance team.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits