Ramp today announced $150 million in debt financing from Goldman Sachs to fuel growth for Ramp, a corporate card focused on helping businesses spend less money and automate their finances. Goldman Sachs Bank USA provided the credit line to Ramp.

The news follows the appointment of Srinath Srinivasan as Head of Risk at Ramp last month. Srinivasan previously worked at Goldman Sachs and was deeply involved with developing credit underwriting for the Apple Card. Earlier this year, Nik Koblov also joined Ramp to lead Risk and Underwriting Engineering. Before joining Ramp, Koblov served as the VP of Engineering at Affirm and as a Vice President in Credit Technology at Goldman Sachs.

“We are thrilled to work with Goldman Sachs for our first debt capital facility," said Eric Glyman, CEO, Ramp. “The funding from Goldman Sachs will allow us to accelerate our rapid growth and serve more customers as America’s fastest growing corporate card and spend management platform.”

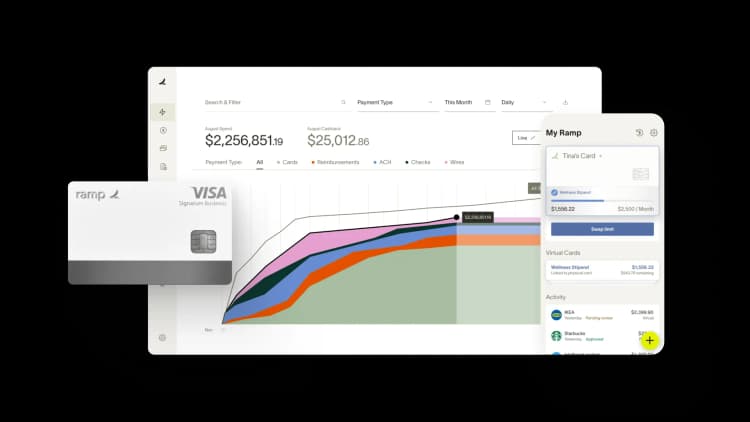

Based on industry analysis, Ramp is the fastest corporate card company in history to reach $100M in transaction volume, and grew monthly transaction volume significantly year over year—with meaningful acceleration towards the end of 2020. While technology startups were early adopters of Ramp, today the company works with a wide array of industries spanning healthcare, construction, nonprofit, retail, agriculture, and legal services. In less than a year, Ramp saved customers more than ten million dollars through its proprietary software that identifies ways for businesses to spend less on its vendors, cash back on all purchases, accounting automation, and deep vendor discounts.

Last month, Ramp launched an advanced expense management platform that allows companies to automate policies and approvals with machine learning, while employees can track and organize all purchases, including transactions not made with a Ramp card. Since its launch, over 30% of Ramp customers have cancelled existing third party expense management subscriptions and have recognized further savings in doing so.

Ramp has raised over $200 million in debt and equity since its launch in February 2020. Investors in Ramp include Founders Fund, Coatue Management, D1 Capital, and over 50 CEOs and finance leaders from leading companies like Warby Parker, Twitch, Away, Opendoor, Plaid, and Rent the Runway.

“Eight Sleep previously relied on American Express for its corporate card and Expensify as our expense management system,” said CEO, Matteo Franceschetti, Eight Sleep. “Ramp was a complete game changer. It’s a single platform that can handle every aspect of our spending - including things that aren’t paid for with a card. This has led to immense savings - both in terms of dollars and time for our finance team. Given our success with the product so far, it’s no surprise to see the company is growing the way it is.”

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits