How I built it: Ramp's 'Know Your Customer' spend program

In fintech, KYC usually means compliance requirements. At Ramp, it now means something more.

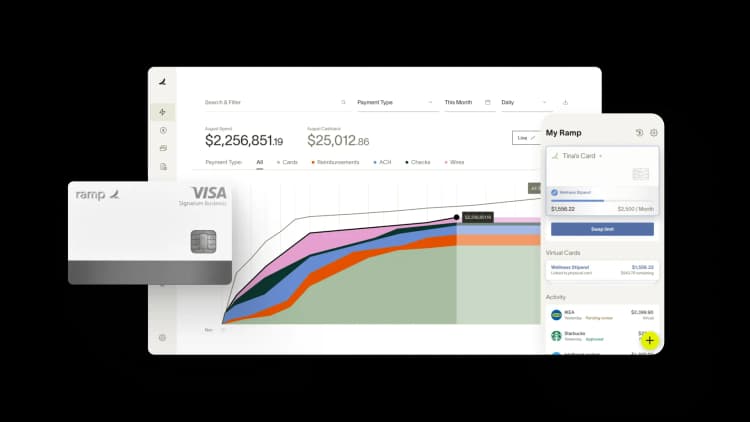

With more than 30,000 businesses using Ramp, we wanted to give employees a way to explore and support our incredible customers while also putting our own product to the test. In this case, we’re testing our merchant restriction features.

That’s why we launched the “Know Your Customer” spend program: a quarterly initiative that gives every employee $50 to spend with a select group of customers.

To make it even more engaging, our Customer Marketing team crowdsourced nominations and shared details about each customer’s story and offerings.

Some of our recent featured customers:

- Barry’s—Get your sweat on with HIIT workouts

- AllTrails—Find your next hike and grab outdoor gear

- Athletic Brewing—Enjoy non-alcoholic craft beer

- Kolkata Chai—Sip on authentic chai without leaving the U.S.

- Food52—Discover beautiful kitchen and home goods

Here’s exactly how we implement our Know Your Customer spend program at Ramp.

How the spend program works

1. Set an amount and frequency

Each employee gets $50 per quarter, and the balance automatically resets at the beginning of each quarter. We select new customers each cycle based on employee nominations.

2. Decide how funds are issued

Funds are auto-issued to every employee and appear instantly upon onboarding so new hires can start using Ramp right away.

3. Set restrictions

The fund can only be spent at the five selected customer merchants. Employees can use their Ramp card in-person (for example, at Maman’s cafe on Manhattan’s Upper East Side), access a virtual card for online purchases (like ordering hydration packs from LMNT), or reimburse themselves for out-of-pocket purchases.

4. Set accounting rules

Every transaction is automatically booked to a dedicated “Know Your Customer” general ledger account in NetSuite. Since we’ve already mapped these transactions to the appropriate accounting category, we mark them “ready to sync” to the GL. This helps us close the books faster.

5. Enable auto-approval and post-purchase requirements

After the purchase, employees submit receipts and memos. The system auto-approves card transactions and reimbursements go to managers for approval. If someone loses a receipt, employees can submit a missing receipt affidavit.

Spend programs that scale

Ramp’s Spend Programs feature is one of the most versatile features in our product. It makes it easy to issue and manage company money at scale, whether for coffee, wellness, remote work, travel, or company events.

Who knew compliance could be this fun?

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits