How interest rate risk drove SVB's collapse

- What is interest rate risk?

- Assessing interest rate risk

- The issue with SVB’s interest rate risk

- How Ramp helps you navigate interest rate volatility and duration mismatches

- Why didn't SVB hedge out its interest rate risk?

Many folks have written about what went wrong with SVB over the past few days, but few have explained it from a fixed income investing perspective. The core issue at the heart of SVB’s collapse is really asset liability duration mismatch. But what does that mean? How do we figure it out by looking at a balance sheet or disclosures? How is there risk in investing in Government-Backed Securities? This is what I hope to explain here.

When I was fresh out of college, I started my career as an interest rate trader on the trading desk at Morgan Stanley. I traded a variety of Treasuries, swaps, agency debentures, and both agency and non-agency mortgage back securities. In particular, this all happened through the great financial crisis in 2009 and the subsequent years. You could say I am intimately familiar with investing in a lot of the assets that were on SVB’s balance sheet (the same exact long duration mortgage-back securities and government treasuries)—all of which are very much now in the headlines.

What is interest rate risk?

Every bond carries two types of risks: credit risk and interest rate risk. Credit risk is basically the risk that the underlying issuer defaults on bond payments. The interesting thing about the bonds that SVB invested in is that they actually did not carry any credit risk because they were all government-guaranteed securities. But they did carry a lot of interest rate risk. By the way, this is why I was specifically a “rates trader,” the bonds I traded specifically only carried interest rate risk but not credit risk (that would make you a “credit trader”).

Interest rate risk means the value or the price of the fixed-income instrument changes depending on changes in the prevailing interest rate environment. Think of it like this: if you have a 10-year bond that pays a particular interest rate over the course of 10 years, the Net Present Value (NPV) calculation basically sums up the payments but then discounts it back to the present. Pretty straightforward, but when the market’s interest rate changes, the NPV of the interest and principal payments on a bond changes drastically.

Assessing interest rate risk

The longer the maturity of the bond, the more sensitive the NPV is to changes in interest rates.

Here's a simple rule of thumb to assess interest rate risk: If you have a 10-year zero coupon bond, its duration is literally 10 years. It means for every 1% change in interest rates, the value of the bond (the NPV of its cash flows) changes by 1% times its duration (10), which gets you 10%. Now, I mention zero coupon because for bonds with a positive coupon, the duration tends to contract a little bit. So for a 2% 10 year semi-annual pay plain vanilla bond, the duration is actually very close to 9 years, for simplicity’s sake.

In bond trading 101, when interest rates go up, the bond value goes down and vice versa. In this instance (for our 2% 10 year bond), as interest rates go up 1%, the value of these bonds would decline by 9%. And if rates go up by 4%, the value of the bonds would decline by 36%! This is nuts. (Yes we are ignoring the attenuating effects of convexity for now on duration risk, and non-plain vanilla bonds that are putable, callable, sinkers, and floaters for the purposes of this discussion.)

Unfortunately for SVB, a lot of their investments were made when interest rates were at all-time lows. They invested in a lot of longer-dated bonds, and so their interest rate risk was very very high. A lot of their bonds were actually also mortgages and so actually were negatively convex, which is even worse under some circumstances (but again, ignore that for now).

The issue with SVB’s interest rate risk

There’s nothing intrinsically wrong with investing in 10-year government-backed bonds at all. You will definitely get all of your money back, plus interest, at maturity. It is one of the safest instruments out there.

The issue with SVB is not that it invested in these bonds. All banks do this. The issue is that their liabilities didn’t match the same duration profile as the assets. If your liabilities are short-dated in nature, guess what: you might need short-dated liquidity, you can’t wait around for 10 years to get paid back by your bonds, so you should be investing in short-dated assets. The risk of selling bonds during the interim period when you are holding onto them creates mark-to-market risk.

It turns out that SVB’s liabilities were very short-dated in nature (due to depositors pulling funds out and companies needing more liquidity), but they were still investing in 10-year bonds.

SVB ultimately did need near-term liquidity, they did sell their long-duration bond holdings, and they did have to realize losses, which created a hole in their balance sheet.

How Ramp helps you navigate interest rate volatility and duration mismatches

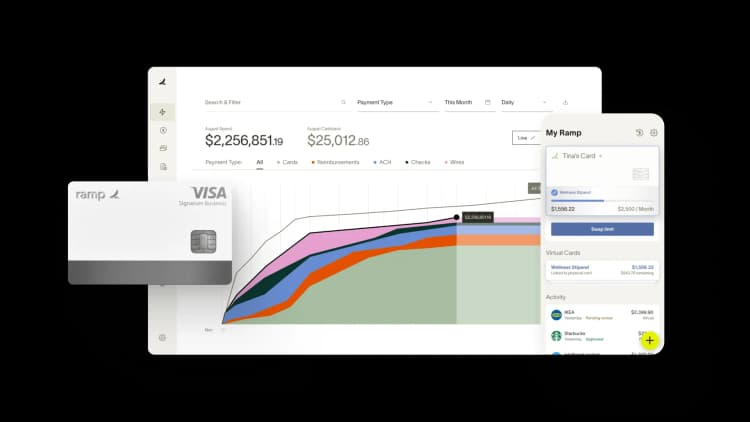

Managing interest rate risk and asset-liability duration mismatches can feel like walking a tightrope—especially when rates fluctuate unpredictably. You're constantly balancing short-term cash needs against long-term financial obligations, and a sudden rate shift can throw your carefully planned cash flows into disarray. For finance teams at growing companies, this challenge becomes even more complex as you juggle multiple funding sources, varying payment terms, and the need to maintain healthy working capital.

Ramp's automated expense management platform addresses these challenges by giving you unprecedented visibility into your cash position and spending patterns. The real-time expense tracking feature captures every transaction as it happens, allowing you to monitor cash outflows instantly rather than waiting for month-end reconciliations. This immediate visibility helps you identify potential duration mismatches before they become problematic—you'll spot when large expenses cluster around certain periods or when vendor payment terms create unexpected cash crunches.

The platform's advanced analytics and reporting capabilities transform raw transaction data into actionable insights about your cash conversion cycle. You can analyze spending trends across different time horizons, helping you better match the duration of your assets and liabilities. For instance, if you notice that marketing expenses spike quarterly while revenue flows in monthly, you can adjust payment terms or negotiate better vendor financing to smooth out these mismatches.

Ramp's corporate cards with customizable spending controls add another layer of protection against interest rate risk. By setting precise limits and approval workflows, you prevent unexpected large purchases that could strain your cash position during high-rate environments. The automated receipt matching and categorization ensures every expense is captured accurately, giving you the clean data you need to model different interest rate scenarios and optimize your working capital strategy accordingly.

Why didn't SVB hedge out its interest rate risk?

That's a valid question. Banks face unique accounting challenges when hedging Held To Maturity securities—these transactions can create significant P&L volatility that many institutions prefer to avoid. The tension between managing actual economic risk and maintaining stable financial reporting remains a complex issue in banking.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits